Summary:

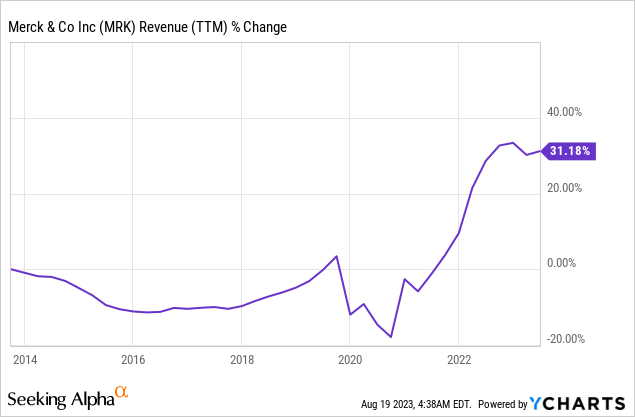

- Merck’s revenues have increased by 31% over the last decade, driven by sales volume, price increases, and M&A activity.

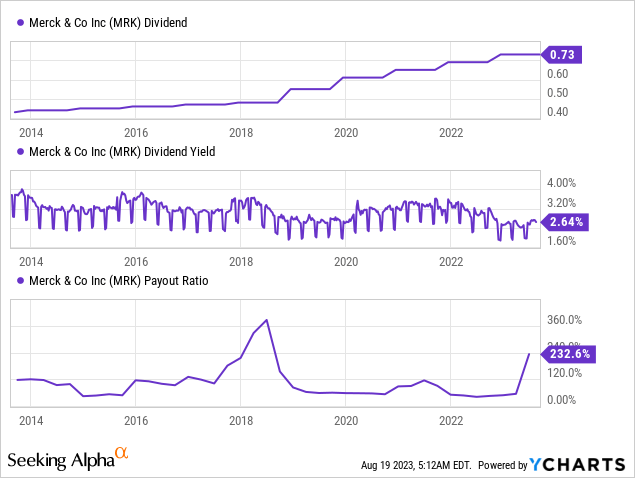

- The company has a strong track record of increasing dividends annually for the past 11 years, with room for further growth as EPS increases.

- The current valuation of Merck is attractive, with a P/E ratio of less than 13 when considering forecasted EPS for 2024.

Sundry Photography

Introduction

As a dividend growth investor, I seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The healthcare sector is one of my favorites as it is a relatively stable segment. One of my holdings in the industry is Merck & Co. (NYSE:MRK). In August, the company reported its second-quarter results and notified investors about a one-time charge regarding acquiring Prometheus. Therefore, the expectation is for 2023’s EPS to be 60% lower compared to 2022.

I will analyze Merck using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Merck operates as a healthcare company worldwide. It operates through two segments, Pharmaceutical and Animal Health. The Pharmaceutical segment offers human health pharmaceutical products in the areas of oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, and diabetes, as well as vaccine products, such as preventive pediatric, adolescent, and adult vaccines. The Animal Health segment discovers, develops, manufactures, and markets veterinary pharmaceuticals, vaccines, and health management solutions and services, as well as digitally connected identification, traceability, and monitoring products.

Fundamentals

The revenues of Merck have increased by 31% over the last decade. That increase is derived mainly from increased sales volume and price increases. Moreover, the company is also engaging in M&A activity, with the recent acquisition of Prometheus Biosciences for $11B. The ability to grow its core business and expand its core using M&A will drive Merck’s sales going forward. In the future, as seen on Seeking Alpha, the analyst consensus expects Merck to keep growing sales at an annual rate of ~4% in the medium term.

