Summary:

- Disney stock has struggled after its post-earnings selloff, even as the S&P 500 took out new all-time highs.

- Disney’s Linear TV business worries investors, given its secular decline.

- Disney anticipates streaming to reach profitability by FQ4, mitigating these concerns.

- The Experiences segment faces a post-COVID normalization, raising Disney’s execution risks as it navigates its streaming transition.

- I argue why the selloff in DIS has likely leveled off, presenting an opportunity to buy and wait patiently for the Disney magic to return. Read on.

Wirestock

The Disney Magic Evaporated

The Walt Disney Company (NYSE:DIS) investors got a rude awakening as DIS stock reached its recent top in March 2024. Accordingly, DIS nearly fell into a bear market from its March 2024 highs, but has yet to recover. Moreover, the S&P 500 (SPX) (SPY) posted new all-time highs as investors reallocated from DIS stock. Therefore, Disney buyers have remained cautious after Disney’s post-earnings selloff.

I upgraded DIS stock in my previous article in March 2024. While the bullish thesis worked out initially, DIS’s buying momentum peaked later in the month as investors reassessed Disney’s recovery. Notwithstanding the decline, I determine Disney’s recovery thesis remains robust, even though ongoing challenges in its Linear TV segment could hinder near-term buying momentum.

Disney’s second fiscal quarter earnings release highlighted the challenges of navigating a secular decline in linear TV, even as Disney anticipates combined streaming profitability by Disney’s fiscal fourth quarter. The 8% decline in Linear Networks contrasted with the 13% increase in direct-to-consumer revenue improvement. However, with Linear Networks generating more than 95% of the Entertainment segment’s revenue, concerns over its long-term sustainability are justified.

Notwithstanding my caution, investor sentiments should remain robust as Disney upgraded its FY2024 adjusted EPS growth guidance to 25%. In addition, Disney management expects to achieve its $3B target in full-year share repurchases, underscoring the confidence in its value proposition.

As a result, bullish Disney investors could have been surprised by the lack of buying enthusiasm on DIS over the past two weeks, as DIS stock hovers above the $100 support level. The unanticipated weakness in Disney’s Experiences segment likely intensified near-term concerns. Management commentary on the Experiences segment’s post-COVID normalization coincided with increased CapEx spending to improve its long-term growth opportunities.

Disney Experiences Must Continue To Deliver

Accordingly, given the secular decline in linear TV, Disney’s Experiences segment is expected to remain the main valuation driver, accounting for nearly 54% of its sum-of-the-parts valuation. Coupled with the relatively tepid studios’ performances, I assess potentially higher execution risks in Disney’s Entertainment segment. Moreover, the transition to sports streaming remains uncertain, even as Disney adds the ESPN tile to its Disney+ platform. Moreover, the increased interest in streaming bundles could also introduce another layer of uncertainty as investors assess the enhancement to Disney’s engagement with its DTC customer base.

Disney CEO Bob Iger articulated his belief that Disney must execute a more effective inflection to achieve sustainable growth in DTC. Iger emphasized Disney’s bundling strategy as a critical driver in achieving its engagement goals. Therefore, investors should pay close attention to the ongoing industry momentum in bundling and improving engagement metrics. Furthermore, Disney has continued its cost optimization plans, leveraging high-value IP to deliver in its feature film development. Pixar’s recently announced job cuts are assessed to be a move toward a more streamlined approach to focus on higher-quality production.

Notwithstanding Disney’s revised content strategy, management recognizes the need to balance quality and volume. However, an increased focus on anticipated stronger content could intensify concentration risks if it fails to deliver the expected results.

Therefore, it’s becoming increasingly clear that Disney needs its Experiences segment to underpin its performance as DIS navigates and tweaks its DTC strategies. Netflix’s (NFLX) foray into live sports broadcasting could worsen an increasingly competitive market with tech giants in Disney’s highly lucrative sports segment.

Disney’s investments in Experiences should remain highly profitable over time. It’s the company’s core operating profit driver in FQ2, accounting for almost 60% of its operating income. However, there are concerns that investing more aggressively in Experiences, while potentially lucrative, might not yield the scalability attributed to Disney’s Linear Networks business. Therefore, with a potentially lower level of scalability, it could remain challenging to assess Disney’s business model relative to its past performances.

Is DIS Stock A Buy, Sell, Or Hold?

DIS is assigned an “F” valuation grade, suggesting relative overvaluation compared to its communications sector peers. However, a closer look, taking into account DIS’s “B-” growth grade, is essential. DIS’s forward adjusted PEG ratio of 1.29 is in line with its sector median of 1.27, downplaying significant overvaluation risks.

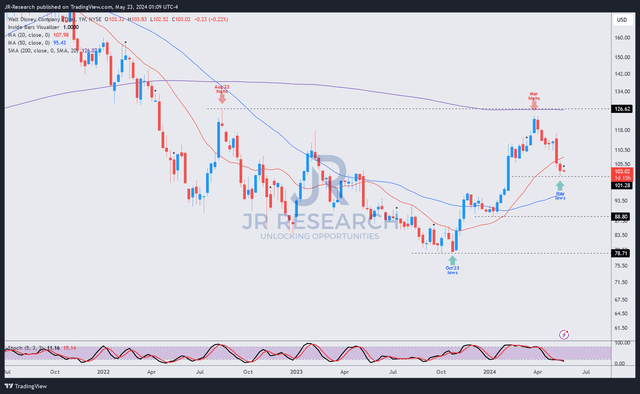

DIS price chart (weekly, medium-term, adjusted for dividends) (TradingView)

DIS’s price action remains constructive, underscoring its medium-term uptrend bias. Therefore, while the pullback brought DIS back toward its February 2024 levels, I have not assessed red flags in Disney’s recovery thesis.

In addition, I have gleaned solid buying sentiments on DIS’s bottom in October 2023 and January 2024, attracting dip-buyers to add exposure. Moreover, the selling intensity in DIS from its March 2024 highs seems to have abated, suggesting a consolidation phase could follow.

While a further decline toward the low $90 levels cannot be ruled out, the market doesn’t seem pessimistic about Disney’s recovery potential, as highlighted earlier. Therefore, I assess DIS stock’s steep pullback as another solid opportunity for investors to add more exposure before its anticipated recovery.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!