Summary:

- Danaher focuses on innovation for steady, high-value recurring revenue, driving financial stability.

- Aging population, longer lifespans, and tech advances drive Danaher’s sector toward significant growth.

- I expect a 10% revenue dip from lowered COVID-19 product sales, with recovery projected in 12 months.

- Investing in DHR now predicts a 12.5% annual return, aiming for a $404.37 target price in five years.

Hiraman

Investment Thesis

I believe that investing in Danaher Corporation (NYSE:DHR) stock is a good choice. From my perspective the company’s strategic positioning to capitalize on innovative and high value recurring revenue streams is crucial, for its stability. Danaher is well positioned to benefit from trends and advancements in technology as well as benefiting from an aging global population and longer lifespans. While there might be a decline in revenue due to decreased demand for COVID 19 related products, I anticipate a recovery within the next year. The investment case for Danaher is strengthened by the projected return of 12.5% over the five years with a target share price of $404.37 based on a discounted cash flow analysis and the company’s growth potential.

Company Overview

I believe Danaher plays a role in the fields of life sciences and diagnostics. Its impact is substantial as it addresses health challenges and aims to improve quality of life. The Danaher Business System (DBS) which emphasizes improvement and innovation serves as their core approach that helps them stay competitive.

In terms of competition Danaher faces rivals in sectors such, as Thermo Fisher Scientific (TMO) and Abbott Laboratories (ABT). Danaher has a business model that focuses on innovation and efficiency through DBS. This positions them well in a landscape where there are key players across different industries.

Danaher’s Business Strategy

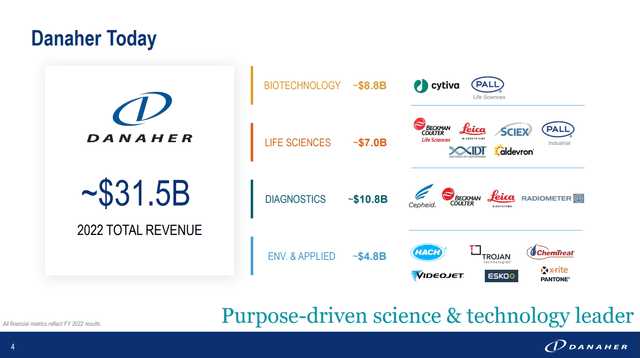

Danaher Corporation (DHR) operates across three business segments: Biotechnology, Diagnostics and Life Sciences. In 2022 the company reported a revenue of $31.5 billion. These segments played roles in their earnings; Biotechnology contributed $8.8 billion Life Sciences contributed about $7.0 billion Diagnostics contributed approximately $10.8 billion and the Environmental & Applied segment brought in around $4.8 billion.

Danaher’s Investor Presentation 2022

The Biotechnology segment plays a role by supporting biological research and developing innovative vaccines, biologic drugs, novel cell and gene therapies as well as new technologies like mRNA. It provides tools and services for life changing therapeutics from discovery to delivery.

Diagnostics is another area for Danaher as it generates insights into diseases and develops solutions with high clinical impact. This segment offers a range of quality diagnostic options, for various health conditions.

The Life Sciences division focuses on accelerating the discovery, development and implementation of solutions that protect and enhance health. It acts as a bridge, between research and practical application enabling the creation of groundbreaking innovations such as biopharmaceuticals and synthetic biologics.

In my opinion, Danaher is often compared to Thermo Fisher Scientific another leading company in the field of life sciences and diagnostics. Both companies have foundations and a culture that values excellence. They have consistently exceeded expectations in terms of earnings and revenue for quarters demonstrating their efficiency and effective business strategies.

I believe, Danaher’s focused approach, including the spinoff of its Environmental & Applied Solutions Segment signifies an emphasis on sharpening its core skills. On the hand I think Thermo Fishers acquisition strategies, such as acquiring The Binding Site highlight its expansion into diagnostics although some view these moves as expensive.

