Summary:

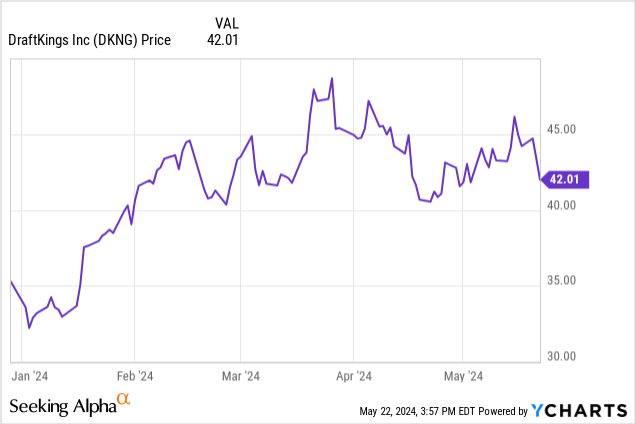

- DraftKings’ share price has jumped 25% this year, outperforming the broader market as it continues to rapidly gain new users.

- The company’s recent launches in North Carolina and Vermont added ~10% more users than the company initially expected.

- DraftKings has a large addressable market, improving customer acquisition costs, and offers a wide range of sports and gaming options.

- The company recently posted a positive adjusted EBITDA and is also expecting $400 million in FCF this year, with plans to unveil a new capital allocation program next quarter.

svetikd

Amid tough macro conditions that have consumers watching their spending on just about everything, one industry has held up quite well: gambling and gaming. The marquee 150th annual Kentucky Derby, hosted on the first Saturday of May each year, saw a record inflow of bets. And amid this backdrop and continual state expansion, leading sportsbook manager DraftKings (NASDAQ:DKNG) is soaring as well.

So far this year, the gaming platform has seen its share price jump by 25%, beating the broader S&P 500. If you’re looking to invest in a technology and growth stock that has nothing to do with AI, this is a great pick.

Rapidly gaining users alongside new state launches

I last wrote a bullish note on DraftKings in March, when the stock was trading at slightly higher and closer to ~$44. Since then, amid a minor recent correction alongside a very strong Q1 earnings update, I remain quite bullish on DraftKings’ prospects for the remainder of the year.

Note that DraftKings just launched sportsbook operations in Vermont and North Carolina earlier this year. The company notes that, just as with previous launches, it managed to accumulate paying users quite quickly (demonstrating the pent-up demand in states where sports betting is not yet legal) and that it expects both states to contribute to positive adjusted EBITDA by the end of the year. In fact, DraftKings notes that these two states achieved customer acquisition that was 10% above the company’s expectations, while cost per customer acquisition was also 20% lower than another recent comp for the launch of Massachusetts.

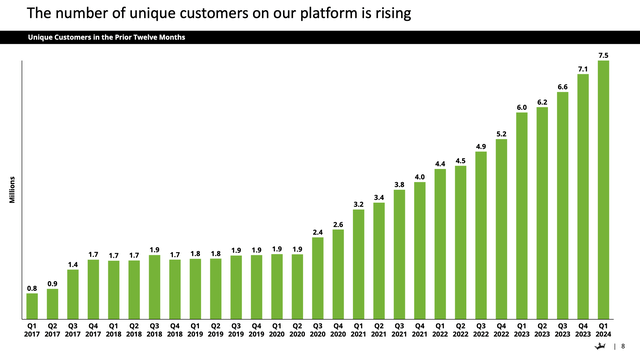

The chart below showcases how aggressively the company has been building up its active user base, driven not just by new state launches, but by greater engagement in states where the company has long operated already:

DraftKings user trends (DraftKings Q1 earnings deck)

Beyond these near-term positive developments, here’s a reminder of my long-term bull case for DraftKings:

- Large addressable market in the U.S. alone for sports betting, and an even bigger market for iGaming. Today, DraftKings’ sports betting is live in only roughly half of the U.S. population. Major states like California and Texas are still major holdouts; the sum of the remaining states have some form of legalization legislation in the works.

- Customer acquisition costs are going down with time, as demonstrated by the Vermont/North Carolina launches. DraftKings’ CAC (customer acquisition costs) have gone down each and every year, and with the company’s addition of both iGaming and lottery offerings, the company has an even bigger opportunity to capitalize on its national marketing campaigns and cross-sell its users across its products.

- The number of sports to engage in, and ways to play across the platform, have improved DraftKings’ mass appeal. DraftKings has something for everyone. Though anchored by big sports like football, DraftKings also has other sports, including golf, NASCAR, basketball, and MMA. DraftKings also has fantasy formats as well as direct online sports betting where legal, as well as offerings in casino gaming.

- Immense profitability at scale- Once legal in a given area, DraftKings continues to build audience share and gain more traction on marketing reinvestment, allowing these older and more mature markets to become tremendously profitable. The company sees over $2 billion of adjusted EBITDA opportunity within its existing states alone in the long run, and more than $6 billion of additional opportunity if the remainder of states legalize.

