Summary:

- Netflix is positioned to dominate the streaming-video-on-demand space, despite decreasing market share.

- The company has low churn, high retention rates, rapid user growth, and industry-leading average revenue per user.

- NFLX’s crackdown on password-sharing further solidifies its dominance in the market.

- Exciting award-winning content and reinvestment into the original and licensed content wheel keep subscribers indulged.

- 1-year price target of $710 with a reinstatement of a buy and overweight rating.

hapabapa

Investment Thesis

I am writing this article to reinstate Netflix (NASDAQ:NFLX) as a buy and overweight. Netflix is a clear market leader, being the only pure play streamer with a first-mover advantage in paid sharing monetization. Netflix is at the forefront and the primary beneficiary of the disruption in linear TV. With over 260 million paid members, Netflix has the most expansive reach of views. Its pricing power and content offerings continue to drive margins higher and create a moat for the firm. Netflix’s recent move to crackdown on password sharers has monetized millions of additional subscribers for $7.99/month. Moreover, Netflix’s move to drop its basic subscription tier ($11.99/month) has forced new users towards its pricier standard subscription for $15.49/month or standard with ads tier for $6.99/month. Additionally, Netflix’s shift into live entertainment with its 10-year deal with TKO (NYSE:TKO) to acquire the exclusive rights to Raw will considerably scale its advertising footprint. Content remains king in media, so Netflix will remain the apex of streaming.

Sustained subscriber growth: Net additions of 13 million significantly topped Wall Street estimates of 9 million through capitalizing on sharing households and appealing to lower-income consumers with its ad-supported plan. I am confident that Netflix will be able to see high single-digit (HSD) subscriber growth(roughly +40 million net additions) into 2026 from the complete rollout of its password crackdown. Bundling with T-Mobile and the removal of the basic tier will continue to accelerate subscriptions on the ad-based side.

Advertising tier, still in the early stages: Scaling membership in its ad business is Netflix’s top priority. Consistent annualized ~8% price hikes for the last decade in its standard and premium tiers will drive existing and new members to ads. Advertising remains in the early innings and will likely be a small catalyst until 2025-2026 for top-line impact. The monthly ARM for the ad tier is almost comparable to Netflix’s ad-free tiers, sitting at roughly $11.25/month. Co-CEO Greg Peters said, “It may take years for ads to have a material impact on revenue, but Netflix’s ad-supported plan is helping boost subscription growth…” Live programming with exclusive rights to Raw will attract new subscribers and advertisers who want to capture the AVOD experience. I see a ballpark of 30/40 million advertising subscribers and annual revenue in the range of $2.4/$6.7 billion for 2024 and 2025, respectively.

Netflix will remain a growth stock: With growth comes a higher valuation multiple. My estimates of a HSD/low teens long-term forecast for top-line, paired with around 250 bps of operating leverage because of the fixed cost nature of the firm’s content commitments, Netflix should also see high teens EBIT growth. The opportunity for high-quality content licensing from unprofitable competitors like Disney (NYSE:DIS) and Warner Brothers Discovery (NYSE:WBD) is another reason I remain bullish.

Near- and Long-Term Catalysts

Key 2024 Content Releases:

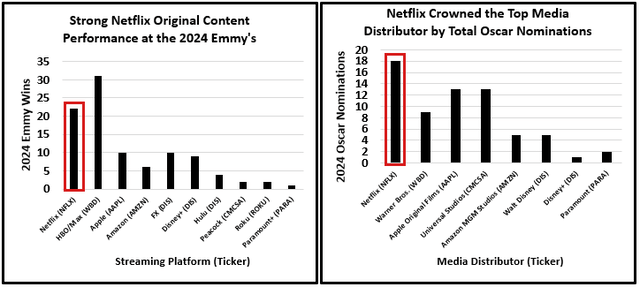

Content is the key differentiating factor between offerings in the streaming service industry. By platform, Netflix ranked second in Emmy Award wins in 2024 (behind HBO/Max – Warner Bros. Discovery) and first in Oscar nominations by distributor. Netflix continues to impress the Street and its end users with high-quality original content, surpassing 50% of its platform content with original vs. licensed content.