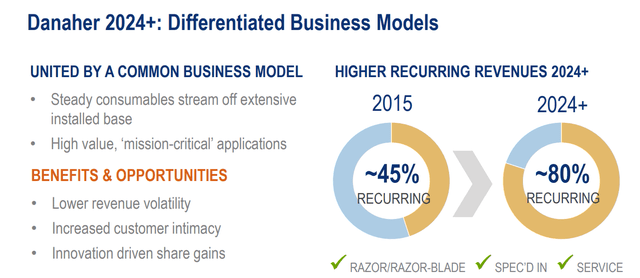

The image below illustrates Danaher’s business model with an emphasis on transitioning towards recurring revenues. In 2015, 45% of Danaher’s revenue came from recurring sources, a figure they anticipate will rise to, around 80% by 2024.

Danaher’s Investor Presentation 2022

This shift is quite significant as it indicates a stable source of revenue. It is a result of supplying consumables to a customer base and offering valuable services. In my view Danaher’s focus on applications highlights their commitment, to providing products and services that customers need regularly. This strategic approach brings advantages such as reducing revenue fluctuations strengthening customer relationships and gaining market share through innovation. Their diversified business model aligns with their strategy to minimize reliance on one-time sales while ensuring stability through customer engagement and service offerings.

Drivers Of Growth in End Markets

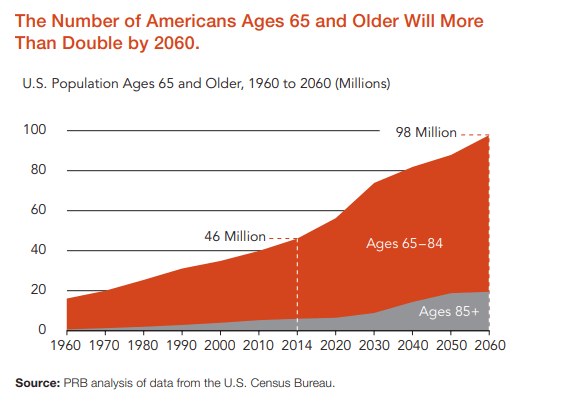

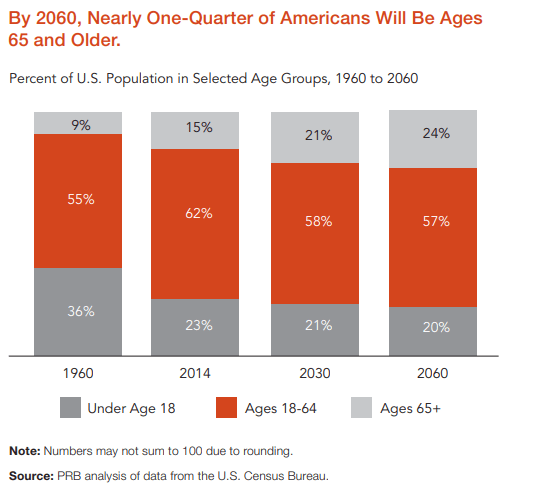

In my opinion, the growth prospects for Danaher’s industry are significantly supported by trends reflecting an aging population. According to the Population Reference Bureau the number of Americans aged 65 and older is projected to double from 52 million to 95 million by 2060 with their proportion of the population increasing from 16% to 23%. Moreover, this aging demographic is becoming more diverse as the percentage of Hispanic white individuals is expected to decline from 77% to 55%.

PBR

Furthermore, life expectancy has increased from an average of 68 years in 1950 to 78.6 years today. This suggests that there will continue to be growing demand, for health-related products and services.

PRB

The aging of the baby boomer generation is expected to lead to a 50% increase in the demand for nursing home care by 2030. Furthermore, with the projected doubling of Americans living with Alzheimer’s disease by 2050 there will likely be a need for care and related services.

The industry’s progress is also being driven by a focus on transformation after the COVID 19 pandemic as seen in groundbreaking advancements such as mRNA vaccines. Investments in research and development in using intelligence for drug discovery are poised to streamline processes and reduce costs thereby making the industry more dynamic and cost effective.

Additionally, efforts to revamp supply chain strategies within the life sciences sector aim to enhance flexibility and digital oversight in response to challenges faced by distribution networks. These strategic actions, combined with a growth in the drug delivery market position the industry for strong expansion and an increased operational presence.

