Summary:

- The recent FDA complete response letter to Eli Lilly and Company about donanemab was inevitable.

- Approval of donanemab remains uncertain.

- There are several regulatory events for Eli Lilly and Company in 2023.

jetcityimage

On January 19, Eli Lilly and Company (NYSE:LLY), one of the largest ($329 billion market cap) global health care companies, received the U.S. Food and Drug Administration’s (FDA) complete response letter (“CRL”) to the biologics license application (“BLA”) for donanemab under the accelerated approval pathway for the treatment of early symptomatic Alzheimer’s disease (“AD”). The single deficiency revealed was that the submission included data on fewer than 100 patients who received a minimum of 12 months of continued treatment on donanemab, which happened because patients could stop receiving the antibody once enough amyloid plaque was cleared. Lilly should’ve and likely did expect this consequence.

The FDA “indicated that the data to meet the exposure expectation would likely need to include the unblinded controlled safety data from TRAILBLAZER-ALZ 2 upon completion.” Topline data on this trial is expected in Q2, although it’s unclear whether Lilly will try resubmit for accelerated approval or just go with the traditional route. Other than a longer review process for traditional approval, donanemab will need to show efficacy in a clinical endpoint, not just reducing a surrogate marker like amyloid plaque. Investors should, therefore, ignore any noise regarding the CRL, recognize how much riskier approval has become, and not pin their Lilly outlook on donanemab’s chances in AD.

First of all, the 100-patient rule has been in the books for a long time:

For products intended for long-term treatment of non-life-threatening conditions, (e.g., continuous treatment for 6 months or more or recurrent intermittent treatment where cumulative treatment equals or exceeds 6 months), the [International Council for Harmonisation] and FDA have generally recommended that 1500 subjects be exposed to the investigational product (with 300 to 600 exposed for 6 months, and 100 exposed for 1 year).

The original TRAILBLAZER was the only study to go past 52 weeks, and at the 1-year mark, there were at most 93 evaluable patients still on donanemab (Figure 1). With estimated enrollment of 1800 participants, it is unlikely that TRAILBLAZER 2 will meet same pitfall.

Figure 1. Donanemab Investor Presentation

Eli Lilly

If there were truly no other issues, then one concern might be safely laid to rest. Both TRAILBLAZERs’ primary endpoint (“PEP”) measures changes from baseline on the integrated AD Rating Scale (iADRS; scores range from 0 to 144, with lower scores indicating a greater cognitive deficit and greater impairment of the ability to perform activities of daily living). The iADRS was made up by Lilly scientists in 2015 and is ignored by pretty much everybody else. However, in the FDA’s guidance document on AD, the Agency states:

“An integrated scale that adequately and meaningfully assesses both daily function and cognitive effects in early AD patients is acceptable as a single primary efficacy outcome measure.”

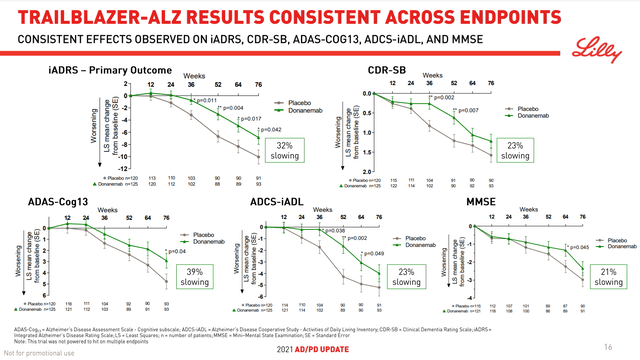

The iADRS was originally conceived in 2015 as a linear combination of the AD Assessment Scale-Cognitive 13-item subscale (ADAS-Cog13; score range 0 to 85) and the Alzheimer’s Disease Cooperative Study-instrumental Activities of Daily Living (ADCS-iADL items 6a and 7-23; score range 0 to 59) scales and subsequently refined to the current items. In the ADAS-Cog13, higher scores mean worse performance, while higher scores on the ADCS-iADL reflect better performance, so ADAS-Cog score is multiplied by (−1) to calculate the integrated scale. The 32% slowing on the iADRS represents an average difference of 3.20 points (−6.86 in the donanemab group versus −10.06 in the placebo group) on the 144-point scale.

As discussed in an earlier Biogen (BIIB) article, the pivotal trials for the only two marketed treatments to address a defining pathology of AD, Aduhelm and now Leqembi, demonstrated 22% and 27% reduced decline on the Clinical Dementia Rating-Sum of Boxes (CDR-SB) scale, respectively. It was further highlighted that the absolute score differences on the CDR-SB scale that ranges from 0 to 18 were 0.39 and 0.45 points, respectively, which cannot be detected by clinicians. Consequently, the drugs’ twin approvals give the impression that the FDA is easily swayed by big numbers.

Alternatively, it may be that the Agency is willing to accept that a treatment effect difference of 20%-30% is clinically meaningful, and longs are hopeful that the favorable view may extend to the iADRS. The last cited journal article also stated that a clinically meaningful decline was 5 points in patients with mild cognitive impairment due to AD and 9 points for patients who have AD with mild dementia. In other words, a clinician can’t tell the difference between two patients when one scored 3.2 points lower on the iADRS (worsened, but not clinically).

Obviously, TRAILBLAZER 2’s PEP can’t be negative, but relying on donanemab passing the CDR-SB secondary for confirmation is a very bad bet. A positive PEP isn’t necessarily a guarantee for approval either. After all, Lilly’s previous AD candidate, solanezumab, notched statistically significant improvements on the iADRS in all three Phase 3 studies in the EXPEDITION series. It is still awaiting results from a 4-1/2 year long Anti-Amyloid Treatment in Asymptomatic Alzheimer’s (A4) Study, which was supposed to complete at the end of 2022. Even a solid showing in A4 might not lift solanezumab out of developmental limbo.

To conclude, Lilly should not have allocated any resources or effort on the BLA, even as a publicity stunt, and just ended up wasting everyone’s time, including the government’s. It’s true that the CRL changes nothing. Nonetheless, management should attempt to resubmit the BLA and try for accelerated approval again if at all possible, which is all but assured for one of the most effective agents at plaque clearance ever seen. Otherwise, donanemab only has a slightly higher than 50% likelihood of market authorization with just a positive TRAILBLAZER 2 PEP, but those chances will be greatly buoyed by a win in at least one other key secondary measure. The odds are better with ADAS-Cog13, ADCS-iADL, or the Mini-Mental State Examination (MMSE).

Until a few months ago, Lilly would’ve been an adequate choice for a defensive biotech stock in a bear market, with respectable cash flows ($1.7 billion operation income in Q3), profit margins in the high 70’s which the company expects to maintain (earning an A+ on Seeking Alpha’s Quant system) and a passable 1.32% dividend yield (after a 15% increase in December). However, declining revenue growth and poor valuation in particular are too much to overlook, as every Seeking Alpha contributor has pointed out.

Investors are cautioned to hold and wait for Eli Lilly and Company regulatory actions expected this year for mirikizumab (ulcerative colitis), lebrikizumab (atopic dermatitis), and even empagliflozin (chronic kidney disease; marketed as Jardiance for diabetes and heart failure), as well as confirmatory readouts for donanemab and especially tirzepatide (obesity; marketed as Mounjaro for diabetes). All of these agents are in large markets and approvals (or label expansions for empagliflozin and tirzepatide) would boost Eli Lilly and Company sales and other metrics.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.