Summary:

- The Eli Lilly and Company diabetes upstart was on fewer formularies than reported.

- Less coverage meant lower Eli Lilly and Company sales, contributing to a revenue miss in Q4.

- In oncology, a label expansion could continue the outperformance of Verzenio.

ALIOUI Mohammed Elamine/iStock via Getty Images

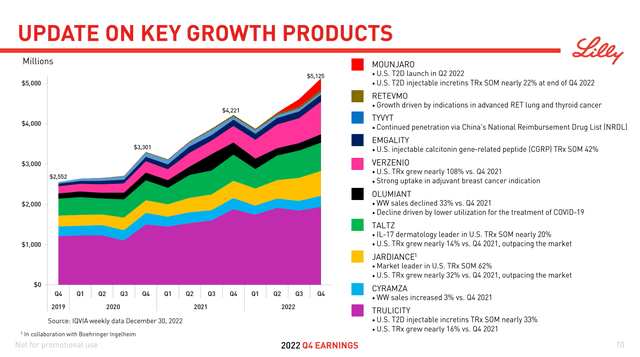

On February 2, Eli Lilly and Company (NYSE:LLY) announced its financial results for the fourth quarter of 2022. The mixed earnings report hasn’t caused share prices to deviate from the general market movement, although there was some initial momentum due to EPS guidance exceeding Wall Street expectations at the time. The company highlighted their top 10 brands, which generated $5.1 billion and 70% of the company’s total Q4 revenues (Figure 1).

Of these key products, the largest earner by far, Trulicity ($5.7 billion in 2022 U.S. sales, latest patent expiry in 2027) and #4 Jardiance ($1.2 billion, 2028) are the most vulnerable to loss of exclusivity this decade. Longs should hope for continued growth from the rest of the group to make up for the potential shortfall. In particular, broader uptake from insurers for Mounjaro (Tirzepatide) would help the most.

Figure 1. Q4 2022 Lilly Presentation.

Coverage was explored at the 15 largest health insurance companies in the U.S. overall. Combined, these payors control 59% market share, with 38 million covered lives as of 2021. The most common plan was examined when possible and are specified in Table 1. If the insurer offered non-Medicare prescription drug plans (“PDP”) in a state Marketplace (Obamacare), the most populous state was chosen (California > Texas > Florida). Humana (HUM) doesn’t do Exchanges, so their Medicaid plan and that of Blue Cross and Blue Shield of Texas are the only ones in the survey.

How to read Table 1:

Tier # Higher Tiers have higher cost share. Drugs in Tier 4 or higher (in 5+-Tier plans) are non-preferred brands and may also include drugs recently approved by the FDA or specialty drugs and may need special handling. Specialty drugs are used to treat difficult, long-term conditions and may need to get filled through a specialty pharmacy.

PA Prior authorization is the process of obtaining approval of benefits before certain prescriptions may be filled.

NF A non-formulary drug is not included on a plan’s Drug List. Exception processes such as PA or Step Therapy could be available to request coverage for a NF drug.

X Not Covered drugs are specifically excluded from coverage by the terms of the plan. Patients likely won’t get any reimbursement and will have to pay out-of-pocket for these drugs.

Table 1. 2023 Coverage of Eli Lilly’s Recent Growth Products at the 15 Largest Health Insurance Companies in the U.S.

