Summary:

- The Coca-Cola Company’s 61st consecutive dividend increase arrives on time as expected.

- Payout ratio has worsened considerably based on Free Cash Flow.

- 6% fall YTD is making Coca-Cola stock a bit more attractive.

- Buying The Coca-Cola Company around 3.30% is not a bad idea based on the historical yield.

Georgiy Datsenko

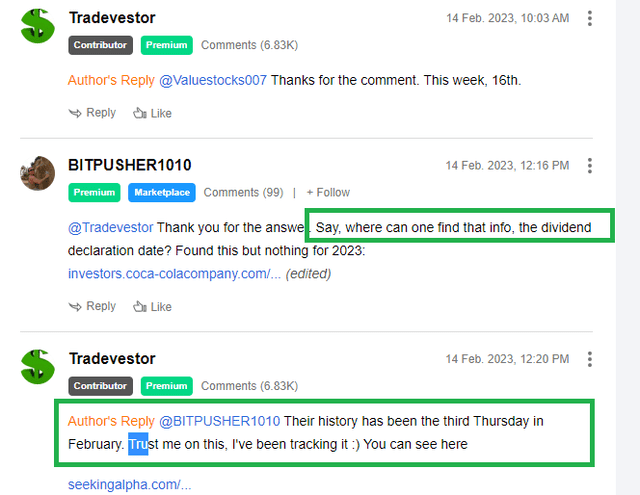

Not that anyone is keeping scores here, but The Coca-Cola Company (NYSE:KO) has just kept up my words to the Seeking Alpha community as shown below, by announcing its 61st consecutive dividend increase. I was planning to not write anymore if I failed on this prediction, but thanks to Coke, I can continue here. Just kidding.

Jokes aside, I recently previewed this expected annual dividend increase. Staying true to its reliability once again, Coca-Cola has just announced its annual dividend increase today, the third Thursday of February as it has done for a while now. I also reviewed the company’s recent earnings, with a focus on free cash flow-based dividend coverage. Now that the company has announced its 61st consecutive annual dividend increase, it is time to revisit the stories.

I projected a 5% dividend increase to 46.20 cents, and Coca-Cola has given out a 4.50% increase to 46 cents. Not too shabby. Once again, that says nothing about my predictive abilities but a lot about the company’s reliability. I mean, retirees can (and have) safely predict and count on Coke’s annual dividend increases to the day and cent if history and recent numbers are studied carefully. Let’s see how the numbers look after this increase.

- Current outstanding share count is at 4.325 Billion.

- The new quarterly dividend is 46 cents per share.

- That would represent a commitment of $1.989 Billion/quarter towards dividends (4.325 Billion shares times 46 cents).

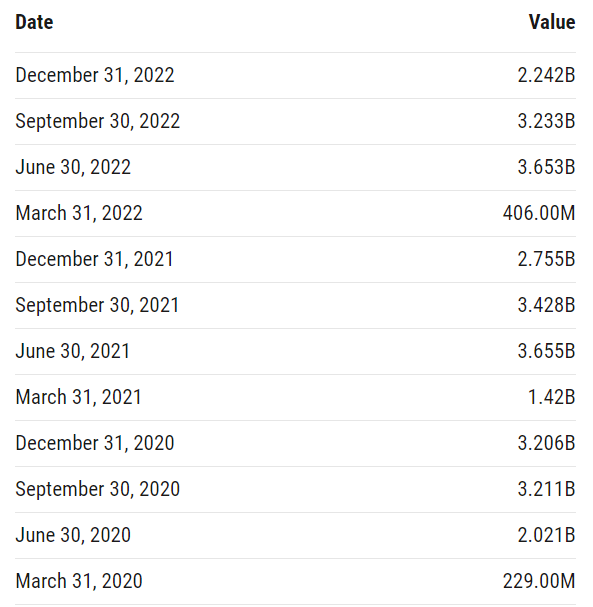

- Coca-Cola’s free cash flow [FCF] has generally been consistent, especially if you compare each quarter YoY. But you are in for a surprise here.

- The average quarterly FCF was $2.38 Billion using the most recent 4 quarters, which would represent a payout ratio of 83% ($1.989 B divided by $2.38 B). This number has gone up by quite a margin compared to my 2022 review, when the payout ratio based on trailing twelve months FCF was 67%. This is a little concerning and to be sure I don’t jump the gun based on just a single twelve month period, I looked at the five-year average on quarterly FCF. That isn’t sobering either as the five-year average was $2.19 B. That would represent a payout ratio of 90%.

- While I’d panic if this were a different company, I am inclined to give Coca-Cola the benefit of the doubt. Perhaps the 2021 FCF numbers were much stronger than usual due to COVID-related pent-up demand. Hence, a deceleration in 2022 is natural. I’ll be watching FCF numbers in the upcoming quarters more closely than I’ve done in the past.

- Using forward earnings per share projections of $2.58 per share, a new quarterly dividend of 46 cents per share would represent a payout ratio of 71%, exactly where it was last year. So, this is a good sign, or at least not a bad sign.

- In summary, Coca-Cola once again proven its reliability by sticking to its annual dividend increase, down to the day. FCF has declined considerably compared to 2021, and that, coupled with an increasing dividend, has pushed out the payout ratio beyond comfortable levels (for me). But EPS based payout ratio being steady shows the company likely reigned in on expenses to make earnings better for shareholders.

Coke FCF (Ycharts.com)

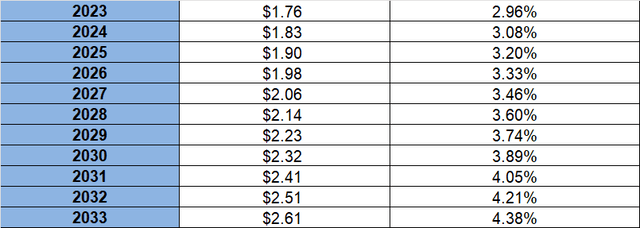

Extrapolation

This section looks at the projected yield on cost for someone buying Coca-Cola today assuming a 4% dividend growth rate per year. Please don’t make the mistake of looking at Coca-Cola’s current 3% yield and laughing at how it can be so low after 61 years of increasing dividends. It only means the stock price has appreciated over the years to sync up with the stock’s based yield, which has rarely been above 3.50%.

Conclusion

While I am happy with a near 5% dividend increase, I was definitely surprised when calculating the FCF based payout ratios (both trailing 12 months and 5 year average). The Coca-Cola Company stock has lost about 6% YTD, and that gives it a forward multiple of 23 as of this writing. That is still a bit too rich for me, and I suggest waiting till the 3.30% mark to buy, which after the recent dividend increase is around the $56 mark. That day may not be far off if we get more inflation related surprises like the one this morning.

Meanwhile, stay patient and enjoy a Coke if that is your taste. Even if Coke is not your taste, be sure to watch the Free Cash Flow with me after each earnings report if you are interested in The Coca-Cola Company stock.

Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.