Summary:

- The Tesla, Inc. Cybertruck has finally been released after four years of anticipation.

- The unique design of the Cybertruck has polarized opinions, with some loving it and others hating it.

- Tesla is banking on the success of its self-driving technology, which could bring in significant revenue for the company.

Tesla Cybertruck on public display at NYC”s Lincoln Center. Roman Tiraspolsky/iStock Editorial via Getty Images

After four long years of waiting on the part of Tesla, Inc. (NASDAQ:TSLA) fans, the automaker’s Cybertruck has finally arrived.

The new model is unlike any personal transportation on the road, which is putting it mildly. The driving and investing public will decide whether that is a good thing. My fearless prediction is that they will deem it so.

Not because Cybertruck has the potential to disrupt the full-size pickup truck market, which will remain dominated by the Big Three of General Motors (GM), Ford (F), and Stellantis (STLA).

At the prototype’s unveiling in 2019, the most often used descriptor was “weird,” and most of the time not in any positive sense. For about seven decades, full-size pickup trucks have adhered to a general sense of size, shape and proportion that has evolved into today’s General Motors Co. Chevrolet Silverado, Ford Motor Co. F-150 and Stellantis N.V. Ram models.

Odd design

The point of creating an unpainted, stainless steel, “squared off cockroach,” as one reviewer put it, was to differentiate Cybertruck from every other truck. Mission accomplished.

Recalling the logic of Chrysler executive Bob Lutz when the automaker designed a Ram pickup that looked more like a miniature, chopped-down semi-trailer than its competitors from GM and Ford, it’s likely a mistake to offer the public a “me too” version of existing successful models. The newcomer likely will become everyone’s second choice.

Better to stretch the boundaries of design with a vehicle that polarizes, that people will either love or hate. And many do already hate the look of Cybertruck.

The ones who love it include at least the million or so that plunked down $100 to reserve one. Naturally, more than a few in this group are disappointed that the starting price for the entry-level two-wheel-drive version with 250 miles of range has risen to $61,000 from the initial announcement of $40,000 – and will move on to something else. All-wheel-drive versions, including an extra-powerful Cyberbeast capable of reaching 0-60 in less than 3 seconds, will start at about $99,000.

Don’t need too many

Elon Musk, Tesla’s CEO, has said the company could produce as many as 250,000 on a theoretical basis, though reaching that number will be quite difficult, given the number of all-new technologies that Cybertruck embodies as well as the cutting-edge manufacturing processes entailed. Even if Cybertruck sold 50,000 to 100,000 annually, that would be quite a feat.

Among Cybertruck’s new technologies is the industry’s first true steering-by-wire system, with no mechanical connection between the steering wheel and the vehicle’s wheels. The model’s lithium-ion battery features the so-called 4680 cylindrical cells pioneered with Panasonic that deliver more energy density and range. An additional battery can be stored in the bed as a backup to the main battery or to charge another Tesla.

One good charge deserves another (Tesla)

Future versions of the model will be available with an additional range-extending battery that can ride in its truck bed and is the size of a toolbox. The range extender can add up to 130 miles of range. For the Cybertruck all-wheel drive version, the range extender can add over 130 miles, and for the tri-motor Cyberbeast, it can add over 120 miles. The range extender increases the maximum range of the Cybertruck to around 470 miles, which is closer to the originally advertised range.

From a safety perspective, the stainless steel body appears to provide superior protection in the event of a collision, according to Musk, and to crash tests observed by reviewers. The truck hasn’t yet been awarded an official rating by the National Highway Traffic Safety Administration’s New Car Assessment Program (NCAP).

For a more detailed review of Cybertruck’s engineering innovations and performance characteristics, see Jason Cammisa’s excellent video review.

Cybertruck is likely to be much more popular with younger rather than older drivers because it is iconoclastic in the same sense the music, language, tattoos and so forth are meant to signify a break from the standards of the past. Yes, lots of people will swear the new design is the ugliest thing they’ve ever seen – these will be mostly older folks and their opinion will only make the truck more appealing to the young.

Autonomous progression

Tesla is banking on another innovation, which is unfolding more quietly than Cybertruck. Self-driving in the form of FSD12 has been released to Tesla employees and could be the game changer that brings massive new revenue to the company. Using artificial intelligence (AI) and camera vision rather than sensor-based systems such as those used by rivals, Tesla’s methodology potentially could prove safer than human driving – claims the company will have to prove comprehensively to regulators and the public.

According to Ultima Insights:

Tesla had around 285,000 FSD customers in the U.S. as of 2022, with payments ranging from $4,000 to $12,000 for FSD. With Tesla’s expansion in vehicle sales and the potential increase in FSD prices (up to $14,000 or $20,000, or via monthly subscriptions), Tesla could add potentially billions in revenue each quarter with this technology.

The debate over TSLA share price and the sustainability of the company for the long term won’t be decided in the short term. The company has proven to be solidly profitable, a leader in its industry and a pioneer of innovation. Kind of like Amazon (AMZN), which has the same P/E ratio as TSLA at the moment.

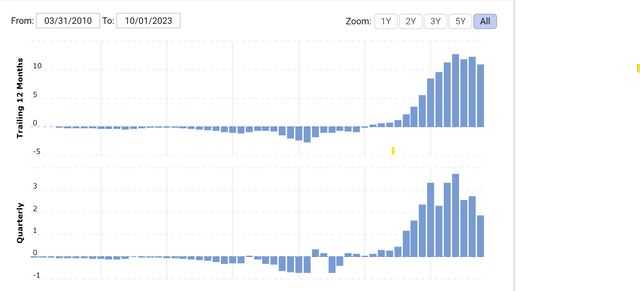

Tesla Net Income in billions of dollars (Macrotrends)

All of this adds up to an increasingly optimistic outlook for Tesla’s growth and profitability, the keys to a sustainable stock price. I have moved in the past decade from skeptic to neutral observer and now am in the camp of those analysts recommending a BUY of TSLA at current prices. I am further emboldened by the company’s global footprint, especially in China – strongly suggesting that Tesla vehicles are establishing themselves as international status symbols, much like Hermes handbags and Rolex watches.

A looming risk factor is the vow by the United Auto Workers union to begin organizing non-union automakers in the U.S., including Tesla. I think it is likely that the UAW will choose a target, and that target probably won’t be Tesla. But in the event Tesla does get into an organizing battle with the UAW, how shrewdly it manages the contest could bear consequentially on its future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.