Summary:

- Nvidia Corporation faces declining demand, increasing competition, and lower margins, making it a poor investment despite its current high valuation.

- China’s probe and GPU competition from major customers like Amazon threaten Nvidia’s market position and profitability.

- Over-investment in AI by big tech and slowing progress in AI advancements further challenge Nvidia’s growth prospects.

- A CALL spread strategy offers a way to bet against Nvidia with capped downside, but risks remain due to Nvidia’s momentum stock nature.

JHVEPhoto

The nature of investing is sometimes you’re wrong.

Markets can remain irrational longer than you can remain solvent.

– John Keynes.

Nvidia Corporation (NASDAQ:NVDA) was our top short pick of 2024, and it’s clear, despite 3 weeks before year-end, that our timing was off. Using a CALL spread, which we’ll discuss more below, caps our downside, but the paper losses still exist. Despite that, as we’ll see throughout this article, a combination of the potential for declining demand, ramping competition, and lower margins in 2025 make it so that we’ll continue our beneficial short position.

Nvidia China

Nvidia recently saw a probe opened up in China as a result of antitrust concerns in the country.

Keep in mind that the GPUs that Nvidia can sell to China are already heavily restricted as a matter of export policy, and Nvidia does not have large operations in China. This combination of factors could make restricting access to Nvidia GPUs in China a successful policy for China in an upcoming trade war.

Rumor is that Huawei Silicon is already competitive with Nvidia GPUs in China, and with China Nvidia’s second-largest market after the United States, the immediate impact could trigger multiple contractions for Nvidia.

Nvidia GPU Competition

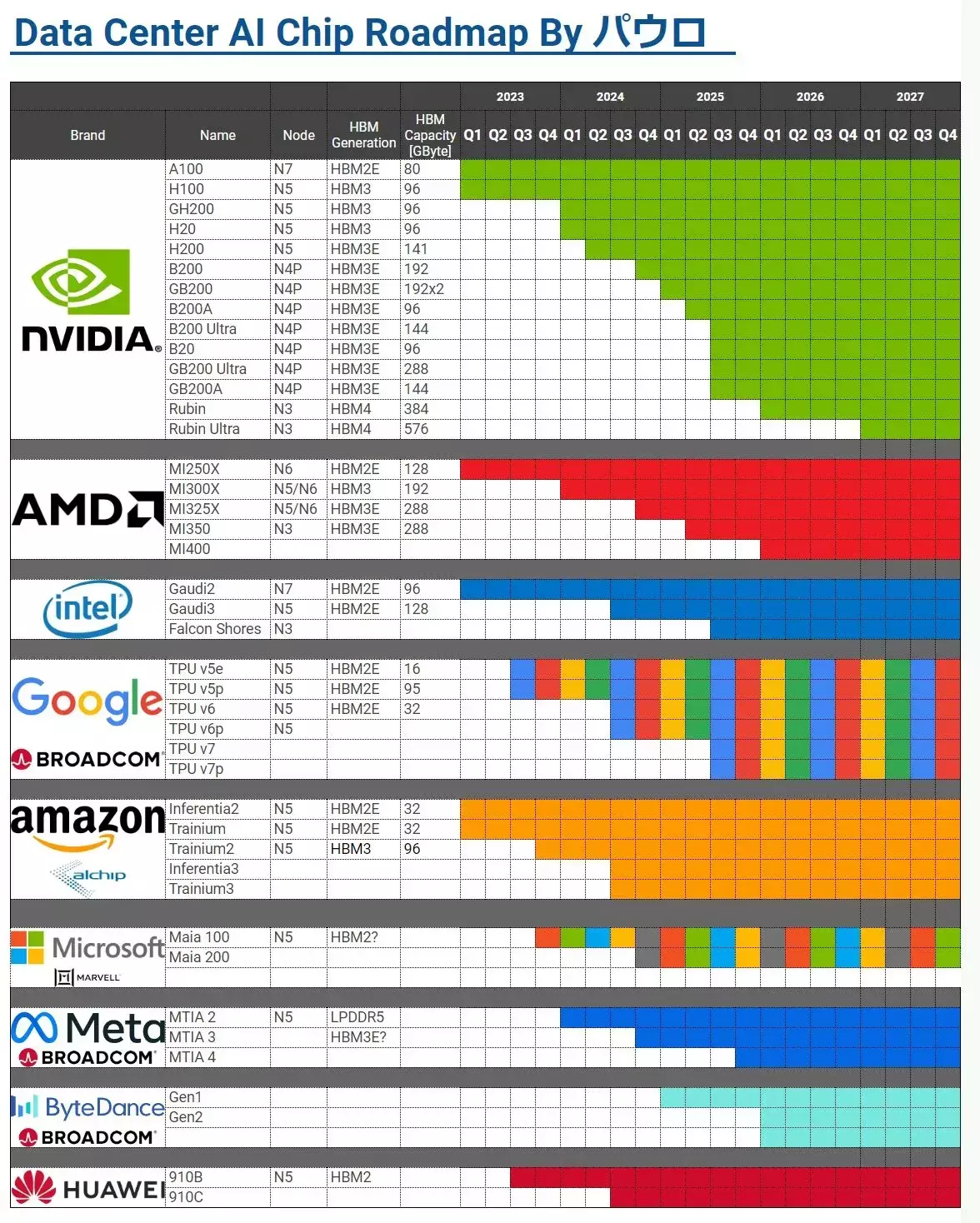

Nvidia is facing GPU competition that’s rapidly ramping up from its largest customers, as seen below.

