Summary:

- Eli Lilly and Company is a fast-growing and promising leading pharmaceutical company.

- Eli Lilly’s shares are expensive now, trading for almost 40 times future earnings.

- Therefore, Eli Lilly is priced for perfection, and in this volatile market, it is risky. Thus, Eli Lilly and Company shares are a HOLD.

JHVEPhoto

Introduction

As an investor focusing on dividend growth, I constantly seek new opportunities to invest in assets that generate reliable income. Whenever I find my existing holdings undervalued, I add to them to maximize my returns. Additionally, I take advantage of market volatility by initiating new positions that help diversify my portfolio and boost my dividend income with a lower amount of capital.

The healthcare sector is a dynamic and exciting investment area, offering a wide range of opportunities for growth and innovation. Eli Lilly and Company (NYSE:LLY), in particular, is an intriguing company that has established itself as a leader in developing life-changing drugs in various therapeutic areas such as diabetes, oncology, and neuroscience. The company has been on my watchlist, and it is time to revisit it.

I will analyze Eli Lilly and Company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide. It offers drugs for, among others, severe hypoglycemia, diabetes, cancer, rheumatoid arthritis, psoriasis, and more. The company collaborates with Incyte Corporation, Boehringer Ingelheim Pharmaceuticals, Inc, AbCellera Biologics Inc, Junshi Biosciences, Regor Therapeutics Group, Lycia Therapeutics Inc, Kumquat Biosciences Inc, Entos Pharmaceuticals Inc, and Foghorn Therapeutics Inc.

Fundamentals

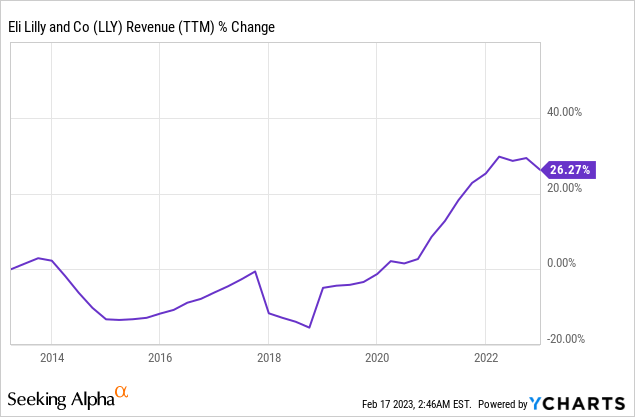

Over the last decade, Eli Lilly has shown some revenue growth over the last decade, with revenues up by 26%. The company has achieved this growth by combining organic and inorganic strategies. Eli Lilly has invested heavily in research and development, which has led to the development of innovative new drugs, such as Verzenio, Emgality, and Trulicity. These drugs have helped to drive the company’s organic growth by expanding its product portfolio and entering new therapeutic areas. Additionally, the company has pursued inorganic growth strategies, such as acquiring Akouos, a gene therapy company focusing on hearing loss.

In the future, as seen on Seeking Alpha, the analyst consensus expects Eli Lilly to keep growing sales at an annual rate of ~15% in the medium term.

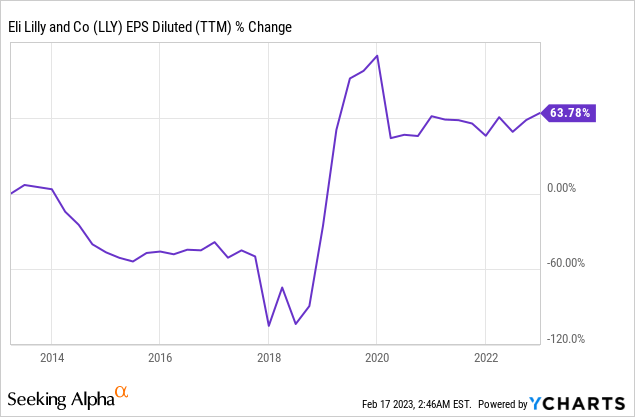

In addition to solid revenue growth, Eli Lilly has also seen an impressive EPS (earnings per share) increase, which has grown at an even faster pace of 64% over the past decade. The company achieved this growth through a variety of measures. Eli Lilly has consistently lowered the number of shares outstanding through share buybacks. The company has also increased its sales, particularly in key markets such as the United States, Europe, and Japan. Furthermore, Eli Lilly has improved its margins by streamlining its operations, cutting costs, and increasing its efficiency. In the future, as seen on Seeking Alpha, the analyst consensus expects Eli Lilly to keep growing EPS at an annual rate of ~25% in the medium term.

