Comcast Q4 Reflections: Buying An Undervalued 10% Equity Yield

Summary:

- Comcast Corporation delivered strong Q4 2022 results, beating analyst consensus revenue estimates and meeting EPS estimates.

- Although Comcast continues to post better-than-anticipated earnings results with little volatility in revenue or EPS, investors continue to value Comcast cheaply.

- Comcast is trading at an EV/EBIT of approximately x11, which is about 25% below the respective industry median multiple.

- As media stocks are starting to be en vogue again, and earnings momentum is improving, I upgrade my target price for Comcast Corporation stock to $61.56.

Cindy Ord

Thesis

Comcast Corporation (NASDAQ:CMCSA) delivered strong Q4 2022 results, beating analyst consensus revenue estimates and meeting EPS estimates. Reflecting on likely EPS upgrades on the backdrop of stronger-than-expected Q4 2022 report, paired with a positive outlook going into 2023, I upgrade my target price for Comcast stock to $61.56, as compared to $47.16 prior.

Although the media companies start to be back “en vogue” again, after Netflix (NFLX) gained more than 100% since May 2022, CMCSA stock continues to be a relative underperformer versus the broad market: for the trailing twelve months, Comcast stock is down approximately 19%, as compared to a loss of only about 8% for the S&P 500 (SP500).

Comcast’s 2022 December Quarter

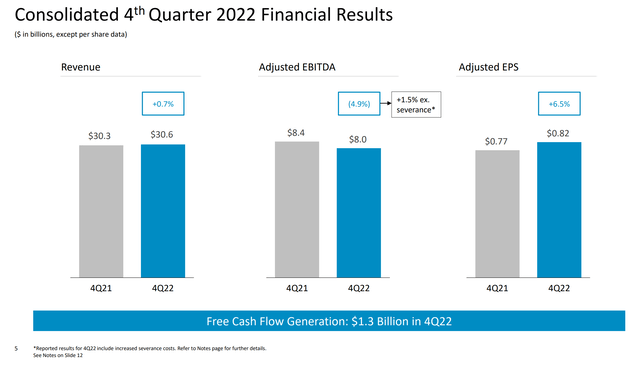

During the December quarter 2022, Comcast managed to generate total group revenues of $30.6 billion, up about 0.7% versus the same period one year earlier ($30.3 billion in Q4 2021). Notably, Comcast’s sales number topped analyst consensus estimates by about $150 million ($30.45 billion estimated, according to data compiled by Refinitiv).

With regards to profitability, during Q4 2022, Comcast recorded adjusted EBITDA of $8 billion, and adjusted net income of approximately $3.5 billion, or $0.7/ share. Although net profitability is down about 0.4% as compared to Q4 2021, results are approximately in line with what analyst consensus had expected going into Q4 reporting.

Closing 2022 Strong

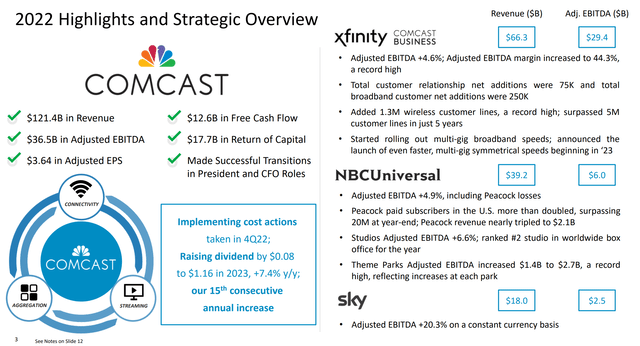

Despite macroeconomic challenges, that need no further elaboration for Seeking Alpha readers, Comcast delivered a strong 2022: for the FY 2022, the media and communication giant reported total group revenues of about $121.4 billion, representing a 4.3% year-over-year expansion as compared to FY 2021. EBITDA grew by 5.0% and adjusted net income by 7.3%, recorded at $36.5 billion and $16.1 billion respectively.

One attractive aspect of Comcast s business model, which is arguably somewhat underappreciated, but its value has been clearly highlighted in 2022, is the company’s stable and diversified income stream. For example, while Comcast lost approximately 440,000 video/ TV subscribers in the December quarter, as people continue to move away from cable TV services, the media giant recorded 20 million new paid subscribers for its Peacock streaming service. Similarly, while unpredictable events such as the Hurricane Ian contributed to a net loss in Comcast’s broadband subscriber base, the easing of other unpredictable events, such as the end of COVID, caused theme parks revenue to rebound by approximately 12%.

