Summary:

- A reprise or tweak of what was, won’t work. The Walt Disney Company CEO Robert Iger was part of the past for both good and problematical moves.

- Has Mr. Market valued Disney assets realistically in the coming Ice Age of the entertainment media sector?

- Disney’s great strength was its internal creative juices, but it has lost that mojo and opted to pay huge premiums for established icons. That’s what created much of the debt.

JHVEPhoto/iStock Editorial via Getty Images

“Its deja a vu all over again…”

Yogi Berra, NY Yankees catcher, philosopher.

Caution: we don’t want to stretch the analogy too far that it becomes unworkable, but the hard truth is that The Walt Disney Company (NYSE:DIS) and its peers in mass entertainment are becoming extinct in a forming ice age. And if that is the case, it means that re-emerging as a viable form of life after the ice melts needs a certain agenda. So how does Disney become a wooly mammoth surviving the Ice Age into a new construct? What can Mr. Market realistically expect from Iger 2.0?

CEO Robert Iger’s return could be a positive, but incremental at best. Remember, he was part of what went right and wrong during his tenure as CEO. Disney needs a refresh button hit fast. Misreading the zeitgeist ahead can be fatal for the entire entertainment sector. Consumer fatigue on content and pricing will rule the days ahead and, by extension, the forward earnings projections of the sector. In the case of Disney, the first step is the return of Iger. Finding his successor should be his “Job One” as the transformation of what works rolls ahead.

Competitors with stocks priced much closer to the realities of the challenges afoot are far better bets despite their shared shortcomings. Warner Bros. Discovery (WBD) and Paramount (PARA) are troubled, but priced for recovery on a much easier path than Disney. The precipitous fall from a March 2021 Disney high of $202 suggests a very long trek along a twisting yellow brick road for the Mouse Kingdom. The other guys face a much faster trip to a new Oz.

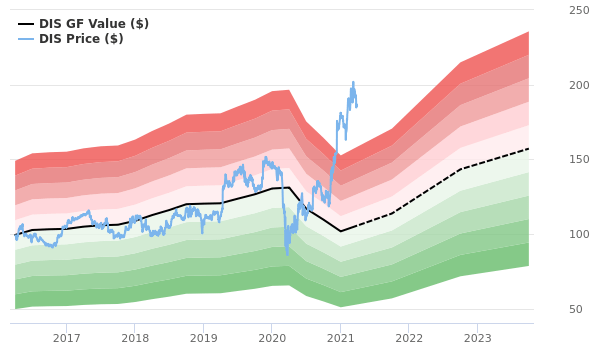

Above: The big question: Where will Disney stock finally come to rest at the point where the market believes its corporate culture can compete?

Prices at writing:

WBD: $10.27

Paramount Global: $18.41

Disney: $91.98.

Share prices are clearly composed of dozens of factors, and we don’t presume to imply apples-to-apples comparisons on price alone. We only wish to show relative costs of entry points for those who may see opportunities in the sector beyond present challenges. Disney price recovery will be longer and tougher.

There is no shortage of opinion in the investment community slicing and dicing every applicable metric to Disney stock as it, along with peers, faces what may be the single most dangerous interregnum ever lingering over the industry.

google

Above: In the new world of entertainment media where nothing can be taken for granted, can Disney settle anywhere near its former trading range?

The golden age of Disney and its competitors was in a slow process of erosion just before the pandemic. It long ago became a fat, dumb, and happy stock basking in the sun of Mr. Market’s belief that the company was minted gold. Covid produced rip-roaring “get out of jail free” cards of a streaming sign-up bonanza for the entire sector. Stay-at-home life ironically came to the rescue. But it also planted the seeds of the coming Ice Age in which the sector finds itself now. Buried deepest under the glaciers, Disney needs to unwind itself, slim down, and become the in-house creative powerhouse it once was. There are just so many pop culture icons you can buy, and their cost has ballooned.

Alpha spreads for current discounted cash flow (“DCF”) value for Disney shares is $48.17, or 46%, overvalued by its calculations. But this projection isn’t gospel. DCF valuations for Disney are all over the place, many much more bullish. What suggests caution here without question, though, are projections of cash flows to a terminal value 5 years forward. Again we quote the great screenwriter William Goldman (Chinatown) when asked about studios making money in movies. He said, “Nobody knows anything…”

In a post-pandemic world where factoring Black Swan events suddenly trash analytic projections of cash flows and forward earnings, we need to understand that such forecasting has its time limits. For example, we found a DCF valuation of Disney for 2018 at $175 a share. It has gyrated much since then.

That no pandemic was even dreamed of at that point is certain. But as a general starting point in 2023, it is fair to state that, given the herculean challenges facing Iger 2.0, his BOD, and hench people in senior management, Disney’s current price against peers for the near term seems, at least to us, vastly overvalued.

