Summary:

- Growing national security concerns could limit any gains in TikTok’s spending from large brands.

- Leading brand advertisers are shifting away from Twitter toward other social media platforms, including META.

- Reels and Message ad products remain top growth catalysts for the next two years.

- META is a strong buy, and I have recently doubled down on my position as it is a wonderful business to own for the long term.

Mario Tama/Getty Images News

Trouble At Twitter & TikTok Could Favor META

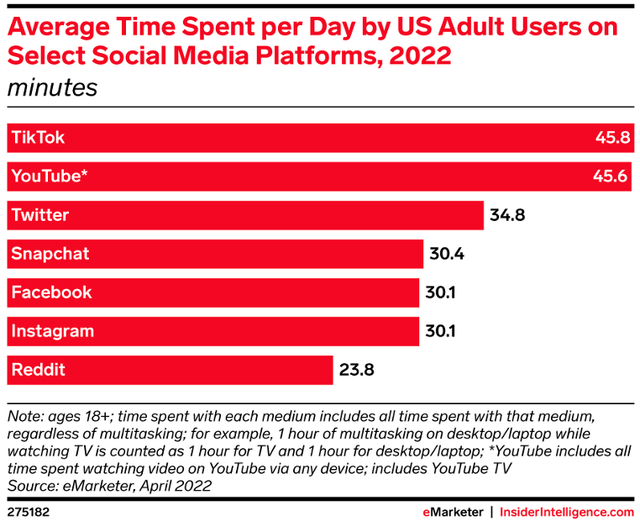

TikTok has been a formidable competitor to Meta Platforms, Inc. (NASDAQ:META) and now leads the chart for time spent on the platform by US adults. According to eMarketer, TikTok and YouTube lead the way with about 45 minutes each for average time daily time spent per user, compared with Facebook and Instagram at 60 minutes combined. Not surprisingly, TikTok has achieved 45 minutes/day in the US (up from zero) in the past four years, but now the company has been under the regulatory cloud in the US and may face severe headwinds in the near term in the US.

TikTok is in talks with CFIUS, an interagency body that performs national security evaluations of foreign corporations’ deals, to evaluate if it can operate in the US as a separate entity after divestment by Chinese parent company, ByteDance. The company came under the regulatory watch after several published reports claiming that user data is unsecured on the platform since it is stored outside China.

The public comments by the Federal Communications Commissioners and, more recently, by the head of the FBI certainly reflect the challenging environment TikTok is currently facing in its US operations. Although it’s too soon to conclude that a US ban on TikTok is in the offing, I believe the risk of being portrayed as a national security threat could limit any gains in advertiser spending from large brands, which may go in favor of other social media platforms like META.

Similarly, Twitter, Inc. (TWTR) struggles with ad spending from leading brands. As per a report by Media Matters for America, Twitter has lost about half of its top 100 brand advertisers after the takeover of the company by Elon Musk. In addition, Twitter is now grappling with an image problem with the political leanings of the new CEO, causing concerns among leading advertisers.

Several marketing groups, like IPG Mediabrands and Omnicom Media Group, have been advising brands to refrain from advertising on Twitter as it is failing to provide an environment that is “brand-safe.” Some notable brands that have paused their advertising on Twitter include General Motors, Coca-Cola, Heineken, Mars, Nestle, and Ford.

Leading brand advertisers shifting away from Twitter toward other social media platforms, including Meta, Google, and Snap, would aid their market share amid rapid changes and growing uncertainty at Twitter, along with its employee layoffs.

Reels Remains A Growth Catalyst

The low monetization of the growing user engagement around Meta’s TikTok clone, Reels, contributed to Meta’s eroding pricing power in advertising. However, in the recent earnings call, Meta continued to provide supportive commentary around Reels, which is a crucial part of the bull case over the next few years.

The company has started to sell ads matching the new short video format, and this approach is paying off. Last quarter, the annualized revenue run-rate for Instagram Reels ads crossed $1 billion, and further scaling of the new ads across both Instagram and Facebook has increased the combined run-rate across these apps to $3 billion. However, this still corresponds to just 2.5% of ad sales. Improving earnings around Reels is a high priority. Still, Meta expects the shift from its more lucrative advertising formats to new short video ads to be negative for possibly 18 more months.

Reels are currently incremental to overall engagement time, and the management highlighted that there are 140 billion+ Reels plays across Facebook and Instagram daily, a 50% increase compared to two quarters ago. More importantly, Reels is not only additive to the overall time spent but also takes share from TikTok. This weakens one of the more structural bear arguments around TikTok siphoning engagement share from platforms like Facebook/Instagram.

