Bubble Warning: Unrealistic Growth Priced In And Multiple Risk Factors For Eli Lilly

Summary:

- The weight loss drug, Zepbound, faces immense competition and may lose its battle once a pill form of weight loss drug becomes available.

- The company has a surprisingly low diversification of revenues.

- Revenues are susceptible to upcoming LOEs. Trulicity is set to lose exclusivity in 2027 in the U.S.

- Our DCF model suggests that annual growth of 35% is priced in.

- Eli Lilly would need $84 billion per year in revenues over the next five years to justify its valuation. There is no way Eli Lilly will reach these levels.

mesh cube

It’s time for us to share with you our view on Eli Lilly (NYSE: LLY). There’s been a lot of hype surrounding their contribution to the fight against diabetes and obesity, and accordingly, the shares have experienced a strong bull market in the last few years. But the whole Eli Lilly business screams risk to us. We believe there are multiple factors that all pose significant downside risks, not the least Eli Lilly’s staggering valuation. There are simply not enough growth prospects to justify the current valuation of Eli Lilly. The company has a forward P/E ratio of roughly 90 which is miles apart from the sector median of 18, and our DCF model indicates that growth of 35% annually in every year for the next five years is priced in. The market seems to believe that Eli Lilly will thrive. But even if they do, their valuation has gone through the roof.

So, let’s dig deeper into some of the downside risks we see with holding this stock, risks that may have been overlooked but that are undoubtedly important.

Downside risk

A potential misconception around Eli Lilly’s weight loss drug

First, we argue that there is a potential misconception related to their weight-loss drug, Zepbound. The injectable drug shouldn’t revolutionize the field. First, the product is already in the market for diabetes-2 treatment with major revenue streams already priced in. Secondly, the product faces fierce competition from Novo Nordisk now that it enters the U.S. market for weight loss treatment. Third, people don’t really like injections and as soon as a weight loss drug in the form of a pill makes its way to the market, the sunny days should soon be over for Zepbound.

Pfizer is currently working on a weight loss pill known as Danuglipron and investors are waiting for the company to release Phase-2 trial data by the end of this year.

High exposure to upcoming LOE

Secondly, Eli Lilly is now heavily exposed to Loss of Exclusivity (LOE). The product with the largest revenue share, Trulicity, is losing exclusivity already in 2027 in the US and shortly thereafter, in 2029, in the majority of the EU and Japan. Trulicity brought in 5.46 billion in revenues YTD in Q3 2023, representing 22% of total revenues. When LOE hits Trulicity, it should reduce its revenues significantly, adding pressure on the company to deliver on its R&D and product pipeline to replace lost revenues. We believe that Eli Lilly rides on a wave of unrealistic expectations and market hype around their weight loss drug.

Low diversification of revenues

Also, the company has a surprisingly low diversification of revenues. The top-four revenue-bringing drugs, Trulicity, Mounjaro, Verzenio, and Taltz, account for more than 50% of total revenues. Stagnating growth from any of these drugs due to market saturation or LOE will put significant pressure on revenue growth. This is far from optimal and adds significant risk when forecasting future growth for the company. Because replacing lost revenues is not a piece of cake. According to Eli Lilly, it can take over a decade to take a drug from the discovery phase to market and it often costs in excess of $2 billion. Meanwhile, failure can occur at any point in the process, including in later stages after substantial investment. As a result, most funds invested in research programs will not generate financial returns. New product candidates that appear promising in development may fail to reach the market or may have only limited commercial success. The hard truth is that future revenue streams for Eli Lilly are highly unpredictable. Not precisely a Sleep Well At Night situation.

Financial Risk

Eli Lilly has as many as 24 drugs in the Phase-1 stage. This raises the question of funding. If taking one drug to market can cost more than $2 billion, then the company’s Phase-1 studies may incur costs of nearly $50 billion long before they reach the market, not to mention drugs in Phase-2 and Phase-3. What we mean here is that if it costs $2 billion for one drug to reach the market, then in order for Eli Lilly’s early-stage drugs to reach the market it will require nearly $50 billion in cumulative investments. With that said, drug development success is of course a positive thing.

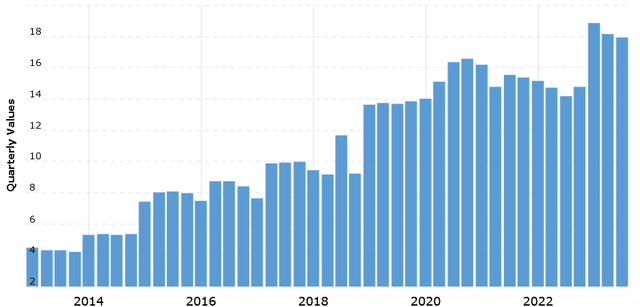

However, we are not sure how Eli Lilly intends to fund its R&D. They will most likely need to take on further debt. Eli Lilly has a history of building up vast piles of debt with their Long-Term Debt growing from $4.4 billion in 2013 to 18 billion by 2023, and with debt-related key financial indicators far worse than its rival Pfizer. For instance, the Total Debt-to-equity ratio is at 1.81. This can be compared to 0.66x for its rival, Pfizer. Meanwhile, the Quick Ratio is at 0.49x for Eli Lilly compared to 1.78x for Pfizer. A justified question is then if Eli Lilly’s financials will put a spoke in the wheel for their future investments in R&D, or at least if the market will react adversely to further indebtedness.