2024 Emmy wins and Oscar nominations by streaming platform and distributor – Netflix’s original content impresses on both stages (Variety & Deadline)

Notable show releases for 2024 include:

- Formula 1: Drive to Survive S6 (returning docuseries, 2/23 debut)

- The Netflix Slam (Live Sports/Tennis 3/3 debut)

- Full Swing S2 (returning docuseries, 3/6 debut)

- Bridgerton S3 Part 1, 2 (Expected May, June 2024)

- The Diplomat S2 (Expected mid-late 2024)

- Squid Game S2 (Expected late 2024)

Notable film releases for 2024 include:

- Through My Window: Looking at You (2/23 debut)

- Mea Culpa (2/23 debut)

- Damsel (3/8 debut)

- Mother of the Bride (5/9 debut)

- Hit Man (6/7 debut)

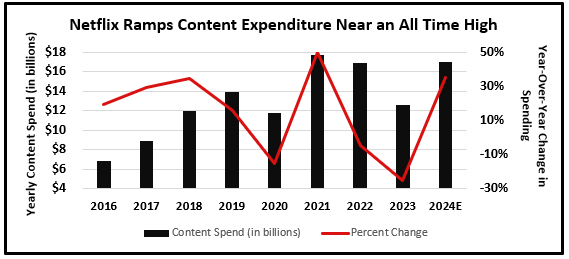

Netflix annual streaming/content expenditure (2016-2024E) – rebounding back to company highs (Edgar)

Due to the strikes from the Hollywood Screenwriter (SGA) and Actor (SAG-AFTRA) Guilds in 2023, Netflix’s content spending was suppressed to $13 billion. Management plans to allocate ~$17 billion in 2024 for its licensed and original content slate (~$2.5 billion in licensing).

Licensed content will remain a catalyst for Netflix because a $2-$3 billion run rate will allow Netflix to cannibalize members from the licensing streaming service. For example, licensing Suits from NBCUniversal has disincentivized subscribers to sign up for Comcast’s (NYSE:CMCSA) Peacock or leave Peacock to join Netflix. Successful licensed content will create value via organic net additions and poaching members from its competitors.

Continued Build-Out of Advertising Tier:

Netflix’s ad-supported plans are available in the U.S., U.K., Australia, Brazil, Canada, France, Germany, Italy, Japan, Korea, Mexico, and Spain. The advertising tier is an attractive option to those in all income ranges, as it is less than half the price of the next available option. Netflix’s AVOD penetration continues to thrive, with ad-tier subscribers up 70% Q/Q in Q4 ’23 (accounting for 40% of new sign-ups). Most of the APAC region is untapped for the ad tier, as are many of the prevalent EMEA and LATAM nations. Netflix will be able to generate a CPM well above AVOD averages due to its impressive ad products/features and industry-leading viewer interaction rates. After starting with 15 and 30-second ads, Netflix can now run 10, 20, and 60-second ads globally.

Due to the success of removing the basic tier in the U.S., U.K., and Canada, Netflix will likely remove the basic tier in all countries with ad tiers to drive subscribership. The removal of the basic plan paired with T-Mobile’s “Netflix on Us” deal, where a Netflix standard with ads subscription is included with most Go5G plans at no extra cost, will drive MAU growth. While MAUs and revenue should see 30-40% growth for the next couple of years, ad monetization will have a material top and bottom-line impact starting in 2025-2026. Guaranteed live weekly programming with Raw will bring recurring advertising viewership to the platform, which attracts prospective advertisers.

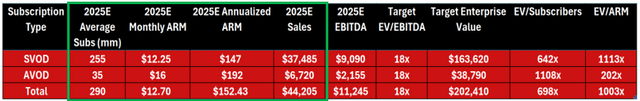

2025E Netflix SVOD vs AVOD: AVOD is trading at an expected EV/ARM discount showing room for growth (Personal Predictions/FactSet Estimates)

With expected total paid streaming members of 300 million by year-end 2025 (290 million pictured above = the average of BOY and EOY numbers), I anticipate the advertising tier to capture ~12% of these members. This will drive 2025E ad tier revenues to $6.7 billion, using a monthly AVOD tier ARM of $16 ($7/month in subscription cost + $9/month in ads revenue, currently $8.50/month). Although I expect ads to capture ~12% of total paid membership, my revenue estimate of $6.7 billion for FY ’25 contributes ~15% of the revenue estimate of ~$44.2 billion, mainly from a much higher ARM.

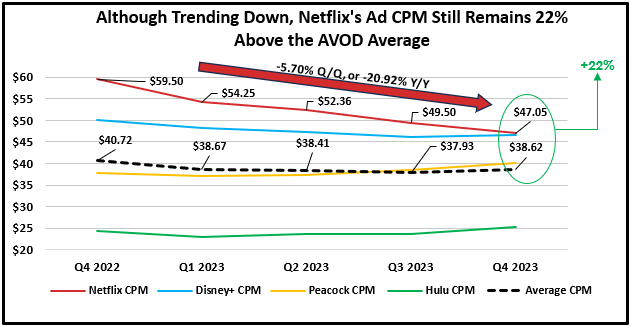

The cost per mile/CPM gap continues to thin; however, Netflix still leads the pack (Insider Intelligence)

Completed Rollout of Paid Sharing Initiatives:

Netflix IR – Q3 2023 Shareholders Letter

Since Netflix’s rollout of its password-sharing crackdown in May ’23, the firm has amassed roughly 30 million new members (from 230 million to 260 million). Because added-on accounts from the password crackdown are accounted for in this number, I anticipate around a third of new members in this period were from password sharers. I believe a third is a reasonable estimate, given that 40% of new subscribers are using the ad tier, very few subaccounts will be on the ad tier, and the rest of the new subscribers would be organic net additions in the other tiers.

