Summary:

- Intel’s catastrophic performance in Q4 and a weak outlook for Q1 indicate that it would be hard for the business to become FCF-neutral in 2023.

- As a result, there’s a risk that the management would be required to cut the dividends at the end of the year to decrease the cash burn rate.

- However, Intel’s stock could be a solid investment for long-term investors due to the company’s potential to access a significant pool of public funds to decrease the costs of turnaround.

Justin Sullivan

There’s no denying that Intel’s (NASDAQ:INTC) latest earnings report for Q4 was catastrophic. Not only did the company experience a Y/Y decline in revenues and performed below the street expectations, but it’s now a certainty that it will face significant challenges to become FCF neutral in 2023. While I remain cautiously optimistic about Intel’s future due to the fact that the company is likely to become one of the biggest beneficiaries of public programs that are aimed at securing chip supply chains in the western world, there’s nevertheless a real possibility that the management would be required to cut the dividends to achieve its goals. As such, there’s a risk that the stock would face additional pressure in the short to the near term, but it could nevertheless become a solid investment for patient investors with a longer time horizon.

Dividends Are At Risk

Intel’s latest disastrous earnings results for Q4 indicate that the company’s management is unlikely to execute a much-needed turnaround in a timely manner and as a result, it’s likely that the business would continue to underperform in 2023 as well. Not only did the revenue of $14 billion in Q4 was down 28.2% Y/Y and below the street estimates by nearly half a billion dollars, but its non-GAAP EPS of $0.10 was also below the estimates by $0.10. What’s worse is that Intel’s management also noted that the company expects to generate only $10.5 – $11.5 billion in revenues in Q1, below the street estimates of $14.02 billion.

On top of all of that, the company has also generated a negative FCF of ~$4 billion in 2022 which is on the lower end of its initial forecast under which it was expected to generate FCF in the range from negative -$2 billion to negative -$4 billion. In addition, if in my previous article, I’ve noted that the management aims to be FCF neutral in 2023, then now there’s a risk that Intel would once again have a negative FCF this year. The management has already noted that it’s likely that Intel’s adjusted FCF will be below the previous expectations of approximately neutral in the first half of 2023. There’s also no guarantee that financials would greatly improve in the second half of 2023. This leads to the possibility of Intel cutting a significant portion of its dividend payments to continue to execute a turnaround, especially if it decides to stick with its goal of having capital spending at the level of ~35% of revenues this year.

While the management didn’t explicitly state that they would cut the dividends and even announced dividends for Q1 already, if the financials deteriorate in the following quarters, then a potential cut or a temporary suspension of dividends could be in play in the future. In 2022 alone, Intel paid close to $6 billion in dividend payments and is expected to pay a similar amount in 2023. Wall Street is already worried about the company’s ability to spend so much on dividends given the cash burn rate and the lack of growth. If the business is unable to become at least FCF neutral in 2023, and my updated model below expects another year of negative FCF, then a dividend cut is likely to be the only scenario in the future as I don’t see a scenario where CapEx would be cut in the middle of a turnaround.

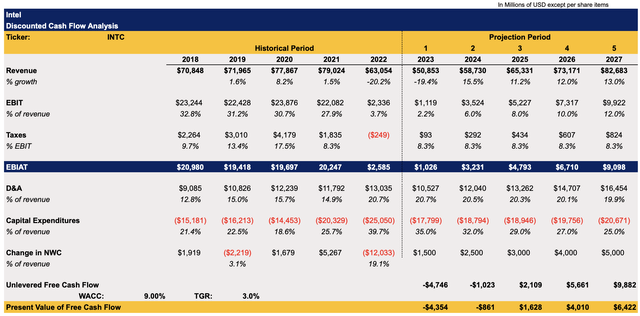

Considering all of this, it makes sense to update Intel’s DCF model by adding the latest earnings data and changing some of the assumptions to better reflect reality. My previous model which was published before the Q4 results were released was slightly more optimistic and showed the company’s fair value to be $31.60 per share. One of the main differences in the new model below in comparison to the previous model is the change in Intel’s forecasted top-line growth rate. Unfortunately, the weak performance in Q4 made the street less optimistic about the company’s performance in 2023 and as a result, I’ve updated the revenue growth rate for the following years which now reflects a more pessimistic scenario and is in line with the street’s updated revisions for 2023 and 2024 after which the situation begins to improve.

At the same time, there’s an indication that earnings in 2023 once again will take a major hit and as a result, the EBIT forecast for the following years was also greatly revised. The tax rate in the updated model remains at 8.3% as the likely tax incentives make it possible for Intel to pay taxes below the standard corporate tax rate. The D&A as a percentage of revenue has been increased in FY23 due to a higher D&A in FY22 after which it gradually decreases. The capital expenditures for FY23 of 35% of revenues are in-line with the management forecast after which it also decreases thanks to further implementation of the savings program while the change in net working capital hasn’t been changed much in comparison to the previous model. The WACC in the model is 9% while the terminal growth rate is 3%.

Intel’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

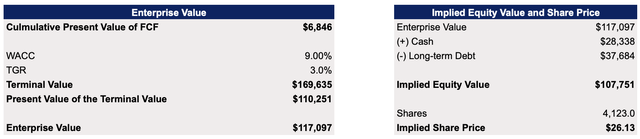

My updated DCF model shows Intel’s enterprise value to be $117 billion while its fair value is $26.13 per share, below the previous valuation of $31.60 per share in part due to the relatively weak performance on the business in Q4 and weak guidance for the following quarters.

Intel’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Friendshoring To The Rescue

While my model indicates that Intel trades close to its fair value, I wouldn’t say that its upside is limited. Despite the relatively weak performance, there’s still a case to be made that the management would be able to transform the business and revive its growth. The potential dividend cut alone could ensure that the business is FCF-positive. While this could certainly lead to a temporary depreciation of the share price as dividend investors and funds would sell their stakes, it would also ensure that the company would be able to focus fully on growth without worrying about the cash burn.

The upside for Intel is that the company is executing a turnaround at the right place and at the right time. As western governments aim to better secure their supply chains by decoupling from China and moving production closer to home, Intel is able to greatly benefit from the influx of public funds that could be used to expand the business without the need to fully fund its facilities on its own.

In my latest article on Intel, I’ve highlighted how the company could get over $20 billion this year across CHIPS Act and FABS Act to build its fabs in the United States. At the same time, the European Union is also preparing legislation similar to the CHIPS Act that would open additional opportunities for Intel to receive public European funds to expand its foothold in Europe at the fraction of the cost as well.

Thanks to all of this, Intel has everything going for it to transform its business and revive the growth story without fully funding the necessary expansion projects on its own. During the latest earnings call, Intel’s management already noted that thanks to various cost-savings programs the company would be able to reach $8 billion to $10 billion in cost reductions by the end of 2025 alone. As such, it’s too soon to lose full faith in Intel at this stage.

The Bottom Line

Intel is lucky that the need to transform its business comes at a time when western governments try to decouple from China and secure their own supply chains. The company is likely to receive a significant portion of public funding that could help it to expand its foothold and potentially ensure that its former glory is restored. However, significant risks remain.

The catastrophic performance in Q4 along with the weak guidance for the first half of 2023 already make it certain that Intel is unlikely to rapidly execute a turnaround. At the same time, it’s also hard to believe that Intel would become FCF-neutral this year. The only way to do so it seems is to cut dividends which would then negatively affect the company’s shares in the short to near term but make it easier for the management to achieve its goals in the long term as cash burn would no longer be an issue. As a result, I remain cautiously optimistic about Intel at this stage.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He’s/It’s/They’re solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!