Summary:

- Disney’s Direct-to-Consumer strategy continues to make heavy losses, with at least another two years of financial pain ahead, absent a drastic change in direction.

- The Parks, Experiences and Products segment provides considerable support for the share price, but this business is vulnerable to near-term softness in the case of economic recession.

- With Bob Chapek ousted, and the return of Bob Iger as CEO, some investors may give Disney the benefit of the doubt in regard to a quick turnaround.

- Applying a sustainable earnings framework to assess value, I arrive at a HOLD rating.

David Peperkamp

4Q22 Results Overshadowed By Return Of Bob Iger

Less than two weeks after the release of their 4Q22 result, The Walt Disney Company (NYSE:DIS) announced that CEO Bob Chapek was leaving and that Bob Iger would immediately return for another stint in the CEO seat. For the benefit of readers new to the stock, it is worth stating that Bob Iger has plenty of history at DIS; prior to his departure in late 2021 he had been with the group for forty years, including fifteen as CEO (2005 to 2020). Iger has an impressive track record – under his leadership the group achieved huge market cap growth, much driven by acquisitions (including Pixar, Marvel, Lucasfilm, 21st Century Fox), and DIS stock performed very well.

Volumes have already been written on what Iger’s return implies for DIS. Generally speaking, it seems that the market approves of the CEO change. My read of the situation is that negative sentiment towards Chapek was probably somewhat too harsh and that bullish commentary regarding what Iger can do during his expected two-year CEO tenure is likely to prove over-optimistic.

Rather than dive heavily into analysis of the CEO change, I’ll keep this note focused on the 4Q result and provide an update of views expressed in my initial Seeking Alpha DIS research published in June 2022.

DTC Timing Of Profitability – Far From Clear

In the prepared remarks of the 4Q22 management speech, CEO Bob Chapek referred to the target for DTC (Direct-to-Consumer) to reach profitability in FY24:

And assuming we do not see a meaningful shift in the economic climate, we still expect Disney+ to achieve profitability in fiscal 2024 as losses begin to shrink in the first quarter of fiscal 2023.

Source: DIS 4Q22 Transcript, page 3, CEO Bob Chapek.

Based on Chapek’s wording, it wouldn’t be unreasonable to assume that the target is for DTC to be profitable for the accounting period FY24. However, a response from CFO Christine McCarthy during the Q&A session paints a different picture:

So, direct-to-consumer for ‘24 profitability, you should be thinking about it as a quarter, not a year basis.

Source: DIS 4Q22 Transcript, page 15, CFO Christine McCarthy.

Putting aside the potential negative impacts of an economic downturn, my interpretation of the CFO’s comment is that DTC will again be loss-making on a FY24 accounting basis, and potentially materially so if the profitability target is not reached until 4Q24. Add in the likelihood that economic weakness creates a headwind for DTC, and I conclude that without meaningful action on DTC costs, losses could easily continue into FY25. It’s possible that Chapek shared this view, and that faced with a soggy global economy he may have taken the hard decision to tackle DTC’s losses sooner rather than later. But we will never know.

Caution: Major Restructure Charge Ahead

Perhaps Bob Iger is a brilliant genius whose skills are unmatched in the universe of potential candidates, but it is surprising and somewhat disappointing that the Board of an iconic company such as Disney was unable to bring in a CEO under the age of seventy to take over from departing CEO Chapek. To an extent, I think Iger can’t fail. He will only be in the job for two years, and has probably been given a license to tackle what are rather obvious problems in the DMED division – mainly relating to the DTC strategy. I think Iger will be free to take big swings that might appease the market in the near-term, without needing to worry about longer-term consequences.

The wording below, taken from the DIS FY22 10K, highlights that DIS investors ought to be braced for major organizational change, material restructuring charges and impairments:

As contemplated by the leadership change announcement, we anticipate that within the coming months Mr. Iger will initiate organizational and operating changes within the Company to address the Board’s goals. While the plans are in early stages, changes in our structure and operations, including within DMED (and including possibly our distribution approach and the businesses/distribution platforms selected for the initial distribution of content), can be expected. The restructuring and change in business strategy, once determined, could result in impairment charges.

Source: DIS FY22 Form 10K, page 32.

Iger’s job has been made even easier by the fact that Chapek laid out the playbook to redirect from ‘peak DTC operating losses’ in his 4Q22 management speech:

Our financial results this quarter represent a turning point as we reached peak DTC operating losses, which we expect to decline going forward. That expectation is based on three factors: first, the benefit of both price increases and the launch of the Disney+ ad tier next month; second, a realignment of our cost, including meaningful rationalization of our marketing spend; and third, leveraging our learnings and experience in direct-to-consumer to optimize our content slate and distribution approach to deliver a steady state of high-impact releases that efficiently drive engagement and subscriber acquisition.

Source: DIS 4Q22 Transcript, page 3.