Attractive Multiples And Shareholder Returns

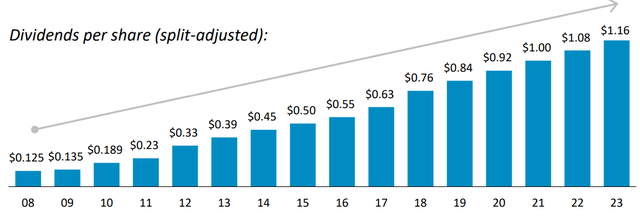

Trading at a FWD EV/EBIT of x11 and an EV/Sales of 2.2, Comcast Corporation is valued very attractively. The argument is compounded by the company’s excellent track-record of high shareholder distributions, which are also growing. In 2022, for reference, Comcast returned about $17.7 billion to shareholders, which is a record high for the firm. In more detail, Comcast returned about 13 billion through share repurchases, and about $4.7 billion through dividends. Moreover, for 2023 the company now plans to increase dividends even further, by $0.08 to $1.16 per share on an annualized basis (about 7.4% year over year growth as compared to 2022). Notably, the annualized equity yield for CMCSA, as a function of buybacks and dividends, is now well over 10%.

For reference, while Comcast’s share repurchases are a bit more volatile, and certainly depend on the company’s market equity valuation, dividends have increased steadily and reliably since 15 years.

Update Target Price Estimate: To $61.56

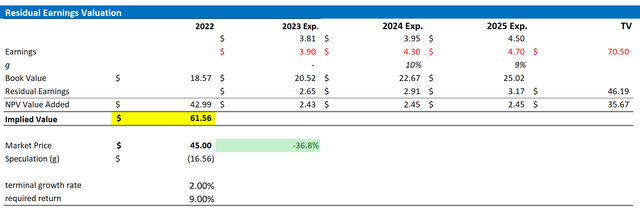

Reflecting on a stronger than expected Q4 2022 for Comcast, as well as the likelihood of margin expansion through increased OPEX discipline, I update my residual earnings valuation framework for the company. I now estimate that Comcast’s EPS in 2023 will likely expand to somewhere between $3.85 and $4.0. Moreover, I also raise my EPS expectations for 2024 and 2025 to $4.3 and $4.7, respectively.

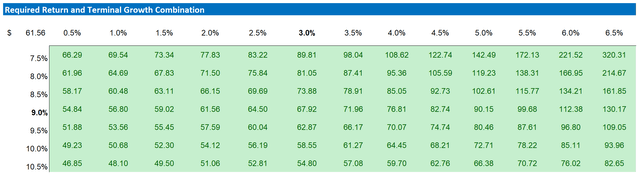

I continue to anchor on a 2% terminal growth rate, as well as on a 9% cost of equity.

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price of $61.56, as compared to $47.16 prior.

Author’s Estimates & Calculations

Below also the updated sensitivity table.

Author’s Estimates & Calculations

Risks

As I see it, there has been no major risk-updated since I have last covered Comcast stock. Thus, I would like to highlight what I have written before:

First, in a rising interest rate environment, investors are worried about Comcast’s debt position. As of Q2 2022, Comcast recorded total debt of $98.7 billion, against cash and short-term investments of only $6.8 billion. Accordingly, Comcast’s $91.9 billion of net debt could be exposed to higher interest payment costs. If rates were to stay elevated for a longer period of time, Comcast would need to roll debt at much less favorable interest rate conditions. But investors should consider that even if Comcast’s cost of debt were to jump to 10% (about $9 billion of interest payments, versus $4.13 billion TTM), the company would not at all be in difficulty.

Update on financial position: as of Q4 2022, Comcast recorded total debt of $94.8 billion, against cash and short-term investments of only $4.7 billion:

Secondly, Comcast suffered from the broad sector selloff in the media space – as The Walt Disney Company (DIS) lost about 35% YTD, Netflix, Inc. (NFLX) 59%, Warner Bros. Discovery, Inc. (WBD) 51% and Paramount Global (PARA) 38%. Investors became increasingly worried that competition in entertainment will eventually erode profitability, as content investments surged and global subscriber potential for streaming services suddenly hit a limit, with Netflix posting disappointing subscriber growth.

But investors should consider that Comcast is a diversified media company with strong exposure to multiple verticals, including streaming, news, cable television, film studios, theme parks, and sports. Fretting that Comcast’s portfolio has a dim future is, in my opinion, as unreasonable as believing that streaming attracts unlimited potential. Markets simply have a tendency to overreact. And now they are clearly reacting too much on the downside for the media industry.

Conclusion

Although Comcast Corporation continues to post better-than-anticipated earnings results with little volatility in revenue or EPS, investors continue to see CMCSA as “risky.” Otherwise I could not explain why CMCSA is trading at an EV/EBIT of approximately x11, which is about 25%below the respective industry median multiple. However, investors should not complain, but buy the bargain opportunity with a relatively low-risk 10% equity yield. Personally, I believe Comcast stock should be fairly valued at around $61.56 per share. Buy.

Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: not financial advise