Summary:

- Comcast continues to trade at a well-below-average valuation.

- It has a valuable and moat-worthy collection of businesses and management plans to strengthen its broadband segment.

- Investors today could see potentially strong long-term total returns from present levels.

Cindy Ord

A recent survey by Fortune magazine indicated that most baby boomers are not ready for retirement, with many worried about rising costs and the inability to fund their standard of living when income from a career job dries up.

It doesn’t always have to be this challenging, however, as the right strategy with income generating assets can buffer and even improve a person’s standard of living in retirement.

That’s why I’ve always liked dividend payers that generate income above that of the market average, since capital gains don’t pay the bills and force one to sell a holding should one get into a cash crunch.

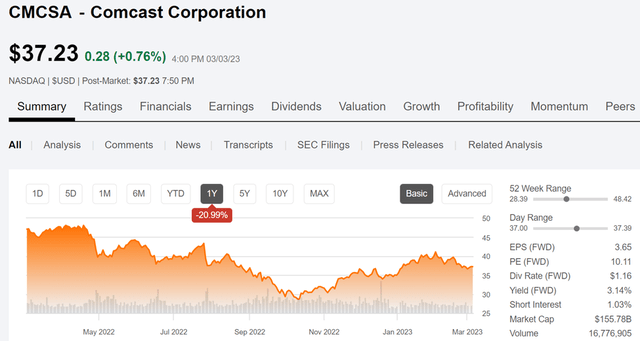

This brings me to Comcast (NASDAQ:CMCSA), which is one moat-worthy dividend stock that’s cheaply valued compared to its historical norms, and currently trades well under its 52-week high of $48.42. Let’s explore why now may be a great time to layer into this excellent dividend stock for the long run.

Why CMCSA?

Comcast is a global media and technology company that provides broadband and streaming services to 57 million customers across the U.S. and Europe. Its broadband, wireless, and video services include Xfinity, Comcast Business and Sky Brands, and its media empire includes Universal, Sky Studios, NBC, Telemundo, and Peacock streaming.

Comcast derives a moat from its wide collection of assets, including internet broadband that reaches just over half of all American households. This results in CMCSA being the only game in town for many regions, despite telecoms like AT&T (T) beginning to compete in select markets.

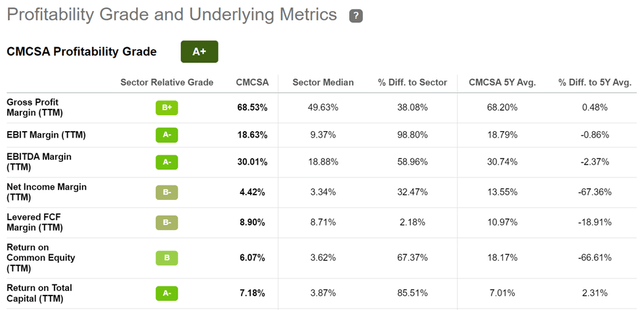

This results in sector leading margins for CMCSA. As shown below, it scores an A+ grade for profitability in the Communication Services sector, with Gross Profit and EBITDA margins that are well in excess of the sector median.

Meanwhile, CMCSA’s multi-cylinder model is demonstrating strong results, with record revenue, adjusted EBITDA, and adjusted EPS all achieving record levels during the fourth quarter.

Specifically, adjusted EPS grew by 13% YoY, and this was partly driven by robust share buybacks at CMCSA’s discounted valuation for much of last year, during which management returned a record $17.7 billion of capital to shareholders.

As shown below, CMCSA retired 4.3% of its outstanding float during the past 12 months alone. Share repurchases during the fourth quarter were especially accretive to shareholders, as its shares traded at historically low valuations with a forward PE under 10x during that time. This implies a double-digit earnings yield in the low-teens from share buybacks alone.

Moreover, CMCSA is seeing robust wireless growth, adding 1.3 million new lines, its best result since launch, and more than doubled Peacock streaming subscribers to 20 million and tripled Peacock revenue to $2.1 billion. While this is still a far cry from Netflix’s (NFLX) 230 million worldwide subscribers, it does show that the streaming business isn’t a one-horse race with plenty of greenfield being up for grabs.

Looking forward, CMCSA has sights set on strengthening its core broadband service as it seeks to defend its incumbency in most of its markets. This is supported by management’s comments around 10 gig-speed internet and software-based network with AI capabilities during the recent conference call:

We have always maintained an intense focus on providing the absolute best products and experiences, which comes down to having the highest capacity, most reliable and most efficient broadband network.

Our evolution to 10G and the unique way we are pursuing this through DOCSIS 4.0 is a huge benefit for our customers across the entire footprint that they will all have access to an entire ecosystem built around multi-gigabit symmetrical speeds, some as early as this year.

It’s also great for the company investors as our transition to a virtual software-based network infused with the marvelous AI capabilities will not only provide tangible benefits when it comes to operating and capital expenses, but it will enable us to innovate faster than ever before, solidifying our leadership position in broadband, which is extremely important given what is certain to be continued increases in demand for both speed and usage.

Notably, CMCSA carries a strong A- rated balance sheet, and it recently raised its dividend by 7.4%, marking its 15th consecutive annual increase. The new dividend remains very well covered with a 32% payout ratio, based on full year 2022 adjusted EPS of $3.64.

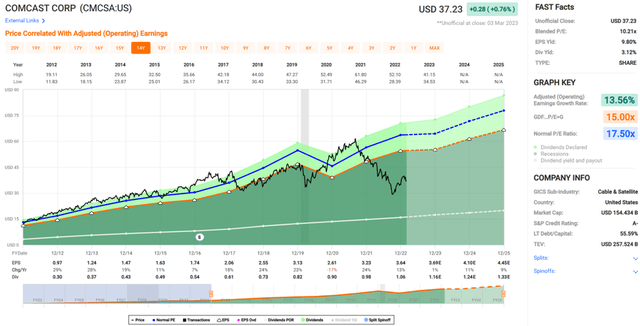

Turning to valuation, CMCSA remains “dirt cheap” at the current price of $37.23 with a forward PE of just 10.2, sitting far below its normal PE of 17.5. Analysts estimate robust 10% to 12% annual EPS growth in 2024 and 2025 and have a consensus Buy rating, with an average price target of $43.42. This implies a potential 20% total return over the next 12 months.

Investor Takeaway

CMCSA’s multi-cylinder business model is demonstrating strong performance, driven by record top and bottom line results. Meanwhile, the company’s share repurchase program has been especially accretive to shareholders, as its shares have traded at historically low valuations, especially over the past 6 months.

With the expectation of continued strong capital returns and investments in its core broadband business, CMCSA could produce market beating total returns in the coming years. As such, I view now as being an excellent time to buy CMCSA for long-term income growth and capital appreciation potential.

Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!