Summary:

- Cisco is reporting quarterly results with solid, single digit growth rates and analysts as well as management are also expecting similar growth rates for the years to come.

- While Cisco can’t be described as recession-resilient, the subscription model is helping and leading to stability and recurring revenue.

- In my opinion, the stock is still trading about 25% below its intrinsic value.

Justin Sullivan

In my last article published in December 2021, I called Cisco Systems, Inc. (NASDAQ:CSCO) a buy. Since then, the stock declined 12% and one must assume that Cisco is still a buy and an even better investment right now. In the following article, I provide an update and we start by looking at the last quarterly (and annual) results.

Quarterly and Annual Results

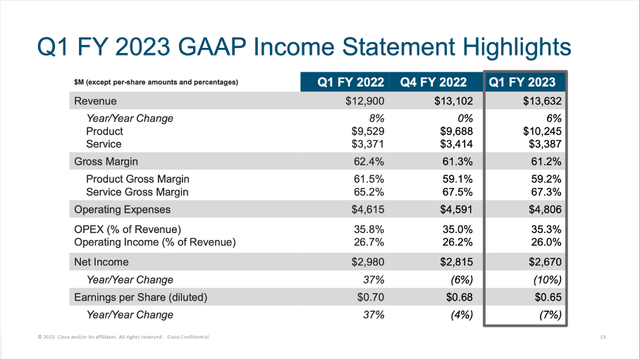

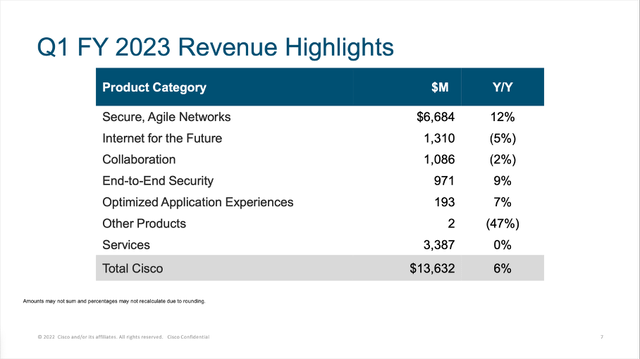

In the first quarter of fiscal 2023 (which ended October 29, 2022), Cisco generated $13,632 million in revenue and compared to $12,900 million in the same quarter last year, top line increased 5.7% year-over-year. Operating income also increased 3.0% year-over-year from $3,438 million in Q1/22 to $3,540 million in Q1/23. However, diluted net income per share decreased from $0.70 in the same quarter last year to $0.65 this quarter – a decline of 7.1% YoY. Adjusted earnings per share increased 5% YoY to $0.86.

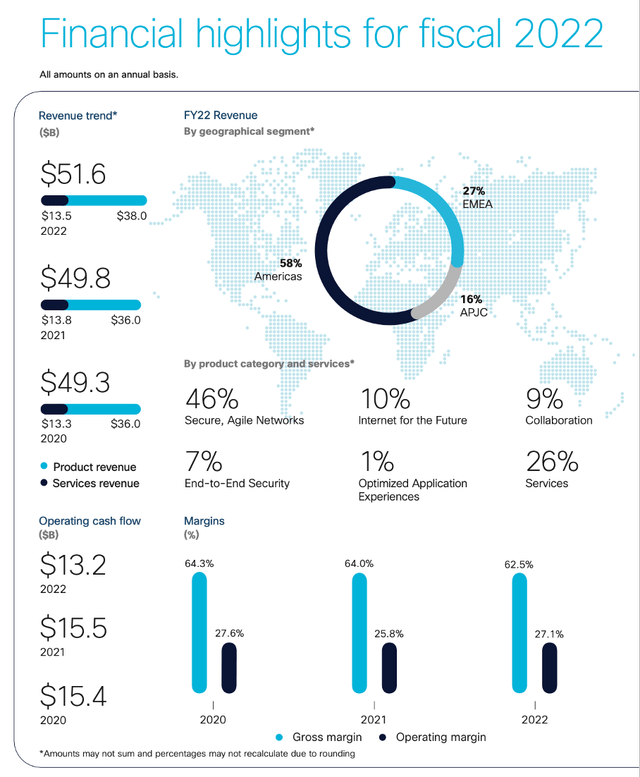

When looking at the annual results for fiscal 2022, revenue increased 3.5% year-over-year to $51,557 million and earnings per share increased 12.8% YoY to $2.82. Adjusted, non-GAAP earnings per share increased 4.3% YoY to $3.36.

