How To Trade Google Into 2023

Summary:

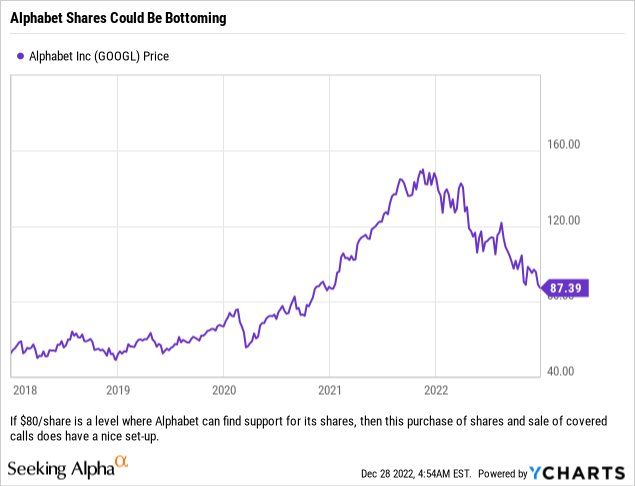

- Alphabet shares could be bottoming if earnings do bounce back in 2023 and the Fed takes its foot off of the pedal.

- Using covered calls might allow investors to add exposure to Alphabet by minimizing some downside while capping gains.

- Going overweight Alphabet in this manner might generate underperformance against the stock but could create outperformance overall by outperforming one’s benchmark.

Justin Sullivan

There are a lot of ways to invest and many more ways to make money in the market. There are also even more ways to lose money when investing, but one of the key takeaways in our experience centers around having a plan when making an investment. Most people focus on the research for the buy/sell thesis and ignore the process of planning the trade and understanding their personal process for achieving success. Why go to all of that work on researching to not set yourself up for success?

Whenever we look at portfolios for placing trades, we utilize names on our buy list at the time. While many will argue that if one simply buys at the right price, then one just has to buy-and-hold to make money, we have found that to not always be the case – because well, stuff happens. Over long periods of time, with certain names, that can hold true – Warren Buffett has built a career out of it (and that is an understatement) – but knowing when to sell or your plan for exiting is just as important. Our preference is to have an idea of what we are trying to accomplish, not only for the entire portfolio, but also for that individual holding.

This is one of the key differences between retail investors and institutional investors. Not saying that one is better than the other, but on the institutional level there is more attention paid to exit strategy and managing risk.

This brings us to yesterday when looking at a portfolio that had plenty of room (on an allocation basis) for Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) as it has been sitting in mostly cash lately.

So What Was The Situation?

We were questioned on why Alphabet was included on the buy-list for the portfolio with the potential for further downside. Never mind our plan to carry an overweight position, but the question centered around owning the name at all. Our response was that yes, the market looks ugly, the stock probably has room to head lower (especially if the Fed continues to raise rates) and we most likely are not purchasing at the very bottom, however we thought that going overweight this name made sense for this particular portfolio, especially if we utilized the portion we were going overweight to manage risk and better define expected returns for the portfolio.

So What Was The Plan?

Our thinking for 2023 is that it will be a rough year. The Federal Reserve is still raising rates, and if they continue to be aggressive, it would be bad news for the market. It would also be bad news for the market if their aggressiveness up to this point proves to have been too much, too fast, and they have to quickly pivot. Yes, it would be good news that the Fed was done raising rates, but then attention will shift to whether the damage is reversible or not. In our experience, when that question is being asked, the answer is that damage was in fact sustained and that there will be some fallout. We do feel that the damage will not be too severe if it plays out along the lines we anticipate, and that the end of 2023 could be decent for investors.

Because of this thinking, we had no issue purchasing Alphabet shares at current prices, because our intent was to simultaneously sell covered calls against most of the position. With the stock closing the session at $87.39/share, and Alphabet’s historical returns, we thought that for this particular account the proper move would be to set up a trade that would cap gains, have the potential to provide outperformance so long as the shares do not rise sharply and generate a cash flow in the present and essentially hedge our downside risk.