Stay long here: DraftKings’ YTD rally still has plenty of room to run.

Market share gains and guidance boost

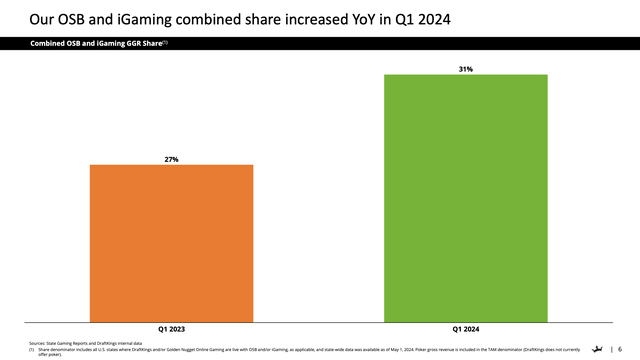

It’s not just that DraftKings is experiencing secular tailwinds that are increasing the gambling population and seeing legalization tailwinds in the U.S., but DraftKings is gaining share against rivals like FanDuel.

The company reports that it has a 31% market share in online sports book and iGaming in the first quarter of 2024, which is four points higher y/y versus a 27% market share in Q1 of 2023:

DraftKings market share (DraftKings Q1 earnings deck)

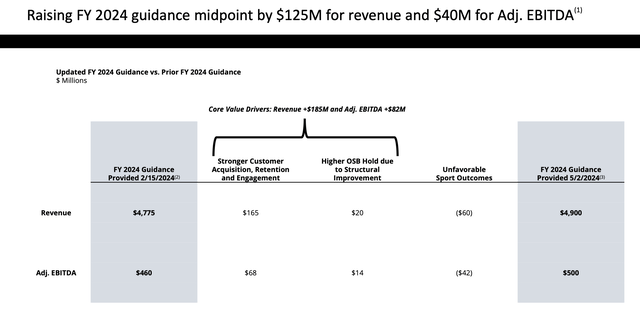

Furthermore, note that DraftKings yet again boosted its full-year outlook for FY24. The company is now expecting $4.90 billion in revenue for the year (+37% y/y), while also raising its adjusted EBITDA outlook by 9% to $500 million:

DraftKings outlook update (DraftKings Q1 earnings deck)

The chart above shows a helpful breakout for the drivers behind the company’s guidance boost, from both a revenue and profitability perspective. Higher than expected customer acquisition (including the ~10% beat to launch expectations in North Carolina and Vermont), as well as strong player engagement, account for the majority of the guidance boost. This, in turn, was partially offset by unfavorable sports outcomes, mostly during the March Madness (NCAA Championships) tournament.

We note that these stronger player engagement metrics also come against the backdrop of a more controlled marketing environment, as well as extreme opex discipline. Writing in the Q1 shareholder letter, management noted as follows:

We will continue to focus on our dual goals of improving our financial expectations while also investing in customer acquisition and our product and technology capabilities […]

We continue to expect Adjusted Sales and Marketing Expense to decline modestly in fiscal year 2024. We also continue to expect 2024 stock-based compensation expense to be flat-to-down in dollar terms and to represent 8% of revenue in fiscal year 2024 compared to 11% in fiscal year 2023 and 26% in fiscal year 2022.”

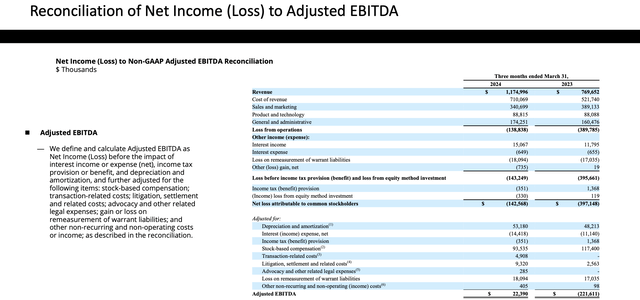

DraftKings adjusted EBITDA (DraftKings Q1 earnings deck)

In Q1, as shown in the chart above, adjusted EBITDA shot up to $22.4 million, representing a 2% adjusted EBITDA margin: versus a loss of -$221.6 million, or a -29% margin, in the year-ago Q1. In other words: DraftKings is hardly just growing at all costs. It’s growing rapidly, but it’s also scaling nicely as well. The company notes that it is expecting $400 million of free cash flow this year, and expects to update investors in Q2 on its new plans for capital allocation. While unconfirmed, a dividend or buyback program would provide further fuel for the DraftKings rally.

Key takeaways

DraftKings continues to enjoy a number of tailwinds. New state launches are helping to fuel customer growth, building on an already-prominent national brand that is requiring fewer dollars per customer to attract new users. Profitability is turning a corner this year with nearly half a billion in expected FCF this year to potentially finance a new shareholder returns program. Stay long here and keep riding the recent tailwinds.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DKNG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.