Facing the double whammy of the streaming wars mulcting billions in content production and signup deals plus a probable recession, further twisted into a Gordian Knot by inflation, it’s hard to see how Disney will prevail on the other side of these macro headwinds. Unless, that is, they accept the simple truth that the company is too big, too ungainly, and too hard to structure a span of control without overstuffing it with bureaucrats. And its debt load is far too heavy a burden to carry while attempting to introduce a new corporate culture of profitability first.

- Too many questions remain unanswered now and likely to remain so for the foreseeable five years ahead.

- When and how can streaming become profitable if you have at least four top-tier companies battling for subscriber share in a hot content price war? How do you take a sledgehammer to Disney’s massive $45b debt load (low debt service average of 3% notwithstanding). Layoffs yes, cancel pricey content deals or just eat sunk costs, as WBD did on Batgirl. Selling its two-thirds of Hulu makes great sense for Disney, as presumably both itself and its minority partner Comcast (CMCSA) are both obliged by contract to pay a mandated $27.5b for the company. Comcast can argue for an adjustment, making the case that Hulu can no longer be valued as it was. Conversely, Disney can counter that it may well be worth more and play tough. Or vice versa.

- Either way, as we have learned from the long and tortured battle between Fox and PDYPY (Fan Duel) over the 18% it bought that it’s a rock and a hard place issue. They went to arbitration, which ruled that Fox must pay current value, not the cheaper price originally negotiated. You can expect a birthday party for lawyers on this should Iger 2.0 opt to sell Hulu. Better to arbitrate than carry another problem. Valuing the Disney library, among the most valuable in the entire space, needs a housecleaning investors can believe in. Is it worth what it was pre-pandemic?

- For one thing, early Disney IP such as Mickey Mouse & pals have passed their 100-year copyright protection and are now clearly worth considerably less than before. For many other reasons, some of the acquired pop iconography characters by Iger and company over the years are also beginning to show signs of age.

- A good, hard look at the library from a perspective of aging it as new generations of kids shrug at what may have been must-see 20 years ago, is a top priority to see which, if any, might be candidates for sale as well. It’s not crazy, It’s the post-covid world of entertainment. No pop culture characters or stories have 100- year evergreen value as they once may have. Re-valuing the library up or down clarifies value overall.

- Sell ESPN. These possibilities have taken center stage in many Disney discussions among big holders and everyday investors as well. The unit is still viable as a cash generator. But its subscriber base has been slowly eroding for ten years as the cost of sports rights deals have skyrocketed. There is a squeeze play here that Disney is far better off being free of considering the future. A sale can fetch a bundle of cash with proceeds used to reduce debt.

- The prospect of a sold or spun-off ESPN bears the immediate plunge into sports betting, with the potential of it grabbing a first-tier share of market given its massive existing audience. The sports betting story is simple: It’s a low-margin, high-marketing-cost business, but it is growing. One of the key drags to its continuing losses is customer acquisition marketing. With ESPN’s existing 24.3m subscribers as a natural database to mine for bettors, their average cost per customer acquisition will be dramatically lower than most platforms in the leadership tier. Since 2011, ESPN subscribers have dropped 24% and their payment for sports rights are rising; the unit seems to be facing a viable but slowly eroding profitability engine for Disney as it now stands. Hoping global growth will come to the rescue is a fool’s errand in the new world ahead.

- We could see a BetESPN platform, late in the game or not, building toward a $2b market share within five years. That would alone help offset its subscriber decline and cushion some of the sports rights costs going forward. For Disney, it represents a fast reaping of a cash inflow that could devote most of the net proceeds to take a significant bite out of its debt and thereby reducing interest costs better spent elsewhere.

- Cut prices on Disney theme parks to reflect today’s economic world faced by families. It’s an immense challenge, agreed. But it’s a bad message badly sent by a company presumably that understands all it needs to about price elasticity or lack of same in theme park pricing.

- Slavery to woke-ism preaching is clearly a factor in some portion of audience fatigue hitting Disney. Nobody really knows to what degree. Polling is difficult because it’s probably an area where many people may be reticent to admit one way or another whether they think it’s great or disastrous policy. But it is there and it is a factor. And if the company continues to be such a visible advocate, it clearly has financial negative implications.

Here’s a recent example. My son has subscribed to Disney+ for his two small boys aged 7 to 3. He’d loved Disney’s 1940 hit film Fantasia, which he’d seen on TV when he was small. He clicked and here’s the absurd “warning” came onto the screen before the opening credits:

This program includes negative depictions and/or mistreatments of peoples or cultures. These stereotypes were wrong then and are wrong now. Rather than remove this content we want to acknowledge its harmful impact, learn from it and spark conversation to create a move inclusive future together committed to creating stories with inspirational and aspirational human experiences around the globe. To learn more about how stories have impacted society visit: Stories Matter – The Walt Disney Company.

