Summary:

- Agilent and Danaher have significantly outperformed the market, and have solid competitive advantages.

- The laboratory equipment and measurement devices industry is forecasted to grow at a ~7% CAGR to the year 2030.

- While we believe that both companies are trading close to fair value, there is one we currently find more attractive.

LaylaBird

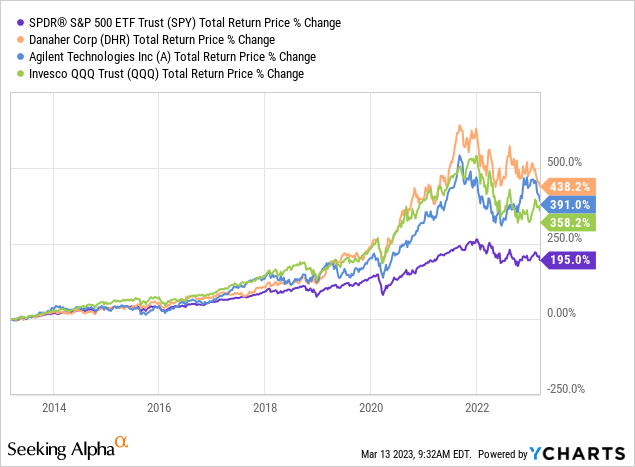

The laboratory equipment and measurement devices industry is particularly attractive, as it has good economics and is fairly resilient. Two companies we particularly like are Agilent Technologies (NYSE:A) and Danaher (NYSE:DHR), both of which have delivered outstanding returns for their investors and have a reputation of being very well managed.

Over the past ten years both companies have outperformed the S&P 500 ETF (SPY) and the popular Invesco QQQ Trust (QQQ). We would not be surprised if they continue to outperform in the coming decade given the quality of these businesses.

Attractive Industry

The laboratory equipment market is forecasted to grow at a ~7% CAGR to the year 2030. It is not just the strong growth prospects, however, that makes this industry attractive. It is also that a good percentage of the revenues are relatively sticky, and some are even recurring in nature, such as consumables.

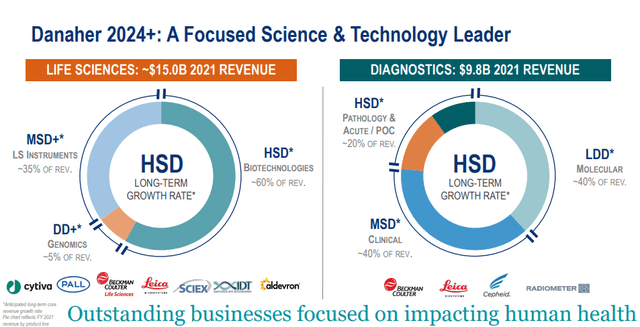

In Danaher’s case recurring revenue could reach ~80% of sales once the environmental and applied solutions (EAS) group divestment is completed. Meanwhile, roughly 60% of Agilent’s revenue is recurring in nature in the form of consumables, services, and informatics.

Both companies expect high single digit long-term core revenue growth in the future, in Danaher’s case from 2024 once it has divested EAS.

Danaher Investor Presentation

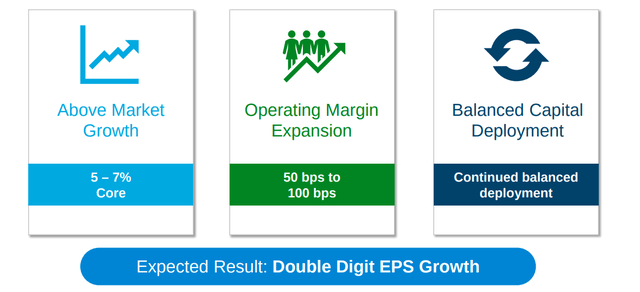

This level of revenue growth should result in double digit EPS growth thanks to the additional boost from operating margin expansion, M&A, share buybacks, etc.

