Summary:

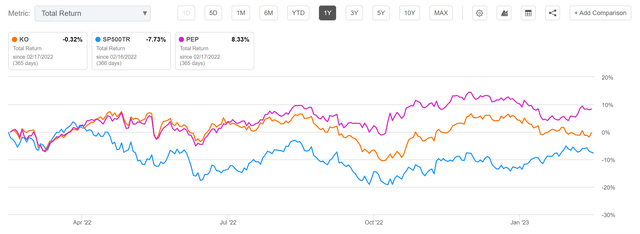

- Within the past 12-month period, Coca-Cola has shown a Total Return of -0.32%, while PepsiCo’s Total Return has been 8.33%.

- Both companies contribute to reducing the volatility of your investment portfolio: while PepsiCo has a 24M Beta of 0.50, Coca-Cola’s is 0.60.

- In this analysis, I will show you which of the two companies is currently the better risk and reward choice for dividend income and dividend growth investors.

esinesra/iStock Editorial via Getty Images

Investment Thesis

Even though both Coca-Cola (NYSE:KO) and PepsiCo (NASDAQ:PEP) currently receive my hold rating, I consider PepsiCo to be the slightly more attractive choice for dividend income and dividend growth investors. This is particularly due to PepsiCo’s slightly lower Payout Ratio of 66.64% when compared to Coca-Cola’s (70.97%) and the company’s higher growth rates: PepsiCo shows a higher Revenue Growth 5 Year [CAGR] of 6.34% (compared to the 3.50% of Coca-Cola) and a higher Dividend Growth Rate [CAGR] over the past 5 years (7.39% compared to 3.53%). Due to its broader product portfolio and even lower 24M Beta of 0.50 (compared to 0.60 of Coca-Cola), I also consider PepsiCo to be the lower risk investment. From my point of view, all of these factors make PepsiCo the more attractive risk and reward choice.

Coca-Cola and PepsiCo’s Performance within the past 12-month period

When looking at the companies’ performance within the past 12-month period, it can be highlighted that PepsiCo has performed slightly better: while PepsiCo has shown a Total Return of 8.33%, Coca-Cola’s Performance has been -0.32%. The S&P 500, however, has been down 7.73% over the same time period. The Performance of both companies confirms that they can be considered as attractive defense plays in order to reduce the volatility of your investment portfolio.

The Valuation of Coca-Cola and PepsiCo

At PepsiCo’s current stock price of $176, my DCF Model indicates a downside of 10.8%, thus indicating an Internal Rate of Return of approximately 6% for the company.

At Coca-Cola’s stock price of $60, my DCF Model shows a downside of 31%, indicating an Internal Rate of Return of approximately 2%.

The calculation of my DCF Model indicates that PepsiCo is currently the slightly more attractive pick between the two companies. However, it also strengthens my opinion to currently rate both PepsiCo and Coca-Cola as a hold.

Even though my DCF Model shows a downside potential for both companies at the current stock prices, they don’t get my sell rating: this is particularly due to the fact that I consider both to be excellent defense plays in order to reduce the volatility of your investment portfolio. My opinion is underlined by PepsiCo’s 24M Beta of 0.50 and Coca-Cola’s 24M Beta of 0.60.

Fundamentals: Coca-Cola vs. PepsiCo

At this moment of writing, Coca-Cola’s market capitalization is slightly higher than PepsiCo’s: while Coca-Cola has a market capitalization of $256.30B, PepsiCo’s is $241.72B.

PepsiCo’s P/E [FWD] Ratio is currently slightly higher than Coca-Cola’s: Coca-Cola has a P/E [FWD] Ratio of 22.85 and PepsiCo’s is 24.36. From my point of view, PepsiCo’s slightly higher P/E [FWD] Ratio is justified due to its broader product portfolio (in contrast to Coca-Cola, PepsiCo does not only operate in the Soft Drinks Industry since it also manufacturers and markets foods and snacks) and higher growth rates: PepsiCo has a Revenue Growth Rate 5 Year [CAGR] of 6.34% while Coca-Cola’s is only 3.50%. At the same time, PepsiCo has a higher EPS Diluted 3 Year [CAGR] Growth Rate of 7.28% when compared to the 1.90% Growth Rate of its competitor. Both are indicators that PepsiCo is ahead when it comes to Growth. PepsiCo’s higher Growth Rates contribute to the fact that I consider the company to be the slightly more attractive choice out of the two.