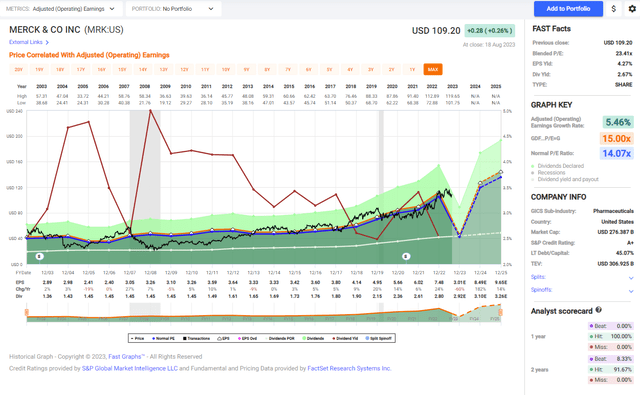

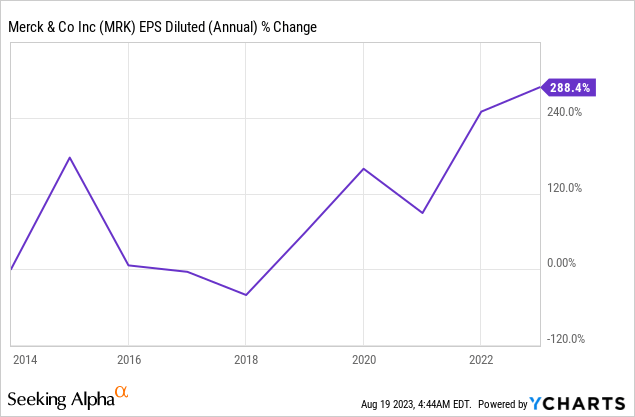

Merck’s EPS (earnings per share) has grown faster over the last decade. The EPS is up by almost 300% using GAAP EPS and 114% using non-GAAP EPS. EPS has increased much more quickly than sales as it grows due to the sales increase, cost-cutting, and price increases that increase margins and due to the company’s buybacks. In the future, as seen on Seeking Alpha, the analyst consensus expects Merck to keep growing EPS at an annual rate of ~9.5% in the medium term.

The company has been increasing the dividend annually for the last eleven years. Moreover, the dividend has not been reduced for more than five decades, meaning the company is extremely serious regarding dividend reliability. The current payout ratio stands at 2.64%, which is not extremely high when considering the risk-free rates. However, there is plenty of room for dividend growth as the company grows its EPS. Investors should expect increases to be in line with the EPS increase. The high payout ratio is a one-time expense and, therefore, not a concern to me. The payout ratio without it stands below 40%, which means the dividend is likely to be safe.

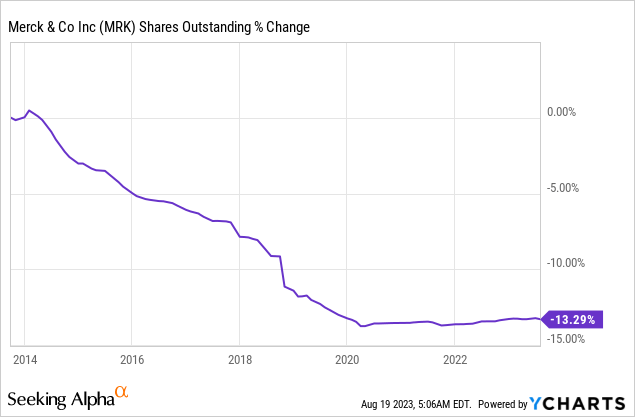

In addition to the dividends, Merck returns capital to shareholders via buybacks. Buybacks support EPS growth as they reduce the number of shares outstanding. Over the last decade, Merck has repurchased 13% of its shares to support EPS growth. The company does prioritize buybacks, but it is the least important compared to R&D, capex, dividends, and acquisitions. Still, the company has returned significant capital and increased shareholder value with that tool.