Agilent Investor Presentation

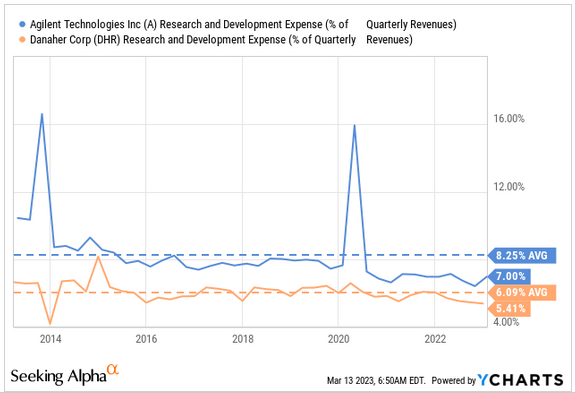

R&D

Agilent and Danaher have created a competitive moat by investing heavily in developing intellectual property. Agilent spends a higher percentage of its revenues in R&D compared to Danaher. Part of the reason is that Danaher has a business strategy that is more dependent on acquisitions.

Y charts

Financials

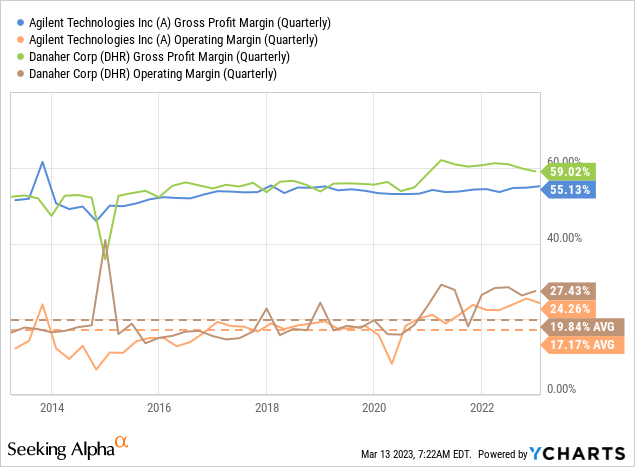

The strong competitive advantages that both companies have, together with the attractiveness of their industry, is reflected in outstanding profit margins. Both companies are currently operating with an operating margin above 20%. Danaher has slightly better margins currently, but historically they have been very close to each other. When considering the higher R&D spending by Agilent, we would declare the profit margins a tie.

Balance Sheets

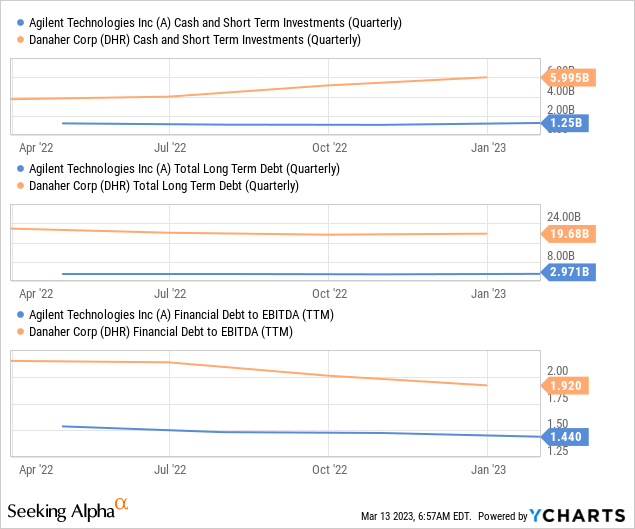

One big difference between the two companies is that Danaher carries a lot more debt compared to Agilent. This is the result of its M&A driven growth strategy that requires substantial debt to finance the acquisitions. Still, we are not overly worried about the amount of leverage of either company, with both having a financial debt to EBITDA ratio under 2x. In terms of balance sheet strength we would declare Agilent the winner.