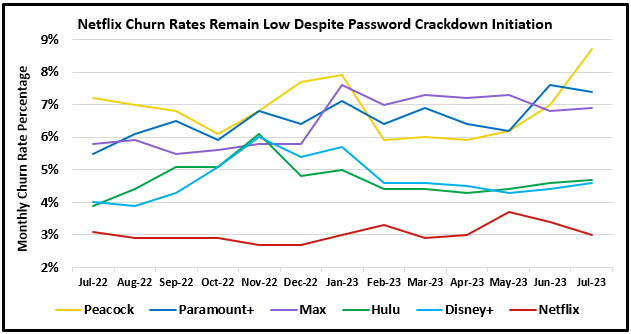

With only ~10 million new signups via password sharing, this leaves a potential addressable market of sharers of 90 million households. This is an aggressive estimate, given some households that were exposed to the initial round of crackdowns (i.e., U.S., U.K., Australia) turned down the option to add a subaccount. However, Netflix’s current churn rate of ~3% is way below its core competitors, with a weighted average of 5.3%.

Initial uptick in churn rates in May ’23 due to password crackdown has trended back down (Yahoo Finance) Netflix IR – 2022 Annual Shareholders Letter

- With over 90 million sharing households still untapped, I see Netflix sustainably growing its user base in the HSD to 300 million by the end of 2025.

- Paid sharing monetization will reasonably shift Netflix’s household/member TAM up 20-25% to around 550 million households.

- With ~1.7 billion out of the 2.3 billion global households listed as TV households, I anticipate Netflix can capture a third of these households. Already accounting for 35% of TV viewing, streaming will continue to capture cable cord-cutters, and Netflix will be the main beneficiary.

Risks to the Investment Thesis

Weak Consumer Spending in Low ARM Regions: A key part of Netflix’s expansion strategy for 2024 and beyond is its attempt to monetize lower-income regions through its cheaper ad-based tier. One concern is that these consumers will continue to be cost savers and look towards lower-priced AVOD offerings like Peacock at $5.99/month or even free streaming options like Pluto TV or the Roku Channel.

Advertising Spending Headwinds: Advertising spending on the six biggest OTT platforms saw an 8% decline from 2022-2023. With high expectations for Netflix’s ad platform, any decrease in advertising expenditure will provide a headwind to the advertising tier ARM. To differentiate its ad offerings, Netflix must continue to innovate its ad tech stack. CPM on Netflix’s platform is another concerning point, falling by ~21% since it’s been tracked due to a saturated AVOD environment.

Heavy Reliance on the Performance of Content: As a pureplay streaming service, Netflix is 100% exposed to risks of faltering demand for its original and licensed content. Its competitors have several other business segments to spread its risks in an unfavorable media & entertainment environment. With licensed content comprising 40-50% of its content library, Netflix will continue to rely heavily on third-party shows/films. Spending about $2.5 billion/year on licensed content will incentivize subscribers to shift away from streamers like Max, but it will also drive up the premiums Netflix will have to pay for the content.

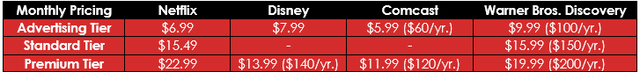

Low Switching Costs: Streaming is a space with very low switching costs, as it is a cheap and seamless experience to go from a platform like Netflix to Disney+. Although Netflix has an identifiable pricing power moat, competitors like Disney (Disney+, Hulu, ESPN+), Warner Brothers Discovery (Max), Comcast (Peacock), & Paramount (Paramount+) offer similar award-winning DTC experiences for lower price points. For larger households that need premium subscriptions to support more screens, Netflix costs over $275/year. With more bundling opportunities and discounted annual price plans, Disney+ and Max are great alternatives for $140/year and $200/year, respectively.

Among major streamers, Netflix remains the only SVOD platform without a discounted annual pricing plan (Company Websites/IR’s)

Valuation

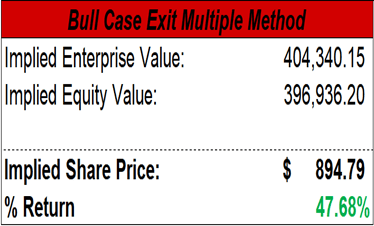

Bull Case – Discounted Cash Flow: $894.79/share|+47.68%

- Relaxed macroeconomic pressures allow for a cheaper borrowing environment for Netflix to reinvest more capital into original and licensed content.

