Summary:

- eBay’s stock has risen 20% this year, but there are concerns about its future upside and ability to compete with larger e-commerce platforms like Amazon.

- Core risks include flat GMV growth, higher expenses, capital returns at risk, and a large net debt position.

- eBay’s Q4 earnings showed some positive highlights, such as growth in advertising revenue, but profitability declined. Investors should remain cautious and consider locking in gains here.

stockcam

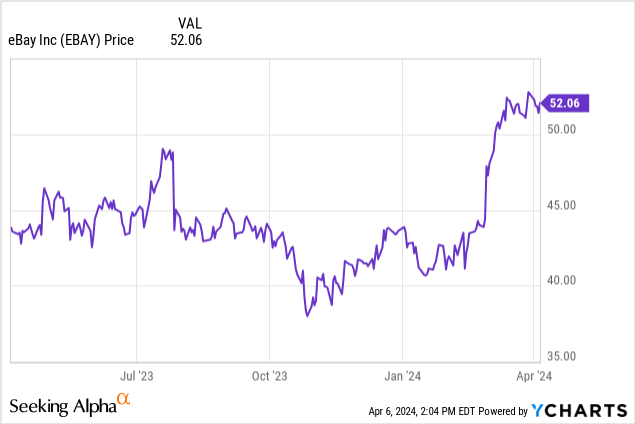

It’s been a surprisingly strong year for stocks this year as investors have banked on rate cuts to drive re-inflation of valuation multiples, which are already high enough as they are. Even some surprise laggards have enjoyed rebounds this year, including and especially eBay (NASDAQ:EBAY), the once-dominant auction site that was at one point one of the most prominent names in e-commerce.

Shares of eBay have rocketed up ~20% this year on the back of a strong Q4 earnings print and a relatively sanguine outlook for Q1 and the remainder of the year. The question investors have to ask now, however, is: does eBay really have any upside left?

I last wrote a neutral opinion on eBay in early November, when the stock was trading closer to $40 per share. Since then, eBay (alongside the rest of the market, bear in mind) has soared ~30%. But in my view, many of the same risks remain in eBay. Despite the temporary optical acceleration in GMV rates this quarter, we have to ask: is the eBay auction model really one that will be sustained in a decade from now? And for direct purchases, what exactly is eBay’s moat versus Amazon and much more prominent e-commerce platforms?

There are a number of core risks that investors should be aware of:

- GMV is not only flat, but also depends on growth in a couple of niche categories. eBay has developed a relatively dangerous concentration to categories like collectibles and auto parts, some of which are more cyclical and fad-driven than others. Outside of these areas, eBay doesn’t have any generalist strength that allows it to truly compete in the e-commerce arena.

- Much higher expenses. eBay has been reinvesting in product and infrastructure, which has driven up its opex costs and taken an axe to operating margins.

- Capital returns at risk – eBay has driven EPS growth through share buybacks, and rich dividends (currently at a ~2% yield) have kept investors patient. Yet, with declining revenue and margins, it’s unclear whether eBay will be able to continue at its current pace.

- Large net debt position. eBay has just shy of $3 billion in net debt, or a ~1.4x multiple of its EBITDA. This debt position will further constrain its capital returns program.

All in all, with eBay’s shares having inflated since the start of the year and the persistence of these longer-term risks, I remain neutral on the company’s prospects through the remainder of the year. In my view, the best move is to remain on the sidelines and watch the stock cool off from its most recent rally before considering buying back in.

Q4 download

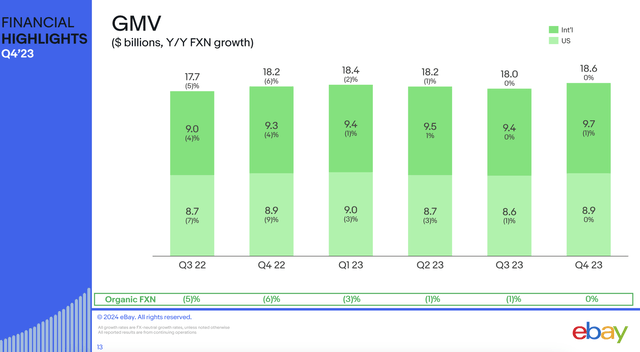

Let’s now go through eBay’s latest quarterly highlights in greater detail. First, the headline that investors cheered most was the fact that at least optically, GMV (gross merchandise volume) returned to 2% y/y growth, from a -1% y/y decline in Q3.

eBay GMV trends (eBay Q4 earnings deck)

However: eBay benefited from FX movements in the quarter. On a constant-currency basis, GMV was actually flat y/y, though this was a marginal improvement over a -1% y/y decline in Q3.