Chapek’s commentary outlines three simple steps to improve DTC: increase revenue through pricing and advertising income, cut excess marketing spend, and dial back content production costs. These three steps appear to be good bets in terms of delivering short-term benefits (useful for a new CEO with a short time-frame) but there is plenty of uncertainty regarding the longer-term impacts of such actions. I don’t profess to have the right answer regarding the DIS DTC strategy, but it looks like Chapek has set out a handy framework for Iger to develop and potentially take credit for.

Material Ongoing Costs Reported Outside Segment Operating Income

I continue to find it odd that DIS does not include ‘corporate and unallocated shared expenses’ within segment operating income. These expenses totaled $1,159m in FY22 (up 24.9% on FY21). I would normally expect costs of that magnitude to be allocated to operating divisions. Allowing such high costs to remain unallocated increases the risk that they are not tightly managed. For valuation purposes, I have allowed for a base year ongoing cost of ~$1.2bn pa.

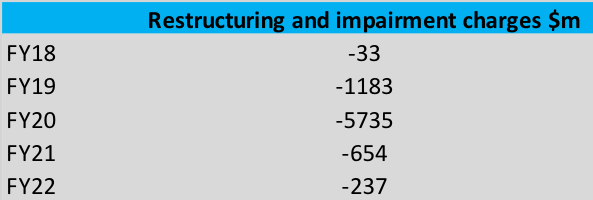

Another adjustment that DIS reports outside segment operating income that aggravates me is ‘restructuring and impairment charges’. Looking at the group’s historical data, it is quite clear that restructures and associated asset impairments occur frequently; on that basis, such costs are better considered as business-as-usual items in my view.

Table 1 highlights that over the four years to FY22, DIS has incurred a total of -$7.8bn in restructuring and impairment charges. As discussed above, it appears likely that we will see further large restructuring and impairment charges in FY23, and perhaps extending in to FY24, as Bob Iger implements the strategic changes that he has presumably been hired to execute upon. I have allowed -$250m pa as an ongoing cost item in my valuation assessment (up from $200m at my prior 1H22 review).

Table 1:

Source: constructed by author using DIS annual and quarterly reports.

Disney Parks, Experiences And Products

Table 2 sets out historical segment revenue and operating income results for the Disney Parks, Experiences and Products segment – “DPEP” – along with a simple margin calculation. The negative impact of COVID-19 on DPEP can be clearly seen in FY20 and FY21; it was only thanks to very strong results in Consumer Products that DPEP was able to avoid material losses over those two years.

FY22 DPEP operating income was very strong in FY22, achieving a record high level for the division. The Domestic Parks & Experiences result would have been even stronger were it not for a revenue loss of -$65m due to Hurricane Ian. International Parks & Experiences produced operating income of $74m in 4Q22, but clearly has scope to improve upon the FY22 loss of -$237m.

Table 2:

Source: author calculations based on DIS annual and quarterly reports.

In my 1H22 valuation review, I used an assumption of $5,600m pa for Domestic Parks & Experiences operating income; in part this was driven by the margin expansion to 30.3% delivered in the first half of the year. The Domestic Parks & Experiences margin for the full year dropped back to 26.5%; this was an improvement versus FY19, but I had expected a stronger outcome given the steps that DIS took in order to reduce expenses during the COVID-19 downturn. In the results Q&A session, the CFO flagged that there had been some small ‘one-off’ items that dragged the 4Q22 operating margin lower, but these items were not quantified. International visitor numbers to domestic parks improved materially in 4Q22, however relative to FY22 as a whole, we can expect to see higher international visitor numbers in FY23E.

Capital expenditures for the DPEP segment continued to run above the corresponding depreciation charge in 2H22. For FY22, capital expenditures for DPEP were ~$1.1bn above depreciation expenses. DIS points to cruise ship fleet expansion as a driver of the increase in capital expenditure in FY22, and it is not unreasonable to assume that this investment will support new components of earnings growth. In the FY22 management speech, the CFO commented that capital expenditure would increase further in FY23 at a group level, and I do not expect a material reduction in DPEP capital expenditure in the near-term. I therefore continue to make a negative adjustment to my sustainable earnings calculation for DPEP to account for the material gap between capital expenditure and depreciation.

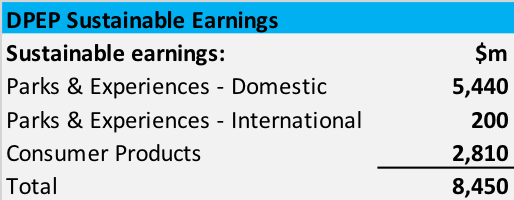

Table 3 shows the updated sustainable earnings base for DPEP that I landed at for this valuation assessment. Relative to my previous assessment at 1H22, I have reduced DPEP sustainable earnings by -$150m pa.

Table 3:

Source: author calculations.

