Summary:

- Disney is the most loved and irreplaceable brand with unique pricing power in the world.

- Disney DTC Business will continue to take shares, and turn profitable by 2024.

- Linear TV is not dead right away, and Disney could have a way of a soft landing.

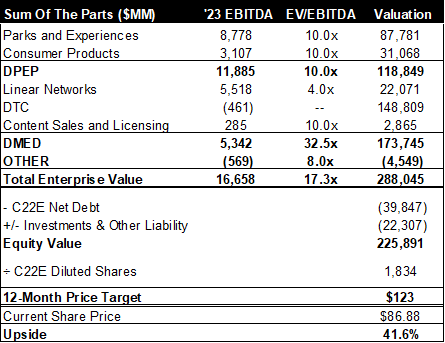

- My valuation for DIS is $123, a +42% upside from its current price.

FrozenShutter

The Walt Disney Company (NYSE: DIS) generates revenue from two segments: Disney Media and Entertainment Distribution (DMED), and Disney Parks, Experiences and Products (DPEP). DMED focuses on content creation by Studios, Entertainment, and Sports, and content distribution through Linear Networks (ABC, Disney, ESPN, Freeform, Fox, etc.), Direct-to-Consumer (Disney+, ESPN+, and Hulu, etc.) and Content Sales/Licensing. DPEP includes Disney Theme parks and resorts, Disney Cruise Line, and Consumer products (branded merchandise, and IP licensing).

DIS is now traded at $86.88, -44% down since the beginning of 2022. Main concerns from investors include 1) significant operating loss from their streaming business; 2) the $71B deal to acquire 21st Century Fox; and 3) the structural decline of Linear TV in light of Streaming services.

CapitalIQ

DIS’s recent developments include:

Dec-22 – launched Ad-Supported Disney+ plan in US with over 100 advertisers at launch

Nov-22 – announced “Robert A. Iger, who spent more than four decades at the company including 15 years as its CEO, is returning to lead Disney as Chief Executive Officer. Iger has agreed to serve as Disney’s CEO for two years, with a mandate from the Board to set the strategic direction for renewed growth and to work closely with the Board in developing a successor to lead the Company at the completion of his term.”

Jul-22 – reached an agreement with The Trade Desk to “power greater audience activation at scale programmatically”

In this article, I will mainly dive into each of the concerned areas, and then discuss its valuation and investment recommendation.

Disney’s Pricing Power

Disney is the most loved and irreplaceable brand with unique pricing power in the world. Some of the business lines Disney operates could not be possibly replicated, hence consumers would not find a substitute especially when many of its products and services are relevant to the sweetest moments families, friends, and kids have shared generation after generation on the globe. For other businesses that Disney has recently tapped into, Disney is not necessarily the No.1 or No.2 on the market, but there are many ways for Disney to differentiate itself from others leveraging its strengths in creativity.

Once Warren Buffett said “The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.”

With Disney’s pricing power, investors have reasons to believe Disney will be able to do well in good times and bad times.

Growth and Profitability of Streaming Services

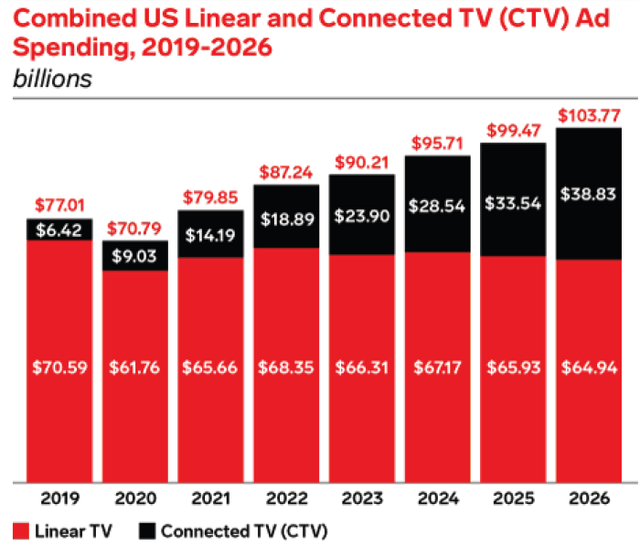

Connected TV Ad is the future, and Disney is making the right investment in this space. As discussed in my previous article, CTV Stocks to Invest In, in US 56% of viewers watch video content through connected TV apps, and by 2023, that number is expected to reach 82% (data source: tvScientific). As shown in the following figure, the CTV Ad spend in US is $19B in FY22, growing to $39B in FY26 (’22-’26 CAGR of 20%).

