Summary:

- Billionaire investor David Tepper revealed a new investment in Disney in Q4 2022.

- The guru’s investment in Disney stands out as he recently revealed that he is leaning short on the stock market heading into 2023.

- Although there could be many reasons behind Mr. Tepper’s investment in Disney, his confidence in Bob Iger could be one of the main reasons.

yujie chen

This article was originally published for members of Leads From Gurus on February 27. All data as of Feb. 27.

David Tepper, a billionaire American investor and philanthropist, is the founder and president of Appaloosa Management, a hedge fund that manages over $13 billion in assets. Tepper is known for his successful investment strategies, particularly in distressed debt and value investing niches. According to recent 13-F filings, Mr. Tepper made some significant trades through his Appaloosa stock portfolio in Q4 2022. Tepper, who is known for his contrarian investment strategies, revealed that he is “leaning short” on the stock market heading into 2023 due to concerns about the hawkish Federal Reserve. However, this did not stop him from owning a concentrated portfolio of 24 stocks, which he believes has the potential for market-beating returns.

One of the most notable trades made by Mr. Tepper last quarter was his decision to initiate a new $26 million position in The Walt Disney Company (NYSE:DIS). This move demonstrates his confidence in Disney’s long-term growth prospects and highlights his focus on investing in companies with a strong competitive advantage and a history of successful innovation.

The guru’s investment in Disney is just one of several notable trades he executed last quarter. He trimmed his stake in Meta Platforms Inc. (META) by 34% as concerns grew about the company’s growth amid a slowdown in the advertising market. At the same time, Mr. Tepper boosted his stakes in Chesapeake Energy Corp (CHK), Salesforce Inc (CRM), and Uber Technologies Inc (UBER), reflecting his continued focus on investing in companies with strong fundamentals and growth potential.

Disney Earnings: Trending In The Right Direction Despite Short-Term Headwinds

Mr. Tepper’s investment in Disney is particularly significant given the current state of the entertainment industry. The COVID-19 pandemic has had a significant impact on the sector, with cinema closures and production shutdowns leading to decreased revenue for many companies. However, Disney has proven to be a resilient business with its diversified business model and strong brand helping it weather the storm. Disney’s recent focus on its direct-to-consumer streaming service, Disney+, has also contributed to its success. The service, which was launched in November 2019, has quickly become a major player in the streaming market, with over 161.8 million subscribers at the end of last year. Disney’s decision to shift its focus towards streaming has helped the company adapt to the changing media landscape and position itself for future growth.

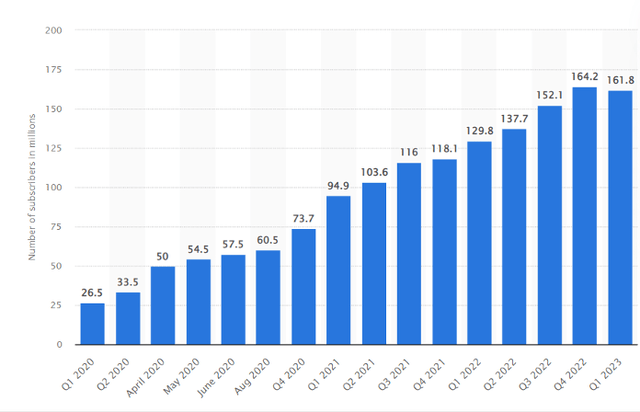

Exhibit 1: Global Disney+ subscribers growth

In Fiscal Q1 2023, the number of Disney+ users worldwide declined for the first time since the service was launched more than 3 years ago. The drop of 2.4 million subscribers compared to the previous quarter was attributed to a recent price hike and losses reported by the Indian Disney+ Hotstar brand, which saw a decline in subscribers primarily because of a lack of live cricket content. Despite this decline, the platform’s total user count remains well ahead of its original target of 60 to 90 million users by 2024, which is impressive. Additionally, although Disney+ Hotstar experienced a decline in subscribers in Q1, the number of international and domestic customers continued to increase.

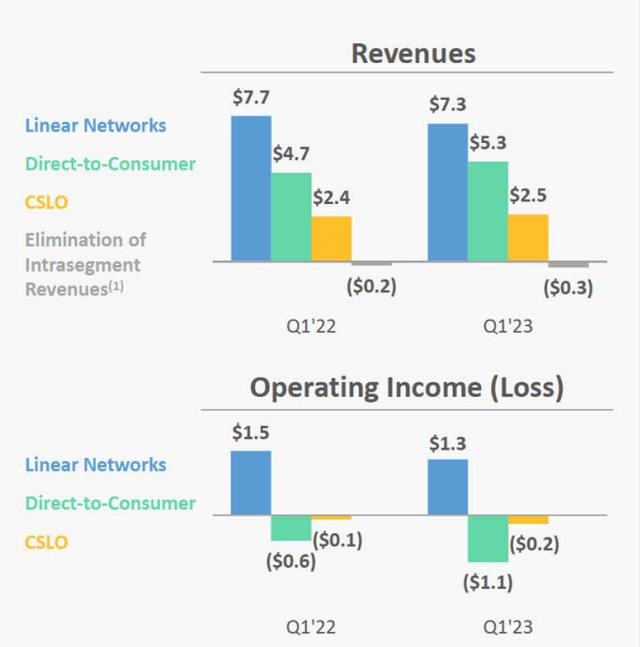

To maximize its long-term profits, Disney has made substantial investments in restructuring the business, such as launching Disney+ and acquiring a majority stake in Hulu. Furthermore, the company has made significant investments in the streaming industry, including a $30 billion content investment in 2022 to expand both Disney+ and its theatrical business. While the company’s media and entertainment revenue increased 1.3% YoY to $14.78 billion in Q1, after falling 3% YoY in the previous quarter, operating income from this segment decreased by over $800 million compared to the prior year. However, the company reported a QoQ improvement in operating income of $400 million.

