Summary:

- The Walt Disney Company stock is still a buy despite recent price rallies.

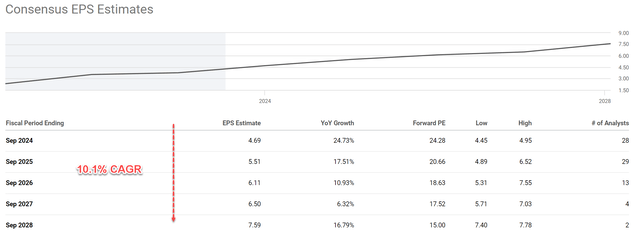

- Its current P/E is still reasonable and is expected to shrink quickly due to EPS growth.

- Analysts expect Disney’s EPS to grow at a CAGR of over 10% over the next 5 years.

- I see good catalysts to support such projection, including Disney+, cost-cut initiatives, and asset utilization recovery.

Henrik Sorensen

DIS is still a BUY despite large price rallies

In my last article, I argued for a strong buy thesis on The Walt Disney Company (NYSE:DIS). The key catalyst I saw at that time (see the chart below) was that:

…with the Hollywood Writer strike over and a new 3-year agreement in place, many of the uncertainties the company was facing in the recent past have been removed. I saw limited impacts of the new agreement on Disney stock, and its current P/E implies the market is overestimating these impacts.

The stock prices have indeed advanced substantially since then, far outpacing the broader market. Thus, the P/E ratio was not as attractive as before. However, I still think the stock is a solid buy for two key reasons: A) the current valuation is still reasonable and would shrink quickly with its expected growth; and B) there are indeed a few strong catalysts that can propel its earnings growth.

The chart below summarizes consensus estimates of DIS’s future earnings growth. As seen, analysts expect its EPS to grow at a compound annual growth rate (“CAGR”) of over 10% over the next 5 years. Based on such projection, DIS’s forward P/E ratio is expected to decline quickly over the next 5 years. For example, the consensus estimate for DIS’s forward P/E ratio in FY 2024 is 24.28x. It would shrink to 20.6x in FY 2025 and eventually 15x only by 2028.

Next, I will argue that such a growth curve is plausible given the catalysts afoot.

Disney+

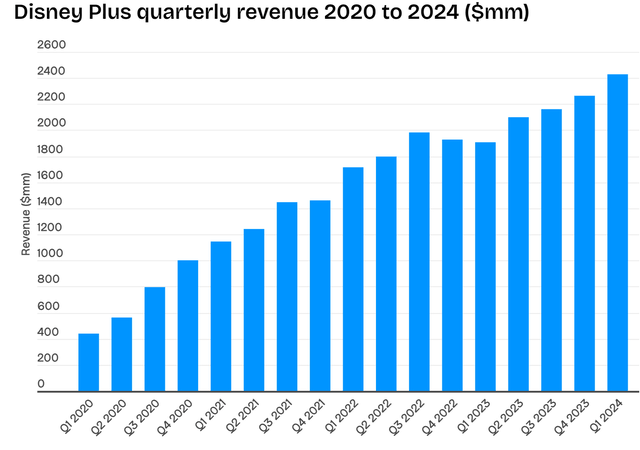

The most nonlinear growth driver in my mind is Disney+. Admittedly, the competition in the streaming space is intense (more on this later). However, I see several differentiation factors with Disney+ that could sustain its growth in this space.

Disney+ has been a huge success in my view since its recent launch. Its revenue has grown rapidly since then (see the next chart below). To wit, Disney+ has generated over $8 billion for the media conglomerate in 2023, representing a YOY revenue growth of more than 13%. The momentum continues in 2024 as well. Revenue exceeded $2.4B in Q1 2024 alone. Disney+ subscribers rose by seven million in the final quarter of fiscal 2023, more than doubling the Wall Street consensus for the three-month period.

Looking ahead, I see the momentum to continue for a few differentiation factors. The top one to my mind is its strong brand recognition. Disney+ leverages the DIS vast library of popular characters and franchises, including Star Wars, Marvel, and Pixar, an unmatched advantage in attracting subscribers in my view. The next differentiator in my view is its exclusive content. Disney+ offers exclusive content not available on other streaming services, such as original shows and movies based on popular Disney franchises. This can be a major draw for subscribers. The final factor to me is its family-friendly content. Disney+ positions itself as a family-friendly streaming service, which can be appealing to parents looking for safe content for their children. I can vouch for the last two factors from first-hand observation as a parent of a teenager.

And for the first differentiator, Warren Buffett’s following comments made in 1996 are still valid now:

It’s kind of nice to be able to recycle Snow White every seven or eight years. You hit a different crowd. It’s like having an oil field where you pump out all the oil and sell it. And then it all seeps back in over seven or eight years.

The nice thing about the mouse is that he doesn’t have an agent. He is not in there renegotiating every week or every month… If you own the mouse, you own the mouse.

