Summary:

- CleanSpark has shown significant growth through mergers and acquisitions, aiming for 37 EH/s by year-end and 50 EH/s by 2025.

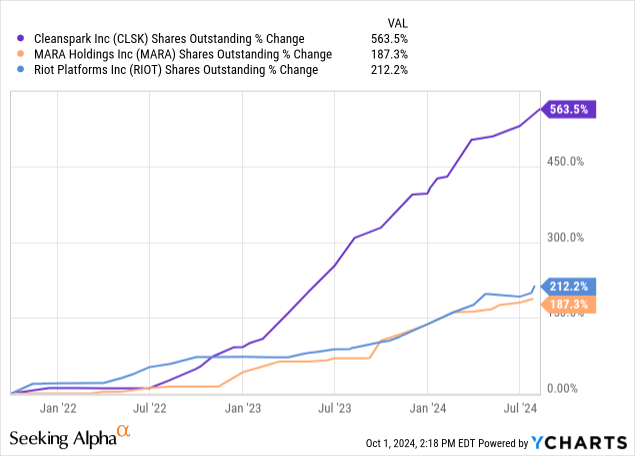

- Shareholder dilution remains a major concern, with a 564% increase in shares outstanding over three years, raising questions about long-term benefits.

- Despite recent underperformance and a breakeven Bitcoin price of $73k in Q2, CleanSpark’s ability to raise capital provides financial flexibility.

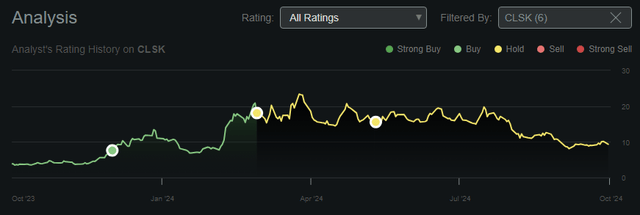

- Upgraded to “buy” due to potential capitulation and a possible BTC price run, but caution is advised until more corporate performance data is available.

Olemedia

It has been over four months since I last covered CleanSpark (NASDAQ:CLSK) for Seeking Alpha. This is a company that I’ve written about several times going back to late 2022. I wouldn’t say that CleanSpark has become my “favorite” public Bitcoin (BTC-USD) mining stock through the years, but I think it would be fair to say I’ve generally had a more favorable view of it compared to industry peers, having called it a “buy” three times. However, more recently I’ve been cautious about the stock:

- CleanSpark: Locked And Loaded For Post-Halving Acquisitions (“Hold” May 2024)

- CleanSpark: Pre-Halving Profit Never Hurts (“Hold” Feb 2024)

- CleanSpark: Well Positioned For The Future (“Buy” Dec 2023)

My caution has come, in part, because of the longer-term economics of Bitcoin mining. But also because shareholders enjoyed enormous returns as 2023 came to a close, and I felt it was getting difficult to justify the share price with a looming halving back in February.

My recent CLSK ratings (Seeking Alpha)

However, in May I noted the company would be active from an M&A perspective, and we’ve seen that expectation come to fruition. In this article, we’ll look at CleanSpark’s recent scaling efforts and assess if CLSK is a buy after what has been a rough selloff since late June.

Growth and Mergers

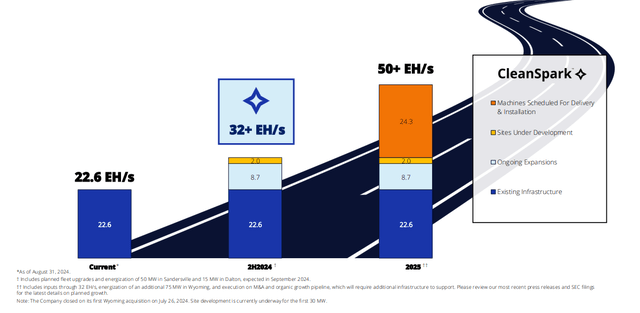

At the end of August, CleanSpark reported 22.6 EH/s active and operating. The company still has plans for rather large growth through the end of the year:

September Investor Deck (CleanSpark)

Since this slide was created, CleanSpark has actually increased guidance up to 37 EH/s by the end of the 2024. Additionally, the company has reaffirmed guidance for 50 EH/s by the end of 2025. To get to that lofty 50 EH/s figure, CleanSpark acknowledges that it has to grow through mergers and acquisitions. To that end, it’s been a very busy summer for the company.

