Summary:

- GOOG’s stock price is near its 2Y lows after the Bard mishap, providing investors a chance to subsequently reduce their dollar cost averages.

- The company is more than a search engine, with YouTube’s 2.56B MAU, Google Cloud’s growing RPO, and Google Play’s 32.8% market share.

- Combined with the robust FY2022 revenues of $282.83B and net income of $59.97B, GOOG remained the largest advertising company globally.

- Mishaps like Bard might only fuel the company’s speed and rate of innovation moving forward.

- As a result, investors should take advantage of this correction while it lasts.

Deagreez

We previously covered Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) here in January 2023. At that time, GOOG’s search engine moat had been questioned by many market analysts and SA contributors alike, due to the exciting arrival of ChatGPT. The company had consequently launched a “code-red” operation to counter the perceived threat, representing a potential technological and experiential revolution in the search engine model moving forward.

For this article, we will be focusing on GOOG’s short-term prospects, particularly the market’s pessimistic reaction to the Apprentice Bard mishap. While the company’s AI event might appear hasty and reactive to ChatGPT, OpenAI’s offering posed no real threat to the advertising giant’s core business model in our view. The company is more than a search engine.

GOOG Is A Definite Buy During This Deep Correction

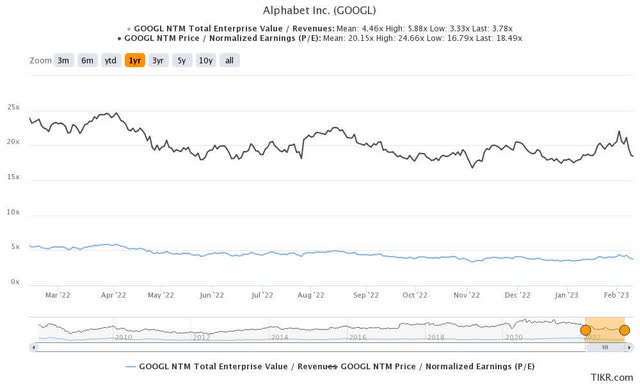

GOOG 1Y EV/Revenue and P/E Valuations

GOOG is currently trading at an EV/NTM Revenue of 3.78x and NTM P/E of 18.49x, lower than its 3Y pre-pandemic mean of 4.63x and 25.08x, respectively. Otherwise, it is still lower than its 1Y mean of 4.46 and 20.15x, respectively.

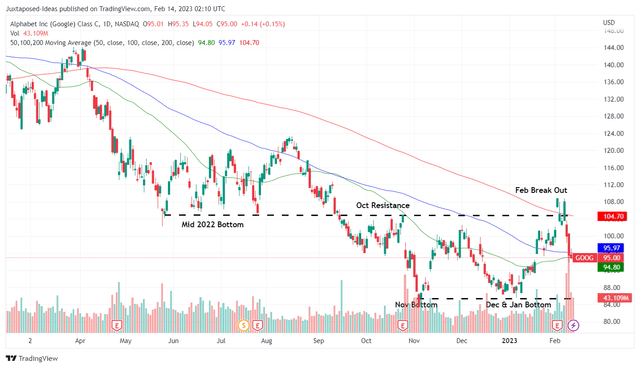

GOOG 1Y Stock Price

The pessimism was not surprising due to the surge in trading volume by 4x in the past few days, with the GOOG stock losing -12.1% of its value after the Apprentice Bard mishap.

Microsoft (MSFT) had backed OpenAI with another $10B investment, potentially becoming the largest shareholder with a 49% stake. Alibaba (BABA), Baidu (BIDU), and JD.Com (JD) are reportedly in the process of integrating a ChatGPT-like tool into their technological offerings as well, including their search engines, online education business, and communication platforms, amongst others.

It was evident that many tech companies had thrown caution into the wind and embraced these AI tools, come what may, despite the potential pitfalls that might arise from the hasty integrations. GOOG’s public demo on February 8, 2023 painfully demonstrated the possibility of inaccurate or ambiguous answers.

It appears GOOG now bears the brunt of Mr. Market’s FUD (fear, uncertainty, and doubt) despite the stellar advertising revenues, as the company seeks to evolve from a simple search engine to a knowledge-based platform by generating its own answers/ insights through its AI tools.

As previously discussed in our January article, it would be open to massive “reputational risks, since the AI chatbot had been known to mimic human speech from the internet, propagating certain forms of hate speech, fake news, racist/sexist remarks, with a large degree of informational inaccuracy as well.” Otherwise, this phenomenon had been termed as “a hallucination of answers” by Adam Rogers from Insider.

However, we reckon the fears are overblown indeed, since GOOG’s AI strategy is not limited to Apprentice Bard alone. The company had long propagated the use of Artificial Intelligence in its Google Search capabilities. This was through the introduction of BERT in 2018 – expanding the linguistics complexity of its search function and MUM in 2021 – including various languages/ video search functions.

The recent AI event also allowed the company to introduce new AI features, which sought to engage users through Google Maps and Lens, enabling search features through their phone cameras. Market analysts unfortunately seemed to deem the AI event as unexciting, thus in part explaining the decline in its stock prices. However, we reckon that there are more chances for GOOG to shine, naturally after a much needed retrospection.