Valuation

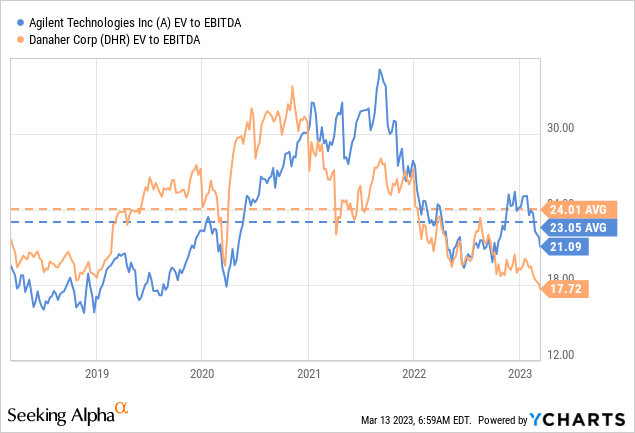

Given their attractive characteristics both companies tend to trade at premium valuations. That said, it is worth noting that Danaher is currently trading with one of the cheapest EV/EBITDA multiples it has had in the past five years.

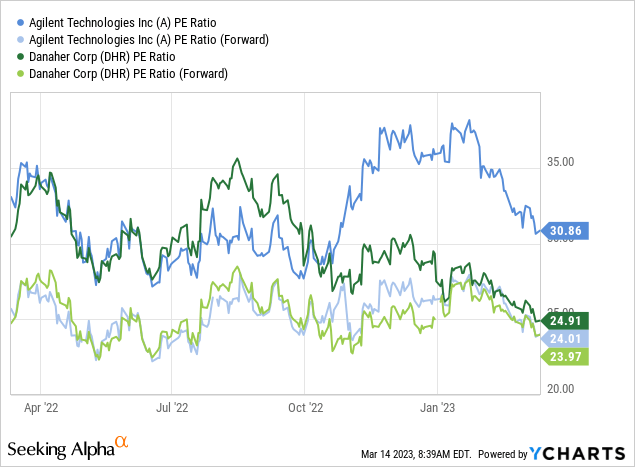

Danaher is also trading with a more attractive trailing twelve months price/earnings ratio compared to Agilent. Nevertheless, looking at the forward p/e, which is based on analyst estimates, both are trading with a FY23E p/e ratio of ~24x.

Given that for FY24 and FY25 both companies are expected to grow earnings per share at similar rates, their FY24E and FY25E p/e ratios are also nearly identical. We therefore conclude that in terms of valuation it is a tie. Based on our valuation models both companies are currently trading very close to fair value. Our estimated fair value for Agilent is ~$122 per share, and for Danaher is ~$212, using a 10% discount rate.

Risks

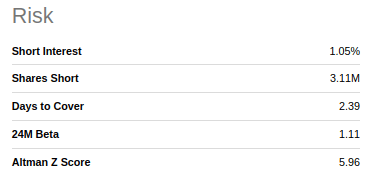

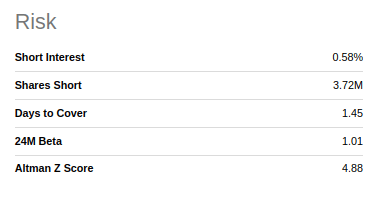

We consider both Agilent and Danaher to be below average risk investments, given the resiliency of their industry and their strong balance sheets. Both have Altman Z-scores comfortably above the 3.0 threshold and low short interest.

Seeking Alpha – Agilent Risk

Further mitigating risks, both companies have recurring revenues that represent a high percentage of their total revenues. The biggest issue we find with both is that they have very little in terms of margin of safety with regards to their valuations.

Seeking Alpha – Danaher Risk

The Verdict

While their valuations are very similar, we prefer Agilent for a number of reasons. It has a slightly stronger balance sheet, spends more on R&D as a percentage of revenue, and its business strategy is less reliant on M&A.

Conclusion

Agilent and Danaher have significantly outperformed the market and have solid competitive advantages. With high percentages of recurring revenue, strong profit margins, and healthy balance sheets, both companies are considered to be below average risk investments. While both companies are trading close to fair value, we prefer Agilent due to its stronger balance sheet, higher R&D spending, and less reliance on M&A as a growth strategy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.