Summary:

- Bitfarms Ltd. is a global Bitcoin mining company.

- While the Company’s stock price rose dramatically in 2023, unlike Bitcoin, it has not fully recovered from its 90+% decline during the most recent crypto bear market.

- Bitfarms generated a material net loss in 2023, and the Company is dependent on raising capital in the capital markets in order to fund operations.

Aleksandra Zhilenkova

Introduction

While I am bullish on Bitcoin (BTC-USD) (“Bitcoin“), I am increasingly cautious on several crypto miners, including Bitfarms Ltd. (NASDAQ:BITF)(TSX:BITF:CA) (“Bitfarms” or the “Company“). In particular, I am cautious on Bitfarms for several reasons:

First, the Company’s stock soared in 2023 and, in my view, a pause, consolidation or pullback is more likely than a repeat of 2023’s stellar performance.

Second, the Bitcoin halving expected to occur in April (the “Halving Event“) will cause Bitcoin’s mining rewards to decrease from 6.25 BTC to 3.125 BTC, and likely result in a lower hash rate, making it more difficult for the miners to generate revenue.

Third, and perhaps most importantly, Bitfarms’ financial performance has not been particularly impressive, and the Company is heavily reliant on raising funds in the capital markets in order to fund operations. In this regard, as I was writing the article, the Company announced (yet) another equity raise.

For the foregoing reasons, I am not buying shares of Bitfarms. With the current Bitcoin bull market underway, I rate it a HOLD.

Brief Background

Bitfarms develops, owns and operates mining farms with in-house management running the entire operation. Such vertically integrated management allows the Company to reduce downtimes and improve its hash rate. A brief summary of the Bitfarms operation is found on its website:

Operationally, Bitfarms has a diversified production platform with five industrial scale facilities located in Québec, one in Washington state, one in Argentina, and one in Paraguay. Each facility is over 99% powered with environmentally friendly hydro power and secured with long term power contracts. Bitfarms is currently the only publicly traded pure-play crypto mining company audited by a Big Four accounting firm.”

I previously covered Bitfarms in March 2021.

Stock Performance

Since inception, the Company’s stock price has been very volatile.

After peaking around $8.15 in November 2021, the Company’s stock finished 2022 at $0.44 (a decline of more than 90%). Since then, Bitfarms has rebounded, with its stock currently trading around $2.65 at the time of writing (March 8, 2024). Of course, even at $2.65, the Company is still well below its all-time highs.

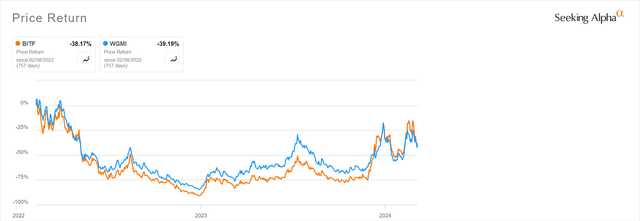

Relative to its peers, the Company has performed mostly in line with the industry as expressed via the Valkyrie Bitcoin Miners ETF (WGMI) – see chart below (from 2/8/22 — present).

However, since March 2021 when I first covered Bitfarms, the Company’s stock price has declined 33%, while the S&P has gained more than 30% and Bitcoin has gained more than 13% (see table below).

Q4 2023 Earnings

On March 7, 2024, the Company reported financial performance for the quarter ended, and year ended, December 31, 2023. Highlights from the Company’s press release are as follows [all data from such press release]:

Quarterly Bitcoin Operating Production

| Quarter | BTC Earned 2023 | BTC Earned 2022 |

| Q1 | 1,297 | 961 |

| Q2 | 1,223 | 1,257 |

| Q3 | 1,172 | 1,515 |

| Q4 | 1,236 | 1,434 |

| Totals: | 4,928 | 5,167 |

| Cost per BTC: | $15,200 | $10,000 |

As shown above, the Company produced less Bitcoin in 2023 than 2022 and it did so at higher cost of production. According to the press release, the increased cost reflects “an approximate 74% increase in average network difficulty over the prior year.”

Q4 2023 Financial Highlights

Per the press release regarding the fourth quarter of 2023:

Total revenue was $46 million, an increase of 34% compared to $35 million in Q3 2023, as a 5% increase in BTC earned and 30% higher average BTC prices contributed to higher revenue…. General and administrative expenses were $13 million, up 12% from Q4 2022 and up 60% from Q3 2023…. Operating loss of $13 million. Net loss of $57 million, or ($0.19) per basic and diluted share…. This compares to a net loss of $13 million, or ($0.06) per basic and diluted share, in Q4 2022….”

During the quarter, the Company raised $41 million in net proceeds through a private placement, and received $11 million in proceeds from the exercise of warrants issued in such private placement (the Registration Statement for the private placement is linked below). After the quarter, the Company received an additional $6 million in proceeds from the exercise of warrants.