The sense of urgency was apparently felt even by GOOG founders, whom had returned to “review the company’s artificial intelligence products,” suggesting its frenetic pace for AI investments/ research ahead. Notably, the company had many hidden cards up its sleeves as highlighted by The New York Times, including:

- Image Generation Studio, to create and edit images.

- Shopping Try-on, to create backgrounds through a YouTube green screen feature.

- MakerSuite, to aid other businesses in creating their own AI prototypes.

- Colab + Android Studio, to generate codes for Androids devices.

- Others: a wallpaper maker for the Pixel smartphone; an application called Maya that visualizes three-dimensional shoes; and a tool that could summarize videos.

For now, with 92.9% in the search engine market share, GOOG could still afford to share some of the limelight, especially since it recorded $162.45B (+9.1% & $13.5B YoY) of revenue from Google Search & Others in FY2022.

Why do we say that? We believe that the pessimism surrounding GOOG’s Apprentice Bard and stock price may light the appropriate fire under the management’s and engineers’ feet towards a more innovation-focused path.

While it is unknown if the hasty strategy will eventually turn out positively for the company, the enemy has thrown the first punch indeed, leaving GOOG with no choice but to respond. Perhaps this was why the recent AI event appeared unprepared and painfully reactionary to ChatGPT’s success thus far.

Further risks included AI legal regulations from the US and EU as well, as a result of the potential “misinformation, harmful content, bias, or copyright” issues. GOOG was no stranger to government inquiries and lawsuits indeed, with the company paying $4.12B of anti-trust fines in the EU, $391.5M in the US, and $113M in India in 2022 alone.

While headwinds remained with the departure of its long-term AI engineers in favor of start-ups, GOOG was still the largest media company in the world, with advertising revenues of $224.47B (+7.1% YoY) in FY2022. This easily trumped the company in second place, Meta Platforms, Inc. (META), by 92.4% at $116.61B (-1% YoY).

In addition, GOOG offers so much more than a search engine indeed. Its short and long-format video platform, YouTube, continued to command excellent advertising impressions. As the second largest social media platform globally, it boasted 2.56B monthly active users in 2022. Naturally, META commanded the top spot with 3.7B across its Family of Apps, including Facebook, Instagram, and WhatsApp.

Furthermore, Google Cloud similarly reported a market share of 11% in FQ4’22, despite the notable lag against MSFT’s Azure at 23% and Amazon’s (AMZN) AWS at 33%. While trailing behind AWS’s Remaining Performance Obligation [RPO] of $110.4B (+5.8% QoQ from $104.3B & +37.3% YoY from $80.4B), Google Cloud’s numbers of $64.3B in FQ4’22 (+22.7% QoQ from $52.4B and +26% YoY from $51B) were notably improved compared to MSFT’s at $15.82B by the latest quarter (-8.5% QoQ from $17.29B & +8.8% YoY from $14.54B).

Google Play also comprised a large part of GOOG’s success, since it recorded $31.7B of revenues by the first three quarters of 2022 ($21.3B in H1’22 and $10.4B in Q3’22), comprising 32.8% of the global consumer spending in games and apps then. While the detailed breakdown for Q4’22 had yet to be released by Sensor Tower, 2022 total app spending was estimated at $167B, with GOOG expected to record up to $50B in app revenues. These number implied the company’s excellent revenue diversification from the search engine indeed.

Lastly, Google Search had been the default search engine on Safari for iOS and Android phones alike. The special arrangement with Apple (AAPL) reportedly cost GOOG $1B in 2014, a sum which grew to $3B by 2017, $15B in 2021, and speculatively $20B in 2022. With the iOS contributing approximately 50% or ~$80B to the company’s annual advertising revenues, it was unsurprising that experts expected the current agreement to remain in place moving forward.

In the meantime, OpenAI had also started to monetize its platform with a monthly subscription fee of $20, leading to our aggressive annual revenue projection of $24B, assuming that 100M of its users signed up the premium service. While the paid service had only been introduced in the US, a global launch might come sooner than later.

However, we remained uncertain that there would be much impact on GOOG’s search platform. A similar free-service has been launched by MSFT through Bing and our early tests indicate that the user experience has been decent enough.

On one hand, we prefer the Google experience, due to the ease of integration with Google Drive and Photos. On the other hand, we have also been using MSFT’s Outlook for our email needs. Only time will tell which search engine will prevail as the winner indeed.

As a result of the factors discussed above, we continue to rate the GOOG stock as a Buy here with a price target of $112.78, based on the projected FY2024 EPS of $6.10 and its current P/E valuations. This nears the consensus target of $124 as well, suggesting an excellent 31.1% upside potential from current levels.

Bottom fishing investors may attempt waiting for a below $90 entry point, attributed to the previous support level in the mid $80s in November 2022. However, these levels already provide a rare chance to reduce investors’ dollar cost averages, with the stock trading at its 2Y lows, thanks to the Apprentice Bard mishap. Do not miss this chance!

Disclosure: I/we have a beneficial long position in the shares of GOOG, AMZN, MSFT, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.