Cisco Systems Q2 FY23 Earnings: What To Expect

Summary:

- Cisco had a good Q1 FY23, with revenue and earnings up more than expected and a rise in guidance.

- The transformation to software continues to be strong.

- Since the last quarter, the market sentiment has changed positively due to easing inflation and upping hopes for a soft landing.

- After positive Q1 FY23 numbers and with better sentiment, the management and analysts became more positive, resulting in better guidance and estimates.

- Better sentiment could accelerate product orders, and a weaker USD could contribute to stronger sales growth in 2023.

piranka

Introduction

Cisco Systems (NASDAQ:CSCO) designs, manufactures and sells everything needed to build and maintain IP networks, data centers, enterprise routing, and overall connectivity. To the newer segment belongs ‘End-to-End Security,’ which gives Cisco Systems a foothold in the cyber security sector, which is destined to grow fast in the following years. With its product offering, Cisco Systems is well-positioned to profit from the digitalization trend, data centers (e.g., driven by AI), and cyber security efforts. Nevertheless, the last year wasn’t easy for Cisco Systems. On an annual basis, 2022 was pretty bad, but within the year, Cisco suffered from macroeconomic headwinds, leading to declines in sales and earnings in the middle of the year. Despite that, Q1 FY23, Cisco Systems last reported quarter, showed newly gained strength, beating estimates and leading to a rise in management’s guidance. In this article, I will try to assess if Q2 FY23, reported next week, February 15, will show similar growth and can beat estimates again.

Cisco’s Q1 FY23 Results

Because some of the Q1 metrics are relevant to estimate Q2 earnings, I will give a quick overview of the last reported quarter.

In the latest earnings report, CSCO reported stronger-than-expected growth, with total sales up 5.7% YoY and Non-GAAP EPS up 5% YoY.

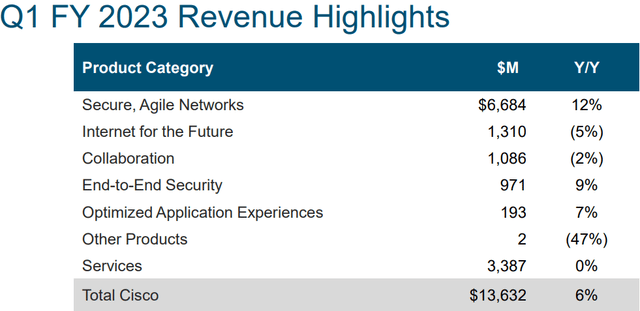

Q1 FY 23 revenue highlights (CSCO IR)

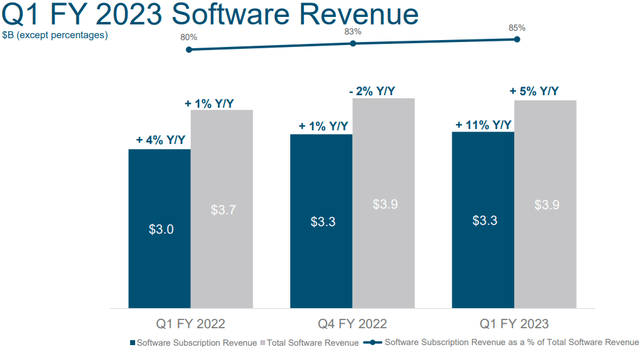

CSCO’s greatest segment, network products, held up the best with 12% YoY growth, while the ‘internet for the future’ segment declined the most. In the case of CSCO’s transformation into a more software-related company, progress looks good, with software revenue being up 5% YoY while the subscription revenue, which is recurring, is up 11% YoY as of Q1.

Q1 FY 23 software revenue (CSCO IR)

I like to see subscription revenue growing faster than overall revenue because it means CSCO has a higher percentage of revenue coming from recurring sources. Recurring revenue has several advantages to normal revenue, being that it is more predictable, enabling a company to plan better, and recurring revenue is safer in hard times like recessions. As of now, subscriptions make up for 43% of total revenue, down from 44% in Q4 FY 22.