Disney Media And Entertainment Distribution – End Game Unclear

As a value investor with a medium-to-longer-term focus, I try not to get overly bogged down regarding near-term earnings volatility, and instead focus on sustainable earnings generation on a ‘through-the-cycle’ basis. Unfortunately, in the case of DMED, estimating sustainable earnings with any degree of confidence is pretty much impossible.

DMED is comprised of three buckets – Linear Networks, DTC, Content Sales/Licensing and Other. Chart 1 plots the components of DMED’s operating income results over the last ten quarters:

Chart 1:

Source: author calculations based on DIS quarterly reports.

A few observations:

- Content Sales/Licensing and Other has gone from a business generating operating income of around $1bn pa, to a business that is making losses (-$287m operating income in FY22).

- DTC’s losses are huge (-$4,015m operating income in FY22). If and when DTC starts to generate satisfactory returns, will these profits be sufficiently high to compensate for shareholder value that has arguably been lost along the way?

- It is fortunate for DIS that Linear Networks operating income is holding up well despite the obvious headwinds facing legacy TV/cable.

In contrast to the heavy focus on DTC subscriber growth, the cannibalizing effect of DTC upon Linear Networks attracts little attention. In Table 4, I track the change in domestic subscriber numbers to cable channels from September 2019 to September 2022 (as estimated by Nielsen Media Research). It is interesting that the rate of subscriber loss for several of the key product offerings has slowed in FY22 relative to the prior two years; this might be a sign that the transition to streaming content is running at a slower pace than previously expected (good news for Linear Networks, bad news for DTC).

Table 4:

Source: author calculations based on DIS annual reports.

Valuation Assessment

In this section I attempt to derive a range of implied market valuations of the DMED segment by working back from the company’s enterprise value and the sustainable earnings for DIS ex-DMED that I have described and analyzed above. Having established a range of implied valuations for DMED, I then use this to back-solve to implied levels of sustainable DMED earnings.

Table 5 provides a summary of my estimate of sustainable earnings (which can be thought of as equivalent to sustainable EBIT) for DIS excluding the DMED segment. Table 6 links to the sustainable earnings shown in Table 5, and sets out a simple enterprise value framework, applying different EBIT multiples to derive a range of implied market valuations for DMED. Table 7 takes the analysis a step further and works back from the implied DMED market valuations shown in Table 6 to arrive at a range of implied annual sustainable earnings results for DMED.

Table 5:

Source: author calculations based on DIS annual and quarterly reports.

Table 6:

Source: author calculations based on DIS annual and quarterly reports.

Table 7:

Source: author calculations based on DIS annual and quarterly reports.

Summary & Conclusion

Based on the analysis described above, and a DIS price of $99.43 per share (market close 03 December 2022), the sustainable earnings for Disney Parks, Experiences and Products along with corporate costs and assumed ongoing restructuring expenses account for between 29% and 41% of the total DIS enterprise value. By deduction, between 59% and 71% of the total DIS enterprise value can be assigned to the Disney Media and Entertainment Distribution – which is facing a highly uncertain future given the group’s DTC strategy. Consistent with my last review, I conclude that investors seeking companies with valuations that can be comfortably supported by sustainable earnings streams should probably give DIS a wide berth.

Applying an earnings multiple of 12x to the components of DIS for which I feel confident in regard to my ability to estimate sustainable earnings, I arrive at a back-solved implied market value for the Disney Media and Entertainment Distribution segment of around $135bn. In the twelve months ending 4Q22, operating income for the Disney Media and Entertainment Distribution segment was $4.22bn. If I exclude the large losses associated with the DTC (Direct-to-Consumer) division, then adjusted ex-DTC DMED segment operating income for the twelve months to 4Q22 increases to $8.23bn – which points to an implied EBIT multiple for DMED of ~16.4x. For a business such as DMED, an EBIT multiple of 16.4x is not alarmingly high.

It is important to recognize the high degree of uncertainty regarding the level of sustainable earnings that can be generated by the DMED segment. Successful execution of the DTC strategy could come at the cost of heavy cannibalization of other DMED earnings streams. Further, in the near-term, there is the obvious risk of major restructure costs and impairment charges associated with Chapek’s departure and Iger’s return.

In addition to the uncertainties driven by the DTC strategy, my rather bearish macro-economic outlook leaves me feeling less than comfortable regarding the near-term prospects for the Disney Parks, Experiences and Products segment. In the 4Q22 results Q&A session, CFO Christine McCarthy made the case that the Disney Parks, Experiences and Products is today better placed to manage through an economic recession than has historically been the case, but in my view, should a deep recession transpire, it still seems likely that DPEP earnings will come under material pressure relative to my through-the-cycle estimate.

On balance, I currently find myself leaning towards a sell rating for DIS, however I struggle to justify such a call on valuation grounds. I therefore conclude this FY22 review with a rating for DIS of HOLD.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. Past performance is no guarantee of future returns.