Even though Coca-Cola has the higher EBIT Margin [TTM] (which is a result of only operating in the Soft Drinks Industry), PepsiCo has a higher Return on Equity: while PepsiCo has an ROE of 53.72%, Coca-Cola’s is 37.77%.

In particular, PepsiCo’s superiority in terms of Growth strengthens my opinion to select the company over Coca-Cola.

|

Coca-Cola |

PepsiCo |

||

|

General Information |

Ticker |

KO |

PEP |

|

Sector |

Consumer Staples |

Consumer Staples |

|

|

Industry |

Soft Drinks |

Soft Drinks |

|

|

Market Cap |

256.30B |

241.72B |

|

|

Profitability |

EBIT Margin |

28.10% |

14.18% |

|

ROE |

37.77% |

53.72% |

|

|

Valuation |

P/E GAAP [FWD] |

22.85 |

24.36 |

|

Growth |

Revenue Growth 3 Year [CAGR] |

4.89% |

8.76% |

|

Revenue Growth 5 Year [CAGR] |

3.50% |

6.34% |

|

|

EBIT Growth 3 Year [CAGR] |

4.36% |

4.56% |

|

|

EPS Diluted 3 Year [CAGR] |

1.90% |

7.28% |

|

|

Income Statement |

Revenue |

43.00B |

86.39B |

|

EBITDA |

13.34B |

14.89B |

|

|

Balance Sheet |

Total Debt to Equity Ratio |

151.59% |

240.18% |

Source: Seeking Alpha

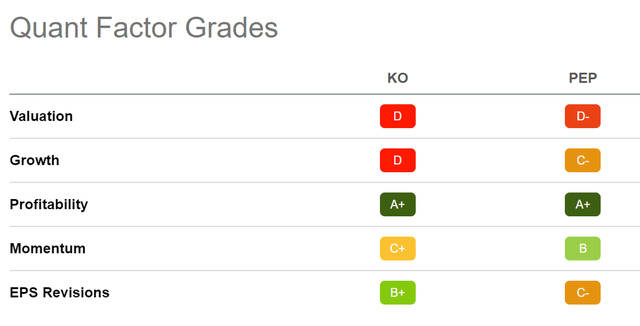

Coca-Cola vs. PepsiCo according to the Seeking Alpha Factor Grades

The Seeking Alpha Factor Grades confirm that PepsiCo is currently the slightly more attractive choice between the two companies: in terms of Growth (D rating for Coca-Cola and C- rating for PepsiCo) and in terms of Momentum (C+ rating for Coca-Cola and B rating for PepsiCo), PepsiCo is rated slightly higher than Coca-Cola.

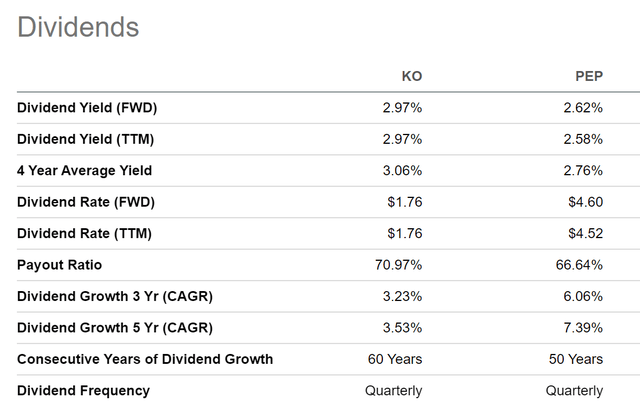

Coca-Cola and PepsiCo’s Dividend

When taking a closer look at the companies’ Dividend Yield, we find further indicators that PepsiCo is the slightly more attractive choice: while PepsiCo has a Dividend Growth Rate [CAGR] of 7.39% over the past 5 years, Coca-Cola’s is only 3.53%.

