Summary:

- Bank of America’s Q1 financial results showed a small increase in net interest income and a decrease in non-interest expenses.

- The FDIC Special Assessment had a negative impact on the bank’s net income, but preferred dividends remain safe.

- The Series HH preferred shares have a fixed dividend yield of 5.98% and are currently trading below par.

- The Series L “busted” preferred shares appear the better choice.

Ceri Breeze/iStock Editorial via Getty Images

Introduction

A portion of my portfolio is dedicated to fixed income securities to generate a steady stream of cash inflow from interest payments and preferred dividend payments. In the preferred equity segment, I usually try to buy cumulative preferred shares (so the issuer has to make preferred shareholders whole on all outstanding dividends before it can pay a single cent as a dividend on its common shares), but due to changing capital rules since the global financial crisis, the perpetual preferred equity issued by financial institutions is non-cumulative in nature. This means that the banks are allowed and able to skip preferred dividend payments, but fortunately the issuers realize the reputational damage would do more harm than the cash savings generated by not paying the preferred dividend.

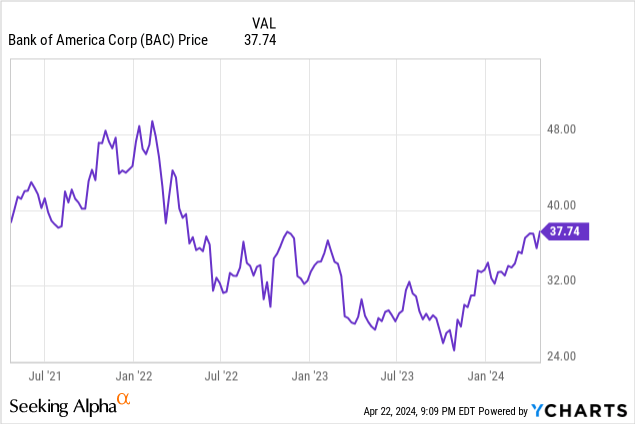

As Bank of America (NYSE:BAC) has recently reported its financial results for the first quarter of the year, this likely is a good moment to have another look at the bank’s performance to see if my expectations and interpretations of the preferred capital stack need to be fine-tuned or adjusted.

The FDIC Special Assessment weighed on the reported results

Before deciding how safe the preferred shares and preferred dividends are, we obviously need to look at the financial performance of the bank and the recently-reported results for the first quarter provide plenty of information to ensure the bank is still performing well.

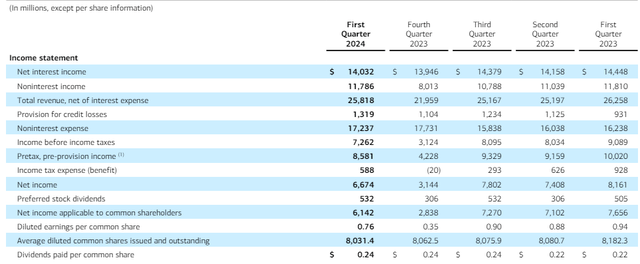

Looking at the summarized financial results for Q1, we see the net interest income showed a small increase compared to the most recent quarter, while the bank also showed a nice increase in the non-interest income while the non-interest expenses decreased by almost 3%. This helped the bank to boost its pre-tax income to $7.26B and this already included a $1.32B loan loss provision.

BAC Investor Relations

After deducting the $588M in net taxes, the reported net income was approximately $6.67B, and after deducting the $532M in preferred dividends, the net income attributable to the common shareholders of Bank of America came in at $6.14B for an EPS of $0.76.

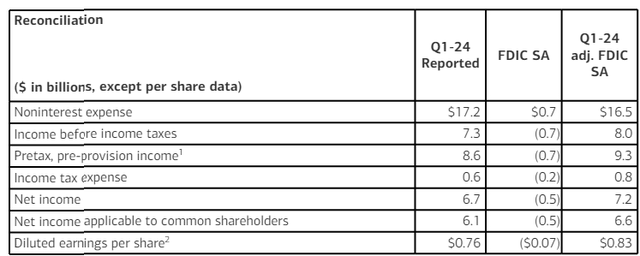

A decent result but a bit lighter than expected. Just like other banks (for instance, Regions Financial, whose case I explained in another recent article here), Bank of America had to deal with yet another FDIC special assessment for uninsured deposits of failed banks which had a negative impact of approximately $700M on pre-tax results. As you can see below, this had a negative impact of approximately $0.5B on the reported net income, which also means the reported EPS of $0.76 was understated by approximately 7 cents per share. Excluding the impact of the FDIC special assessment, the underlying net income was approximately $0.83 per share.

BAC Investor Relations

This has no noticeable impact on the status of the preferred shares. As the condensed income statement already showed, Bank of America only needed about 8% of its reported net income to cover the preferred shares. Seeing the adjusted net income coming in about half a billion higher than the reported net income further reduces this percentage (and thus makes the preferred dividends safer from a payout ratio perspective).

