Danaher Q4 Earnings: Current Growth Is Not Enough To Support Its Valuation

Summary:

- Danaher is now down over 4% since announcing its latest earnings.

- The life science company reported weak revenue growth and suggests strong headwinds in FY23 from COVID related products.

- The current valuation is very elevated and represents a significant premium compared to the sector and its historical average.

- I rate the company as a sell.

skynesher/E+ via Getty Images

Investment Thesis

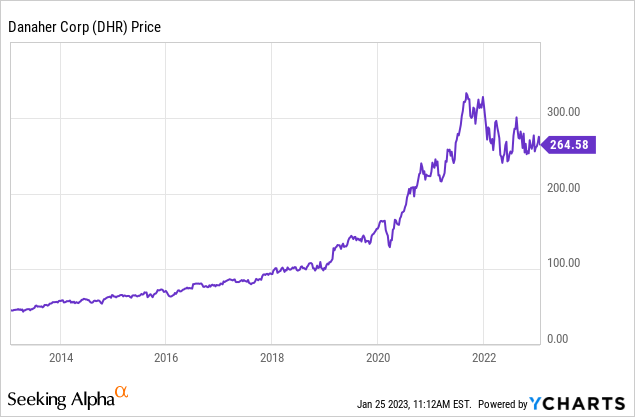

Danaher (NYSE:DHR) may be one of the best companies you have never heard of. The leading life science company has an enormous market cap of over $200 billion and its share price recorded superior performance in the past decade, up almost 480% during the period. The company operates in the resilient healthcare industry and has a recurring business model through selling non-discretionary consumable products. It also has a strong moat thanks to best-in-class products with continuous innovation and R&D.

Danaher recently reported its Q4 earnings and top-line growth appears to be soft while guidance is also weak as revenue from COVID-related products continues to decline. Its share price went on and dropped by over 4% as the result failed to impress investors. This is also likely due to its lofty valuation which leaves no room for mistakes. Despite the latest pullback, its current multiples are still significantly above the industry and its historical averages. The company is high quality but its current growth is not enough to support the valuation and a downward revision in multiples seems very likely. Therefore I rate Danaher as a sell at the current price.

Q4 Earnings

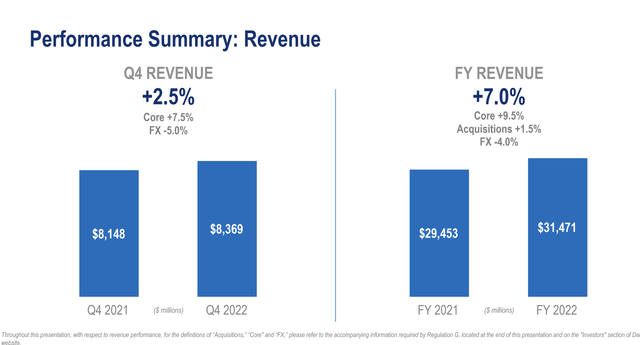

Danaher recently reported its fourth-quarter earnings and the results are quite underwhelming. Numbers are not too bad by any means but considering the valuation, this is not enough. The company reported revenue of $8.37 billion compared to $8.15 billion, representing a 2% growth YoY (year over year). On a constant currency basis, revenue increased by 7.5%. Despite an increase in revenue, gross profit remained flat as costs increased by 7% due to inflationary pressure and the gross profit margin dipped 107 basis points from 60.7% to 59%.

The revenue increase is mainly driven by life science and diagnostic growth, which continues to see solid traction thanks to its ‘mission-critical’ nature and recurring business model. The life science segment reported revenue of $1.95 billion, up 8% YoY from $1.8 billion. While diagnostic revenue was up 3% from $2.88 billion to $2.97 billion. The environmental & applied solutions segment saw its revenue edge up 1% to $1.24 billion and revenue from the biotechnology segment actually declined 1% to $2.22 billion.

The management team did a great job of controlling operating expenses. SG&A (selling, general and administrative) expenses dropped 4.5% YoY from $2.29 billion to $2.19 billion while R&D (research and development) expenses dropped 8.5% YoY from $495 million to $453 million. This resulted in operating income increasing 6.6% to $2.3 billion with the operating margin climbing 100 basis points from 26.4% to 27.4%.

Net earnings for the quarter were $2.21 billion (or EPS of $2.99) compared to $1.75 billion (or EPS of $2.39), representing an increase of 25%. However, the two figures are not really comparable as the net earnings last year included an income tax of $297 million. Therefore operating income would be the better metric to look at here.

The company’s guidance also suggests total core revenue for FY23 will actually decline in mid-single digits due to weaker demand for COVID-related products. Excluding the impact, revenue should increase in high-single digits. Overall, the results are not bad considering the economic backdrop but revenue growth of 2% and operating income growth of 6.6% is certainly not enough to support its valuation.

Rainer Blair, CEO, on COVID’s impact

Looking to 2023, we expect customers to further reduce their COVID-19-related programs. Vaccination and booster rates have been significantly lower than initially anticipated and the availability of alternative therapeutics has reduced the need for monoclonal antibody-based treatment. In light of these dynamics, we now anticipate COVID-19-related vaccine and therapeutic revenue will be approximately $150 million for the full year of 2023, down from approximately $800 million in 2022 and lower than our previous expectation of $500 million.

Valuation

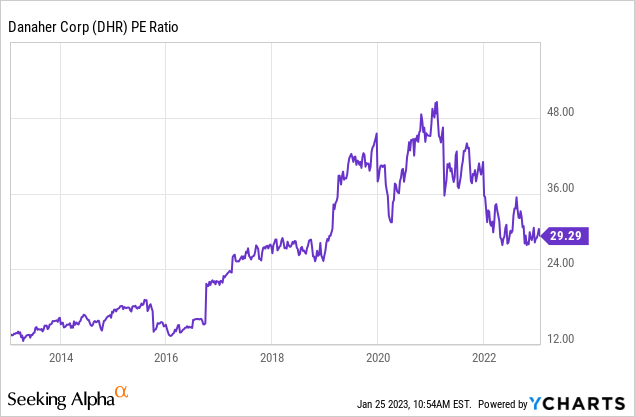

Danaher’s valuation has slightly pulled back from the sky-high levels in 2021 but remains pretty elevated. It is currently trading at a PE ratio of 29.4x which is significantly above the sector’s average. For comparison purposes, the XLV (The Health Care Select Sector SPDR Fund), which Danaher is also a top 10 holding, currently has a PE ratio of just 16.3x. Considering the company’s quality, I believe having a premium makes sense but a valuation gap of 80% is just a bit too large at the moment. From the chart below, you can also see that the current multiple is still meaningfully above its 10-year historical average. I believe it is quite likely we will see a downward revision in multiples to levels closer to the sector’s average.

Conclusion

In conclusion, I believe it is best to stay away from Danaher for now. The company has strong fundamentals but there is no need to rush in now. The latest earnings show very little top-line growth and guidance indicates a further slowdown in overall growth due to strong headwinds from COVID-related products. The valuation is also a huge hurdle here with the company trading at a significant premium compared to the sector and historical average. The current multiples do not seem sustainable at all as growth is slowing and I think a downward revision will happen, which suggests some potential downside. Therefore I rate the company as a sell and investors should wait for a more reasonable entry point before stepping in.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.