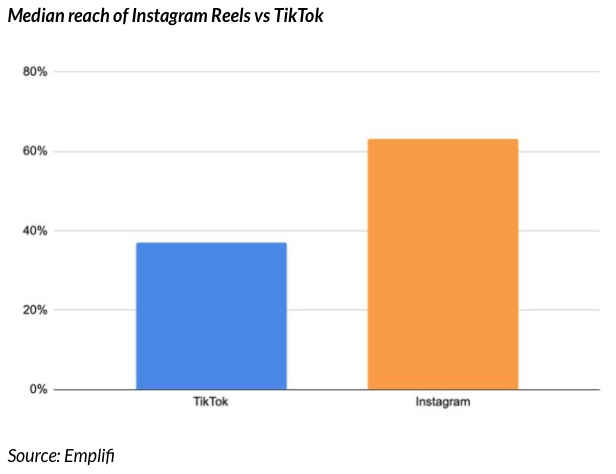

Surprisingly, Reels outperforms TikTok for median reach, and some brands have reported higher interaction and views on Instagram. Strong Reels engagement indicates the ecosystem’s health is improving, which should bode well for future monetization growth, particularly when the macro environment becomes more favorable.

Business Of Apps

Monetizing On Messaging & WhatsApp

Meta highlighted the continued success of messaging monetization through its Click-to-Message and Paid Messaging products to allow businesses to establish a direct relationship with customers easily. The company noted that its Click-to-Message ad product now creates ~$9 billion in annual run rate revenue, representing ~7-9% of Meta’s 2022 total revenue.

Messaging ads can not only potentially play a bigger role within Meta’s broader advertising ecosystem, but more importantly, they can bring more commercial activity directly onto its properties, capturing user intent and thus helping mitigate signal losses that resulted from ATT/ IDFA.

Advantage+ Leads To Higher ROIs

During the quarter, Meta further expanded its ad offerings through its Advantage+ platform, launching Advantage Plus Shopping in August. Advantage+ is a machine-learning-driven automated tool launched earlier this year that reduces the amount of manual input required and streamlines the launch of conversion campaigns.

The company noted that recent tests suggest that advertisers were able to increase ad spend ROI by 32% through Advantage+ Shopping campaigns. Suppose Meta can continue to refine these AI/ML-driven ad products to drive better ROI for advertisers, similar to the positive momentum that Google’s Performance Max has experienced. Given the attractive ROI profile, these tools can help drive advertisers’ willingness to increase ad budgets.

Cost Discipline Is Key

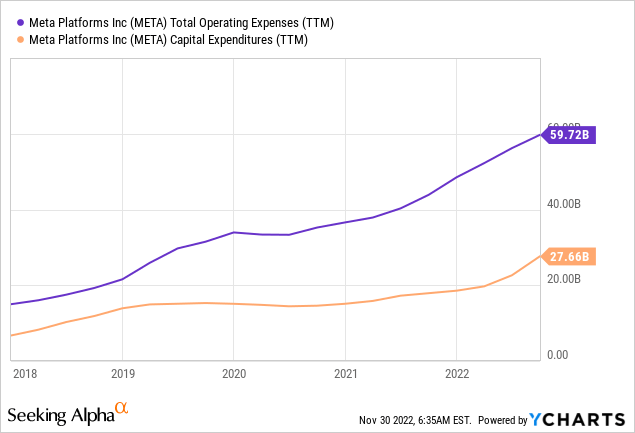

Meta recently announced that it is reducing its headcount by 11k people, or ~13% of the company, across the Family of Apps and Reality Labs. The company noted that the reductions had already been contemplated in its initial 2023 expense outlook, but further refinement of the planning process brings 2023 expenses from $96 billion-$101 billion to $94 billion-$100 billion and CAPEX from $34 billion-$39 billion to $34 billion-$37 billion.

The operating cost reductions are favorable in light of Meta’s slowing revenue growth (which Zuckerberg attributed to a slowdown in e-commerce, macro downturn, increased competition, and signal loss) and significant hiring increases over the last several quarters. As per estimates, the headcount reduction could remove ~$5 billion of costs annually.

While investors had hoped the 2023 expense outlook would come down more, overall workforce reduction is likely bigger than most people had expected. It shows management is operating with increased discipline, especially after a challenging almost two-week period since reporting Q3 earnings.

Conclusion

After solid growth in 2021, the digital advertising industry is seeing cutbacks in ad budgets this year and in 2023, and there are shifts in competitive dynamics. From here on, the critical remaining top-line hurdle for Meta’s ad business is primarily related to cyclical macro-related headwinds rather than fundamental structural issues. As the overall macro environment improves, top-line headwinds associated with the ad business should abate.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.