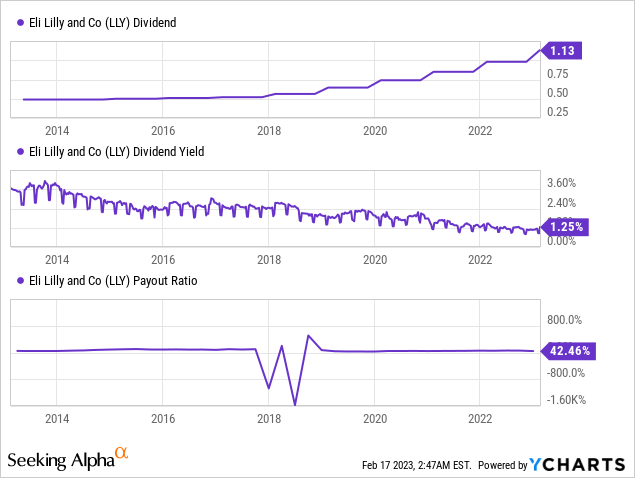

Eli Lilly is a solid dividend growth stock with a track record of 8 consecutive years of dividend growth and over 30 years of uninterrupted dividend payments. The company’s current yield may appear relatively low at 1.25%, but it is pretty safe, with a payout ratio of just 42%. Furthermore, given the company’s impressive earnings growth trajectory, there is plenty of room for future dividend growth. This growth in earnings should translate to higher dividends for investors, making Eli Lilly an attractive option for those seeking a growing dividend income.

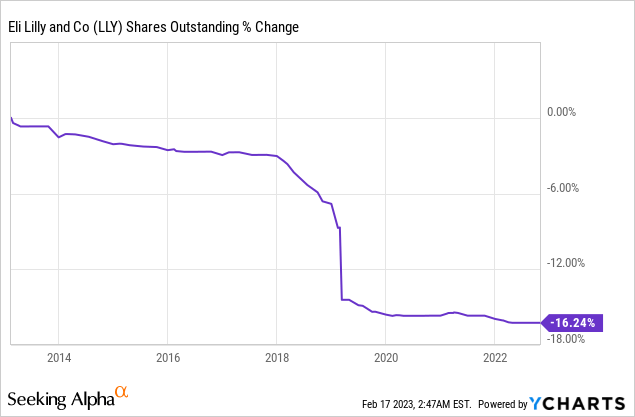

In addition to paying dividends, Eli Lilly returns capital to its shareholders through share buybacks. In 2022, the company bought back over $1.5 billion worth of shares, contributing to a decrease of 16% in the number of shares outstanding over the past decade. Buybacks can efficiently return capital to shareholders, mainly when the share price is attractive. However, given the current valuation of Eli Lilly, which is trading at a premium to the broader market, the company’s focus on dividends makes more sense.

Valuation

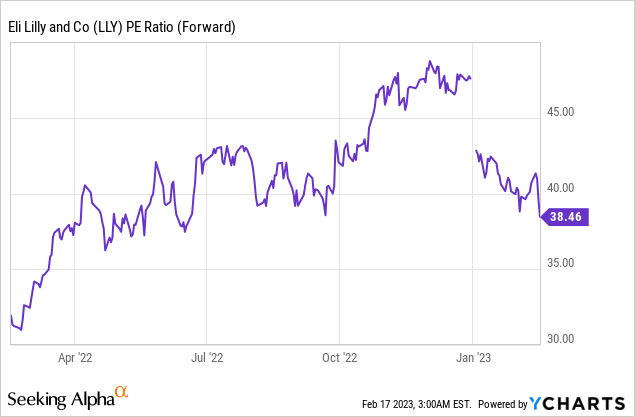

While Eli Lilly has been a strong performer over the past few years, its current P/E (price to earnings) ratio is relatively high at almost 40 when using the 2023 earnings estimates. This suggests that the shares are priced for perfection, with the market expecting superb execution from the company in the coming years. While this is certainly possible, it leaves little room for error, and any missteps could result in a significant decline in the stock price. The current valuation of Eli Lilly is higher than that of many growth companies, which suggests that the market has high expectations for the company’s future earnings growth.

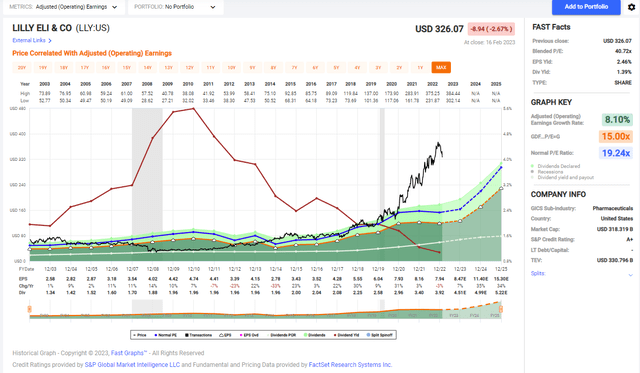

The graph below from FAST Graphs emphasizes how high the price of Eli Lilly is. The average P/E ratio of the company was 19 over the last twenty years, and the current valuation is more than twice the average. The faster expectations for growth are not enough to justify such a rich valuation. You can see on the graph how in 2020, the share price of Eli Lilly disconnected from its average valuation, and this may be a risky position for investors.

