Summary:

- Cyngn is an autonomous vehicle technology company which listed on NASDAQ in October 2021 through a $26.3 million IPO.

- The company is spending only around $5 million on R&D per year, and I doubt it will be able to achieve its ambitious growth plans.

- Cyngn’s market valuation has more than tripled over the past week and I think the reason behind this is high retail investor interest.

- In my view, the share price is likely to fall back to below $1.50 in the near future as retail investor interest gradually fades off.

Vanit Janthra/iStock via Getty Images

Investment thesis

I like browsing the trending stocks on Fintwit because I think that among them there are often microcap stocks whose market valuations have soared due to retail investor interest, which seldom last for long. Today, I want to talk about Cyngn (NASDAQ:CYN) which has 25 mentions over the past 24 hours as of the time of writing. The company’s market valuation has more than tripled over the past week and I think the fundamentals just aren’t there at the moment. Let’s review.

Overview of the business and financials

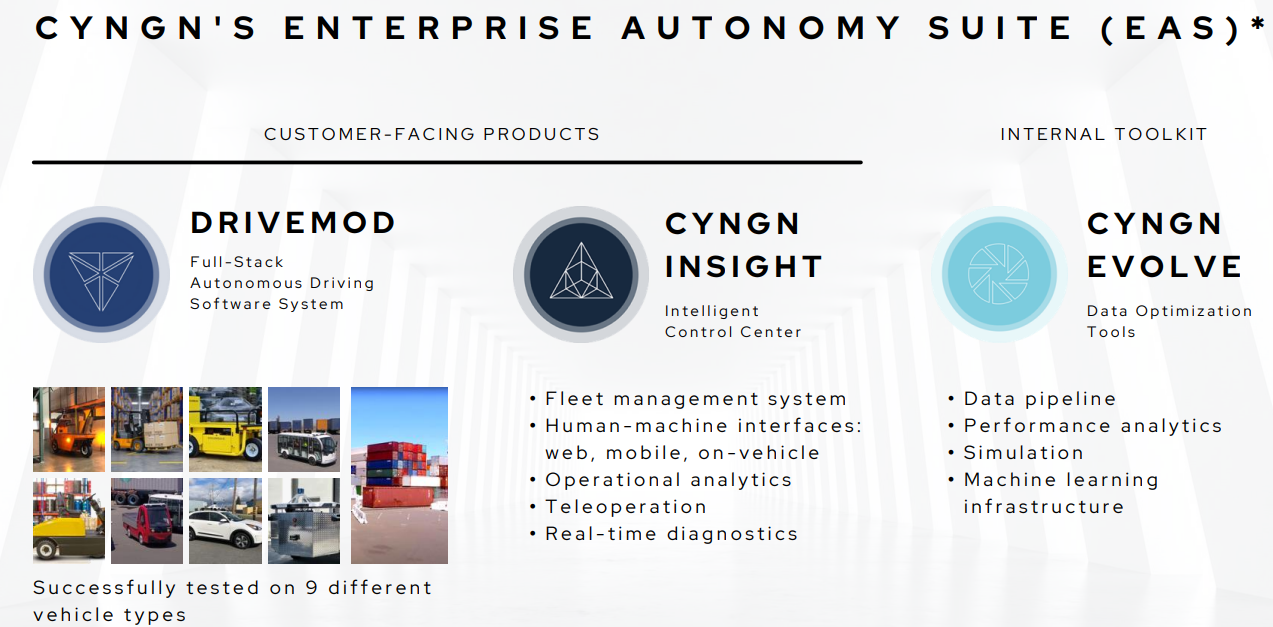

Cyngn is involved in the development of industrial mobile robot automation software. The company’s technology is a combination of robo taxi-level autonomous driving software, off-the-shelf leading hardware, and precise analytics, and the focus is on things like forklifts. Its offering can be split into three main products, namely DriveMod (autonomous driving software), Cyngn Insight (tools for managing AV fleets), and Cyngn Evolve (AI training). The company says that it has been operating autonomous vehicles in production environments since 2017.

Cyngn

In October 2021, Cyngn raised $26.3 million in an initial public offering (IPO) on NASDAQ after issuing 3.5 million shares at $7.50 per share. I consider the IPO somewhat underwhelming considering the assumed issue price in the prospectus was $8.50 per share. Unfortunately for investors, the company’s share price performance hasn’t been good since then.