So What Was The Trade?

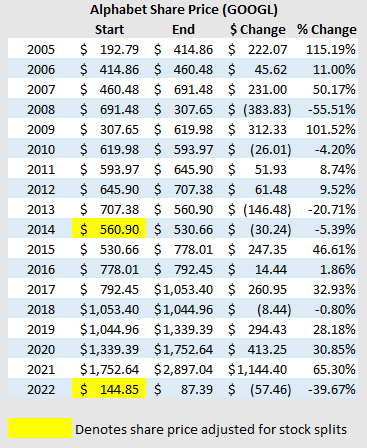

So the shares need to be purchased. Using the closing price from yesterday’s session, $87.39/share, we looked at potential returns over the next 12+ months as well as Alphabet’s historical returns. Below are Alphabet’s historical returns:

Historical returns for Alphabet/Google. The average is just over 20% per year. (Bloomberg)

With the average return being just under 21%, we also looked at the annual returns individually and saw that 8 out of 18 years Alphabet/Google shares have historically had returns over 25%. There are 5 down years also, and 3 times after those negative years saw gains over 25%, although one of those years was just over 28%. The average for those subsequent years following a down year was just under 36%, however if you pull out the highest and lowest return, you come back to about a 28% return.

For this particular account, we liked the January 19, 2024 Calls with a strike price of $100, which based off of closing prices generates an option premium of $9.45, or a total of $945. The option premium potentially provides the account with just over 10.81% of outperformance so long as Alphabet’s stock price does not close above $100/share. The trade generates outperformance so long as Alphabet shares do not trade above 109.45/share, but most importantly, the trade is designed to cap gains at 25.24% (10.81% from the option premium and 14.43% from the gain on the shares) but would provide us with nearly 11% of outperformance (so long as the stock price did not rise more than $12.61/share) and shares can fall $9.45/share before the portfolio will have losses on the position.

Since this account takes less risk, this trade makes sense and actually allows the account to get more exposure to Alphabet because we have minimized potential downside by capping potential upside.

Final Thoughts

We get that many Alphabet investors will probably hate this trade as it caps gains at a price which seems so close. In the case of this portfolio, that 14%+ gain on the stock price appreciation would be plenty for the account, but throw in the $9.45 option premium and the almost 11% return that provides and this becomes a potential slam dunk for the portfolio. Ordinarily an overweight for this portfolio would not work, but by capping the gains, we are able to cover the first almost 11% of downside risk if it occurs. And getting upset with a 25%+ return, especially after this year, would be silly.

This is not a perfect trade as we are not buying insurance to the downside to truly hedge downside risk, but with this year looking like it might be the second worst down year on a percentage basis for Alphabet in its history we think that the majority of the probable potential downside risk is covered by the option premium generated by the covered call.

We would point out that for some other portfolios today we will most likely utilize the $100, $105 and $110 strikes with September 15, 2023 maturities which have the potential to generate returns of 22.06%, 25.99% and 30.28%, respectively – should those positions be called. Those options might be more attractive for readers wanting to be more aggressive as they position one to work out that option position ahead of October (historically a volatile month) and leaves November and December (historically pretty strong periods) out as well…meaning one might be able to pocket the option premium without having their shares called and get to participate in a year-end rally. If called in September, those returns are respectable…and even more so when annualized.

Keep in mind that options are not for everyone, and capping gains to try to engineer returns for the overall portfolio might not suit some investors’ strategies, but for this portfolio the trade works and is a win-win. If in a year shares are flat or down, there is always the potential to set up another covered call trade to generate a significant option premium.

Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We have various positions in GOOGL in portfolios we manage. We personally own shares in GOOGL, have sold covered calls and have sold cash secured puts. Portfolios we manage also have similar positioning. We will also most likely be trading this position as mentioned in the article for accounts.