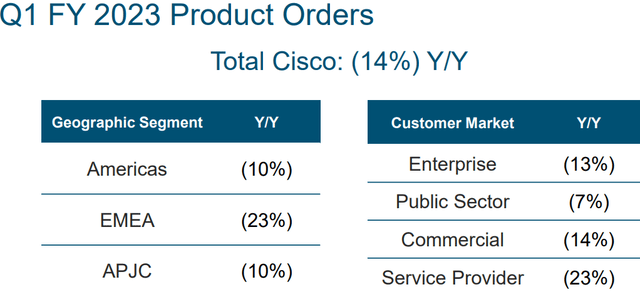

Future growth indicators didn’t look so good in Q1 FY 23:

Q1 FY 23 product orders (CSCO IR)

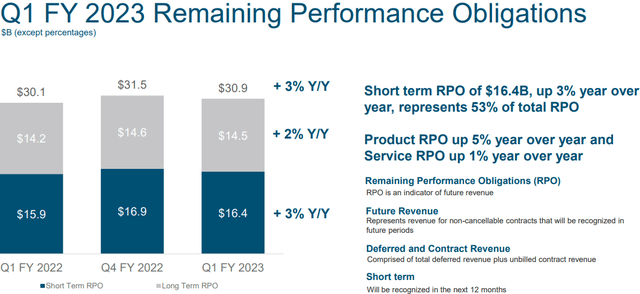

In total, product orders declined by 14% YoY, not supporting a continuing growth story. Remaining Performance Obligations (RPO) are an indicator for future revenue as they include deferred revenue and unbilled contract revenue. In Q1 FY 23, RPO grew 3% YoY but declined from the previous quarter.

Q1 FY 23 RPO (CSCO IR)

Cisco Q2 FY23 earnings – What to expect

CSCO’s fiscal year differentiates from the calendar year. When I’m talking about Q2, I’m talking about November, December, and January.

After the strong Q1, management upped their guidance and expected revenue to grow between 4.5% and 6.5% YoY and Non-GAAP EPS of $0.84 to $0.86. Regarding revenue, this would mean similar growth to last quarter (5.7%). If EPS comes in as $0.84, this would mean no growth YoY and a decline of 2.3% QoQ. If CSCO can get to the highest guidance of $0.86, this would mean no growth QoQ and just 2.4% YoY. So according to the management, this quarter is not about faster sales or earnings growth. The most likely reason the market appreciated the rise in guidance last quarter is that CSCO was expected to report slowing growth due to macroeconomic influences. Analysts had the same assumption but also revised their estimates after the Q1 report.

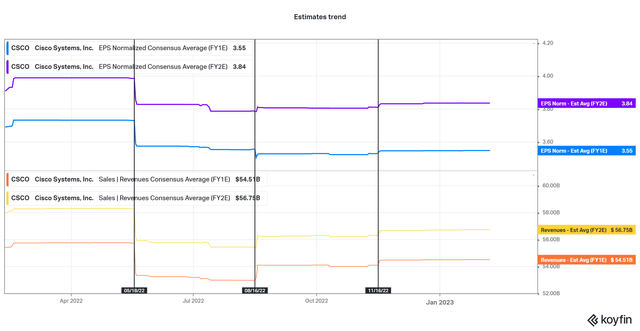

Estimates trend (koyfin.com)

In the chart above, you can see the estimate revisions after the last three quarters for the full FY 2023 and 2024. Both revenue and EPS estimates are below what they were at the start of 2022 but got meaningfully better after the last two quarters. These are the analyst’s estimates for Q2 FY 23:

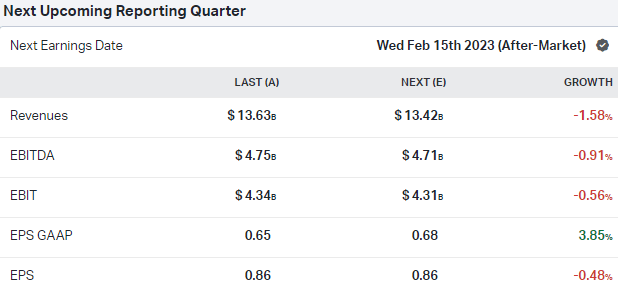

Analyst’s Q2 estimates (koyfin.com)

Same as the management, analysts see Q2 as a more stagnating quarter but are a bit more pessimistic about the revenue, with just $13.42B against management’s $13.64B.

Can CSCO beat these estimates?

I see two reasons for an earnings beat:

- CSCO has a good track record in beating estimates. They beat sales estimates 90% of the time in the last five years and EPS estimates 100% in the same timeframe. Management’s guidance was also right most of the time. So according to that, an earnings beat seems probable.

- The strong USD was a headwind for CSCO for the better of 2022. Since November, the USD has declined a lot -> 10% against the EUR, for example. In Q1 FY 23, CSCO made 42% of its revenue outside of the US, so changes in the USD have great impact on their sales. A weaker USD has positive effects, which could be one reason why CSCO beats earnings.

But there are also two reasons for CSCO to miss earnings:

- Macroeconomics. November and December marked one of the most pessimistic months of 2022. It felt like at the end of the year, everyone was certain that there would be a recession in 2023. Since the start of the year, the market sentiment has improved a lot. Now way fewer people, like retail investors or economists, seem to expect a recession in 2023. The sentiment is important because it has direct influence on the companies willing to invest. In 2022, most companies reduced investments to be prepared for an economic downturn, hence the decline in product orders of 14% YoY in Q1. Since Q2 includes November, December, and January, I expect product orders to decline further. In the best case, January was able to balance out November and December, and product orders are flat. But in general, in Q2, the macroeconomic environment was rather against CSCO, leading to a potential miss.

-

Not significantly higher RPO. As explained earlier, RPO gained 3% YoY in Q1 but declined QoQ. Since RPO is an indicator of future growth, with a QoQ lower and YoY just 3% higher, RPO does not support a growth story.

Summed up, I think that CSCO will be on par with estimates, maybe slightly below or above but not meaningfully negative or positive. Given the upside revision of estimates, guidance, and the economy’s circumstances, I think that would be a good sign but shouldn’t move the share price significantly. What is more important and will probably have much more impact on the share price is the guidance. I would appreciate if CSCO would give similar growth prospects for Q3 as for Q2.

What to look for in Cisco’s Q2 earnings report

Apart from the usual metrics to look out for, like revenue and EPS, I think the following metrics are interesting, too.

- Software revenue growth: I would like to see software revenue in total, but especially the subscription revenue, to growth similar to Q1 (>=5% total, >=10% subscription). Additionally, I would appreciate if the software subscription revenue % of total software revenue would further rise. That would show further acceleration of the transformation to a software company.

- Product orders: Like I already said, I expect product orders to decline YoY or, in the best case, be flat. What I don’t want to see is an even bigger decline (>14%) in product orders. A gain would be a good sign, especially coming from enterprise customers.

- Remaining Performance Obligations (RPO): To see if growth can continue, a (meaningful) gain in RPO would be good. If RPO continues to decline, that would be a reason to think of slower growth ahead and, therefore, a negative sign.

Conclusion

I think CSCO is able to hold up to the higher estimates and guidance, but I don’t see enough signs that would justify the assumption that a bigger earnings beat is ahead. The same goes for the guidance, which I expect to be similar to the last one. Hence, I don’t think that a bigger movement in the share price will occur, as long as my assumptions are correct. Therefore, I rate CSCO a ‘hold.’ This rating is solely related to the earnings prediction. For the long-term, I think CSCO is a buy. They will experience several tailwinds, like the trend to cybersecurity, and are attractively valued in my view.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.