| Site Acquisitions | MW Added | Location | Cost |

|---|---|---|---|

| May 9th | 75 | Wyoming | $18.8m, cash |

| June 18th | 60 | Georgia | $25.8m, cash |

| June 27th | 400 | Tennessee | $155m, stock |

| September 11th | 85 | Tennessee | $27.5m, cash |

| September 17th | 16.5 | Mississippi | $5.8m |

Source: CleanSpark

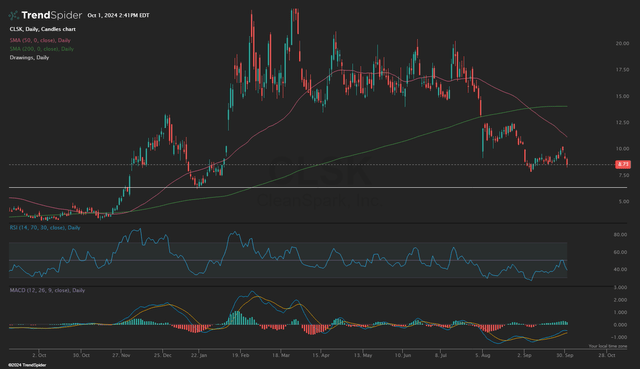

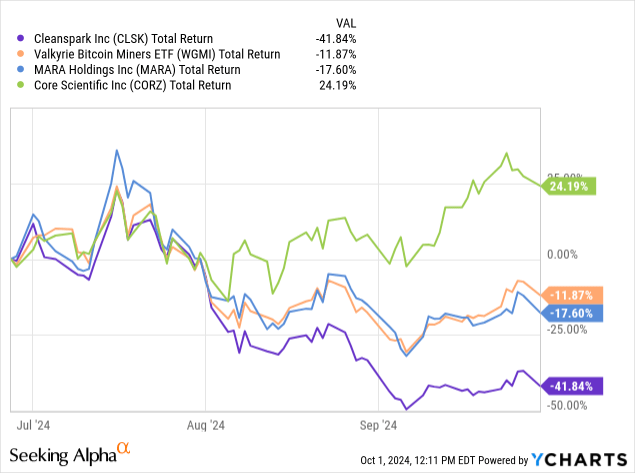

At the end of June, CleanSpark reported $126.1 million in cash on the balance sheet. Thus, I believe it’s safe to assume the September acquisitions bring the company’s cash balance back below $100 million for the first time since the end of 2023. This is fairly significant due to the all-stock deal in June to acquire GRIID Infrastructure (OTCPK:GRDI) for $155 million. GRIID is certainly not a company that we can call financially healthy. I suspect this is why CLSK shares have badly underperformed industry peers since the announcement:

At the time of the announcement, CLSK shares were trading north of $16. As of article submission, those same shares can be had for less than $9. This is not an attempt at playing the ‘I told ya so’ game, but my caution regarding CLSK has proven to be well-founded. It’s one thing to have a hoard of capital for expansion plans, putting that capital to work well can be a bit more challenging.

According to the recently released prospectus, the GRIID acquisition brings CleanSpark $3.8 million in cash and less than 2 BTC against $68.5 million in total liabilities. Beyond that, I think it’s fair to be curious about how this balance sheet is going to look given what we’ve seen from deal pricing going back to May:

| MW Added | Location | Cost | $ per MW |

|---|---|---|---|

| 75 | Wyoming | $18.8 | $250,667 |

| 60 | Georgia | $25.8 | $430,000 |

| 400 | Tennessee | $155.0 | $387,500 |

| 85 | Tennessee | $27.5 | $323,529 |

| 16.5 | Mississippi | $5.8 | $351,515 |

Source: CleanSpark, author’s calculation

Pricing the announced deals in MW, the GRIID acquisition was actually one of the more expensive deals CleanSpark made over the last several months. Each negotiation is obviously different, and we don’t know how motivated any individual seller is, but I think it’s interesting nonetheless.