- Netflix can successfully capture and monetize 90% of sharing households by 2025, thus attributing ~80 million new users.

- Netflix’s advertising tier will achieve $18/month ARM with over 40 million paid members by 2025. ARM will be driven via higher CPM charges from Netflix to prospective advertisers.

- Sustained success with award-winning licensed and original content to keep churn at an industry-low 2%.

Bull Case DCF – 18x EV/EBITDA Multiple Used (Personal Estimates/Seeking Alpha)

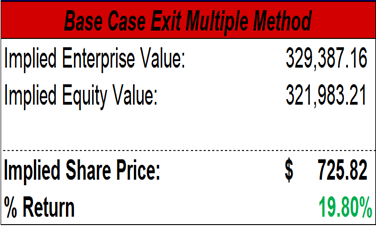

Base Case – Discounted Cash Flow: $725.82/share|+19.80%

- Netflix’s focus on lower ARM regions will potentially hinder firmwide ARM for the coming years, thus lowering implied future top-line growth.

- Investment in Raw proves to be an overpayment to WWE/TKO but produces a material change in advertising revenue and net additions.

- Netflix’s churn ticks slightly higher, closer to the industry standard of 5-6% from paid sharing monetization. Netflix only captures ~70 million households/members.

- Ad tier demand remains sticky, but ARM fails to go above $14/month from lacking CPM and no price hikes.

Base Case DCF – 18x EV/EBITDA Multiple Used (Personal Estimates/Seeking Alpha)

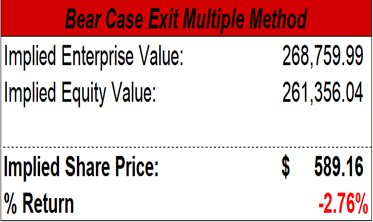

Bear Case – Discounted Cash Flow: $589.16/share|-2.76%

- A “higher for longer” rate environment will pose interest rate risks for the company, as it is relatively highly leveraged at ~2x LT debt to cash.

- Competitive pressures from DIS, WBD, etc., worsen as these firms close in on streaming profitability.

- Potential negative subscription growth will hinder the firm’s ability to trade at 80% 5-year EV/EBITDA (24x) and 70% 5-year P/E (32x) premiums to its peer group multiple.

- Declining quality of original content will increase the reliance on licensed content and disprove Netflix’s most substantial moat.

Bear Case DCF – 18x EV/EBITDA Multiple Used (Personal Estimates/Seeking Alpha)

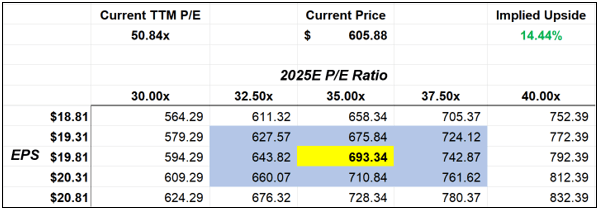

P/E Valuation:

With a 35x 2025E P/E ratio, Netflix currently has ~14% upside from our 2025 EPS expectation of $19.81/share (Personal Estimates/Seeking Alpha)

- Netflix’s 5-year blended forward P/E multiple has been ~33x, a 72% premium compared to the peer group average of ~19x. The current multiple is 34x (78% premium).

- With a current TTM multiple of over 50x, a 35x 2025 P/E is very plausible, given the current top and bottom-line growth forecasts.

- The expected EPS of $19.81/share for 2025 is slightly below Street estimates ($21.14/share) because of conservative buyback estimates and higher tax rate inputs.

- I expect repurchases of $5-$6 billion (~2% of OS) for 2024 and 2025

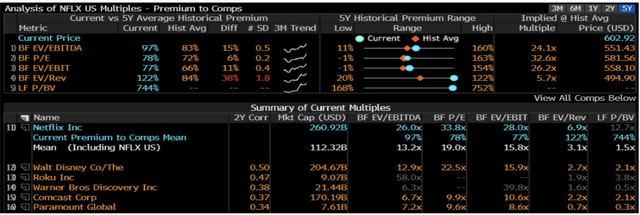

Netflix Equity Relative Value – Comps (Bloomberg Terminal EQRV Function NFLX)

Closing Remarks

Although the stock has run by over 80% Y/Y and over 30% YTD, this is again an amazing buying opportunity. There are plenty of catalysts and initiatives in place that cement Netflix as a clear industry leader. It has already gone through its contraction phase of subscribership, and the complete rollout of the ad tier as well as paid sharing monetization, will organically grow Netflix’s membership and financial performance. Using my valuation approaches, I see no present reason why Netflix’s price can’t appreciate another 15% or so and reach a new all-time high. My 1-year price target is $710 – using an equal weight of my base case DCF and P/E valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NFLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is purely my opinion, and prospective investors should conduct further research to make a conclusive decision.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.