The profitability of this business depends on scale. So in this section I want to focus on how Display’s DTC business can grow its scale and become profitable.

1. What metrics make a successful CTV Ad business?

Reach: The total number of unique audience exposed to a campaign. Disney’s DTC offerings include Disney+, ESPN+, and Hulu, and the variety of its contents is supposed to achieve good Reach.

Cost Per Mille (CPM): cost of one thousand impressions. This reflects advertiser’s willingness to pay for the ad spot, and pricing could be resulted from real-time auction (second high price) in the open internet, real-time auction in the private marketplace, or at pre-negotiated rates.

Return on Ad Spend (ROAS): This measures how much value advertisers get from a campaign, which is a ROI measurement from an advertiser perspective. Depending on whether it is brand ad or performance ad, advertisers would assess the ROI of ads campaigns against different metrics.

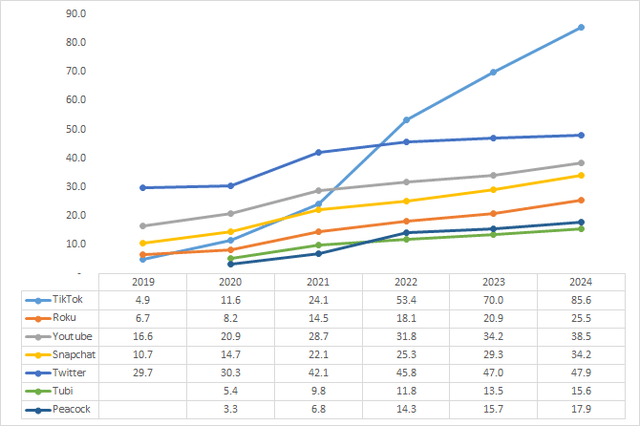

Average revenue per user (ARPU): measures how much revenue the average user generates. The following figure shows the ARPU of eMarketer estimates for CTV players and Social Ads players in US (Full year ARPU in $)

2. Is Disney well positioned to succeed in those CTV metrics?

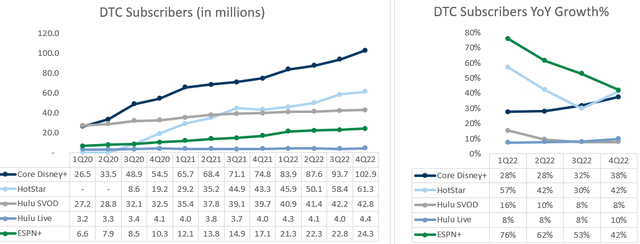

Disney has 236 million DTC subscribers by Q4-22, +32% YoY. Core Disney+ accounted for 44% of their subscribers, growing at 38% YoY.