Financial Analysis

In my opinion, DHR has demonstrated solid performance from 2018 to 2023. The company’s revenue rose from $17,049.00 million in 2018 to $29,566.00 million over the year representing a compounded growth rate of approximately 11%. Similarly, there was improvement in Earnings Per Share which increased from $3.39 to $7.93 at a CAGR of around 18%. This indicates that the company has been successful, in converting revenue into profit by expanding its margins over time.

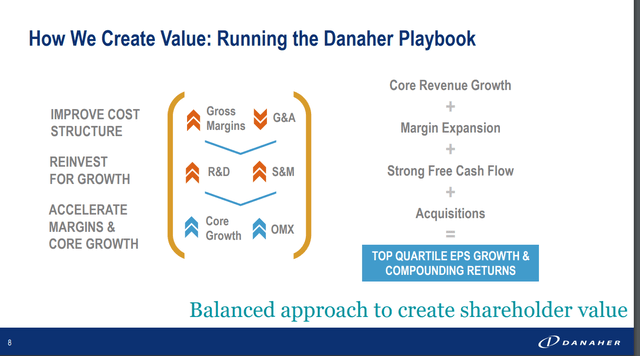

Additionally, the Book Value has experienced growth going from $28,226.70 million in 2018 to $52,415.00 million. The Compound Annual Growth Rate for this metric is 13% suggesting that the company has increased its value over the years. The management team emphasizes a rounded approach to growth which involves enhancing cost structures reinvesting for expansion and improving both margins and core growth. I believe these endeavours will contribute to revenue growth, margin expansion and robust free cash flow. Acquisitions also play a role in this strategy. Collectively these efforts aim to achieve earnings per share growth and compounded returns – reflecting a focus, on term financial performance and shareholder benefits.

Danaher’s Investor Presentation 2022

In terms of liquidity the recent quarterly report reveals cash and cash equivalents amounting to $12,277.00 million. The total debt of the company stands at $19,513.00 million. Appears manageable considering it can be repaid using three years’ worth of free cash flow. The current ratio is 2.26 – generally regarded as an indicator of the company’s term financial well-being.

In the earnings report it is expected that Danaher (DHR) will experience a decline, in performance due to reduced sales of COVID 19 related products such as testing kits and vaccines. This decrease in revenue is estimated to be around 10%. The reason behind this anticipated downturn is the decreasing demand as the world adjusts to the normal after the peak of the pandemic. However, it is believed that this challenge will be temporary. It is predicted that within the 12 months Danaher will overcome these comparison quarters marked by high sales during the pandemic and readjust to pre pandemic market conditions. The company’s portfolio and strong fundamentals indicate resilience and potential for recovery as these exceptional quarters are surpassed.

Valuation

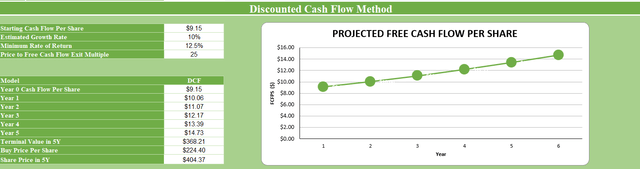

As of Q3 2023 DHRs current TTM Cashflow per Share stands at $9.15. Considering the long-term growth opportunities discussed in this article, I anticipate a growth rate of 10% for DHRs Cashflow per Share over the five years. Taking this growth into consideration it can be projected that DHRs Cashflow per Share, by Q3 2028 would amount to $14.73.

Based on an exit multiple of 25 it is estimated that the stock’s price target, in five years would reach $404.37. Consequently, if you decide to invest in DHR at its share price of $221.00 you can expect a Compound Annual Growth Rate (CAGR) of 12.5% over the five years according to these calculations.

Conclusion

In my view, Danaher Corporation has strategically positioned itself to capitalize on recurring revenue streams by prioritizing innovation, which’s crucial for maintaining financial stability. The company is well positioned for growth as it benefits from shifts such as an aging global population and advancements in technology that continue to unfold. Despite facing a decline in revenue of 10% due to reduced sales related to COVID 19 I believe that Danaher’s recovery will be swift and likely occur within the next 12 months as it surpasses the challenges presented during the pandemic. Looking at it from an investment perspective the company presents an opportunity with a projected return of 12.5%, over the next five years aiming for a share price target of $404.37.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.