Exhibit 2: Media & Entertainment revenue and operating income

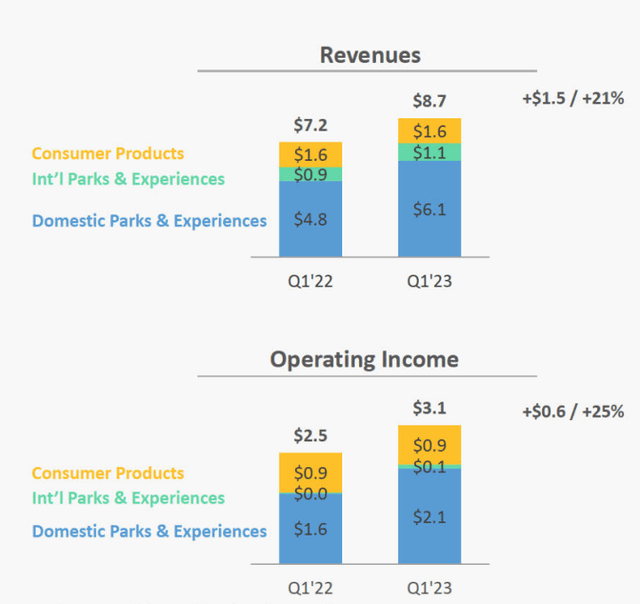

Despite successfully retaining its dominant position in the entertainment industry, the past few years were a challenging period for the company. One primary reason for this was the outbreak of the pandemic that adversely affected the Disney cruise and theme park business in 2020. The pandemic’s impact in certain regions, such as China, lasted until 2021 and even 2022, causing substantial harm to the theme park business. In FQ1 2023, Disney’s parks, experiences, and products division recorded a 21% YoY increase in revenue to $8.7 billion, while operating income surged by over 25% to $3 billion, thanks to a rise in the number of guests following the reopening.

Exhibit 3: Parks, Experiences, & Products revenue and operating income

The comeback of the theme park segment should not be underestimated. When Covid-19 wreaked havoc in 2020, Disney’s financial performance deteriorated because of the significant contribution made by the theme park business. In the two years that followed, Disney’s DTC business has grown exponentially, becoming the growth engine of the company. The company is nowhere near profitable as it used to be but the revival of the theme park business, in my opinion, will help Disney’s bottom line in the coming quarters.

The Leadership Change

In a market-moving development, Bob Iger, the former CEO of Disney, was reinstated as CEO after continued pressure from top executives and investors, replacing Bob Chapek. Mr. Iger has a proven track record of expanding the company and implementing successful strategies during his 15-year tenure. Bob Iger’s first tenure as CEO saw the successful acquisition of Pixar, Marvel, and Lucasfilm, which helped fuel the company’s growth and dominance in the entertainment industry. Under his leadership, Disney also launched its streaming service, Disney+, which quickly gained popularity and surpassed its initial subscriber goals.

In contrast, Mr. Chapek’s leadership was criticized for his focus on cost-cutting and short-term financial gains, rather than long-term growth and innovation. Investors should note that the COVID-19 pandemic challenged the company’s operations with the closure of its theme parks and disruption to its production schedules, leaving Mr. Chapek a lot to deal with.

Mr. Iger’s return as CEO is expected to provide stability and renewed vision for the company’s future growth, particularly in the face of growing competition in the streaming industry. He has already stated his commitment to prioritizing the most important aspect of Disney, creativity, to maintain Disney’s leadership position in the entertainment industry.

A number of you who worked with me know I’m obsessed with that (creativity). But I’m obsessed with that for a reason. It is what drives the company.” – Bob Iger on CNBC

Upon assuming his role as CEO, Bob Iger took swift action to make his mark by reorganizing the company’s content distribution structure. On a recent earnings call, Mr. Iger announced that the company would undergo a significant reorganization, including a plan to slash costs by $5.5 billion. According to the new business structure, Disney will now operate under three divisions: Disney Entertainment, which will encompass most of its streaming and media operations, an ESPN division that will include the TV network and ESPN+, and a Parks, Experiences, and Products unit. This move is expected to streamline operations and increase efficiency across the company. By reducing costs and creating more focused business units, Disney is positioning itself for long-term growth and success in the ever-evolving media and entertainment industry.

Takeaway

David Tepper’s recent investment in Disney demonstrates his confidence in the company’s leadership, particularly CEO Bob Iger, and his ability to navigate the company through difficult times. I am bullish on the prospects for Disney and I believe the company will generate excess returns on invested capital in the long run, although short-term macroeconomic headwinds will hurt margins and profitability.

Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The unexpected moment is always sweeter

At Leads From Gurus, we strive to achieve sweet returns by predicting which companies would report unexpected earnings. Join us to discover the power of earnings surprises.

Your subscription includes access to:

- Weekly actionable ideas that would help you beat the market.

- In-depth research reports on stocks that are well-positioned to beat earnings estimates.

- Three model portfolios designed to help you beat the market.

- Educational articles discussing the strategies followed by gurus.

- An active community of like-minded investors to share your findings.

Act now to secure the launch discount!