Summary:

- CSCO’s strengths include its extensive product portfolio, strong brand reputation, focus on R&D, and robust financial performance with significant cash flow generation and a large cash position.

- CSCO’s weaknesses include vulnerability to competitors with a more specific focus and its heavy reliance on outsourced manufacturing, which puts its supply chain at risk.

- CSCO’s strong net cash position opens up the potential for acquisitions. Splunk, Okta, Cloudflare, and Box are valid targets that align with CSCO’s strategy.

- The technology industry is highly competitive, and the threat of new entrants and disruptive technologies is ever-present, which could make CSCO’s products obsolete.

- While the shares are currently trading slightly above the 5-year EV/EBITDA average, my DCF valuation suggests a fair value of $55 per share, a 12% upside.

jejim

Cisco Systems, Inc. (NASDAQ:CSCO) is a leading technology company that provides a wide range of networking and communications products and services. It has an impressive market share, an innovative product portfolio, and excellent financial performance. In this article, I will analyze CSCO’s strengths, weaknesses, opportunities, threats, and conclude with my valuation of the shares.

Strengths

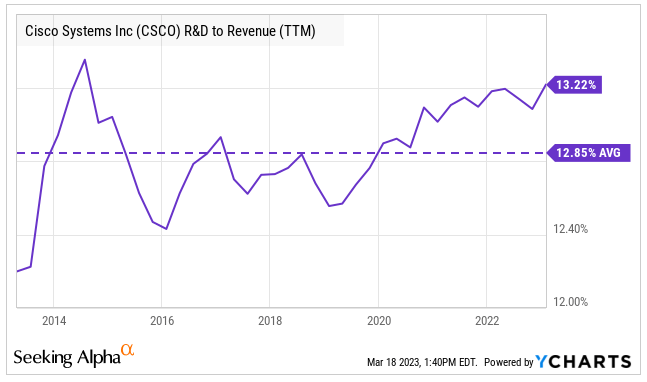

CSCO’s primary strength lies in its ability to provide reliable and high-quality networking and communication products and services. CSCO’s strong brand reputation and extensive product portfolio make it a leader in the technology industry. Its diverse product range includes routers, switches, security products, collaboration tools, and cloud-based services. CSCO’s focus on R&D enables it to stay at the forefront of innovation in the industry, which is a critical advantage in a fast-evolving technological landscape. In the past ten years, CSCO has invested almost 13% of its revenues in R&D. This high level of investment in R&D helps CSCO to fortify its large existing install base and allow it to renew customers with new, cutting-edge equipment. With a focus on digital transformation, CSCO’s solutions are well-suited to help customers navigate the shift to cloud and hybrid IT environments.

Ycharts

Another strength of CSCO is its robust financial performance. CSCO’s steady organic investment into R&D and strategic acquisitions have allowed CSCO to consistently grow its revenue and earnings. Starting in 2017, CSCO has prioritized four key areas in its acquisition strategy: 5G wireless, data center and hyper-converged infrastructure, artificial intelligence, and security. Through recent actions, CSCO has demonstrated its commitment to playing a major role in the 5G industry and to retaining its top position as a platform business for infrastructure.

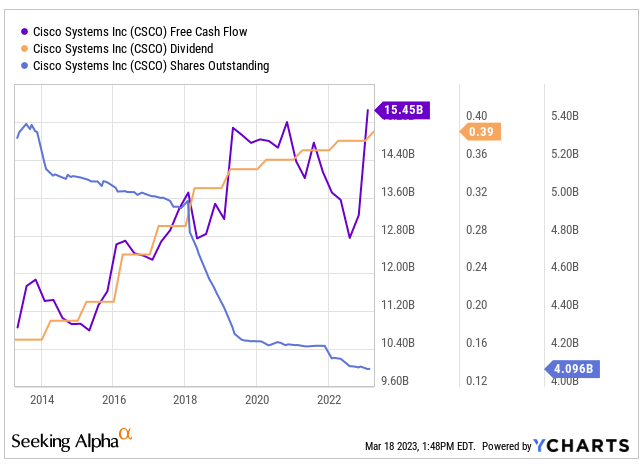

CSCO’s strong balance sheet and consistent free cash flow generation allow it to maintain a growing dividend and return cash to shareholders through stock buybacks. CSCO maintains a large cash position and relatively low debt, with consistently robust annual free cash flow. It targets more than 50% of free cash flow to go back to shareholders. Even after significant organic investment, CSCO maintains a growing dividend at a high payout ratio and sends extra cash toward repurchases. CSCO has well exceeded its 50% target in the past, and I expect this to continue.