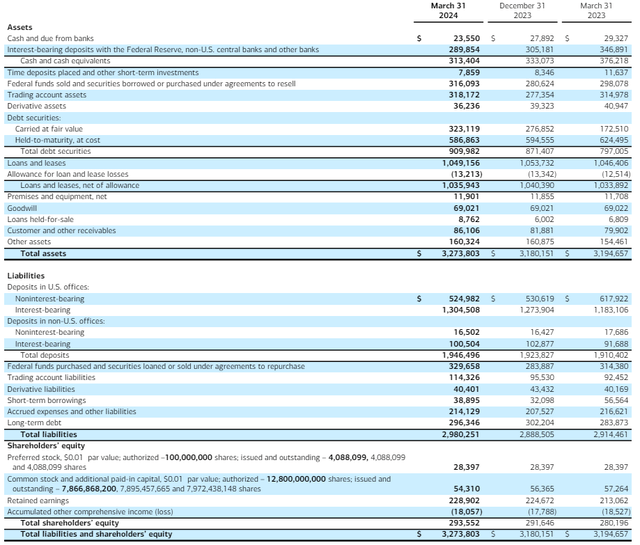

The payout ratio for the preferred dividends isn’t the only important metric. I would obviously also like the balance sheet to remain sufficiently strong to avoid capital losses. As you can see below, the total amount of equity on the balance sheet at the end of March was just under $294B.

BAC Investor Relations

And it’s encouraging to see the vast majority of the total equity consists of common equity, which ranks junior to preferred equity. Indeed, the book value of the preferred equity was just $28.4B which means there was about $265B in common equity which ranks junior to the preferred shares. That’s a nice cushion. Even if you’d study the fair value of the securities held to the unrealized losses on those items are approximately $109B. While that’s a sizable amount, the balance sheet should be able to deal with that given the pre-tax pre-provision quarterly income of approximately $35-40B per year.

I’m still a fan of the preferred shares

Bank of America has issued a wide array of preferred shares and I have been keeping track of a few of them. As explained before, I like the “busted” preferred share (Series L, trading with (NYSE:BAC.PR.L) as its ticker symbol) very much as that preferred share cannot be called by Bank of America.

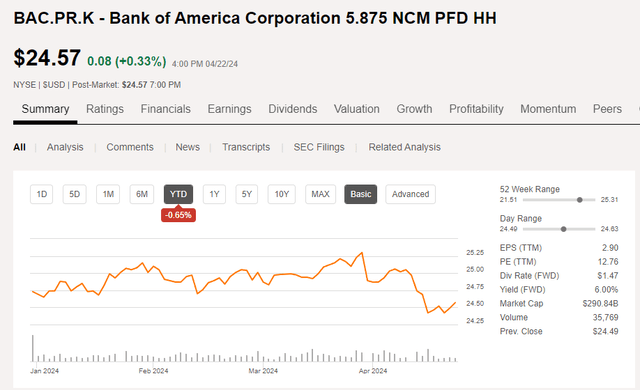

In the past, I also had a look at the Series HH preferred shares, which are trading with (NYSE:BAC.PR.K) as its ticker symbol.

Seeking Alpha

The Series HH has a fixed preferred dividend of $1.46875 per share per year (for a preferred dividend yield of 5.875% based on the $25 principal value of the preferred shares), payable in four equal quarterly installments of $0.3671875. These preferred shares are currently trading at $24.57 per share (as shown above) for a current yield of approximately 5.98%. As you can see, the securities traded above par during the first quarter leading up to the ex-dividend date on March 28 and have been trading below par since.

The securities can be called at any time, so we shouldn’t expect the shares to trade at a substantial premium to the principal value as that would increase the call risk assuming the share price of the fixed rate preferred shares increases due to the lower return requirement on the financial markets for preferred stock of Bank of America.

Should the preferred shares be called, investors would generate an immediate capital gain of 1.75%, but that’s not a scenario I’m taking into consideration right now as 5.875% is a pretty low cost of capital for perpetual equity for a bank. Of course, should the world move back to a zero interest rate policy, it’s always possible Bank of America may refinance this security at a lower cost. But for now, I think we should assume the securities will remain outstanding. Additionally, as BAC has several other securities with a higher cost of capital (like (BAC.PR.B) which has a 6% preferred dividend coupon) we can expect the higher-cost securities to be called first.

Investment thesis

I have started writing put options on the common shares of Bank of America as I wouldn’t mind initiating a long position in the low-$30 range, but I’m still predominantly focusing on the company’s preferred equity securities. The Series HH preferred shares are interesting, but I still prefer the “busted” preferred issue as (BAC.PR.L) currently has a yield of approximately 6.25% based on its current share price of $1,163/share. As the preferred shares rank pari passu, I think it makes more sense to focus on the higher-yielding securities.

That’s why I’m rating (BAC.PR.K) a “hold” at the current level, and why I’m sticking with a “buy” on (BAC.PR.L). Should the share price of the Series HH decrease, resulting in an increasing yield, I may revert my opinion (if the share price of the Series L preferred shares doesn’t decrease accordingly).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC.PR.L either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I currently have no position in BAC's common shares, but I have written out of the money put options as I'm trying to initiate a long position at a lower average cost.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!