Summary:

- Disney’s Direct-to-Consumer business has experienced slowed growth, and heavy content spending is impacting overall profits.

- The DTC business is expected to remain loss-making for the next three quarters, and it is unlikely to achieve a comparable operating margin to Netflix.

- Disney’s high re-organization costs, debts, and increasing capital expenditures pose significant challenges to their free cash flow generation.

JHVEPhoto

Since the launch of Disney+ in late 2019, Disney (NYSE:DIS) embarked on their direct-to-consumer streaming journey, offering Disney+, ESPN+, and Hulu directly to consumers. Subscribers surged during the pandemic, but growth has now slowed. I believe Disney won’t generate operating profits from their Direct-to-Consumer business soon due to heavy content spending, which continues to impact their overall profits. In my assessment, the stock is overvalued, leading me to assign a ‘Sell’ rating to Disney.

Continuing Spending for Direct-to-Consumer Business

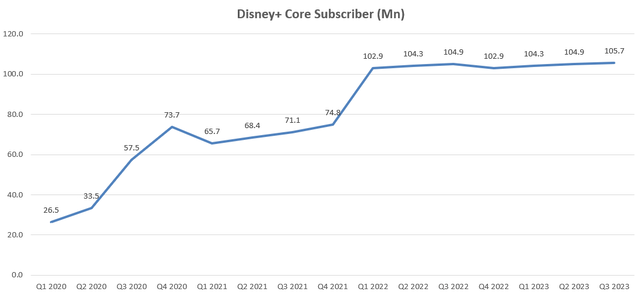

Disney’s Direct-to-Consumer Business (DTC) includes Disney+, Disney+ Hotstar, ESPN+, Hulu, and Star+ video streaming services. The number of Disney+ core subscribers witnessed remarkable growth from their launch in late 2019 to Q1 FY22. During the pandemic, the shift to remote work led to a significant surge in streaming services usage as people spent more time on screens. However, in the post-COVID era, streaming services have started to experience slower growth.

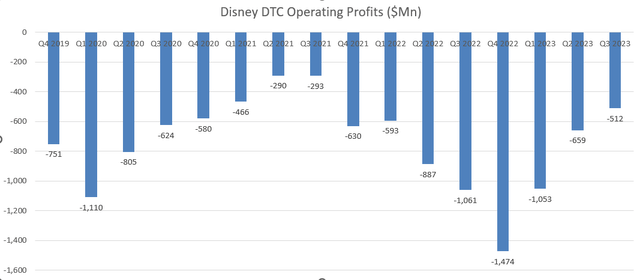

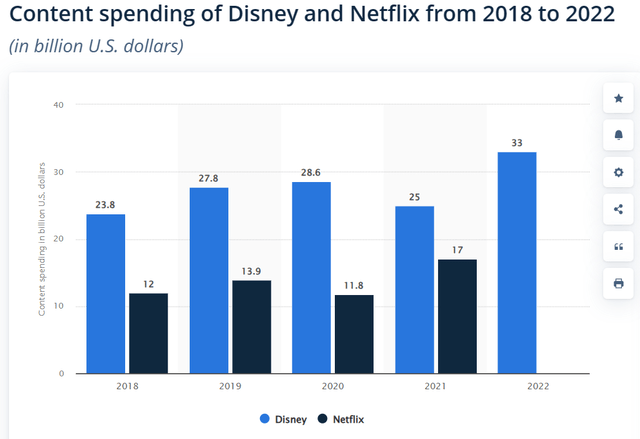

Disney’s DTC business generated $19.5 billion in revenue and $4 billion in operating profits during FY22. One of the key reasons for the operating loss was their hefty content spending. Disney spent $33 billion in FY22 for the contents, $25 billion in FY21, $28.6 billion in FY20 and $27.8 billion in FY19. Bob Iger returned to the CEO role in late 2022, and he started to cut the content spending budget. In Q3 FY23, Disney expected their FY23 content spend to be approximately $27 billion, which was $3 billion lower than their previous guidance. As illustrated in the chart below, Disney’s DTC business has been loss-making for a long time, and I don’t think they can turnaround anytime soon.

Disney’s management anticipates meaningful improvements in the DTC business by mid-FY24, implying that their DTC operations will remain underwater for the next three quarters. Despite Netflix’s (NFLX) 20% operating margin, I remain skeptical about Disney achieving a comparable margin anytime soon. There are several key factors contributing to my doubt.

Firstly, according to Statista, Disney has consistently outspent Netflix on content. Reports indicate that over half of Netflix’s content consists of original and exclusive titles, a sharp contrast to Hulu’s 4%. Moreover, Netflix’s management aims for a 50/50 split between original and licensed titles in the coming years, a strategy that aids in content cost control.

Secondly, Netflix operates as a pure technology-driven company from its inception, while Disney adheres to a more traditional consumer-centric approach, which I believe is not inherently technology-oriented. A technology-driven company demands a streamlined approach, reduced bureaucracy, and swift, efficient cost management. In my view, these elements are not deeply embedded in Disney’s organizational DNA. Considering these factors, I doubt Disney can achieve a comparable operating margin to Netflix in the foreseeable future.

