Summary:

- Dell Technologies stock presents a conundrum with serious headwinds in its core PC business and uncertain economic environment.

- Insider sales in tech are on the rise, including Michael Dell selling nearly $800 million of Dell stock.

- Dell’s recent outperformance is driven by optimism in the company’s potential in the artificial intelligence sector, but challenging trends in the PC market pose risks.

AnthonyRosenberg

Dell Technologies (NYSE:DELL) stock currently presents a conundrum. On one hand, the valuation appears attractive, and the company is making strides to streamline and capitalize on emerging trends. On the other hand, there are serious headwinds in both its core PC business and a generally uncertain economic environment.

Investors who buy into Dell are essentially betting on a turnaround story – the belief that the company can overcome its near-term challenges and unlock the potential value the stock market seems to be discounting. This makes DELL a higher-risk proposition than some of its blue-chip tech peers.

Insider Sales

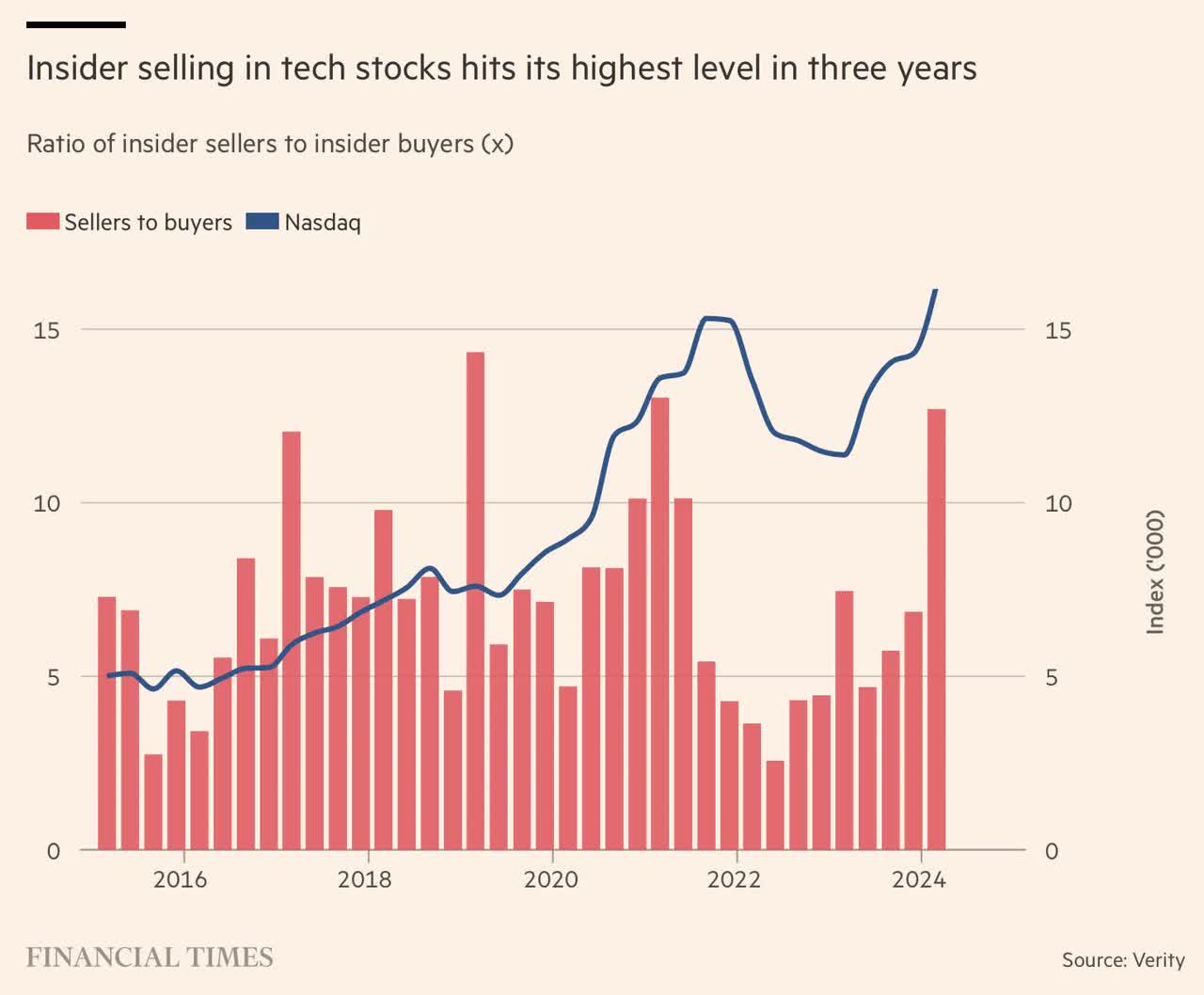

Financial Times recently reported that insider sales in tech are on the rise:

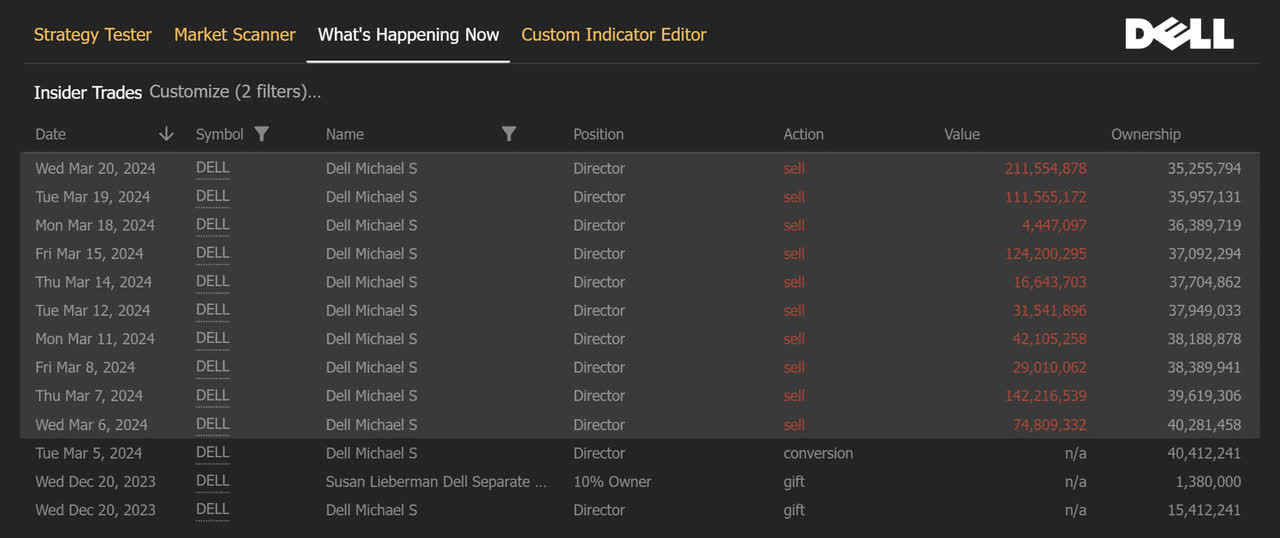

What the article did not include, however, is the recent sales by Michael Dell:

In the first three weeks of March alone, Michael Dell, the Founder, Chairman, and CEO of Dell Technologies, sold more nearly $800 million of Dell stock.

I note that Michael Dell has a net worth of $99.5 billion as of March 2024, so his recent sales approximate one percent of his net worth, but given the large amount of insider sales on an absolute level, these recent insider sales warrant a further analysis of the stock for potential sale.

Recent Outperformance

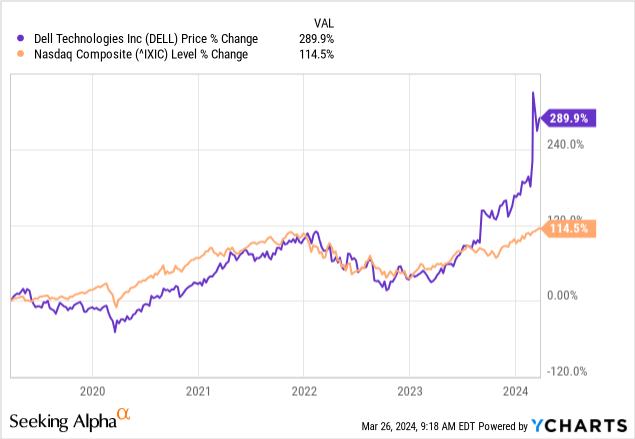

Dell stock has experienced a significant surge recently, propelled by optimism surrounding the company’s potential to benefit from the booming artificial intelligence sector, after years of performing in-line with Nasdaq index:

Dell’s robust position in servers, storage, and data center infrastructure are key factors that propelled the stock in the last year, as these technologies form the backbone of AI development and deployment. Additionally, with Dell’s recent earnings exceeding expectations, investors appear to be regaining confidence in the company’s ability to navigate ongoing challenges.

