Summary:

- Cisco may be a great choice for income investors seeking to ride out market volatility.

- It’s seeing strong growth as it pivots towards increasing ARR and is making inroads in new AI-driven technology.

- Meanwhile, it carries a stellar balance sheet and pays a respectable and growing dividend yield.

MarsBars

It seems every day is a roller coaster these days, with banks like First Republic (FRC) see-sawing in price on every piece of news. For investors wishing to avoid the drama, it may be a better idea to turn to moat-worthy behemoths that have stellar credit ratings and a reasonably low valuation.

Such may be the case with Cisco Systems (NASDAQ:CSCO), which remains attractive and carries a strong balance sheet.

The stock has done rather well since my last bullish take on it at the end of 2022, giving investors a 6.1% total return, comparing favorably to the 2.3% return of the S&P 500 (SPY) over the same timeframe. Let’s explore why conservative investors seeking value ought to give CSCO a hard look.

Why CSCO?

Cisco is the world’s leading networking company, offering a wide range of products and services, including routers, switches, and security equipment for enterprise and service provider networks, as well as collaboration, data center, and cloud products and services.

This wide product and services offering makes Cisco a go-to source for many of its customers’ networking needs. Its industry leading positioning also reinforces the notion amongst IT professionals that “you don’t get fired” for buying Cisco products.

Moreover, Cisco carries a moat that’s derived by the high number of industry standards that it’s set and by the institutional knowledge from the high number of Cisco Certified professionals out there. This helps to reinforce its large installed base, especially with large enterprises. It also gives Cisco significant bargaining power with its suppliers and also creates a switching costs for customers.

Meanwhile, Cisco has exhibited respectable growth despite macroeconomic headwinds, with revenue growing by 7% YoY to $13.6 billion in the fiscal second quarter (ended in January).

Importantly, Cisco continues to transform its business model from traditional hardware perpetual licenses (think lumpy revenues) to higher quality annual recurring revenue (think smoother subscription revenue). This is reflected by ARR growing by 6% YoY to $23.3 billion. Also encouraging, software revenue growth outpaced companywide growth, at 10% YoY.

Looking forward, Cisco is uniquely positioned with its Silicon One architecture, which is a groundbreaking new product that Cisco aims to revolutionize the way that networks are built and managed. Silicon One is designed to be highly flexible and scalable, and can be used in a wide range of applications.

This product has the potential to be a game-changer for the networking industry, and could help to solidify Cisco’s position as a market leader. This includes AI-optimized infrastructure, which management highlighted as generating plenty of buzz among enterprise customers, as highlighted during the recent Morgan Stanley (MS) technology conference:

The hyperscalers have an extremely large networks and they’re only going to get bigger and they have unique requirements for how the traffic flows through those AI networks and we’ve been working closely with them for years to understand how our software needs to change to make sure the traffic is flowing across those AI networks exactly the way they need to.

So we are in a great position, because they’re working with us and collaborating with us. We have the intellectual property to change our silicon, to change our software that change our systems to enable these very large AI networks. We’re uniquely positioned in that space. And we see that there’s definite continued upside for how large those networks are going to be. That knowledge can be taken into the enterprises.

Meanwhile, Cisco is very well-positioned with an AA- rated balance sheet to fund its growth. This includes a staggering $22.1 billion in cash and short-term investments on hand and a negative net debt balance of $12.1 billion. It also pays a very well-covered 3.1% dividend yield with a 44% payout ratio and a 5.6% 5-year CAGR.

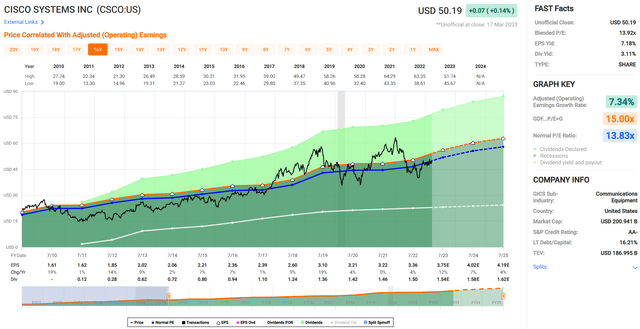

Lastly, Cisco remains reasonably attractive at the current price of $50.19 with a forward PE ratio of 13.4. While this sits just under its normal PE of 13.8, I believe CSCO fits the definition of a “wonderful company trading at a fair price”. Analysts have a consensus Buy rating on the stock with an average price target of $58, equating to a potential 19% total return over the next 12 months.

Investor Takeaway

Cisco is a leader in the enterprise networking space, with a wide moat provided by its large installed base, industry standards and certified professionals. The company has seen impressive revenue growth, driven primarily by higher-margin software revenue. Furthermore, Silicon One provides the potential for meaningful upside over the foreseeable future.

Meanwhile, Cisco appears to be immune to high interest rates considering its very strong balance sheet with negative net debt balance. It also pays a respectable dividend and is reasonably priced at well under 15x PE. As such, Cisco may be a great choice for income investors with a growth kicker.

Disclosure: I/we have a beneficial long position in the shares of CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!