Top GPU Competitors

Many of Nvidia’s largest customers and competitors were slow in 2023 and ramping up production in 2024-2025. Amazon (AMZN) has recently released details on its Trainium 3 chip that will be released by YE 2025. Given that AWS is the largest cloud computing provider in the world, the company’s ability to potentially push out Nvidia is significant.

The company expects the new chip to be 2x as fast with 40% more power efficiency than the prior generation, as the chip is manufactured on TSMC’s (TSM) cutting-edge N3. With new density, the company expects servers to be able to have 4x as much performance. Reportedly, technology giant Apple (AAPL) will be a consumer of Amazon’s new silicon.

The ramp-up of GPU competition is clear, and it presents a present risk to Nvidia. More importantly than a risk to Nvidia’s GPU business, it represents a risk to Nvidia’s margins. The company will be relevant for a while, but it might be forced to cut the legendarily high margins it earns currently. That could hurt the company’s ability to justify valuations.

Big Tech Over-investment

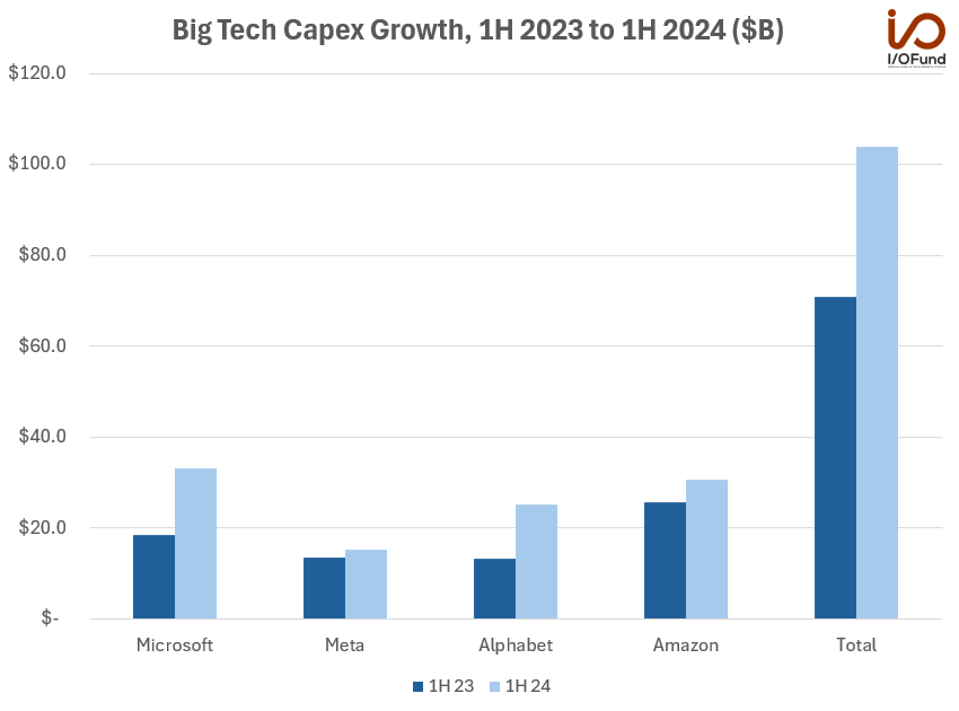

Big tech has been rapidly ramping up its capital expenditures, with annualized capex going from $150 billion to more than $200 billion.

Chart of Microsoft, Meta, Amazon and Alphabet capex spend

Given this massive investment, concerns are being raised about whether these major companies are over-investing in AI and will struggle to earn returns. Investors are concerned about the ability of these tech companies to justify the massive investments, but as seen with Meta Platforms (META) and VR, these companies have the cash flow to keep losing billions in these investments.

More and more information is coming out that the hype around artificial intelligence will slow down.

“I think that there’s a meaningful chance that a lot of the companies are overbuilding now and that you look back and you’re like, oh, we maybe all spent some number of billions of dollars more than we had to,” Zuckerberg said on a podcast this week with Bloomberg’s Emily Chang.

“I think the progress is going to get harder. When I look at [2025], the low-hanging fruit is gone,” said Pichai, adding: “The hill is steeper … You’re definitely going to need deeper breakthroughs as we get to the next stage.”

The first is clear already. Tech companies have the spare cash, and they’re scared about being left behind. How do you handle that? You overinvest. However, at some point, you can quantify the risk and manage that risk, and you can tone down your investments accordingly.