Solid Growth Potential

When looking at the performance in the past decade, we can’t be under the impression of Cisco being a growth company. But we can be a bit optimistic that Cisco might be able to grow with a higher pace in the years to come. Morningstar is seeing the focus on security as well as networks as a strength of Cisco and potential for growth in the years to come:

We view Cisco Systems as the dominant force in enterprise networking and expect it to retain its strength in both legacy and future networks. Cisco holds leading market shares across switching, routing, and wireless access, with strong complementary positions in security and collaboration. We believe Cisco’s portfolio is appropriately positioned to benefit from trends toward hybrid work and hybrid cloud environments. It offers the most comprehensive suite of capabilities across converging networking and security markets, and we deem its intertwined products as sticky and worthy of a wide economic moat.

When looking at the different product categories, we can see especially “Secure, agile networks” as well as “end-to-end security” contributed to growth in the first quarter of fiscal 2023.

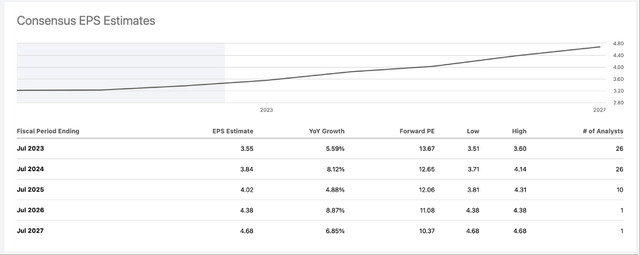

And for the next few years, analysts are expecting Cisco to increase its earnings per share with a stable pace. And in the next five years – between fiscal 2022 and fiscal 2027 – analysts are expecting the company to grow with a CAGR of 6.85%.

Cisco Earnings Estimates (Seeking Alpha)

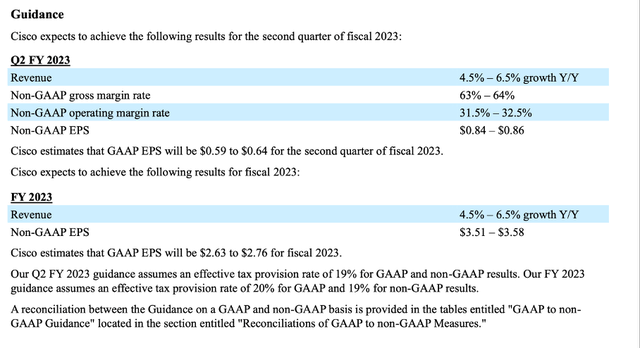

And for fiscal 2023 (a year where many other businesses are rather cautious), management is optimistic it can continue its path of solid growth. For fiscal 2023, the company is expecting revenue to grow between 4.5% and 6.5% year-over-year and non-GAAP earnings per share are expected to be in a range between $3.51 and $3.58 (resulting also in a growth rate between 4.5% and 6.5%).