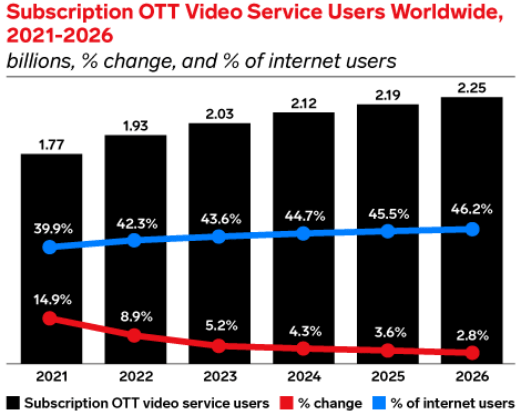

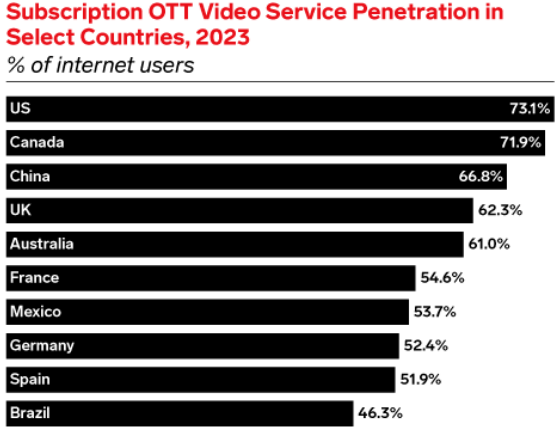

Admittedly the OTT subscriber penetration % of internet users appear high across all regions. However, it does not mean there is no room for Disney to continue to grow. For Streaming services at $7-8 monthly rates with exclusive shows and movies across different providers, consumers will be very open to subscribe to multiple packages. Also I would believe Disney is well positioned to convert some of its Linear TV consumers to DTC consumers. If we benchmark Disney’s current DTC subscribers, Disney’s market segment share is about 12%. My forecast suggests that Disney can increase its market share to at least 18% by 2026.

eMarketer eMarketer

In terms of ROAS and ARPU, it comes to how effective Disney can fulfill Advertiser’s advertising goals in an efficient manner. Disney’s partnership with TTD, which runs one of the most successful DSPs in the world, will empower that. Under this partnership, Disney will develop an ad platform that will allow advertisers to automate targeted ads across Disney’s many linear and digital video channels.

Last and not least, the primary question from investors would be how soon Disney can keep the operating loss from Streaming under control. Iger said “the company needs to start chasing profitability, and needs to take a very, very hard look at the cost structure across its businesses.” There is limited information available about what Disney will do to improve its profitability. But in general, there are plenty of things a capable CEO could put focus on. My forecast suggests that Disney will be able to reduce its DTC Operating Loss by half in 2023 (-9% in Operating Margin), and then generate $1B in Operating Income (+4% in Operating Margin) in 2024.

1. Monetization improvement: when users increase time spent on Disney’s platform, when advertisers are willing to pay premium to drive incremental reach and brand lift, and when advertisers want to increase budgets to Disney given their flexibility in audience targeting and budget allocation across linear and streaming channels, the improvements will flow into profitability improvements.

2. Content investment: there are ways for Disney to assess the economic values of its contents and optimize for capital around various types of contents.

3. Cost optimization: the evidence that Disney was able to reduce fixed and variable costs for their DPEP business is compelling for us to believe Disney’s capability of driving further cost optimization.

Does Linear TV Have A Future?

It is clear that Linear TV’s growth will be declining with more original contents directly rolling out to Streaming TV. It appears an alarm for Disney that is still generating 50% of its DMEP revenue, and 200% of its DMEP operating income (as DTC and content sales are losing money) from Linear TV. My opinion is that since Disney owns both Linear TV and DTC, Disney can figure out a way of soft landing in a multi-year journey.

First, Linear TV is not going to die right away. It’s still considered the most effective advertising platform when it comes to award programs, holiday parades, and sporting events as the ads can reach people on the globe at once. Advertisers might still want to diversify its media investments at least in near term.

Second, Content produced from Linear TV can be distributed effectively across both Disney’s and other’s streaming platforms. The value of contents is there, and it could be just a matter of how the audience is connected (via Cable or Internet).

Third, as Disney’s DTC business continues to grow, Disney can figure out more creative ways to convert its customers (so it’s like moving money from one pocket to another, and it’s only getting more effective in monetization with targeting and campaign optimization.

What is DIS Worth?

I am positive that Disney will be able to grow its DTC business with improved profitability, transform its Linear TV business in an undisruptive way, and continue to the most loved brand for consumers on this planet.

In terms of investment risks, I would call out two things. First, Mr. Inger promised a two-year service to figure out the strategic direction while developing his successor. Two-year is short, and the company has to work really hard to deliver results in the extremely hot streaming market. Second, enhancing its Ad Tech capability is key to gain allocated budgets from advertisers, and I hope the execution with TTD’s UID 2.0 integration and the development of its omni-channel buying platform won’t take too long.

my stock valuation

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.