If you’re already over-investing, the chance that you’ll increase spending substantially from current levels for Nvidia to justify its valuation is low. The second part of this is that, as Google’s (GOOG) Sundar Pichai says, the pace of improvement is slowing down. Doubling the size of models gets you noticeable benefits only for so long.

Once limits of size are needed, demand stops growing for GPUs.

Nvidia Double-Whammy Profits Slowdown

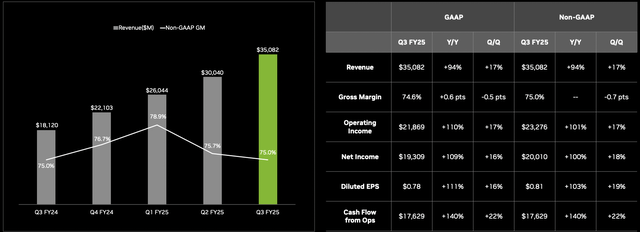

As we can see in Nvidia’s earnings report from the most recent quarter, which we discuss in more detail here, the company is failing a double-whammy.

The company has seen its QoQ revenue growth slow down. The company is still seeing ~$4 billion in quarterly revenue growth, but as it’s grown, the % growth rate has become much weaker. The company’s guidance for the next quarter of $37.5 billion of revenue means only $2.5 billion in revenue growth, indicating not only slow growth in revenue but slowing growth in the rate.

On top of this, the company already saw a decline in its gross margin over the past quarter. The company’s margins are no longer growing from massive demand, they’re now shrinking. We expect increased competition to result in further shrinking in the upcoming quarters. That means the company’s revenue growth will be even less beneficial.

Given the company’s $80 billion in annual income versus a $3.4 trillion valuation, it needs substantial income growth to justify its valuation.

Where To Bet

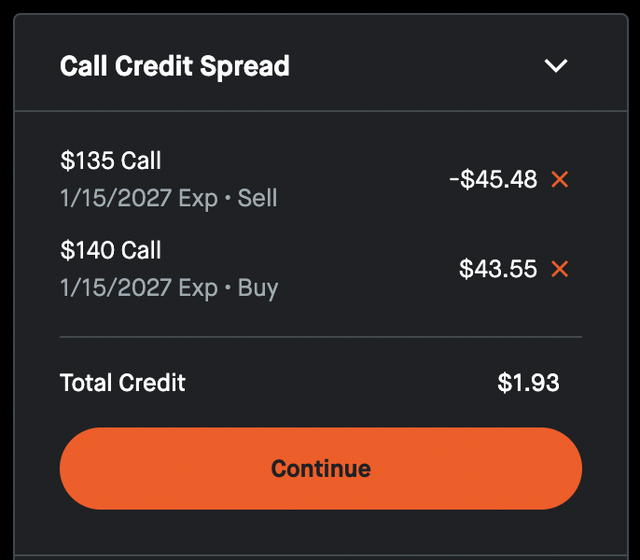

For those looking to bet against the company, one way to do so with a capped downside is a CALL spread.

Investors can sell a mid-Jan 2027 CALL (just over 2 years away) at $135 strike for $45.48 / share. You can hedge the downside by buying a $140 strike CALL for $43.55 / share. You receive a credit of $1.93 / share for that trade. Your breakeven price is $136.93 / share, or just a few percent above the company’s current share price.

If the company is below that level in 2 years, you earn up to a cap of $1.93 / share at any price below $135. Above that, you lose up to a cap of $3.07 / share at any price above $140. Capped losses but capped profits. If you want to achieve a true short where your max profit is 100% of the current share price, you can leverage the short upwards.

Essentially, if you would originally wanted to short 100 shares of Nvidia, your maximum profit (~$13.7K) is based on Nvidia’s share price going to 0. You could instead use the above options strategy, but do it for 7100 shares. In that case, your maximum profit would still be $13.7K. However, your maximum loss will be capped @ $21.8K.

Obviously, a substantial loss, but at least a capped loss versus naked shorting which has the potential for unlimited losses. The downside in this scenario, of course, is that you hit your maximum loss at $140 / share instead of any price >$340 which would be your original maximum loss share price. As with everything else, there are trade-offs.

Thesis Risk

The largest risk to our thesis is that Nvidia is a momentum stock. Despite, as discussed above, we view temporary earnings growth given high competition, the company’s valuation is much higher than its peers. YTD the company’s almost tripling in share price substantially outpaces its EPS growth YTD. Despite that, the market can remain irrational longer than you can remain liquid.

An options bet is a timed investment, that can lose, resulting in substantial losses for investors, even if they’re over a longer-term period.

Conclusion

Nvidia has ridden the GPU wave to become one of the most valuable companies in the world. As large language models, or LLMs, and artificial intelligence have taken the world by storm, the company’s hardware has become incredibly important, an increase in demand that has provided $10s of billions worth of profits and cash flow.

As investors have looked for exciting investments, they’ve chased the company. However, at this point, its share price is well above any rational level, and the company is a poor investment. Investors willing to take the risk should bet against the company, and options are a great way to do that. Overall, we recommend against investment in Nvidia.

Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.