Dividend and Share Buybacks

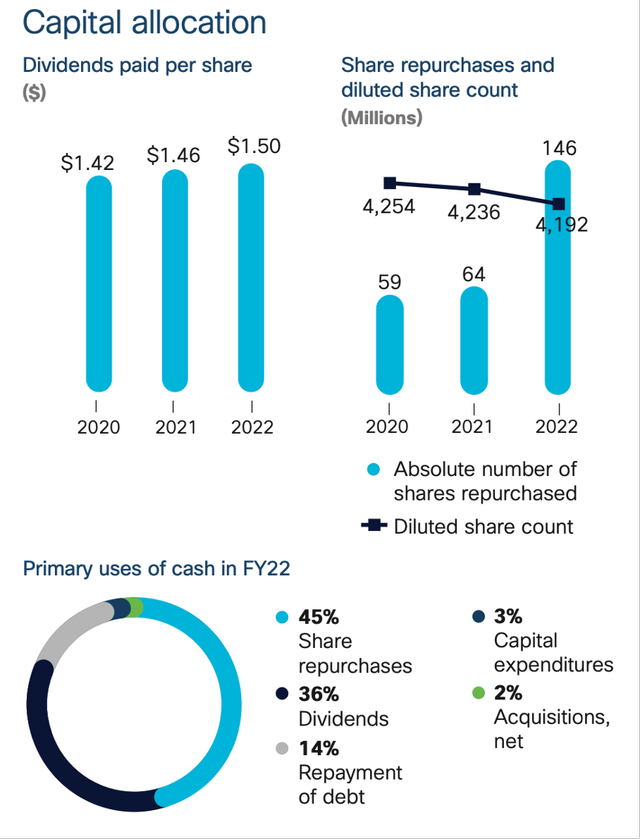

Cisco is also paying a dividend since 2011 and with a current quarterly dividend of $0.38 we get a dividend yield of 3.13%. Based on past patterns, we can expect a dividend increase in mid-February. However, we should not expect a high dividend increase. When looking at the recent past again, a dividend increase of $0.01 per quarter and share seems likely.

When looking at the different uses of cash in fiscal 2022, the extremely low capital expenditures are worth mentioning. Cisco had to spend only 3% of its cash generated by operations on capital expenditures. The biggest part of cash was spent on dividends (about 36% of generated cash) as well as share repurchases (45% of generated cash). And in 2022, Cisco repurchased 146 million shares and reduced the number of outstanding shares about 3.5%.

Recession Resilient?

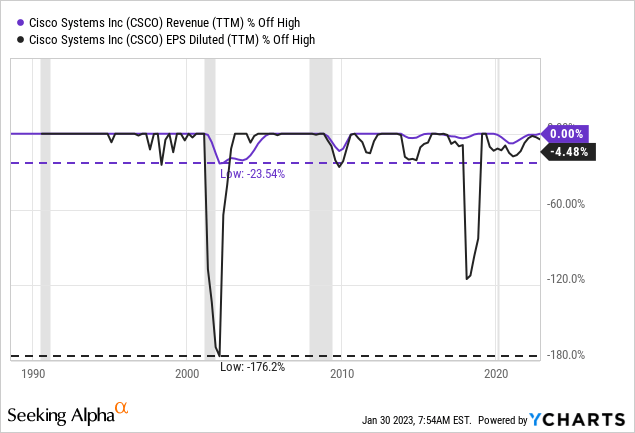

When looking at the performance in the last three decades, I would not really describe Cisco as recession resilient. Aside from the early 1990s recession (when Cisco was still in its exponential growth phase), the stock reacted to every recession. And especially the drawdown following the Dotcom bubble was extreme: Revenue declined 23.5% and earnings per share declined about 180% leading to a loss for Cisco. In the following recessions – Great Financial Crisis and 2020 recession – the drawdowns were more moderate, but in both cases revenue as well as earnings per share reacted to the recession.

Subscription Model

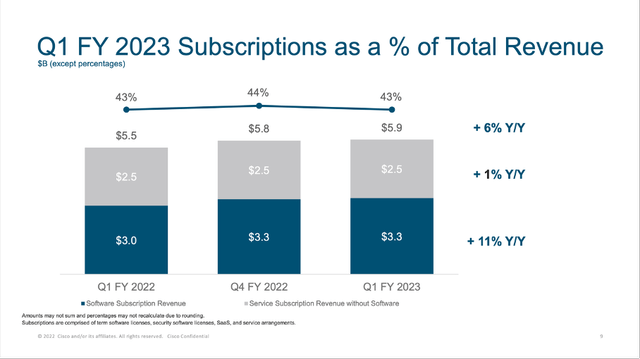

However, I would not worry about Cisco in a potential upcoming recession for several reasons. First, Cisco transformed its business model in the last few years and shifted from a business that was mostly dependent on one-time sales to a business that is generating a larger part of its revenue from subscriptions and recurring sales.