Above: Apparently few, if any, audiences were offended by this work of genius back then as it remains on Disney+ with a warning for today’s viewers.

In other words, the woke mandarins of Disney have arrogated to themselves the role of marketing teaching moments to us unenlightened public. My only beef here is the apparent contradiction of throwing out a virtue warning, but keeping Fantasia on Disney. If the good Reverend Iger and friends finds it so objectionable, why is It still there?

This is no knock on the film, which was a masterpiece in its time. Nobody at Disney in 1940 set out to harm anyone. Sensitivities change for sure over time but can migrate into absurdity, as is the case with Disney’s warning notice on Fantasia.

Just for the record, the original Fantasia animated movie released in 1940 cost $2.4m and grossed in theatrical release $83m. Adjusted for inflation, that would be an equivalent gross of $1.5b in 2023 dollars against a cost in 1940 dollars of $9.2m. Compare that with Disney’s latest Avatar 2, which thus far, a huge hit, clocking over $1.37b to date with a cost of near $500m. The difference? Producer James Cameron estimated the flick would need to do $3.5b from all sources just to break even. Investors need to beg the question: It’s a great sequel idea, but why even do it if the promised land of profit probably lies outside the most optimistic forecast of the guy who made it?

Our point here this that Disney is a company with one foot in its glorious past that produced great returns for investors and terrific product, and another planted in a dead-end future rife with economic challenges, bruising competitions, and above all, a consumer who increasingly finds its products overpriced.

And the last thing the company needs now is to refuse to abandon the pulpit of preaching that may be inhibiting the appeal of some of its content to the widest possible public. Iger has doubled down on woke-ism in his 2.0 tenure already. Don’t expect analysts to raise this issue in any earnings calls ahead. The Iger cheering squad has the pom poms ready to twirl.

This year Disney will celebrate its 100th anniversary, which will show how the dramatic change in corporate culture has led them to the current bearish outlook beyond the macro challenges the entire industry faces.

What is a corporate culture for 2023 and beyond?

Stipulation: In the space of a Seeking Alpha article, we do not presume to present a McKinsey study of Disney’s corporate culture. It is way above our pay grade, our research resources, and deep dive experience. Our point of view springs instead from 30 years in the c-suite of companies engaged in pleasing masses of public all the time as much as is realistic. What we do understand is how difficult it is to change the culture dynamic in the c-suite, usually rife with cronyism and bobble head dolls surrounding the CEO. This has not materially changed since Iger’s return. He’s got the support, now he needs to move on key issues.

Above: Monday Night Football is a great product, but far from what it was twenty years ago when NFL content wasn’t anywhere near the volume of today. But it is a tent pole in ESPN still attractive to the right buyer.

The entertainment Ice Age: signs are all over the place

The questions is that, given the monumental deluge of covid and the changes in consumer behavior since 2020, have leaders in the sector like Disney really recognized the change beyond earnings release lip service? Assuming a few tweaks here or there will fuel a rebound may not work in the new zeitgeist.

The easy answer is naturally, they aren’t dumb. Given their access to mountains of cutting edge AI data, immediate revenue results, and the presumed combined experience and expertise of their c-suite leaders, we can assume they know a lot more about the coming Ice Age than we can conjecture about here. One central issue here: Ad-supported streaming content tiered with a premium for no ads? Isn’t the reason streaming boomed was partly because consumers saw freedom from broadcast and cable ad pollution?

But how will they change course? Thus far, all we can discern within our flawed perspective, I suppose, is same old same old. Old wines in new bottles.

That’s not the real question. The rubber meets the road scuffle comes as to whether the normal elements of top management blunder traps remains in place, whether it is led by former CEO Bob Chapek or Iger. Outguess: it has not. That’s no rap on Iger. Having spent enough years in the c-suite, I have seen the drill, and the challenge to change a long-standing corporate culture is immense, especially in a market with impatient investors.

Former CEO Michael Eisner is 80 and still active in other businesses. He is sitting on 14m shares of Disney at around $15. He was the guy who tapped Iger as his successor. We haven’t heard from him over the Chapek mess. He might be a good guy you want to talk with, having faced a watershed moment for the company when he arrived in 1984. He might be someone you may put on the board in addition to a few men and women who knew how to entertain kids at a price families could afford.

Eisner’s legacy, troubled at points, still ended in a transformation of the company that was the foundation of its latter success. He chose Iger.

Our investor friendly suggestion: Iger-call Eisner, bring him back on the board if he can be persuaded his opinion will count.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

For in-depth and deep dive research on the casino and gaming sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" – free to existing members and new subscribers.