Summary:

- The DIS stock has underperformed the wide market thus far, completing a massively volatile seven years while returning to its 2016 lows.

- While Bob Iger’s recent execution appears promising, the elevated interest rate environment remains a headwind to its profitability.

- With part of its long-term debts maturing within the next twelve months, refinancing may also trigger higher costs of lending, impacting its FCF generation.

- Combined with the political headwinds in Florida and the potential delay of dividend reinstatement in 2023, DIS may remain volatile in the near term.

- We shall discuss this further.

Artem_Egorov/iStock via Getty Images

The Bottom-Fishing Investment Thesis Is Here

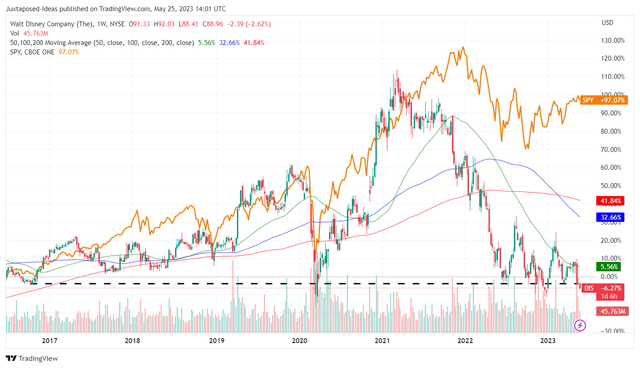

DIS 7Y Stock Prices

The Walt Disney Company (NYSE:DIS) has already dramatically reversed most of its recent gains to breach its March 2023 support levels, nearing its 7Y lows at the time of writing. The pessimism embedded in its stock prices is surprising as well, since the company only missed the consensus EPS estimate by the barest -$0.01.

Its FQ2’23 numbers still look more than decent, in our opinion, with revenues of $21.82B (-7.1% QoQ/ +13.3% YoY) and non-GAAP EPS of $0.93 (-6% QoQ/ -13.88% YoY). Well, the headwinds in its profitability are naturally attributed to a few different factors, despite the moderation in its operating expenses to $4.84B (-3.9% QoQ/ -3.7% YoY).

DIS’ long-term debts of $48.51B as of the last quarter (inline QoQ/ -11% YoY), come at a relatively elevated interest rate of 4.08% (+1.06 points YoY), as last reported in the FY2022 annual report. This is on top of the pay-floating interest rate and cross-currency swaps, converting part of its debts to variable-rate indexed to LIBOR. Thanks to the Fed’s hike thus far, its annualized interest expenses have also risen dramatically to $2.01B (+8.3% QoQ/ +34.7% YoY).

Combined with the impact of its restructuring thus far, triggering a one-time expense of $152M in FQ2’23, it is unsurprising that the company’s EPS profitability has been impacted, despite the excellent EBITDA of $3.66B (+8.2% QoQ/ +27% YoY) at the same time.

Therefore, if we are to look deeper, it is apparent that DIS has executed well thus far, especially aided by the narrowing losses in the Direct-to-Consumer segment by the latest quarter.

The D2C reported an operating margin of -11.2% (+8.6 points QoQ/ +6.8 YoY) in FQ2’23, significantly aided by the subscription price hike. Demand appears to be robust as well, with the segment’s top line expanding to $5.51B (+3.9% QoQ/ +12.4% YoY), despite the notable churn in its subscribers to 157.8M (-2.4% QoQ/ -2.4% YoY).

In addition, DIS’ Parks, Experiences, and Products continue to outperform, with revenues of $7.77B (-10.9% QoQ/ +16.8% YoY) and operating margins of 27.8% in the latest quarter (-7.1 points QoQ/ +1.5 YoY), with the seasonal drop commonly occurring in Q1s.

This cadence is directly attributed to the increased demand for domestic parks/ experiences (-8.2% QoQ/ +13.9% YoY) and international parks/ experiences (+8.2% YoY/ +106.2% YoY), as with the Disney Cruise Lines. As a result, it is unsurprising that its FQ2’23 performance has outperformed pre-pandemic levels, compared to FQ2’19 revenues of $6.16B (-9.6% QoQ/ +4.4% YoY) and operating margins of 24.4% (-7.1 points QoQ/ +2.3 YoY).

This is on top of the expansion in DIS’ cash provided by continuing operations at $3.23B (+432.2% QoQ/ +83.5% YoY), with the restructuring also triggering the cancellation of over $1B in capital expenditures for the Lake Nona campus and aggressive cost optimizations by $5.5B.

As a result, we believe Iger has executed brilliantly over the past two quarters, with the temporary headwinds only attributed to the elevated interest rate environment.