Ycharts

Weaknesses

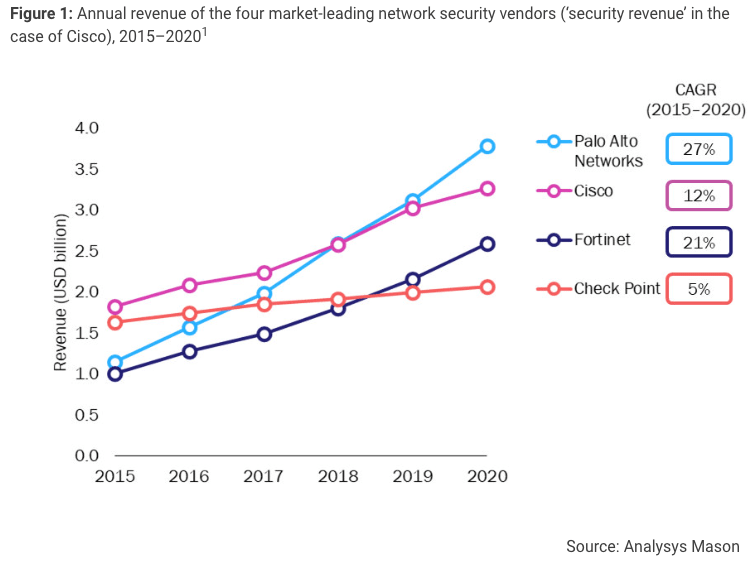

CSCO’s wide-ranging product portfolio may make it vulnerable to competitors with a more specific focus. Despite its strong market position, CSCO faces fierce competition from tech giants such as Arista Networks (ANET), Palo Alto Networks (PANW), and Fortinet (FTNT), who are challenging CSCO’s dominance in specific product categories. For instance, Arista Networks is working closely with cybersecurity firms like Checkpoint Software, F5 Networks, Fortinet, Palo Alto Networks, and VM Ware. Arista Networks has surpassed CSCO in the cloud data center space, while Fortinet and Arista Networks have partnered to offer the industry’s highest-performance next-generation firewall implementation. Meanwhile, in 2020 Palo Alto Networks became the largest network security vendor in terms of revenue, surpassing CSCO.

Analysys Mason

CSCO heavily relies on outsourced manufacturing for over 99% of its products, which puts its supply chain at risk. This risk was evident in fiscal years 2021 and 2022 when supply constraints resulted in lower sales and a potential excess inventory build-up. This could ultimately harm margins if CSCO has to discount or write down inventory.

To address this issue, CSCO recognizes the critical importance of supply chain risk management. According to James Steele, CSCO’s program director for supply chain risk management, the focus on supply chain management has evolved from a reactive approach to a strategic capability for many companies. This evolution continues to receive the necessary resources, visibility, and focus needed to manage it as a platform for growth.

Opportunities

CSCO is well-positioned to capitalize on new and emerging markets due to its broad range of products. One area where the company has been expanding its presence is the cloud computing industry, which is projected to experience significant growth in the upcoming years. To achieve this, CSCO has been increasing its partnership with Microsoft (MSFT) in the cloud and data center space. One result of this partnership is a new platform aimed at accelerating service delivery and streamlining the journey to the Intercloud for cloud providers. Recently, Cisco and Microsoft have taken this collaboration further by giving customers the option to run Microsoft Teams on Cisco’s world-class collaboration devices. From the first half of 2023, Cisco and Microsoft will enable customers to run Microsoft Teams natively on Cisco Room and Desk devices certified for Microsoft Teams.