Valuation

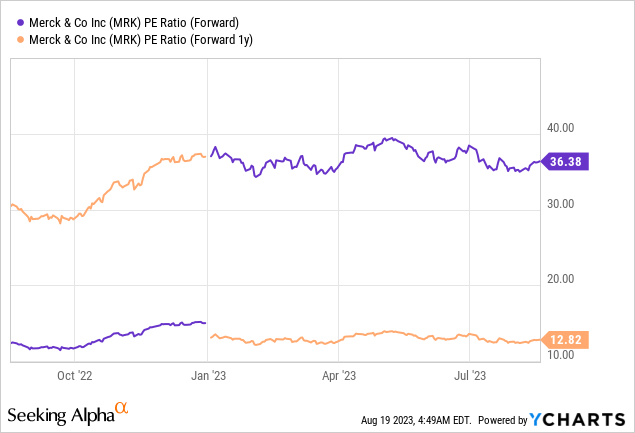

The P/E (price to earnings) ratio stands at 36.38 when using the current EPS estimates for 2023. This is a very high valuation for a solid blue-chip pharmaceutical company. However, this valuation is misleading as it results from a one-time charge associated with the Prometheus acquisition. When looking at the forecasted EPS for 2024, the P/E ratio is less than 13. Even considering EPS forecasts for 16 months are less reliable, the valuation seems attractive.

The graph below from Fast Graphs emphasizes that Merck is valued attractively. The average P/E ratio of the company has been 14 over the last two decades. During that time, EPS growth was 5.5% annually. The current forecast is for a faster EPS growth of 9.5%, which aligns with the historical valuation. I believe that a P/E ratio of 12.8 for 2024, which starts in four months, is similar to the average P/E of 14, while the growth is faster.

Opportunities

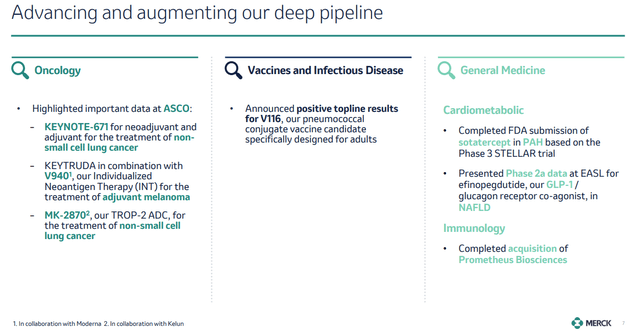

The first growth opportunity is the company’s robust pipeline. The company is working on some prominent products in oncology and vaccines. It is also involved in cardiometabolic advances. The ability to keep developing new and more sophisticated products in oncology is crucial, as it can prolong the use of Keytruda without competition. Moreover, the company develops new treatments for other types of cancer.

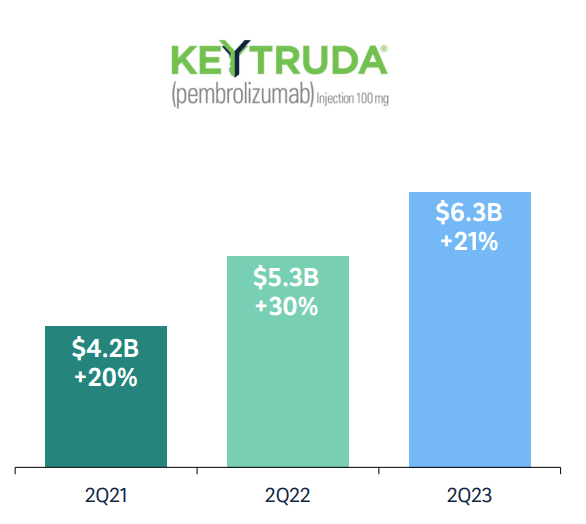

Keytruda is a significant growth opportunity for Merck as it is a blockbuster growing its sales for years. The sales of Keytruda have increased by 21% compared to Q2 2022. Keytruda is a highly efficient drug to fight cancer, and Merck keeps finding new uses and combinations with other medications. The drug has a significant impact on the way doctors treat cancer and, therefore, the sales growth. This drug will stay the company’s main growth driver in the medium term.

