Summary:

- Cisco is a strong dividend growth stock offering attractive risk/reward for income and growth investors.

- Cisco benefits from its very large installed base and is innovating with optical networking products.

- It continues to transition towards recurring revenues, and maintains a fortress balance sheet.

JuSun

With plenty of bargains in the market, it’s not too hard to spot value. However, stocks typically get cheap for a reason, and sometimes it’s just easier to buy into a ‘set it and forget it’ type of company that’s able to weather headwinds that may come in the new year.

Such I find the case to be with Cisco Systems (NASDAQ:CSCO), which continues to trade in value range while offering investors a healthy dividend yield. In this article, I highlight attributes that make Cisco deserving of a “core holding” status and why it offers an attractive value proposition at present.

Why CSCO?

Cisco is the world’s leading networking company, offering a wide range of products and services, including routers, switches, and security equipment for enterprise and service provider networks, as well as collaboration, data center, and cloud products and services. This diversification helps to reduce the company’s risk and ensures that it is not overly reliant on any one product or market.

Moreover, Cisco carries a moat that’s derived by the high number of industry standards that it’s set and by the institutional knowledge from the high number of Cisco Certified professionals out there. This helps to reinforce its large installed base, especially with large enterprises. It also gives Cisco significant bargaining power with its suppliers and also creates a switching costs for customers.

Being very much a global company, Cisco appears to be doing just fine in the current macroeconomic climate. This is reflected by revenue growing by 6% YoY during its fiscal first quarter (ended in October). This was driven in part by easing supply chain concerns, and software revenue growth.

While Cisco has been traditionally thought of as being a hardware-centric company, it’s made significant progress towards transitioning to software subscription revenue, which is recurring in nature compared to “once in a while” perpetual revenue that’s lumpy and less predictable in nature. Cisco’s ARR (annualized recurring revenue) now stands at an impressive $23 billion, representing robust 12% YoY growth.

Moreover, Cisco has plenty of support from a significant backlog, with RPO (remaining performance obligations) at $31 billion. All the while, Cisco maintains a fortress AA- rated balance sheet with $19.8 billion in cash and short term investments on hand.

Importantly, Cisco generated $4.0 billion in free cash flow during its first fiscal quarter alone, more than covering its $1.6 billion dividend commitment and share repurchases. Cisco has grown its dividend every year since initiating a payout 11 years ago. While dividend growth has been muted since 2020, I would expect for it to ramp back up after economic concerns clear.

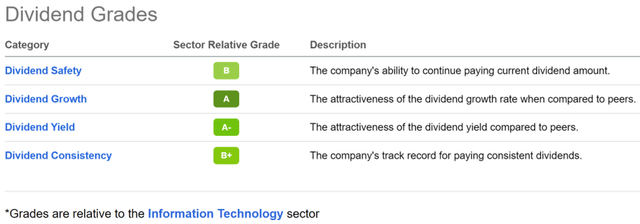

As shown below, CSCO scores A and B grades for dividend safety, growth, yield, and consistency.

CSCO Dividend Grades (Seeking Alpha)

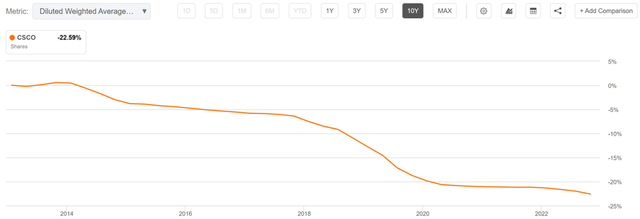

Moreover, Cisco has a strong history of returning capital to investors via share buybacks. Unlike companies like Nvidia (NVDA), which buy back shares at very high valuations, Cisco’s share buybacks are far more accretive due to its much more reasonable valuations. As shown below, Cisco has retired an impressive 23% of its share count over the past decade.

CSCO Shares Outstanding (Seeking Alpha)

Risks to Cisco include less market need for its collaboration solutions as many workers return to the office in either a full time or hybrid fashion. In addition, Cisco faces competition from the likes of Arista Networks (ANET) and Juniper Networks (JNPR). However, it’s making good headway in optical communications that support higher bandwidth. This is reflected by the new NCS 1010 platform, as management noted at this month’s Barclay’s (BCS) Global Technology conference:

We’ve just introduced a new optical layer platform called the NCS 1010 that offers some very innovative capabilities for customers to simplify operations. It runs IOS XR, which is our routing operating system. And the other key thing for the optical systems business that we have under development is leveraging a new DSP supporting 1.2 terabytes on a single wavelength.

On the optics side, we’re still in early stage on 400 gig deployments. So, a lot of effort in terms of getting 400 gig out there to our customers. We are also very focused on selling Cisco Optics, not only for Cisco routers and switches, but for third-party solutions as well. So, when customers want to consider optics as a buying center and say they want to consolidate their optic spend, we want to be considered as an optic supplier.

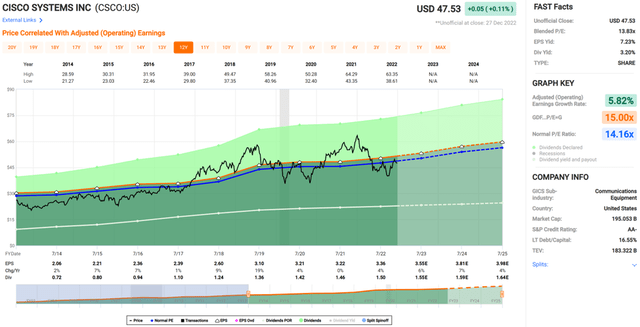

Turning to valuation, Cisco remains attractively priced at $47.53 with a forward PE of 13.4, sitting below its normal PE of 14.2 over the past decade. I find the valuation to be reasonable, considering the 6% to 8% annual EPS growth that analysts expect this fiscal year and next. Analysts have a consensus Buy rating on CSCO with an average price target of $55, translating to potential double digit total returns from here.

Investor Takeaway

Cisco is a strong dividend growth stock with very solid free cash flow generation, making it an attractive defensive play for income investors. Moreover, the company’s continued transition to software-based subscriptions provides a more stable recurring revenue base, and management is shareholder friendly with significant capital returns through share buybacks. At current levels, Cisco offers an attractive risk/reward profile for income and growth investors with a long-term horizon.

Disclosure: I/we have a beneficial long position in the shares of CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!