High Re-organization Costs and Debts

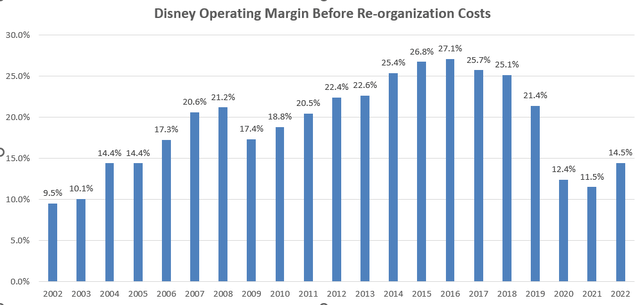

Disney’s margin reached its peak in FY16 and has been declining over time, even after adjusting for their reorganization costs. To some extent, this decline is understandable as they ventured into their DTC business, where early investments are essential for future growth. However, from an investor’s perspective, it is unlikely to be an appealing investment, especially given the unpredictability of their DTC business’s future.

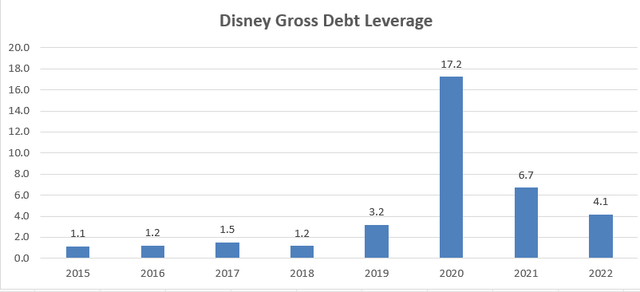

Over the first three quarters of this year, Disney has already spent $2.87 billion on restructuring and impairment charges. These charges will further drag down Disney’s reported operating margin in the near term. Regarding their balance sheet, their gross debt leverage was 4.1x in FY22. I give them credit for deleveraging their balance sheet coming out of the pandemic. However, the debt leverage is still quite high at this point.

Other Risks

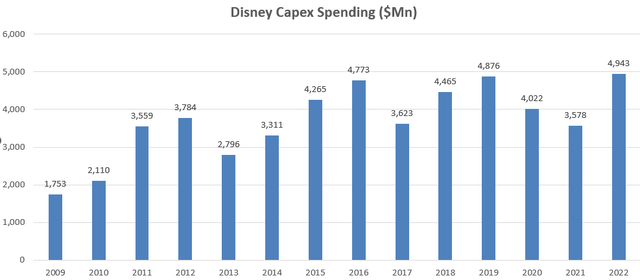

Recently, Disney announced plans to nearly double their capital expenditures for its parks business to about $60 billion over the next 10 years. This means they will be spending more than $6 billion in annual capex on average. This marks a significant increase from their spending over the past decade. In FY22, Disney spent $4.9 billion in capital expenditure and guided $5 billion in spending for FY23. The escalating capital expenditure could pose a significant challenge to their free cash flow margin over the next decade.

In peak years like FY16, FY17, and FY18, Disney generated approximately a 16% free cash margin. However, due to heavy investments in recent years, their free cash flow margin declined to 1.3% in FY22. This decline was primarily caused by struggling profit margins, with Disney’s reported operating margin dropping from 25.5% in FY16 to 7.9% in FY22. Disney also incurred over $8 billion in operating expenses related to restructuring and impairment from FY16 to FY22. The current plan to increase capital expenditures could further strain their free cash flow profile over the next decade.

Financial and Outlook

In Q3 FY23, Disney achieved a 4% growth in top-line revenue, but their adjusted EPS growth declined by -5.5%. Linear Networks revenue saw a 6% year-over-year decline due to reduced spending on advertisements. On the other hand, Direct-to-Consumer revenue increased by 12% year over year, and the operating loss narrowed to $512 million, a significant improvement from the $1 billion loss in Q3 FY22.

Despite some improvements in free cash flow generation in Q2, the overall results indicate that Disney is still struggling with their margins. Moreover, considering the upcoming increase in capital expenditures from FY24, there could be pressure on their free cash flow generation in the near term.

The most significant concern from their Q3 results is that their management team doesn’t anticipate a turnaround in the profitability of their DTC business before mid-FY24. This lack of profitability could continue to weigh down their stock price.

Valuation

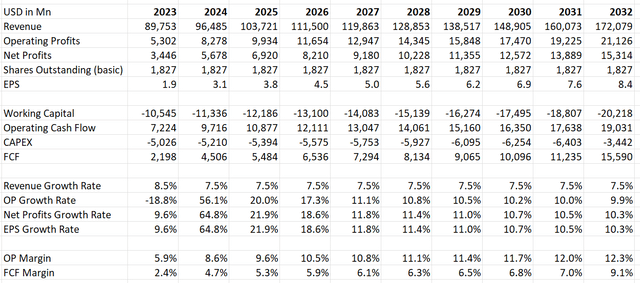

I expect their revenue to grow by 8.5% in FY23, which aligns with their current guidance. Over the past 8 years, Disney’s revenue has grown at an average rate of around 7.3%. Thus, I assume a 7.5% normalized revenue growth rate. Additionally, I have modeled $3 billion in restructuring costs for FY23, $1 billion for FY24, and $500 million for FY25, as I believe their restructuring will peak in FY23 and then gradually moderate over the next two fiscal years. With their planned reduction in content spending, I anticipate their margin will start to improve over time. I assume their margin will reach 12.3% by FY32, with the free cash flow margin reaching 9.1% in the same fiscal year.

Disney DCF Model- Author’s Calculation

Applying a 10% discount rate, a 4% terminal growth rate, and a 25% tax rate, the total enterprise value is estimated to be $158 billion. After adjusting for their debt and cash balances, the fair value of their stock price is calculated to be $67 per share. I believe their stock price is overvalued at this level.

Verdict

I believe it will take considerable time for Disney to turn their DTC business profitable. Moreover, their rising capital expenditure on parks might strain their free cash flow generation. Based on my estimates, the stock price appears overvalued. Therefore, I am assigning a ‘Sell’ rating to Disney.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.