In addition, CSCO’s focus on software-defined networking (SDN) and network function virtualization (NFV) has positioned the company well to take advantage of opportunities in network function virtualization. Recently, Cisco announced its plan to release an update to its software-defined WAN in December 2022, which will make the product more suitable for multi-cloud networking and SaaS applications. Furthermore, in late 2022, Cisco made its Nexus Cloud available powered by Cisco Intersight for best-in-class switching and multicloud management. This move will enable customers to manage across public cloud, private cloud, and edge computing environments of any size or scale.

CSCO’s acquisition strategy has the potential to create significant opportunities for the company, given its strong net cash position of 12.1 billion. Analysts have identified Splunk (SPLK), Okta (OKTA), Cloudflare (NET), and Box (BOX) as potential acquisition targets. In my opinion, these are valid targets as they align with Cisco’s history of strategic acquisitions, which have helped the company enter new markets, expand its product portfolio, and increase market share. Splunk provides an open data platform, Okta offers enterprise-grade identity management, Cloudflare provides secure and fast internet connections, and Box facilitates digital file management and collaboration. While Box’s enterprise value is 4.3 billion, the other three potential targets range from 13 to 18 billion. Leveraging itself to 2 times EBITDA, CSCO could unlock a further 30 billion besides the current 12 billion, enough to acquire a combination of these targets.

Threats

The technology industry is highly competitive, and the threat of new entrants and disruptive technologies is always present. Rapid changes in technology and customer preferences could make CSCO’s products obsolete, and new competitors with innovative products could capture market share. Moreover, CSCO’s heavy reliance on its service provider customer base could result in lumpy spending habits, which could lead to swings in sales and profits.

Valuation

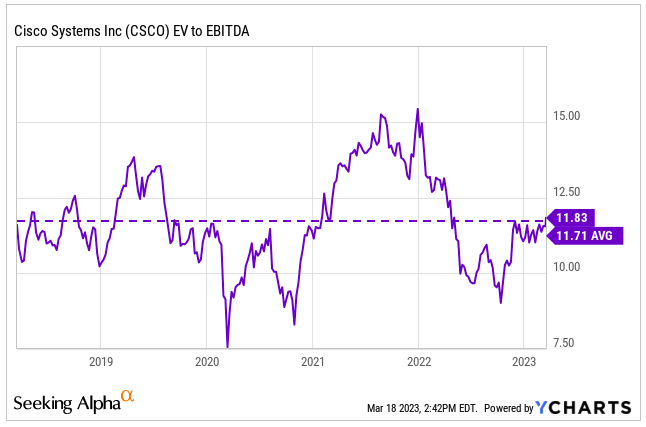

Currently, CSCO’s shares are trading slightly above their 5-year EV/EBITDA average.

Ycharts

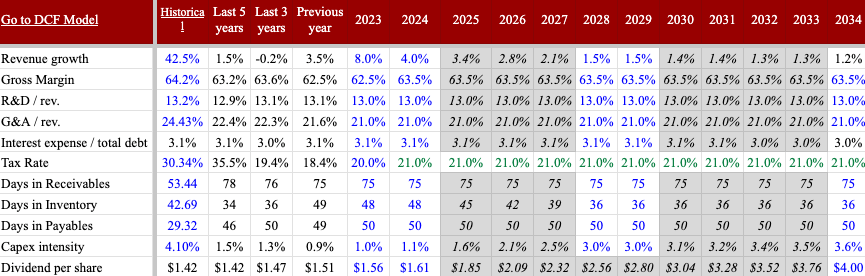

However, my analysis indicates a potential 12% increase in share value based on a DCF valuation. To arrive at this valuation, I assumed a cost of capital of 7.8%, based on an unlevered beta of 1.12 for the industry.

For CSCO’s revenue projections, I expect them to be slightly lower than the lower-end guidance for 2023. Eventually, revenue growth will converge to the historical growth rate. While I anticipate R&D and SG&A investments to remain at the same level, I expect a gross margin expansion as supply constraints are solved. Below are the key assumptions I made in the model.

Author estimates & company 10-K filings

Conclusion

CSCO has a strong competitive position, a solid financial profile, and an excellent track record when it comes to capital allocation. While there are some risks and uncertainties, I believe CSCO’s strengths outweigh these factors. I see a 12% upside to my fair value of $55 per share.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CSCO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.