Cost cut initiatives

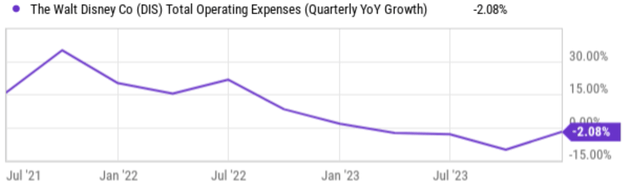

The next more predictable catalyst in my mind is its cost-cutting initiative. During the yearend conference call of 2023, Disney’s management said that it will look to reduce its cost structure by $7.5 billion in the current fiscal year. To better contextualize things, a reduction of a cost structure by $7.5B translates into almost 10% of its average total revenue in the past 3 years and would boost the EPS by a meaningful amount. I totally agree with this strategy and see signs of progress already.

The next chart shows the quarterly increase in its total operating expenses in the past 1~2 years. As seen, due to the tight labor market and overall inflation, the company’s operating expenses have been increasing rapidly between July 2021 and July 2022 with YOY increases persisting above 15%). The pace of the increases slowed after that, but still remained positive till the most recent quarter, which finally reported a decrease of 2.08% YOY.

Asset utilization recovery

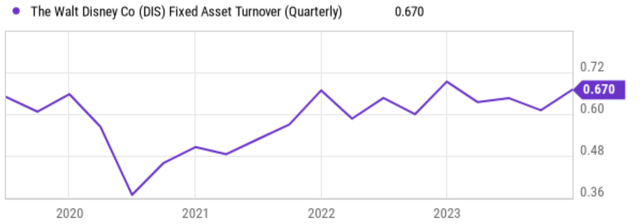

The final catalyst in my view involves the Asset utilization recovery. The chart summarizes DIS’s fixed asset turnover rate in the past few quarters. As seen, the fixed asset turnover rate dipped to a bottom of around 0.36x in July 2020, following the COVID-19 outbreak.

There are a few key causes for the substantial drop in 2020 in my view. The top one was the park closures. Due to the pandemic, Disney Parks were closed for a significant period in 2020. This would have resulted in a decrease in revenue generated by the company’s fixed assets, such as theme parks and resorts. The second one was the overall lower consumer spending, especially those associated with traveling or simply going out. The pandemic may have led to a decrease in consumer spending on discretionary items, such as vacations to Disney Parks or even its movies.

Now, I consider all these headwinds to be over, as evidenced by the recovery of its asset utilization rate. As seen in the chart below, its current asset turnover rate sits at 0.67x, actually slightly above the average level before the pandemic broke out.

Other risks and final thoughts

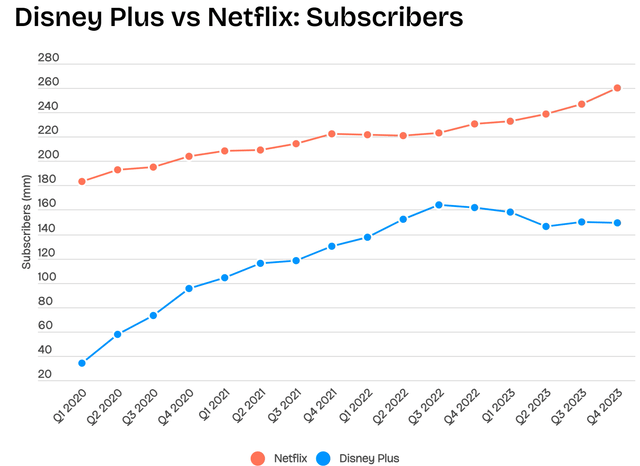

Besides the generic microscopic risks (recessions, inflation, geopolitical risks, etc.), the larger risk I see is the uncertainty with Disney+. As aforementioned, this segment has been enjoying robust growth and I see several differentiators to help its sustained growth. The competition in this space keeps intensifying. And Netflix is still the undisputed leader as seen in the chart below. As of Q4 2023, Netflix has a subscriber base of over 240 million, whereas Disney+ has about 150 million. It is true that Disney+ has enjoyed a steeper growth curve since its launch both because it started from a much smaller base and also because of its unique contents. However, such rapid growth is very likely to slow down (as reflected in the data since 2022 Q3) both due to the larger base and also the competition.

To conclude, admittedly, DIS is not as strong a buy under current conditions as it was when I last wrote about it. But it is still a BUY in my view due to several factors. The company’s P/E was not as attractive as then because of the large price rally, but its forward P/E ratio would decline quickly with the projected growth. And I see good fundamental catalysts that can materialize the projected growth. I expect Disney+ to keep growing and become a more significant revenue stream thanks to its differentiation features. Additionally, DIS is actively implementing cost-cutting initiatives to improve profitability.

Finally, with theme parks and resorts reopening and consumer spending recovering, asset utilization is expected to rise, further boosting the company’s bottom line. My overall feeling is that the positives from these factors still outweigh the downside risks by a good margin.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.