Merck

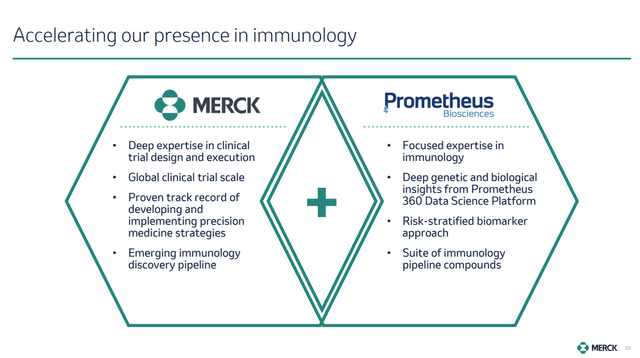

Merck’s revenue skews toward oncology and vaccines, representing 44% and 21% of the company’s top line in 2022. The company seeks diversification into another segment to diversify its sales. Immunology was chosen, and the company acquired Prometheus. Prometheus Biosciences is a biotechnology company developing precision therapies for immune-mediated diseases. This business development will allow Merck to extend its offering and maintain its current focus on immunotherapy and the use of humanized antibodies.

Risks

Keytruda dependency is probably the most significant challenge Merck is dealing with, and as such, it is a risk for investors. The company relies heavily on Keytruda to drive growth. That superb drug accounted for 42% of the company’s sales in Q2 2023. The patents protecting Keytruda will expire in 2028, meaning that the company has a little more than four years to develop and acquire products that will compensate for some sales loss. As other pharmaceutical companies deal with it, it is not a unique challenge, but it is a critical challenge at 42% of sales.

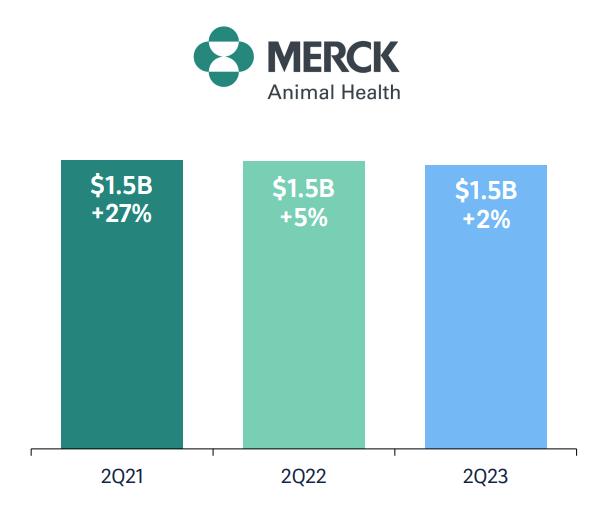

Animal Health stagnation is another risk, as the unit has struggled to grow in the last two years. While the unit is not as prominent as the rest of the business, it seems like Merck can achieve growth in it. It may hinder growth in other businesses if it draws too much managerial focus. Suppose the separate unit cannot support growth mainly due to the patent expiration of Keytruda. In that case, Merck may consider selling it and investing the proceeds in areas with a competitive edge to keep growing.

Merck

Competition and execution are another risk for the company. When it comes to competition, the field is highly competitive with giants such as Novartis and Johnson & Johnson. Moreover, new startups always try to challenge the incumbents. Therefore, with fierce competition, it is more challenging to execute. Since I wrote on Merck 8 months ago. The forecasts for 2023, 2024, and 2025 were reduced by analysts, showing how hard the competitive environment is.

Conclusions

To conclude, a company doesn’t get more blue-chip than Merck. It grows sales and EPS by developing new drugs and therapies and drives value to shareholders, which is returned through dividends and buybacks. The company has plenty of growth opportunities from its pipeline and its ability to engage in M&A due to the high profits it generated.

While there are risks to investing in Merck, mainly the dependency on Keytruda, the current valuation offers enough margin of safety. I believe that at less than 13 times 2024 EPS, the share is attractive. Moreover, there is still enough time to deal with the risk, and therefore, in my opinion shares of Merck are a BUY right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.