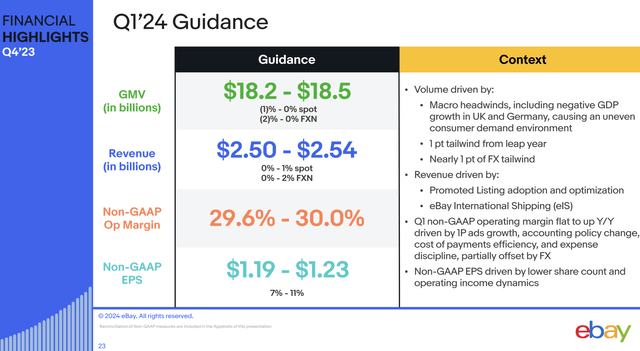

Note as well that eBay doesn’t expect to sustain in growth mode. Its guidance for Q1 is calling for GMV to slide back to a growth rate of -2% to flat on a constant-currency basis, which at the midpoint is in-line with Q3’s -1% decline. eBay is citing continued macro headwinds especially in Europe as the core driver here: and note that this expectation of a -1 point decline is including the benefit of a 1 point benefit from leap year in 2024.

eBay Q1 outlook (eBay Q4 earnings deck)

The company notes that “focus category” performance has indexed above total company GMV, especially in parts and auto. Per CEO Jamie Iannone’s remarks on the Q4 earnings call:

We focused category GMV outpaced the remainder of our marketplace by approximately 6 points, growing roughly 4% for the third straight quarter. Our momentum in Motors Parts & Accessories, or P&A, continued in the quarter, as volume growth held steady in the mid-single digits […]

In 2024, we plan to onboard sellers in other categories to utilize this technology and tighten delivery estimates across eBay more broadly. Our established position in P&A has led to more than 100 million vehicles being saved in the My Garage section of eBay by active customers. In addition to providing better fitment experiences, we are finding more ways to leverage this valuable data to drive utility for our customers.

For example, last quarter, we introduced predictive maintenance that offers AI-driven auto part recommendations based on a vehicle’s mileage. Features like this help eBay stay top of mind for customers looking for auto parts at a great value.”

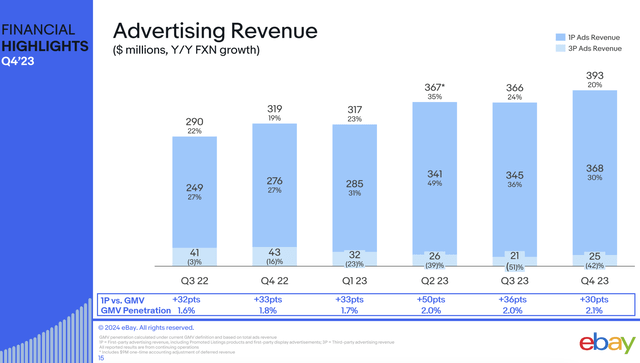

The other bright spot for eBay in the quarter was advertising revenue, as promoted listings attach rates continue to be a benefit to eBay’s revenue (which grew 3% y/y on a constant-currency basis in Q4, three points ahead of GMV growth). Ad revenue in Q4 grew 20% y/y to a record $393 million, also reaching an all-time high GMV penetration rate of 2.1%.

eBay advertising trends (eBay Q4 earnings deck)

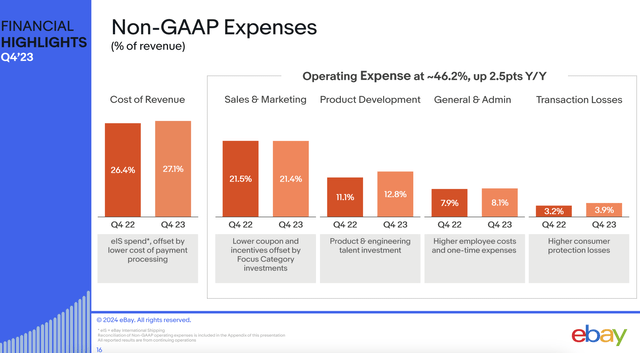

The sore spot in the quarter, meanwhile, was profitability. eBay’s opex as a percentage of revenue soared to 46.2%, driven in particular by a 170bps increase in product development costs as a percentage of revenue – which was a result of increased hiring in product and engineering orgs. Cost of revenue also increased 70bps, driven by higher infrastructure spending.

eBay expense trends (eBay Q4 earnings deck)

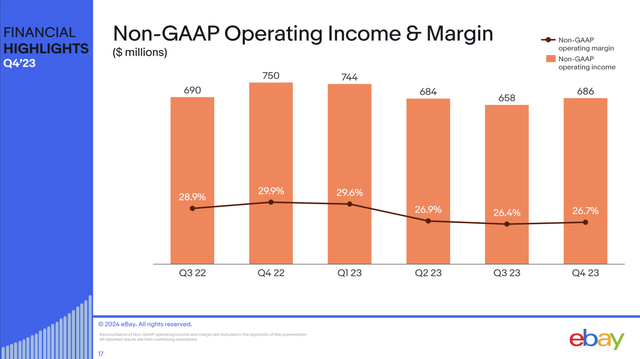

This, in turn, caused a -8% y/y decline in pro forma operating income to $686 million, while pro forma operating margins declined -320bps y/y to 26.7%:

eBay operating margin trends (eBay Q4 earnings deck)

The good news is that eBay’s Q1 guidance does call for operating margins to glide back up to ~30%, but with salary inflation continuing to be a rampant force especially in the U.S., we’re unsure if eBay has the means to maintain these margin levels in perpetuity.

Valuation and key takeaways

eBay’s latest rally has also made it slightly difficult to make the value stock argument in its favor. Currently, consensus is expecting pro forma EPS of $4.67 for the current year, putting eBay at a 11.1x FY24 P/E ratio against consensus expectations. Certainly this is cheaper than the broader S&P 500, but we note that eBay traded at a high single-digit P/E multiple for most of 2023 – and with so many risks to continued profit growth (GMV stagnation, expense inflation) – eBay is cheap for a reason.

All in all, don’t bank on eBay’s rally continuing to sizzle for the remainder of this year. If you have any gains on this stock, it’s best to lock them in here and invest elsewhere for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.