The Company reported that it paid off its long-term debt. Interestingly, the Company has started to engage in some financial engineering, initiating its so called “Synthetic HODL™ strategy with the purchase of 135 long-dated BTC call options held by the Company as of December 31, 2023.” Admittedly, I have not analyzed the strategy, but I do not view it as a positive.

Overall, a tepid quarter, at best. For 2023, the Company had a net loss of $104 million compared to a net loss of $175,000 in 2022. Improvement, but still a long way from profitability. Of course, management is pushing positive narratives, as is to be expected, but it is worth taking a look at the balance sheet to better understand how the company performed in 2023 compared to 2022 and 2021.

Review of Balance Sheet

Selected Balance Sheet Items (in thousands)

| Dec. 31, 2023 | Dec. 31., 2022 | Dec.31, 2021 | |

| Cash | 84,038 | 30,887 | 125,595 |

| Digital Assets | 31,870 | 4,635 | 66,031 |

| Total Assets | $378,725 | $343,098 | $542,587 |

| Long-Term Debt | 0 | 4,093 | 910 |

| Total Liabilities | $83,963 | $87,531 | $120,005 |

| Accumulated Deficit | (294,924) | (239,065) | (15) |

| Total Equity | $294,762 | $255,567 | $422,582 |

Source: Company Website (Investor Relations)

A couple of things stand out in looking at three years of balance sheet figures. First, Total Assets and Total Equity are still down materially from December 31, 2021. Thus, while Bitcoin has recovered from the crypto bear market, Bitfarms has not.

Second, the Accumulated Deficit (representing the cumulative amount of net losses the Company has generated since its formation) of nearly $300 million now exceeds Total Equity. Needless to say, it is important for Bitfarms to start generating some profits and reducing the deficit.

Third, compared to year-end 2022 figures, the balance sheet has clearly been strengthened (debt paid off and cash has grown compared to 2022), and the Company has acquired some breathing room with its recent equity and warrant issuances. Such issuances do dilute existing shareholders, however, and that dilution has been material. In fact, per its Consolidated Statement of Changes of Equity (see p. 7 of the link), the number of share outstanding at January 1, 2022, was 194,806,000, while at December 31, 2023, that figure is 334,153,000 (an increase of more than 58%). That is some material dilution! Unless the Company can start to generate free cash flow, the situation is likely to get worse.

And it did get worse! Late in the day on March 8, 2024, Bitfarms announced plans to raise an additional $375 million of proceeds via an at-the-market equity offering program. Keep in mind that revenues of the Company for all of 2023 were less than $150 million. Selling stock has become the Company’s most important business activity. Now, if the Company had debt, which it does not, then, as a shareholder, I could support raising equity to pay off the debt. That is not the case here. At $3 per share, which is generous, that would be an additional 125 million shares issued, or further shareholder dilution of nearly 30%. I am not surprised to see the Company’s shares trading down nearly 10% in after-hours trading. The last thing I will say about this is that the timing of the announcement is very suspect (Friday after the bell), particularly when the Company announced earnings earlier in the week.

Risks & Conclusion

Risk of investing in the Company are included in the linked SEC Registration Statement (Short Form Base Shelf Prospectus, starting on page 19). Among my particular concerns about investing in the Company are as follows:

First, the Company has not been able to generate net income. Second, since 2021, the Company’s digital holdings portfolio has declined by more than 50% (see balance sheet). Third, operating revenues are not sufficient to fund operations and the Company is dependent on equity issuances. Such issuances dilute existing equity holders and make the prospect of material future net income unlikely. Fourth, the Halving Event could have on adverse effect on Bitfarms. Finally, according to its year-end Financial Statements:

At current BTC prices, the Company’s existing cash resources and the proceeds from any sale of its BTC treasury and BTC earned may not be sufficient to fund capital investments to support its growth objectives. If the proceeds from the sale of BTC are not sufficient, the Company would be required to raise additional funds from external sources to meet these requirements. There is no assurance that the Company will be able to raise such additional funds on acceptable terms, if at all. If the Company raises additional funds by issuing securities, existing shareholders may be diluted. If the Company is unable to obtain financing from external sources or issuing securities, or if funds from operations and proceeds from any sale of the Company’s BTC holdings are negatively impacted by the BTC price, the Company may have difficulty meeting its payment obligations.

***

For the reasons set forth in this article above, Bitfarms is a HOLD (at best). Given the current Bitcoin bull market, however, I would not short the Company (at this time). Do your own due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

he digital assets/blockchain space is very volatile. Between the time of writing and the time of publication, large swings in some of the prices referenced in this article are likely to occur. This article is NOT investment, tax or legal advice and is solely for peer-to-peer learning purposes. Do your own homework and due diligence and consult your financial advisor, as necessary or appropriate.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.