|

Rank |

Commercial health insurance plans |

Mounjaro |

Retevmo |

Emgality |

Olumiant |

Verzenio |

|

1 |

Kaiser Permanente [Southern CA Commercial HMO 3-Tier] |

x |

x |

x |

x |

x |

|

2 |

Elevance Health (Anthem) National Drug List 5-Tier |

NF |

NF PA |

3 PA |

NF PA |

5 PA |

|

3 |

Health Care Service Corporation |

|||||

|

BCBS Illinois Basic Drug List |

x |

5 PA |

3 PA |

x |

5 PA |

|

|

BCBS Montana Basic Drug List |

x |

5 PA |

3 PA |

x |

5 PA |

|

|

BCBS New Mexico Basic Drug List |

x |

5 PA |

3 PA |

x |

5 PA |

|

|

BCBS Oklahoma Basic Drug List |

x |

5 PA |

3 PA |

x |

5 PA |

|

|

BCBS Texas Basic Drug List |

x |

5 PA |

3 PA |

x |

5 PA |

|

|

4 |

UnitedHealth [CA Traditional 4-Tier] |

2 PA |

4 PA |

2 PA |

2 PA |

2 PA |

|

5 |

Centene [Health Net Essential Rx Drug List] |

x |

4 PA |

2 PA |

x |

4 PA |

|

6 |

CVS Health (Aetna Standard Opt Out) |

3 |

4 |

2 |

5 |

5 |

|

7 |

GuideWell (Florida Blue) ValueScriptRx |

x |

5 PA |

5 PA |

x |

5 PA |

|

8 |

Blue Cross Blue Shield of Michigan [BCN HMO] |

2 |

4 PA |

3 PA |

5 PA |

4 PA |

|

9 |

Highmark Healthcare Reform Comprehensive 3-Tier Incentive |

2 |

3 PA |

2 PA |

3 PA |

2 PA |

|

10 |

Blue Cross of North Carolina Enhanced 5 Tier |

3 PA |

4 PA |

2 PA |

4 PA |

4 PA |

|

11 |

Humana Rx5 |

3 |

5 PA |

x |

x |

5 PA |

|

12 |

Blue Cross and Blue Shield of Alabama Blue Saver Bronze |

x |

5 |

3 |

6 |

5 |

|

13 |

Blue Cross Blue Shield of Massachusetts |

2 |

4 PA |

5 PA |

x |

4 PA |

|

15 |

Independence Health Group [Value formulary 5-tier] |

3 |

5 PA |

3 PA |

5 PA |

5 PA |

|

Rank |

Health Insurance Marketplace plans |

Mounjaro |

Retevmo |

Emgality |

Olumiant |

Verzenio |

|

1 |

Kaiser Permanente [CA Marketplace] |

x |

x |

x |

x |

x |

|

2 |

Elevance Health (Anthem) CA Select Drug List |

NF |

NF PA |

2 PA |

NF PA |

NF PA |

|

3 |

Health Care Service Corporation |

|||||

|

BCBSIL 6 Tier HIM Drug List |

x |

5 |

3 |

6 |

5 |

|

|

BCBSMT 6 Tier HIM Drug List |

x |

5 |

3 |

6 |

5 |

|

|

BCBSNM 6 Tier HIE Drug List |

x |

5 |

3 |

6 |

5 |

|

|

BCBSOK 6 Tier HIM Drug List |

x |

5 |

3 |

6 |

5 |

|

|

BCBSTX STAR & STAR Kids |

2 PA |

2 PA |

2 |

2 PA |

2 PA |

|

|

4 |

UnitedHealth Group [TX QHP Standard] |

2 PA |

NF |

NF |

4 PA |

NF |

|

5 |

Centene [Health Net CA Essential Rx Drug List] |

x |

4 PA |

2 PA |

x |

4 PA |

|

6 |

CVS Health (Aetna Health Exchange Plan: CA) |

x |

x |

x |

x |

x |

|

7 |

GuideWell (Florida Blue) ValueScriptRx |

x |

5 PA |

5 PA |

x |

5 PA |

|

8 |

Blue Cross Blue Shield of Michigan [BCN HMO] |

2 |

4 PA |

3 PA |

5 PA |

4 PA |

|

10 |

BCBS North Carolina Essential Q |

x |

5 |

3 |

6 |

5 |

|

11 |

Humana [FL Medicaid Preferred Drug List] |

x |

x |

2 |

x |

2 |

|

12 |

Blue Cross and Blue Shield of Alabama Blue Saver Bronze |

x |

5 |

3 |

6 |

5 |

|

14 |

Molina Healthcare [CA Marketplace] |

x |

x |

2 |

x |

x |

|

Rank |

Medicare Prescription Drug Plans |

Mounjaro |

Retevmo |

Emgality |

Olumiant |

Verzenio |

|

1 |

Kaiser Permanente |

5 |

5 |

x |

5 |

5 |

|

2 |

Anthem Blue Cross MedicareRx [B5] |

x |

5 PA |

3 PA |

x |

5 PA |

|

3 |

Health Care Service Corporation |

|||||

|

BCBS Illinois Blue Cross MedicareRx Basic |

x |

5 PA |

3 PA |

x |

5 PA |

|

|

BCBS Montana Medicare Advantage Classic PPO |

x |

5 PA |

3 PA |

x |

5 PA |

|

|

BCBS New Mexico MedicareRx Basic |

x |

5 PA |

3 PA |

x |

5 PA |

|

|

BCBS Oklahoma MedicareRx Basic |

x |

5 PA |

3 PA |

x |

5 PA |

|

|

BCBS Texas MedicareRx Basic |

x |

5 PA |

3 PA |

x |

5 PA |

|

|

4 |

UnitedHealth [AARP MedicareRx Walgreens PDP] |

x |

5 PA |

x |

x |

5 PA |

|

5 |

Centene [Wellcare Value Script PDP] |

x |

5 PA |

3 PA |

x |

5 PA |

|

6 |

CVS (Aetna) [SilverScript Choice PDP] |

x |

5 PA |

x |

x |

5 PA |

|

7 |

GuideWell (Florida BlueMedicare Premier Rx) |

x |

5 PA |

3 PA |

x |

5 PA |

|

8 |

BCBS of Michigan Prescription Blue PDP Select |

x |

5 PA |

3 PA |

x |

5 PA |

|

9 |

Highmark Performance Formulary |

3 PA |

5 PA |

3 PA |

5 PA |

5 PA |

|

10 |

BCBS North Carolina Blue Medicare Rx Standard |

x |

5 PA |

3 PA |

x |

5 PA |

|

11 |