The same is confirmed when looking at the companies’ Payout Ratio: while Coca-Cola’s is 70.97%, PepsiCo’s is only 66.64%, leaving more room for future dividend enhancements. Taking into consideration both PepsiCo’s lower Payout Ratio and its higher Dividend Growth Rate [CAGR] over the past 5 years when compared to Coca-Cola, we identify strong indicators that PepsiCo is the slightly more attractive pick for Dividend Income and Dividend Growth Investors.

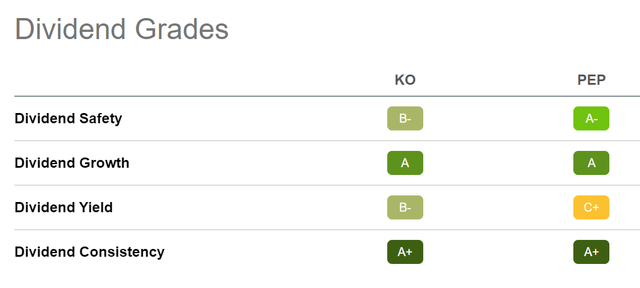

Coca-Cola vs. PepsiCo according to the Seeking Alpha Dividend Grades

Taking into consideration the Seeking Alpha Dividend Grades, it is further confirmed that PepsiCo is the slightly better pick for investors looking for dividend income and dividend growth: while both companies are rated equally for Dividend Growth (A rating) and for Dividend Consistency (A+), PepsiCo is rated higher in terms of Dividend Safety with an A-, while Coca-Cola receives a B-. This, once again, underlines the theory that PepsiCo is the better fit for dividend income investors.

Risk Factors

When it comes to risks, I also consider PepsiCo to be less risky and therefore the more attractive choice for investors: due to PepsiCo’s lower Payout Ratio (66.64% compared to 70.97%) in combination with its higher growth rates (Revenue Growth 5 Year [CAGR] of 6.34% compared to 3.5% and EPS Diluted 3 Year [CAGR] of 7.28% compared to 1.90%), I consider the risk of a possible future dividend cut to be significantly lower for the company than for Coca-Cola. A dividend cut could have a significant negative impact on the stock price of each company. For this reason, PepsiCo is the lower risk investment for dividend income and dividend growth investors from my point of view.

In addition to that, PepsiCo’s 24M Beta of 0.50 is even lower than the one of Coca-Cola (24M Beta of 0.60), which serves as evidence that you can further reduce the volatility of your investment portfolio by investing in PepsiCo, thus indicating that the company is the slightly more attractive defense play between the two.

Another reason why I see PepsiCo as the lower-risk investment compared to Coca-Cola is the fact that it has a much broader product portfolio than its competitor. This allows it to better compensate for possible revenue declines in some of its business units in times of a recession. This once again strengthens my belief that PepsiCo is the less risky investment.

Conclusion

Even though both Coca-Cola stock and PepsiCo stock currently receive my hold rating (which is mainly a result of their relatively high Valuation), I consider PepsiCo to be the slightly more attractive risk and reward choice. This is due to the company having a broader product portfolio (because it not only operates in the Soft Drinks Industry), a lower Payout Ratio (66.64% compared to Coca-Cola’s 70.97%) and for showing higher Dividend Growth Rates (while PepsiCo has shown a Dividend Growth Rate [CAGR] of 7.39% over the past 5 years, Coca-Cola’s has been 3.53%). All of these factors contribute to the fact that I see PepsiCo as the slightly more attractive choice for dividend income and dividend growth investors.

Author’s Note: I would love to know which one out of the two you prefer and if you hold Coca-Cola or PepsiCo (or even both) in your investment portfolio!

Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.