Summary:

- The Coca-Cola Company has outperformed the S&P 500 over the past year, given its robust business model and consistent profitability through the cycle.

- It has continued to innovate, expanding and improving its brand portfolio to protect its competitive leadership.

- But has the rapid recovery from its October lows also reflected its near-term upside?

- We discuss why income investors should also consider improved entry levels to lift their reward/risk and total return profile, even if they are invested mainly for dividends.

AlizadaStudios

The Coca-Cola Company (NYSE:KO) stock has outperformed the S&P 500 (SPY) since we upgraded it in our previous article. The market sent weak holders sprawling in an October panic selloff, from which the leading non-alcoholic beverage company recovered remarkably.

As such, KO posted a total return of nearly 11% against SPX’s 1.2% gain, as investors spurned higher-risk names in SPX as they reached out for the security of KO’s business model.

Relative to KO’s 10Y total return CAGR of 8.5%, investors need to consider whether its near-term upside has been reflected. Notwithstanding, we understand that income investors rely on the stability of KO’s dividend streams and are not perturbed by specific entry levels.

However, we believe investors who picked the lows in October should understand by now why choosing the right levels to add could lead to outperformance with improved reward/risk. As such, we encourage investors to be patient with KO, anticipating another significant dip to add more exposure.

The company updated in a recent Redburn conference that it expects to continue performing well despite the worsening macroeconomic headwinds. Notably, it highlighted that the strength of the dollar had caused some challenges to its growth momentum, as the company prices in their respective local currencies.

As such, the surge in the Dollar Index (DXY) in 2022 has impacted the company’s momentum, as revenue growth is expected to slow to 10.6% from 2021’s 17.1% increase. However, normalization should be anticipated as Coca-Cola recovered from its 2020 pandemic woes. Moreover, given its ex-US revenue exposure of nearly 63%, such a performance is still quite impressive.

In addition, we assessed that forex headwinds should be less significant moving forward, with the DXY down more than 8% from its September highs. Hence, we believe it should corroborate the company’s long-term growth cadence of achieving the top end of its 4% to 6% organic revenue growth range.

New investors to KO should be informed that the company relies on an asset-light strategy that we highlighted in one of our articles. As such, management focuses on topline growth to lift operating leverage. In addition, the company emphasized that it has multiple levers to improve its profitability and drive operating leverage, as CEO James Quincey articulated:

The primary driver for profit growth is going to be the top line. Now even for us in an asset-light model, sometimes the improvement is more [on] the operating margin than the gross margin because the company is likely to be investing heavily in marketing. (Redburn 2022 CEO Conference)

We have been impressed with the company’s ability to continue innovating. Quincey categorizes its brand portfolio into four main buckets, led by its flagship Coke brand in the “gold-medal position.” At its smallest bucket are experimental brands, where it continues to learn and glean crucial market and competitive information on its brand positioning.

As such, we believe the company remains well-poised to continue its leadership against its peers.

Notwithstanding, the critical question is whether the current levels still represent an attractive opportunity for investors to consider adding?

KO last traded at an NTM EBITDA multiple of 21.5x, well above its peers’ median of 10.4x (according to S&P Cap IQ data). While some KO bulls could argue that its premium is justified, KO’s valuation is also no longer cheap on a relative basis. Also, its NTM dividend yield of 3% has fallen below its 10Y average of 3.22%.

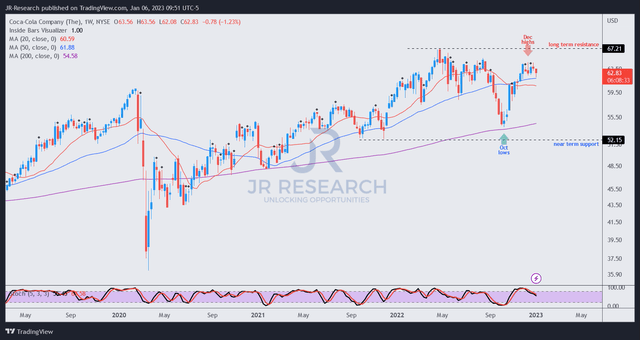

KO price chart (weekly) (TradingView)

KO’s price action indicates that the surge from its October lows has likely captured its near-term upside, as reflected in its valuations. While we don’t expect its October lows to be revisited, we believe a pullback should help investors who missed its recent lows to improve their potential upside.

Hence, we encourage investors to demonstrate some patience for now.

Rating: Hold (Revise from Buy).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!