Humana Basic Rx Plan PDP |

3 |

5 PA |

4 PA |

x |

5 PA |

|

12 |

BCBS Alabama BlueRx Essential |

x |

5 PA |

3 PA |

x |

5 PA |

|

13 |

Blue Cross Blue Shield of Massachusetts |

x |

5 PA |

x |

x |

5 PA |

|

14 |

Molina Medicare Choice Care (HMO) |

x |

5 PA |

x |

x |

5 PA |

|

15 |

Independence Keystone 65 Basic Rx HMO |

NF |

5 PA |

5 PA |

5 PA |

5 PA |

Approved last May, Mounjaro is hampered by suboptimal coverage. The drug did make it in time onto the all-important Standards of Care in Diabetes-2023 (Abridged for Primary Care Providers), published by the American Diabetes Association in December. At the earnings call, Lilly Chief Financial Officer Anat Ashkenazi declared that, “As of January 1st, access stands just over 50% for patients with type 2 diabetes across commercial and Part D.” This claim appears true at the commercial level, but not for Medicare, where Mounjaro appeared on only two PDPs out of the Top 10, and 4 lists overall.

Because of its early launch phase, this means last quarter the drug was on that many or fewer formularies. Despite its superiority to Ozempic 1mg by diabetes archrival Novo Nordisk (NVO), many probably consider Mounjaro as just a slightly more potent incretin mimetic, and there is no head-to-head versus higher strengths of Ozempic. Some may even be holding off for results on cardiovascular and renal endpoints.

Novo Nordisk’s market domination of the incretin-based drugs market has so far been prevented by Ozempic’s ongoing global shortage. This is exacerbated by social media extolling the weight loss benefits of the Wegovy brand. Doctors aren’t really discerning about the differences at the higher doses (to them it’s all the same semaglutide), pharmacies don’t want to upset the weight loss crowd by trying to reserve Ozempic for diabetes patients, and insurers don’t restrict by diagnosis codes, all leading to rampant off-label use. Some pharmacists may then suggest Mounjaro when doctors ask for alternatives, but that may not be enough.

It is clear that, at the least, Lilly would do well to invest resources identifying and targeting prominent social influencers who have type 2 diabetes. A company is limited by the FDA to whatever’s in the label when dealing with prescribers, and there’s a gray area when communicating information with non-prescribing individuals. Nonetheless, Kaiser Permanente, known for its integration of care and focus on cost-effectiveness, sees some off-label value for Mounjaro. While it’s not yet indicated for weight loss, Kaiser, after prior authorization, allows up to four months of Mounjaro use for chronic weight management of patients who don’t necessarily have diabetes.

The other products, having been around longer, have good to great coverage, with Olumiant lacking on the Medicare side. Turning to the other agent mentioned on the call, Chief Scientific and Medical Officer Dan Skovronsky finally revealed the submission a supplemental New Drug Application (“sNDA”) for Verzenio in adult patients with hormone receptor (“HR”)-positive, human epidermal growth factor receptor 2 (HER2)-negative, node-positive, early breast cancer (“BC”) at high risk of recurrence. If the FDA expands the label beyond the currently indicated cohort of Ki-67 score ≥20%, it could double the number of early BC patients eligible to receive Verzenio. The review is likely to be positive, given that the absolute improvement of invasive disease-free survival rate (6.4%) compared to placebo increased after 4 years of follow up from the previous 2-year (2.8%) and 3-year (4.8%) interim rates.

To conclude, Mounjaro’s placement on PDP’s is a glass half-empty/half-full scenario. It has done well with its coverage, but could do much better. Jaypirca will undergo formulary evaluation in the next couple of months and will be reported on accordingly. The likelihood of sNDA approval will definitely bolster future Verzenio sales, but the review can take up to 10 months, so the benefit will be seen in 2024 and beyond.

Finally, the good and bad points about the company remain largely unchanged from last month’s coverage. However, the catalysts mentioned remain, and if positive, along with any formulary “wins” for Mounjaro, might be enough to nudge Eli Lilly and Company stock from Hold to Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.