Hence, we believe the pessimism embedded in DIS stock prices provides investors with the speculative chance to add. This is because the company’s offerings prove to be resilient in the face of tightened discretionary spending, with profitability likely to improve once the restructuring takes effect and the peak recessionary fears ease, likely by 2025, if not 2024.

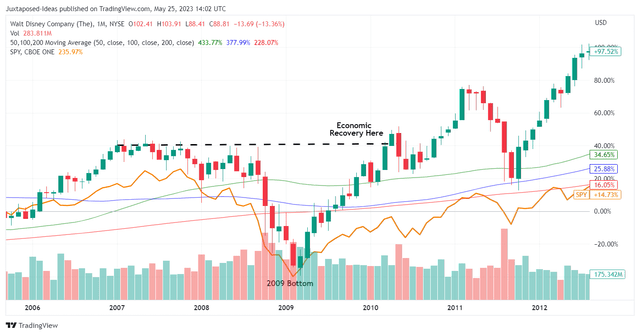

DIS & SPY Bottoming In 2009

Combined with the decelerating April CPI and increased likelihood of a peaking Fed raise, we suppose the recovery of the stock market may be sooner than expected, since it normally precedes the actual economic recovery. The same cadence has been observed in the previous recession, with the stock market (DIS and SPY) bottoming by February 2009, with DIS already recovering financially by early 2010.

So, Is DIS Stock A Buy, Sell, or Hold?

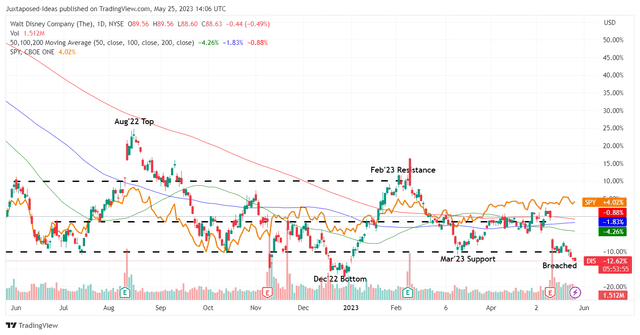

DIS 1Y Stock Price

Well, the answer to the question may not be as straightforward, unfortunately. While past performance may be not indicative of its future results, DIS has underperformed in the wider market for the past five years at -15.21%, compared to SPY at +51.75%. The same has been observed for the past year at -12.90%/ +3.94% and YTD at -0.76%/ +8.44%, respectively.

The stock is not a viable income stock as well, with the semi-annual dividend payouts suspended since early FY2020. While we may see a reinstatement by the end of FY2023, market analysts only expect a payout of $0.01 for the fiscal year, with a jump to $0.83 likely in FY2024.

Furthermore, we want to highlight that DIS continues to generate negative Free Cash Flow [FCF] in FQ2’23 at -$168M (+92.2% QoQ/ +66.6% YoY), with $3.45B of its debts due within the next twelve months. While refinancing remains a possibility, the elevated interest rate environment may trigger an even higher cost of lending, potentially impacting its interest expense and cash flow generation in the intermediate term.

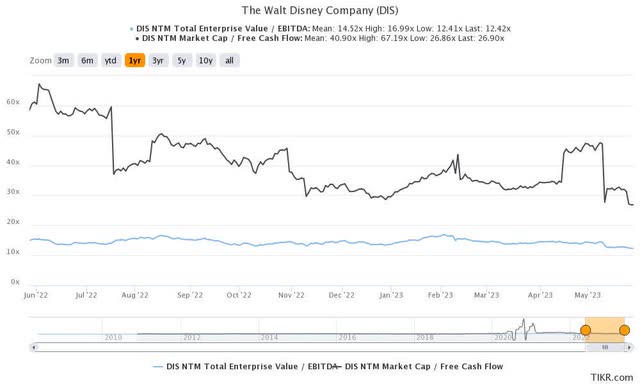

DIS NTM EV/EBITDA and Market Cap/FCF Valuations

As a result of the pessimism thus far, DIS’ valuations are also compressed to NTM EV/ EBITDA of 12.42x and Market Cap/ FCF Valuations of 26.90x, compared to its 1Y mean of 14.52x and 40.90x, respectively. The moderation is also notable compared to its 3Y pre-pandemic means of 17.09x and 30.78x, respectively.

Then again, with DIS already roundtripping for the past seven years and returning to its current depressed levels, we are cautiously rating the stock as a speculative buy here. Naturally, this comes with a caveat that the rating is only suitable for long-term investors seeking to dollar cost average, since the stock may remain volatile in the near term, with the company still facing political headwinds in Florida.

In addition, investors must be aware of the potential risks of adding here, since the pessimism may very well put further downward pressure on the stock, retesting its October 2014 and December 2022 bottom of $86. Assuming those levels are breached, we may see another downward slide to the $70s, implying a downside of up to -15% from current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.