Exxon Mobil: Shares Can Cool Off Following Q4 Earnings

Summary:

- XOM reported its Q4 earnings which beat expectations.

- Effective operational execution and cost savings initiatives have supported strong margins.

- We like the stock but expect the upside to be limited in the near term as the valuation appears stretched against volatile energy prices.

Brandon Bell

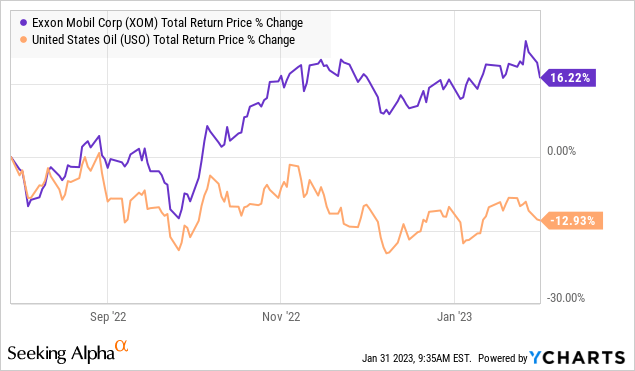

2022 was a massive year for ExxonMobil Corp (NYSE:XOM) with shares returning 87%, as an exception to the broader market selloff. The global energy giant benefited from the surge in oil & gas prices which drove strong cash flow and earnings. Overall solid execution allowed the company to outperform sector benchmarks, reaffirming its blue-chip status. Indeed, Exxon just reported its Q4 results which beat estimates capping off a record year.

That being said, the story here is hardly a secret. XOM has gained momentum in recent weeks sending shares to their cycle high even as conditions in energy have turned more volatile. We’ll note the stock’s valuation premium appears pricey, and now diverging compared to the price of oil and gas which are at their lowest levels in nearly a year. We like the stock, but expect some consolidation going forward. Even with a bullish view on energy prices, the near-term upside for XOM may be limited.

XOM Earnings Recap

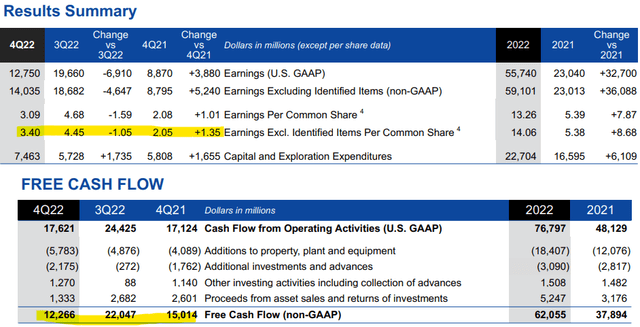

Exxon’s Q4 non-GAAP EPS of $3.40 came in $0.12 ahead of estimates. Revenue of $95.4 billion climbed by 12.3% year-over-year and was also $5.2 billion above the consensus. Earnings of $14.0 billion compared to $8.8 billion in Q4 last year reflecting higher pricing and margins along with modest volume growth across all segments.

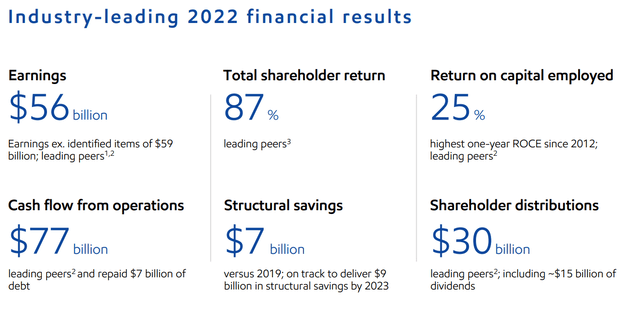

These trends were similar for the full year 2022 with Exxon earning $56 billion on a GAAP basis, up more than 140% compared to $23.0 billion in 2021. From a high level, Exxon is realizing the effects of structural cost savings initiatives implemented going back to 2019 adding to a 25% return on capital employed (ROCE).

Strong points for the year include more than 30% production growth for its strategically important Guyana and Permian basin operations. This balanced the exit and impairment charge of its Sakhalin-1 project following the Russia-Ukraine conflict. Refining margins have also been robust with the company noting the highest throughput since 2012.

source: company IR

The dynamic we want to focus on is the relative slowdown compared to the prior quarter with EPS down by -24% against the $4.45 in Q3. Simply put, oil and gas prices are lower which has already hit margins from a record high between Q2 and Q3. Free cash flow in Q4 at $12.2 billion was also down from $15.0 billion in Q4 last year as Exxon has accelerated its Capex spending and investments.

While the current pricing environment with BRENT crude oil above $85 per barrel and global natural gas benchmarks are still positive for cash flow and earnings, the current levels are far from the bonanza in early 2022 when crude oil traded above $130/bbl.

source: company IR

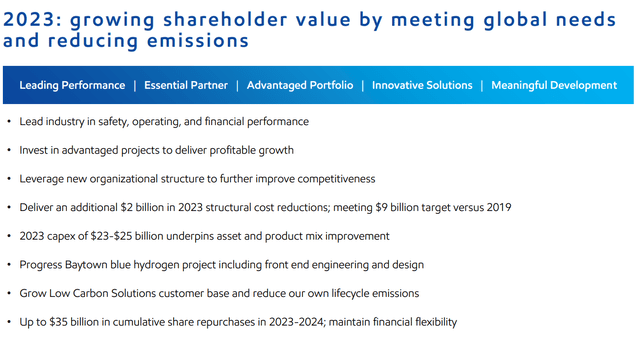

Looking ahead, the guidance from management is centered around continued performance. For Q3, the initial comments suggest an outlook for flat volumes in line with Q4 while scheduled maintenance should add to some modest earnings. Overall, ongoing cost savings efforts are expected to support margins beyond the pricing volatility.