Challenging Trends

IDC’s Worldwide Quarterly Personal Computing Device Tracker, updated most recently on March 15, 2024, noted that Q4 2023 results for traditional PCs were the eight consecutive quarter of year-on-year volume contractions. The following three industry trends create a challenging landscape for Dell, which relies heavily on PC sales:

-

Saturation and Longer Replacement Cycles: The PC market experienced a significant boom during the pandemic years, driven by the surge in remote work and schooling. This has led to a degree of market saturation, as many consumers who needed to upgrade devices have already done so. Additionally, economic pressures are leading both consumers and businesses to stretch out the lifespan of existing devices rather than investing in new ones.

-

Economic Uncertainty and Inflation: Inflationary pressures and concerns about a potential recession are making both businesses and consumers more cautious about major technology purchases.

-

Shift Towards Mobile Computing: The continued rise of smartphones and tablets cannibalizes some of the traditional PC market. For many users, these devices offer sufficient functionality for basic tasks and entertainment, reducing the need for a dedicated laptop or desktop.

The above trends highlight the need for the company to continue diversifying its revenue streams, focusing on areas such as enterprise solutions, cloud infrastructure, and services where growth potential might be more robust.

Revenue and Segment Results

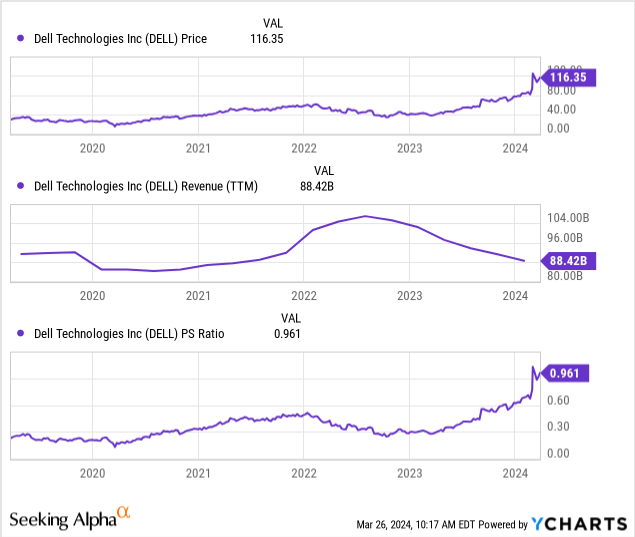

The following three graphs, in order, illustrate Dell’s stock price, trailing-twelve-month revenue, and price-to-sales ratio throughout the last five years:

The key takeaway from the above graphs is that Dell’s revenue has been essentially flat from 2019 to 2024, and that the recent price surge in Dell stock has been entirely driven by an expansion in the valuation multiple.

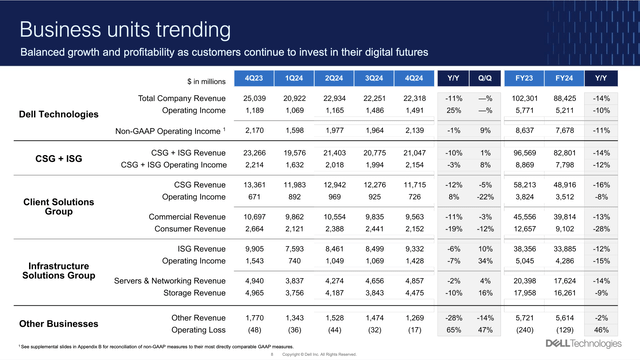

Further, all of Dell’s business units showed top-line year-over-year contraction as of the most recent quarter as well as for the full fiscal year, as the following slide from Dell’s most recent earnings presentation illustrates:

So why did Dell’s stock triple despite widespread declines in segment results?

Animal Spirits

I believe that the Artificial Intelligence theme is making its waves through various stocks, and I’ve been covering the sector in my recent articles and have discussed the red flags I see from extreme sentiment and recent insider selling at Nvidia to low margins and intensifying competitive threats at AMD, to elevated supplier and customer credit risks at Super Micro. I recommend reading those three articles as well for a full picture of my skepticism on the theme. If you have any feedback for me or would like to ask any questions, I’m active daily in the comments sections below my articles, and I’d love to learn from you.

Conclusion

Despite seemingly attractive valuation metrics, Dell faces headwinds in its core PC business tied to evolving market trends and broader economic conditions. While Dell’s recent moves in streamlining operations and positioning itself for growth in AI-related fields are intriguing, the recent surge in stock price may be driven more by speculative animal spirits within AI stocks than by concrete fundamental improvements. The substantial insider sales further increase my caution. Investors seeking exposure to Dell must be prepared for a potentially bumpy turnaround play rather than a smooth ride with guaranteed returns. I rate the stock SELL.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in DELL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.