‘All-In Sustaining Cost’

As noted already, CleanSpark is guiding for 37 EH/s by the end of this year. Since we don’t yet have expense data from the quarter ended September, Q2-24 may give us an important signal pertaining to CleanSpark’s true breakeven price. As I’ve mentioned in previous articles, this is an estimate for what would be comparable to an ‘all-in sustaining cost’ figure that Gold mining stock investors generally reference. This is not just the energy cost to mine that Bitcoin mining stock investors like to point to. My figure takes depreciation into consideration. I should note that I’m only including SG&A and depreciation/amortization in the total opex figure below:

| Q3-23 | Q4-23 | Q1-24 | Q2-24 | TTM | |

|---|---|---|---|---|---|

| Cost of Revenues | $30,400,000 | $93,600,000 | $34,300,000 | $45,200,000 | $203,500,000 |

| Total Opex | $83,100,000 | $203,900,000 | $58,000,000 | $70,600,000 | $415,600,000 |

| BTC Mined | 1,877 | 2,019 | 2,031 | 1,583 | 7,510 |

| Breakeven Price | $60,469 | $147,350 | $45,446 | $73,152 | $82,437 |

Source: Seeking Alpha, CleanSpark, author’s calculation

I’m not including “other operating expenses” of $48.3 million in the quarter from the new FASB accounting rules. That method allows for the re-valuation of BTC that has been previously mined out of quarter as though it is an in-quarter operational outcome. I don’t personally care for it. I think the breakeven price in the table above gives us a more fair assessment of the true cost to operate on a quarterly basis. And I specifically want to point out the Q2 figure because it is almost entirely derived from post-halving production performance with the exception of the first three weeks in April. So getting to the point; CleanSpark’s breakeven Bitcoin price was $73k in Q2.

Dilution

As is generally always the case with publicly traded Bitcoin miners, the biggest risk outside of the dwindling supply of minable BTC is the shareholder dilution of the equities.

Here we can see CLSK has been a particularly brutal offender of shareholder dilution with a 564% increase in shares outstanding over just a three-year time period. Raising capital in this way has allowed the company to generally avoid debt, which perhaps gives leadership better optionality for deployment without ongoing interest expenses. This dilution is what has allowed CLSK to scale to the behemoth Bitcoin miner that it already is. What is unclear is if the strategy will benefit shareholders long term. It’s an enormous bet on either higher BTC prices or global hashrate coming down.

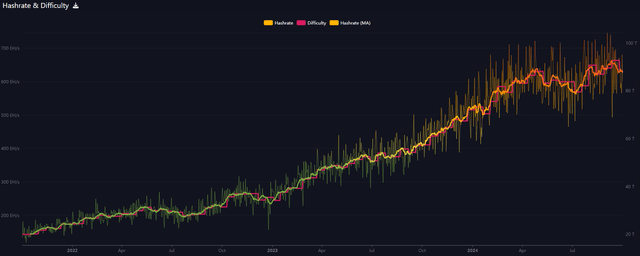

Global Hashrate

Since the April halving, global EH/s growth appears exhausted. The moving average for the Bitcoin network was 633 EH/s on the day of the halving. On September 30th, that moving average was down slightly to 627 EH/s. This means that in the time that CleanSpark has scaled from 16.4 EH/s in March to over 26 EH/s in September, the global hashrate hasn’t gone much of anywhere. From where I sit, CleanSpark’s growing share of global hash post-halving is a bold move and an impressive one if it works out.

Summary

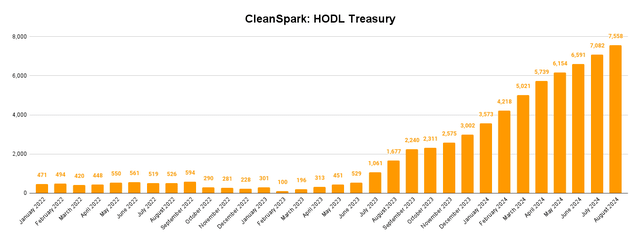

I’m still not going to say CLSK is a great long-term investment. Shareholder dilution is going to remain an ongoing concern. That said, CleanSpark has been able to grow both production and a sizeable Bitcoin stack in a relatively short amount of time.

CleanSpark BTC Stack (CleanSpark, Author’s Chart)

At a BTC price of $62k, CleanSpark has $468.6 million in capital that can be deployed if the company gets in a pinch financially. However, I don’t see that as a significant risk given the company’s ability to raise outside capital. I wouldn’t personally get too heavy into CLSK until we see another quarter or two of corporate performance data.

That being said, I don’t hate CLSK as a swing trade. Now that we’re in the fourth quarter of 2024, I think we’re going to see capitulation in names that have struggled this year – and Bitcoin miners are certainly in that camp with the exception of only a handful of stocks. I don’t currently have any CLSK exposure at this time, but if a greater washout under $8 presents itself, I think that could place to take some shots on CLSK if one expects a greater run in the price of BTC to manifest into the end of the year. Despite clear concerns, I’m going to upgrade this one to “buy” on possible holder capitulation between now and the end of the year.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.