It’s worth noting Exxon also announced an increased and extended share-repurchasing program with up to $35 billion of cumulative buybacks through 2024. This compares to the $14.9 billion repurchased in 2022 incremental to the $15 billion in the regular dividend. The quarterly rate was last hiked by 3% in October to $0.91 per share which yields 3.1% on a forward basis.

source: company IR

Is XOM Overvalued?

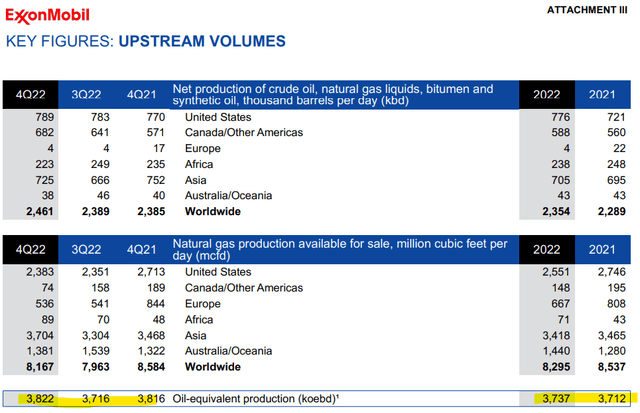

The challenge for XOM is that at the scale of its global operation, incremental production growth becomes difficult. For 2022, its total oil-equivalent production volume at 3.7 million barrels per day was nearly flat from 2021.

The way we’re looking at XOM is that even if the company continues to execute flawlessly, with no material disruptions to its investment plan, the reality is that the financials remain exposed to commodity pricing conditions. We can be bullish on the sector, but there’s no guarantee that prices will reclaim the highs from 2022 for the foreseeable future.

source: company IR

That’s a problem when we start looking at valuations where we’d typically want to see higher earnings and stronger growth to justify further multiple expansion.

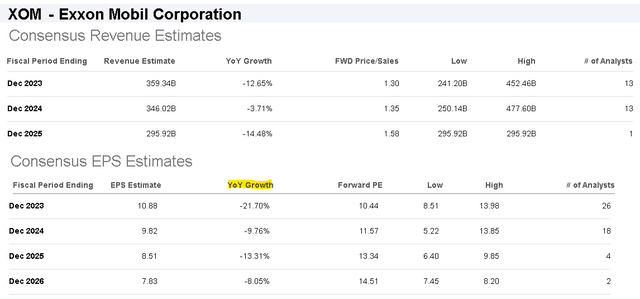

The dynamic is reflected in current consensus estimates with the market expecting a pullback in total revenues and earnings through 2025 as market conditions normalize. For 2023, the forecast is for XOM to reach EPS of $10.68, representing a decline of -22% from the $14.06 in 2022 with total revenues falling in line with average pricing.

Seeking Alpha

In our view, a 10x forward P/E on XOM is fair, but hardly a bargain in the sector. Separately, if we annualize the Q4 free cash flow run rate to $49 billion, XOM is trading at a 10x price to free cash flow on a forward basis which is also elevated relative to the sector. Recognizing XOM’s global leadership and its high-quality cash flows can justify a premium, those aspects can only go so far to drive a stock price higher and higher.

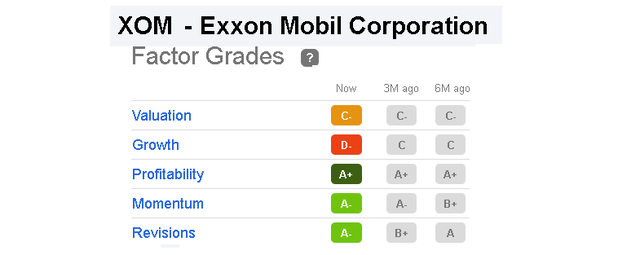

This is also reflected in Seeking Alpha’s quant-based Factor Grade where it scores a C relative to comparables. The D rating for growth considers the same declining outlook for revenue and EPS discussed above.

Seeking Alpha

XOM Stock Price Forecast

We rate XOM as a hold, balancing our bullish view on energy against what we see as a pricey valuation that has already priced in the company’s strong points. From there, the call we have is that outside of a scenario where energy prices rebound significantly higher, we’d expect the upside in shares to be limited.

Specifically, we would want to see the price of crude oil gaining momentum firmly above $100/ barrel to warrant a more bullish positioning on the stock. By this measure, we’d expect the commodity price of oil to outperform the upside XOM from here. Other oil & gas industry players are delivering stronger production growth that could deliver better returns from here.

In terms of risks, let’s also consider the possibility that energy prices take a leg lower. This could be the result of a further deterioration in the macro conditions defined by a sharper slowdown in global trade. On the downside, it will be important for XOM to hold the $110 share price level as an important area of support. In the near term, some consolidation around the current level is our base case.

Seeking Alpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.