Seeking Alpha

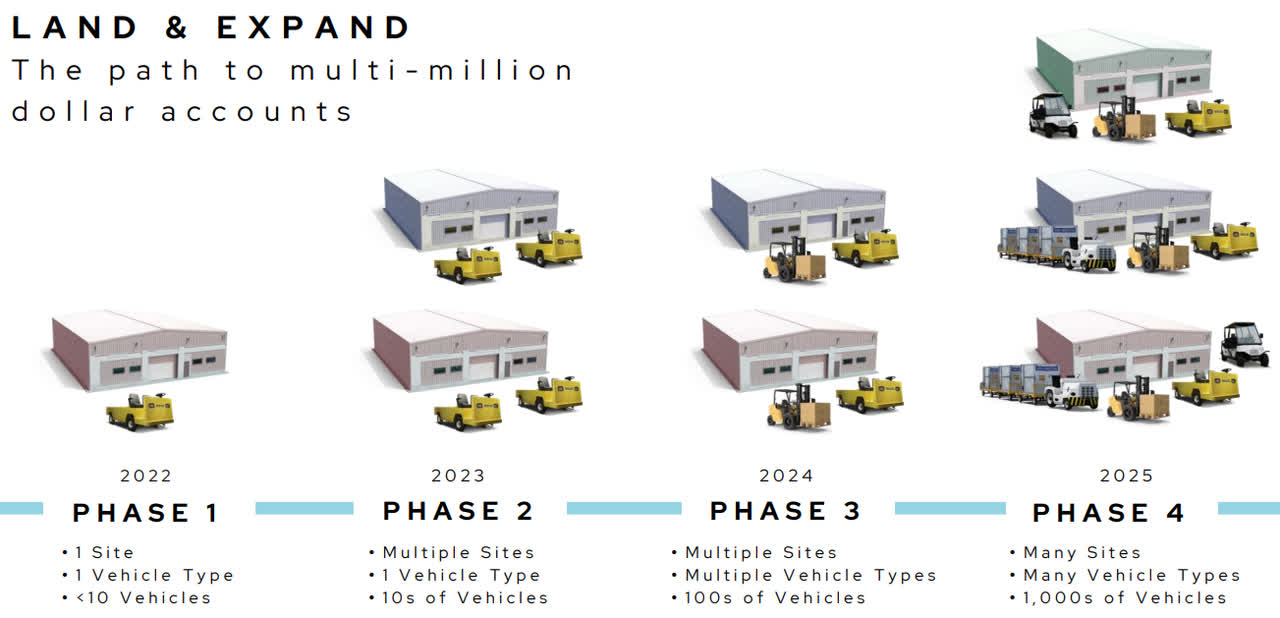

You see, Cyngn is still a development-stage company, and it expects to begin scaled deployments of its Enterprise Autonomy Suite (EAS) in 2024. And in an environment of rising interest rates, the market is shunning tech companies that are far from commercial production.

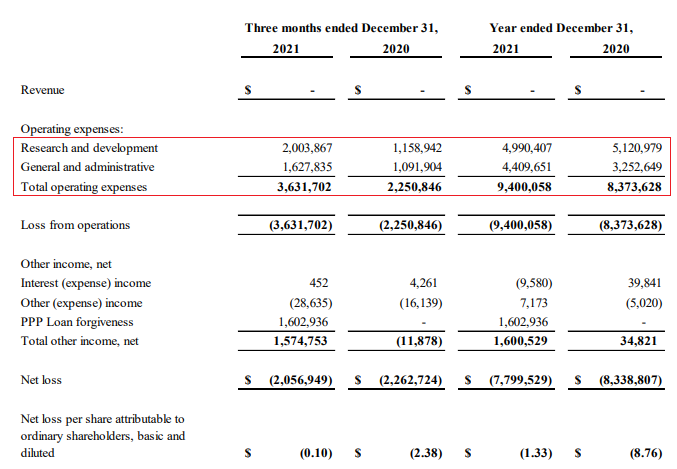

Looking at the latest available financial data, we can see that Cyngn had operating expenses of $9.4 million in 2021, split almost equally between research and development and general and administrative expenses. The sum is about $1 million higher than in 2020 as a result of an increase in stock-based compensation and costs related to the IPO.

Cyngn

As of December 2021, Cyngn had $21.9 million in cash and cash equivalents, and this means the company is well funded for about two years, just until its EAS should start deployment. According to the IPO prospectus, the estimated costs to prepare the EAS for scaled commercialization are roughly $18-$23 million.

So, how do the prospects for Cyngn look in 2024 and beyond? Well, I think they aren’t particularly good. Sure, the industrial equipment market is huge and is projected to reach $200 billion by 2027. Cyngn mentioned in its IPO prospectus that it has been paid $166,000 for one deployment and the company plans to deliver thousands of vehicles by 2024.

