Summary:

- META embarked on drastic cost reduction measures while similarly investing in AI capabilities.

- Much progress had been witnessed indeed, through the optimization of its workforce and reduced operational spending.

- Notably, we may see META operate with a leaner workforce moving forward due to the improved productivity and efficiency of the AI tools.

- This strategy could eventually expand META’s FCF generation to $25B in 2023, suggesting an excellent increase of 31.3% YoY from $19.04B.

fcafotodigital/E+ via Getty Images

We previously covered Meta Platforms, Inc. (NASDAQ:META) here in January 2023. The focus was on WhatsApp Pay, one of META’s key products with massive monetization potential. The platform might deliver up to $22B in revenue over the next few years, due to the strategic partnerships in India, Brazil, and potentially in the U.S. While the fintech segment was still in its nascency, an aggressive market grab exercise might yield surprisingly robust results, attributed to the company’s global social media market share of 78.29% in December 2022.

For this article, we will be discussing META’s FQ4’22 earnings call, particularly the strategic tagline for 2023 to be a “Year Of Efficiency.” Much progress has been witnessed indeed, through the optimization of its workforce, reduced operational spending, and expanded deployment of AI capabilities. We think this could naturally trigger improved margins and profitability in 2023, sustaining the recovery of its stock prices moving forward.

META’s “Year Of Efficiency” Thesis Proves Robust

As part of the dual strategy to be a better and more profitable technology company, META had embarked on drastic cost reduction measures while similarly investing in AI capabilities.

The company laid off 11K of its headcount, trimming its workforce by -13% while freezing new hires through FQ1’23. By FQ4’22, it reported over 86.4K employees, with the finalized number expected by FQ1’23 and flat growth anticipated throughout 2023.

Interestingly, Mark Zuckerberg had highlighted in the earnings call that the deployment of AI tools might eventually result in lower headcount ahead, due to the improved productivity and efficiency. The company had already flattened its organization structure by removing managerial positions, attributed to the layoffs thus far.

As a result, the CEO expected to achieve improved information inflow and faster decision making, in favor of a faster working environment.

The strategy was also visible in META’s choice to using larger generative AI models, which were inherently more efficient due to the use of an optimized foundational model and the centralized location of the GPUs. One notable example is MultiRay, developed by the company’s engineers to improve and expand Machine Learning outcomes in myriad of end uses.

While AI had directly improved its Reels performance with higher ROIs, lower cost per purchase, and helped lift sales in FQ4’22, META also optimized its data center design with a more efficient architecture for both AI and non-AI workloads. With GPUs achieving 3x faster speeds than CPUs, it made sense that the company had recently transitioned to GPU-based data centers, due to the inherent improvement in cost and performance efficiency.

Prices for GPUs had also moderated from hyper-pandemic levels, with Nvidia’s (NVDA) DGX A100 systems now costing as little as $149K, down -25.1% compared to $199K during its debut in 2020. This matters indeed, since META deployed NVDA’s A100 for the Research SuperCluster super computer in California, with a total capacity for up to 16K GPUs. As an interesting comparison, the supercomputer used by Microsoft (MSFT) to train OpenAI’s ChatGPT utilizes 10K NVDA GPUs.

Therefore, it made sense that META had cut down on its planned 2023 capital expenditure from the original guidance of up to $39B, to between $30B and $33B, compared to 2022 levels of $33B and 2021 levels of $19B.

This optimization strategy may eventually expand its 2023 Free Cash Flow generation to $25B, suggesting an excellent YoY increase of 31.3% from $19.04B, though still lacking compared to FY2021 levels of $38.99B. However, any progress is welcome indeed, especially one as promising as META’s thus far.

So, Is META Stock A Buy, Sell, Or Hold?

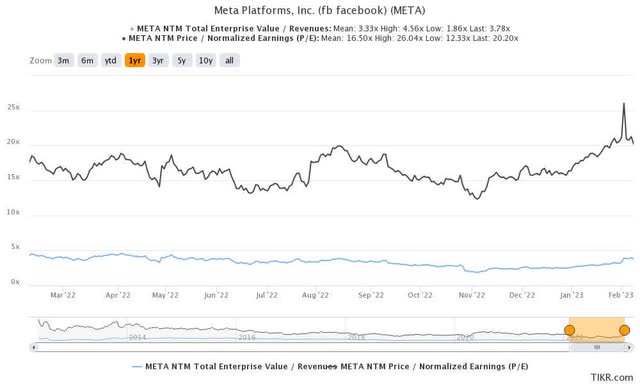

META 1Y EV/Revenue and P/E Valuations

META is currently trading at an EV/NTM Revenue of 3.78x and NTM P/E of 20.20x, lower than its 3Y pre-pandemic mean of 8.07x and 24.68x, respectively. Otherwise, it is notably higher than its 1Y mean of 3.33x and 16.50x, respectively.

Based on its projected FY2024 EPS of $11.12 and current P/E valuations, we are looking at an aggressive price target of $224.62. This nears the consensus estimate target of $210 as well, suggesting a minimal 14.4% upside potential from current levels.

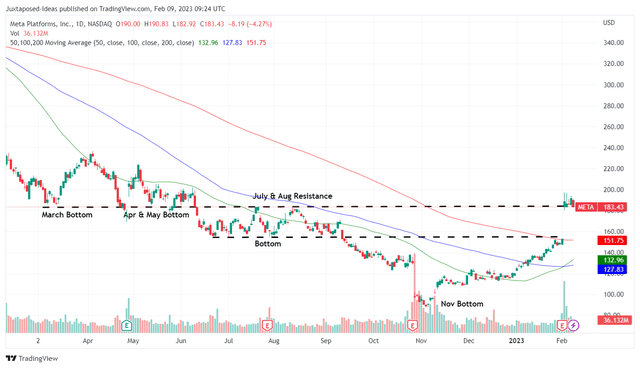

META 1Y Stock Price

This is unsurprising, since META recorded a tremendous stock rally of 19.7% to $183.43 over the past few days. Otherwise, a total of 106.3% since the November bottom of $88.91. The stock had impressively broken through the previous September bottom of $155 and hit the August resistance level of $180 in one fell swoop indeed.

However, it remains to be seen if the stock is able to sustain this level of optimism, since the macroeconomic outlook is still uncertain, suggesting a weaker advertising demand in the short term. Its FQ4’22 performance had been underwhelming at revenues of $32.17B and EPS of $1.76, against market estimates of $31.55B and $2.26, respectively. However, we must also emphasize that forex issues contributed to a -$2B revenue headwind.

On the other hand, META’s FQ1’23 revenue guidance is decent between $26B and $28.5B, against estimates of $27.18B. The projected expenses of between $89B and $95B proves the management is serious about the “Year of Efficiency” in 2023 as well, due to the notable decrease from the original guidance of up to $101B.

Additionally, this implies a minimal increase of 8.2% from 2022 levels of $87.8B (down from the original guidance of up to $97B), compared to the 23.3% YoY expansion reported in 2022 from $71.2B in 2021. Combined with the $50.87B in the stock repurchase program (including $10.87B of existing and $40B from new authorization), it is unsurprising that the stock has rallied as much as it has.

Nonetheless, with the META stock trading above its 50-day moving averages, investors looking to add here must be very careful indeed. For now, patience may prove prudent, as this optimism may be digested over the next few weeks.

Therefore, we prefer to rate the META stock as a Hold for now. As a fellow contributor had mentioned, The Party Has Started But You’re Late.

Disclosure: I/we have a beneficial long position in the shares of META, MSFT, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.