In the first quarter of fiscal 2023, 43% of total revenue stemmed from subscriptions and especially software subscription revenue continues to grow with a high pace (11% year-over-year growth). And as I have already argued in previous articles about Microsoft (MSFT) and Apple (AAPL), a shift towards subscriptions will probably lead to higher consistency and limit drawdowns during a recession as customers might not cancel subscriptions so easily. In Q1/23, Cisco had an annualized recurring revenue of $23.2 billion – resulting in 7% year-over-year growth with “products” mostly contributing to growth.

Of course, Cisco’ hardware business is still cyclical and therefore a recession will probably have an impact on Cisco’s top line – despite the subscription business. But the drawdown might be softer now in my opinion.

Stable Balance Sheet

Another reason why we should not be worried about a potential upcoming recession is the great balance sheet the company has (with only one minor flaw). On October 29, 2022, Cisco had $7,292 million in cash and cash equivalents as well as $12,492 million in short-term investments and almost $20 billion in very liquid assets are good to have in times where market liquidity might dry up.

When looking at the liabilities side, Cisco has $1,249 million in short-term debt as well as $7,629 million in long-term debt. However, when comparing the total debt to the total shareholder’s equity of $40,272 million, we get a debt-equity ratio 0.22. And when comparing the total debt to the operating income of $14,103 million in the last four quarters, it would take less than one year to repay the outstanding debt. Hence, we should not be worried about debt levels (and cash and short-term investments are more than enough to repay all the outstanding debt).

The only issue I see with Cisco’s balance sheet are the extremely high goodwill levels: the company had $38,160 million in goodwill and compared to $93,054 million in total assets, 41% is goodwill (and that is not great).

Intrinsic Value Calculation

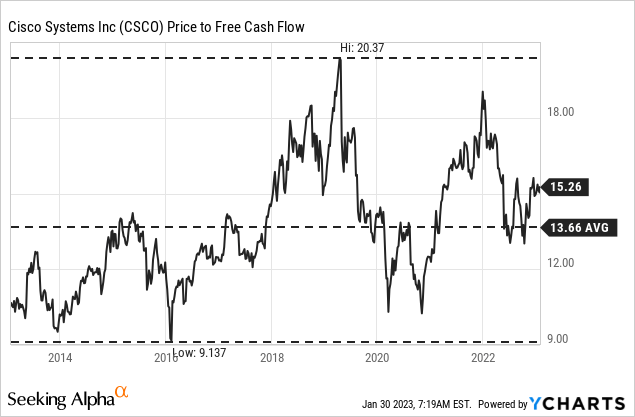

And one of the final steps in our analysis is to determine an intrinsic value for the stock. When looking at the price-free-cash-flow ratio of the last ten years, Cisco was always trading between a valuation multiple of 10 and 20 with the average P/FCF ratio being 13.66. Right now, Cisco is trading for 15.26 times free cash flow and can probably be called neither extremely cheap nor extremely expensive.

When trying to determine an intrinsic value by using a discounted cash flow calculation, we can take the free cash flow of the last four quarters as basis ($13,230 million). Assuming 4,108 million in outstanding shares and a 10% discount rate, Cisco must grow its free cash flow about 3.5% annually from now till perpetuity to be fairly valued.

When looking at the growth rates in the past decade, Cisco could only increase revenue by a CAGR of 1.13% but earnings per share increased with a CAGR of 6.59% in the last ten years and 8.22% in the last five years. And when taking these numbers into account, we should not assume Cisco will suddenly turn into a high growth company, but growth rates in the mid-single digits should be possible (especially as share buybacks might already contribute about 3-4% growth to the bottom line). When assuming 5% growth from now till perpetuity, we get an intrinsic value of $64.41.

Conclusion

Cisco is not a screaming buy and certainly not a stock that is an extreme bargain. But in my opinion, it trades about 25% below its intrinsic value and can therefore be seen as a solid buy once again.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.