Cyngn

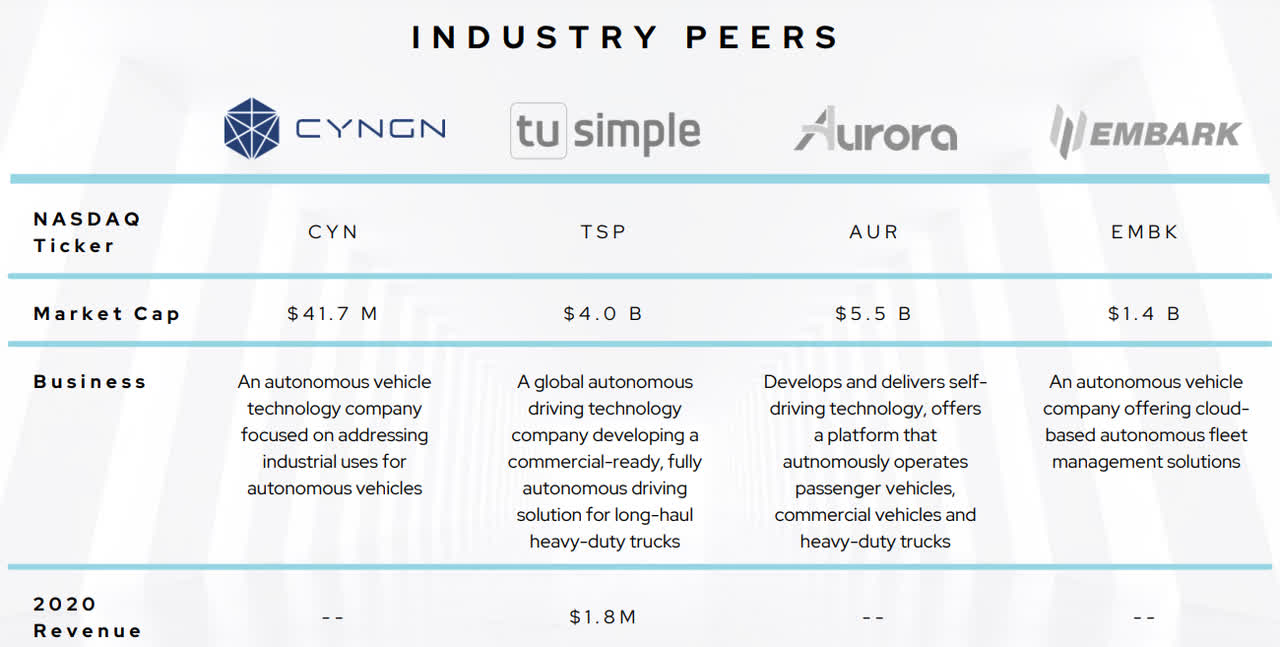

However, Cyngn is a small company with limited research and development investment that is up against several large competitors that are worth billions of dollars at the moment. In my view, this is a David and Goliath story and I don’t think the company’s ambitious growth targets are achievable.

Cyngn

Yet, the market valuation of Cyngn has more than tripled over the past week and the catalyst for this seems to be an announcement about the launch of a turnkey autonomous vehicle solution named DriveMod Kit. The company originally developed this product for Columbia Vehicle Group’s Stockchaser vehicles and it’s unclear how much revenue it can bring in. However, this announcement alone seems to have been more than enough to attract significant retail investor interest as there are also a large number of posts about Cyngn on websites like Twitter, and StockTwits. On YouTube, the company is being covered by several stock trading channels, including Warrior Trading, Jonny Love, StocksToTrade, ClayTrader, Viral Stocks, Alex Winkler, 9 Year Millionaire, Don Leo Trades, W.S. Trades Analysis, and Mighty Scalper. Note that Cyngn isn’t doing the promotion of its business or shares itself, but this is being done by a large number of private investors and traders.

In my view, the launch of DriveMod Kit doesn’t change the prospects of Cyngn’s business in a major way and I think that the share price of the company is likely to return to below $1.50 apiece in the near future as retail investor interest fades off. I’m bearish but unfortunately, there are still no put options on Cyngn, and data from Fintel shows that the short borrow fee rate stands at 238.43% as of the time of writing.

Looking at the risks for the bear case, I think there are two major ones. First, I could be wrong about the potential of Cyngn’s products, and the company somehow ends up triumphing against the likes of TuSimple (TSP). Second, meme stocks are often unpredictable and it’s possible that the share price of Cyngn remains high despite little progress on its operations.

Investor takeaway

I view Cyngn as a small industrial automation software company that is unlikely to meet its ambitious growth plans due to its small investment in research and development as well as the caliber of its competition. The company’s share price had been falling since the October 2021 IPO as the tech sector is out of favor at the moment, but it has more than tripled in the past week. I think that the likely reason behind this is strong retail investor interest which I expect to gradually fade off. In light of this, I expect Cyngn’s share price to return to below $1.50 in about a month or two.

Unfortunately, short selling seems dangerous as there are no put options available and the short borrow fee rate stands at over 200%. In my view, it could be best for investors to avoid Cyngn for now. At least until the short borrow fee rate drops to double digits.

Author’s Note: Thank you for reading my analysis. Please note that I will be launching a marketplace service named Bears and Resources soon. I plan to share my live portfolio and my shortlist, and discuss exclusive investment ideas. Early subscribers will receive a legacy discount. Stay tuned for more details.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial adviser. All articles are my opinion – they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.