Summary:

- DraftKings has raised its outlook for FY24, citing strong customer acquisition results and higher hold percentages.

- The company’s acquisition of Jackpocket expands its total addressable market into the $100+ billion U.S. lottery industry.

- DraftKings’ customer acquisition costs are decreasing over time, and it has a wide range of sports and gaming offerings to appeal to a broad audience.

Justin Sullivan/Getty Images News

We’re in a very frothy stock market environment right now, but in my view, there’s never a bad time to continue leaning in on growth stocks that have a significant runway ahead for fundamental expansion.

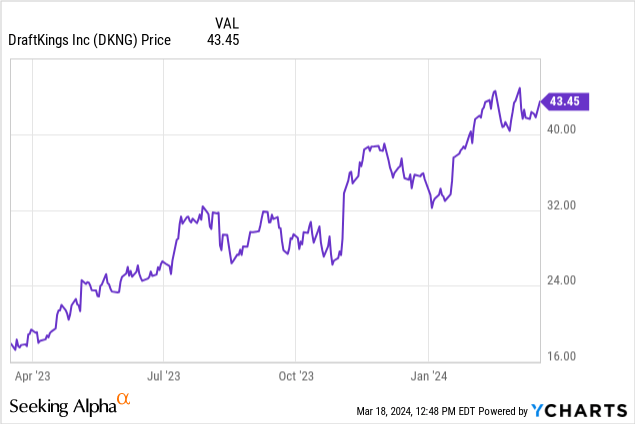

One company that seems to know no bounds in growth is DraftKings (NASDAQ:DKNG). Widely known as the premier sports betting app in the U.S., DraftKings has over the past several years expanded into a much bigger offering across gaming and entertainment, especially with its upcoming acquisition of a digital lottery operator. Shares are already up ~30% year to date and more than 150% over the past year, but I believe there’s further upside ahead.

My last article on DraftKings was in January, and I had rated the company at a buy when it was trading in the mid-$30s. I continue to be bullish on this name as two major things have occurred since:

- DraftKings has substantially raised its outlook for FY24, citing strong customer acquisition results and higher hold percentages both in the fourth quarter as well as in the early few weeks of FY24.

- The company announced a major acquisition of Jackpocket, which further bolsters DraftKings’ TAM into the $100+ billion U.S. lottery industry, and further reduces the company’s reliance on state legalization efforts of sports betting.

Beyond these more recent drivers, here’s a reminder to investors on my updated long-term bull case on DraftKings:

- Large addressable market in the U.S. alone for sports betting, and an even bigger market for iGaming. Today, DraftKings’ sports betting is live in only roughly half of the U.S. population. Major states like California and Texas are still major holdouts; the sum of the remaining states representing 24% of the U.S. population have some form of legalization legislation in the works. In addition to that, online gambling (iGaming) is currently only live in five states today, and ~90% of the remaining U.S. population has no regulated online gambling framework in place.

- Customer acquisition costs are going down with time. DraftKings’ CAC (customer acquisition costs) have gone down each and every year, and with the company’s addition of both iGaming and lottery offerings, the company has an even bigger opportunity to capitalize on its national marketing campaigns and cross-sell its users across its products.

- The number of sports to engage in, and ways to play across the platform, have improved DraftKings’ mass appeal. DraftKings has something for everyone. Though anchored by big sports like football, DraftKings also has other sports, including golf, NASCAR, basketball, and MMA. DraftKings also has fantasy formats as well as direct online sports betting where legal, as well as offerings in casino gaming.

- Immense profitability at scale- Once legal in a given area, DraftKings continues to build audience share and gain more traction on marketing reinvestment, allowing these older and more mature markets to become tremendously profitable. The company sees over $2 billion of adjusted EBITDA opportunity within its existing states alone in the long run, and more than $6 billion of additional opportunity if the remainder of states legalize.

Stay long here and keep riding the upward wave.

2024 looks even brighter than before

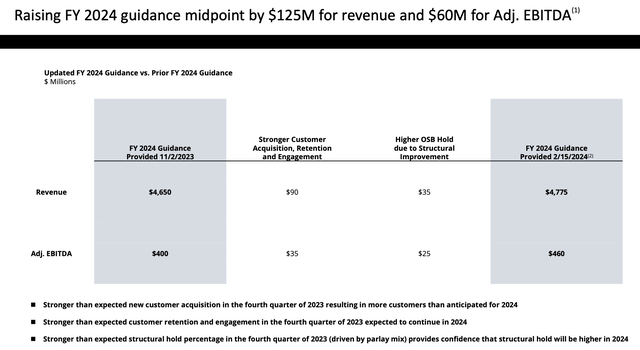

When DraftKings released its fourth-quarter results in mid-February, the company also made a substantial boost to its guidance outlook for this year. Take a look below:

DraftKings FY24 outlook (DraftKings Q4 shareholder letter)

The company is now planning for $4.775 billion in FY24 revenue, representing 30% y/y growth – versus a prior outlook of $4.650 billion, or +27% y/y growth. The company has cited both stronger customer acquisition/retention trends as well as higher sports betting hold percentages as the drivers for the improvement. Also notably, the company raised its adjusted EBITDA outlook for the year by 15% to $460 million, representing a respectable 9.6% adjusted EBITDA margin. As a reminder, recall that this will be DraftKings’ first full year of adjusted EBITDA profitability.

