Summary:

- DIS has partnered with AAPL for the Vision Pro spatial headset by offering Disney+ streaming content and interactive 4D gameplay experiences.

- This partnership could boost DIS’ revenue from 2024 onwards while diversifying its monetization opportunities thanks to the robust IP portfolio.

- The virtual theme park remains a long-term possibility, expanding on its physical theme park and cruise experiences.

- As a result of the diversified strategies, DIS may be a long-term winner at these depressed levels, with excellent upside potential to our price target of $128.87.

- Naturally, given the uncertain macroeconomic outlook and bearish market sentiments, anyone who adds DIS here must be very patient since recovery may take longer than expected.

Justin Sullivan

The Revival Of The Metaverse Investment Thesis

We previously covered Walt Disney Company (NYSE:DIS) in May 2023, covering its mixed FQ2’23 performance then. The company had been impacted by the elevated interest rate environment and churn in the D2C subscribers, naturally triggering the plunge in its stock prices then.

This was on top of the political headwinds in Florida and uncertain dividend reinstatement in 2023, due to the impacted FCF generation.

In this article, we will be focusing on DIS’ unexpected partnership with Apple (AAPL), with the media company interestingly featured in the Vision Pro spatial headset launch.

For the past few years, we had heard about the rumored launch of the Cupertino giant’s AR/VR headset. However, we did not expect Bob Chapek’s “next-generation storytelling” through the “Metaverse” to be directly linked, until after the launch.

In hindsight, the previous CEO had been hinting of Disney+ being a “lifestyle portal for Disney fandom,” linking the service to its theme parks and products, while allowing users “to experience the company’s theme parks from a virtual standpoint.”

An interesting example was highlighted in a previous interview in November 2022:

People like to get off attractions and see exactly how those ghosts in the Haunted Mansion work. [They] say, ‘I want to check that out.’ It’s usually the reason why rides stop. We can give you that ability, to exit the theme park virtually and figure out what makes that tick. Then, when you’re watching Disney+, The Haunted Mansion movie will be served up as your first choice, not buried on page four. (Deadline)

Interestingly, DIS had already obtained the federal approval/ patent to create a virtual world at its theme parks and properties since early 2022, with app development likely already ongoing prior to the launch of the spatial headset in May 2024.

DIS’ Partnership With AAPL

While DIS has yet to elaborate on the detailed partnership with AAPL, we have seen massive hints in the Vision Pro advertisement, as captured in the series of images above. For one, it already indicates that Disney+ will be available on the spatial headset from day one, with ESPN and Hulu likely being offered as well.

ESPN fans may realize that the device’s sports live streaming may be more immersive than in-stadium experience, thanks to the superb video quality and multiscreen offerings. Movie fans may also experience the next-gen theater magic, with Avatar, Star Wars, and the Titanic likely being fan favorites, on top of the exciting possibilities of new 3D movies ahead.

In addition, we are seeing hints of interactive 4D game plays utilizing DIS’ robust IPs, including the Star Wars (Mandalorian), Mickey Mouse, and Marvel already being featured in the Vision Pro advertisement.

If anyone is to browse the AAPL App Store or Google Play (GOOG), fans may notice the myriad of casual games offered by many developers, such as Kabam Games and Gameloft SE. This is on top of the ongoing partnership with Ubisoft (OTCPK:UBSFY) for Star Wars and Avatar games, and Square Enix (OTCPK:SQNXF) for Kingdom Hearts and Marvels, among others.

While Sony (SONY) similarly offers its own version of PlayStation VR headset, likely to create a barrier to the Spider-Man games, DIS may be able to negotiate a similar deal as that for the older Spider-Man movies’ inclusion in Disney+.

Either way, the Bob Iger led company has a massive opportunity to expand its game licensing revenue through the robust IP, while similarly developing its in-house game offerings.

These will diversify DIS monetization opportunities beyond the conventional strategies in the physical theme park/ cruise and streaming segments, with virtual theme parks likely being a long-term possibility as well.

Much of the potential success is naturally attributed to the media company’s winning partnership with AAPL. As similarly discussed in our previous article, the iOS platform continues to command the lion’s share of the global app consumer spending at an annualized revenue of $90.8B by Q1’23 (+3.6% QoQ/ +4.1% YoY), despite only comprising 21.5% of the smartphone market share.

As a result, there is a very good chance that the Metaverse strategy may boost DIS’ top and bottom lines from 2024 onwards, since it “creates an entirely new paradigm for how audiences experience and engage with our stories.” Only time may tell.

So, Is DIS Stock A Buy, Sell, or Hold?

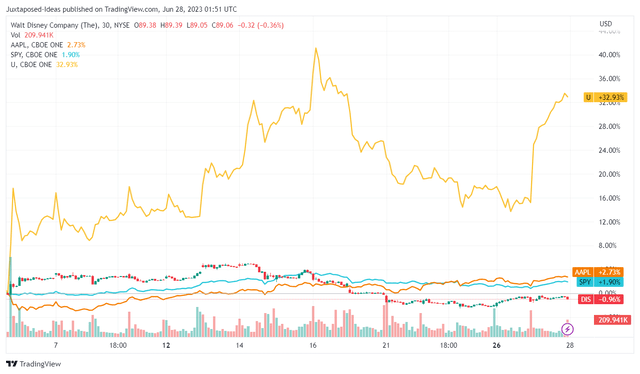

DIS 3W Stock Price

For now, DIS still trades pessimistically after the FQ1’23 earnings call, while failing to recover despite the announcement of the AAPL partnership in early June 2023. Interestingly, the other AR/VR partner, namely Unity Software Inc (NYSE:U) has been able to retain part of the rally at +32.93%, with AAPL similarly climbing by +2.73% since then.

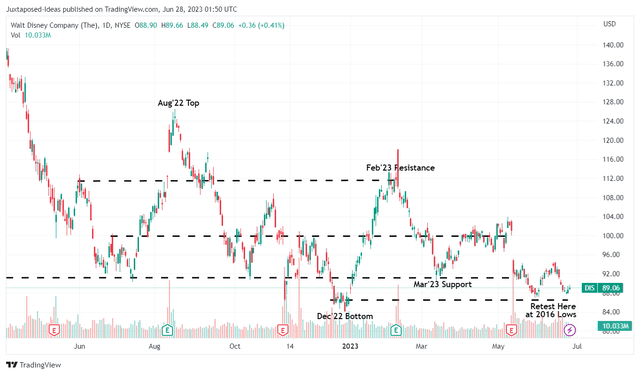

DIS 1Y Stock Price

So, with the DIS stock now returning to its previous 2016 lows, is it a buy here? Yes, in our opinion, since its partnership with AAPL may trigger a new revenue driver moving forward, further expanding Bob Chapek’s Metaverse dream.

However, due to the uncertain macroeconomic outlook, massive pessimism embedded in its stock prices, and minimal contribution from the Vision Pro in the near term, anyone who add DIS here must be patient indeed, since its stock recovery may take more than a few quarters, if not years.

Meanwhile, there are risks that even these depressed levels may be breached if the market sentiments turn even more bearish. Therefore, while we are rating the DIS stock as a Buy here, investors must also size their portfolios accordingly, in the event of possible volatility.

Nonetheless, we believe DIS may be a long-term streaming and Metaverse winner at these opportunistic levels, due to the improved upside potential to our price target of $128.87, based on the market analysts’ FY2025 adj EPS projection of $6.38 and its NTM P/E of 20.20x.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.