To conclude, Eli Lilly is a healthcare company that has experienced significant growth in revenue and earnings per share. The company is a reliable dividend growth stock focusing on returning capital to shareholders through buybacks and dividends. However, investors should be aware of the high current valuation of the company, which suggests that the shares are priced for perfection and leave little room for error.

Opportunities

Eli Lilly and Company is a leading pharmaceutical company that has been in operation for over 145 years. The company has a global presence in more than 125 countries worldwide. The company has a wide range of products in various therapeutic areas, such as diabetes, oncology, neuroscience, and immunology. Eli Lilly’s global and product diversification allows the company to have a broad market reach, which provides it with a level of resilience against market fluctuations and economic downturns. This diversification is a critical strength for Eli Lilly, enabling the company to mitigate risks and capitalize on opportunities in different geographies and therapeutic areas.

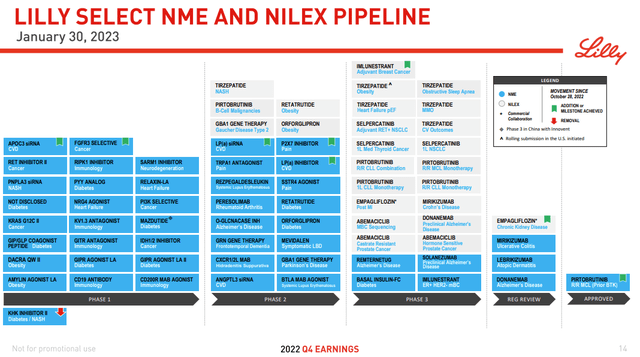

Eli Lilly has a robust pipeline of drugs in different stages of development. The company invests significantly in research and development, with an annual R&D budget of over $6.5 billion in 2022. This investment has led to the developing of several promising products in various therapeutic areas. The company’s pipeline includes over 70 potential new drugs and indications, which gives it a significant advantage over its competitors. The pipeline is well-balanced, with possible early, mid, and late-stage development products.

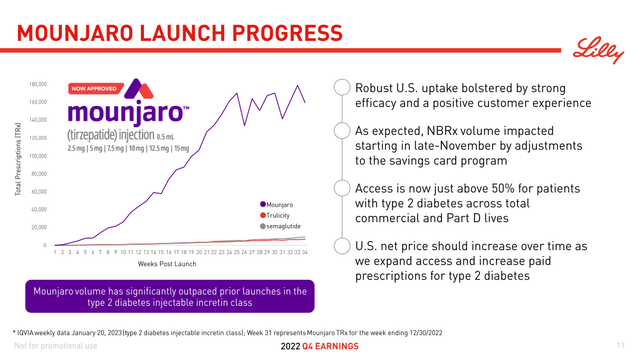

One of the most promising products in Eli Lilly’s portfolio is the recently launched Mounjaro, a drug for treating diabetes and, in the future, obesity. Mounjaro is a once-weekly injectable drug that regulates blood sugar levels and reduces body weight. The drug has shown promising results in clinical trials, with significant reductions in HbA1c levels and body weight observed, and since its launch, patients and doctors are content with the results. Diabetes and obesity are two considerable health challenges affecting millions worldwide.

Risks

Investing in Eli Lilly and Company also comes with risks that investors should consider. One of the primary risks of investing in Eli Lilly is competition. The pharmaceutical sector is highly competitive, with numerous companies vying for market share. Eli Lilly faces competition from other pharmaceutical giants, such as Pfizer (PFE), Merck (MRK), and Novartis (NVS), with similar product offerings in various therapeutic areas. This competition could lead to price pressures, lower market share, and reduced profitability for Eli Lilly.

Another significant risk of investing in Eli Lilly is the lack of margin of safety due to its high valuation. Eli Lilly’s stock has had a strong performance in recent years, with the company’s market capitalization reaching over $320 billion. This high valuation means that there is a risk that the stock may not offer a sufficient margin of safety for investors, as the company’s future growth prospects may already be priced into the stock. As a result, investors need to be cautious about investing in Eli Lilly.

A third risk of investing in Eli Lilly is execution risk. While analysts expect the company’s growth to accelerate in 2024 and 2025, there is still significant uncertainty before reaching these projections. Eli Lilly’s success will depend on the company’s ability to execute its growth strategies effectively and the success of its pipeline. It includes bringing new drugs to market, expanding its global reach, and managing its costs and margins. Failure to execute these strategies effectively could result in lower growth rates, reduced profitability, and negative market sentiment.

Conclusions

Eli Lilly and Company is a fantastic healthcare company with solid fundamentals and excellent growth opportunities. However, there are competitive and execution risks to consider in this business. While the company is a reliable dividend growth stock, its current high valuation leaves no room for error. It may not attract more conservative investors seeking stable growth and a decent entry point.

Therefore, given the potential risks and the high current valuation of Eli Lilly and Company, I believe that LLY shares are a HOLD and should be watched for a better valuation as a more appropriate entry point. While the company has solid fundamentals and growth opportunities, investors must be patient and wait for a more attractive option to invest in this company. I will revisit Eli Lilly and Company in a few months or sooner if there is higher volatility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.