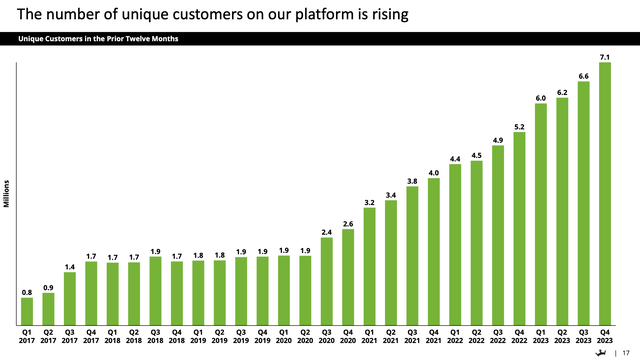

The company is benefiting substantially from an increased user base. It added 500k net-new unique TTM customers in Q4, capping off a year in which its trailing user base jumped from 5.2 million at the end of FY22 to 7.1 million at the end of FY23, a 36% y/y increase:

DraftKings unique user trends (DraftKings Q4 shareholder letter)

Of note, customer acquisition costs are going down as the company leverages more national brand marketing instead of localized campaigns. The company notes that CAC declined 23% y/y in FY23, after FY22 itself had seen a -21% y/y decline.

Jackpocket acquisition substantially increases DraftKings’ TAM

DraftKings’ guidance for 30% y/y revenue growth in FY24 does not yet include any contribution from its pending acquisition of Jackpocket, which it announced in mid-February.

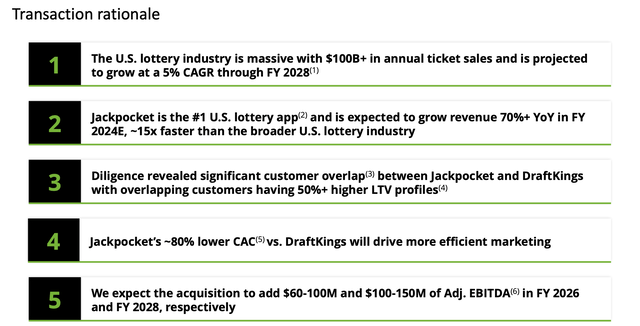

The company is spending $750 million to acquire Jackpocket, marking its first foray into the lottery industry. Jackpocket is essentially a convenient, app-based way to play lottery games such as Mega Millions and Powerball from your phone, instead of buying a lottery ticket from a convenience store.

DraftKings – Jackpocket deal (DraftKings Q4 shareholder letter)

The slide above showcases some of the core deal points behind DraftKings’ desire to acquire Jackpocket. Beyond expanding DraftKings’ TAM into the $100+ billion market for U.S. lottery tickets, of note is the fact that Jackpocket has an 80% lower CAC than DraftKings. Melding that marketing reach into DraftKings’ engine, and enabling cross-selling between Jackpocket and DraftKings customers, gives the combined company tremendous top-line synergy.

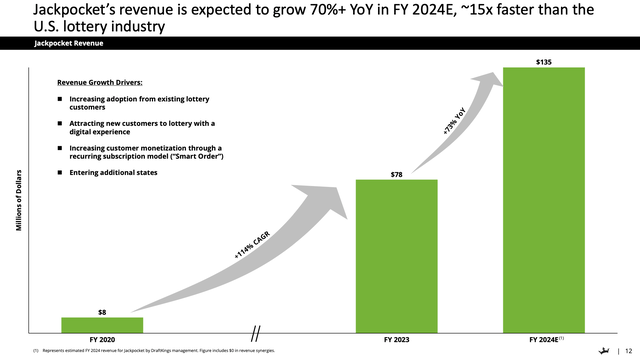

Jackpocket itself is already a high-growth platform, with revenue expected to grow 70% y/y this year to $135 million, which would be roughly ~3% of DraftKings’ consolidated results for this year:

Jackpocket growth trajectory (DraftKings Q4 shareholder letter)

And though we have to take management projections with a grain of salt, note that DraftKings is expecting $60-$100 million of adjusted EBITDA contribution from Jackpocket by FY26, excluding the impact of synergies.

Key takeaways

With strong underlying trends, a pickup in customer acquisition, and incremental growth from the acquisition of Jackpocket, DraftKings is riding a slew of tailwinds through the rest of FY24. Stay long here and hold on for more upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DKNG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.