Eli Lilly Key Financial Indicators

Pfizer Key Financial Indicators

Valuation Risk

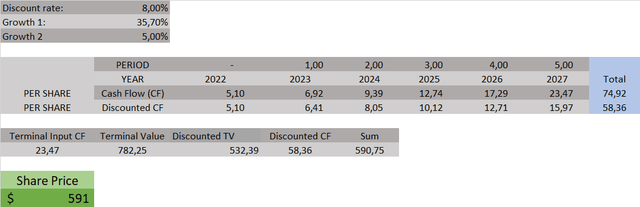

For the valuation of Eli Lilly, we want to take a somewhat different approach this time. This is because a lot of growth is priced in. So, instead of providing you with our target price for Eli Lilly, we want to share with you our assessment of the growth rate required to justify the current valuation of Eli Lilly, currently trading at $591.

Using 2022 years of Free Cash Flow as our starting point we conclude that it will require an annual growth rate of 35% for the next five years to justify Eli Lilly’s current valuation. The trailing twelve months’ free cash flow of Eli Lilly has actually been falling consistently since September 2022 and is well below its peak in March 2022. So, we can safely say that Eli Lilly won’t grow Free Cash Flow by 35% in this year. We also find it highly unlikely that the company will manage to deliver growth even near those levels in the future, especially taking into account the downside risks we’ve discussed.

HedgeMix DCF Model Seeking Alpha

Another way to look at a fair value of $591 is that Eli Lilly likely needs to generate total revenues of ~$420 billion for the projection period or an average of $84 billion per year. We get these numbers by multiplying the total FCF per share of $74.92 with the 899.31 million in shares outstanding and then dividing the product by 0.16 which is the FCF to Revenue ratio as of 2022. There is surely no way Eli Lilly will reach these revenue levels anytime soon.

Current analyst consensus anticipate total revenues of ~$250 billion up to 2028. As such, one may argue that anything above that would beat expectations and take the shares even higher. However, the difference in revenues between our model and analyst consensus is due to the market pricing in growth in year 6 and onwards at a higher rate than we do. But a perpetual growth rate of 5%, which is what we use, is at the high end for any conventional DCF model. As such, we are comfortable with our statement. So, while revenues would beat expectations there is also the case that expectations on long-term growth may fall. For example, if the hype surrounding their weight loss drug fades. Also, even reaching $250 billion in cumulative revenues by 2028 won’t be a piece of cake.

Sales from Mounjaro (Tirzepatide) reached a mere $1.41 billion in Q3 2023. And even if sales of Mounjaro, and now Zepbound, were to double in 2024, its impact on growth would be limited to roughly 20% in 2024, meaning revenues would grow by no more than 20% all else equal. We would need to see high, exponential growth in the years to come from not only Mounjaro and Zepbound, but also from other drugs currently under development to justify Eli Lilly’s current valuation, and so far, we remain cautious. There are a few more drugs for obesity in Phase 3 and a solid candidate for Alzheimer’s Disease, Donanemab, with strong growth potential. Other than that, there is a range of less-known drugs with lesser revenue potential in the late stage. And for those that get FDA approval, the size and timing of their future revenue streams are still highly uncertain.

In regards to Donanemab, Eli Lilly’s Alzheimer blockbuster, we see analysts coming up with numbers like $7 billion in peak revenues, but it’s all just guesses and it would take several years to reach those levels. This is in a market for Alzheimer’s Disease that is expected to grow by no more than 20% annually in the next few years to $13.7 billion by 2030. And even if Donanemab grabs the whole market for Alzheimer’s it won’t be large enough to justify Eli Lilly’s current valuation.

Take-away message

There are several factors to observe in the valuation of Eli Lilly. We believe we have covered the most important in this article. But there may be other factors on top of that, such as competition, regulatory aspects, and macro to name a few. There is especially the risk of a high valuation in itself, the so-called valuation risk. The current share price is pricing in free cash flow growth of 35% annually. But weighing Eli Lilly’s valuation against its growth prospects and downside risks makes us wonder what the heck is going on. The level of growth priced in is far from what Eli Lilly will be able to deliver in the years to come and the company faces multiple challenges along the way.

We fear that the shares are bound for a bumpy ride with a lot of unwanted volatility as we move forward and with significant downside risk. We believe the valuation of the company is based on irrational speculation about Eli Lilly’s future fortunes rather than supportable arguments.

Feel free to follow us!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.