Summary:

- While TSLA chose to aggressively cut its prices to chase market share, FQ1’23 might bring unsatisfactory top and bottom line results in our view.

- Based on our estimates, the company could deliver FQ1’23 revenues of $23.9B (-1.6% QoQ & +27.4% YoY) and EPS of $0.90 (-24.3% QoQ & -15.8% YoY).

- Naturally, it is entirely possible that TSLA may push out just enough volume to counter the notable gap in margins, due to Shanghai’s projected weekly output of 20K vehicles.

- However, with the stock already recording a tremendous recovery thus far, we reckon that it may be more prudent to exercise some caution here.

koyu/iStock via Getty Images

TSLA’s Potential Margin Compression In FQ1’23 Is A Real Concern

Tesla, Inc. (NASDAQ:TSLA) has reigned king in the global EV market, particularly attributed to the tremendous volume growth and stellar margins thus far.

In FY2022, the company delivered an impressive 1.31M (+40% YoY) vehicles, while producing 1.37M (+47% YoY). At that time, it had reported excellent automotive revenues of $77.55B (+51.9% YoY), automotive gross margins of 26.5% (inline YoY), total operating margins of 16.8% (+4.7 points YoY), and EPS of $4.07 (+80% YoY).

While BYD Company Limited (OTCPK:BYDDF) (OTCPK:BYDDY) might had reported better EV equivalent deliveries of 1.86M (209% YoY) in 2022, its margins were not comparable to TSLA indeed. The Chinese automaker recorded gross margins of 16.1% (+3.1 points YoY), adj. operating margins of 5.2% (+3.1 points YoY), and adj. EPS of $0.83 (+434.7% YoY) in FY2022.

For now, we think investors looking at TSLA’s and BYD’s January 2023 deliveries in China shouldn’t be alarmed, since the lower numbers were likely attributed to the Chinese New Year festivities.

However, with the uncertain macroeconomic outlook potentially impacting demand, it seems TSLA has decided to engage in an all-out price war in the US and China alike. Its decision to cut prices in the US stemmed from the Inflation Reduction Act, requiring sedans to be priced below $55K and SUVs below $80K to qualify for the $7.5K tax credit. Its flagship Model Y and Model 3 now cost $57.99K and $42.99K, respectively, suggesting a decrease of -$8K and -$4K from 2022 prices.

In China, the EV subsidies also ended by 2022, leaving consumers with a minimal 10% purchase tax exemption through 2023. Therefore, it made sense that TSLA had slashed prices to match the expired EV subsidies (originally worth 12.6K Yuan) while similarly enticing buyers at a time of uncertain reopening cadence. Its Model 3 and Model Y now retail at 229.9K Yuan and 259.9K Yuan, lower by 36K Yuan and 29K Yuan from 2022 prices, respectively.

This strategy has worked in our view and contributed to the surge of demand in the US, with the wait times for Model Y growing to 17 weeks by February 2023, compared to one week in November 2022. A similar trend was observed in China, with retail demand growing by 36% YoY to 25.68K vehicles in January 2023.

Therefore, it was unsurprising that TSLA’s Shanghai Gigafactory had targeted an ambitious production output of 20K vehicles weekly in February and March 2023, compared to December 2022’s compressed levels of 13.94K.

While this piece of news may point to a surge in production and delivery volume in FQ1’23, we remain concerned about its margins in the short term. With the Model 3 and Y comprising 94.6% of the company’s deliveries in 2022 at 1.24M vehicles, the impact may be tremendous indeed.

The US accounted for the majority of TSLA’s revenues at $40.55B or 49.7% in 2022, with market analysts estimating a 252K of the Model Y deliveries in the country. Considering this information, the Model Y might have accounted for $16.62B of sales in the US then, with approximately 400K vehicles of Model 3 delivered at the same time. Naturally, this was after discounting part of its revenues for energy generation and storage.

Based on a moderate +10% QoQ growth in production output and delivery for FQ1’23, we may see a potential -$550M top-line impact for Model Y and -$330M for Model 3 in the US, attributed to the price cuts offered thus far.

The company similarly delivered 439.77K vehicles in China for 2022, comprising $18.14B or 22.2% of its revenues. Based on similar assumptions, the deep discounts in China may also trigger a -6.13B Yuan or the equivalent of -$900M top-line headwind in our estimation.

This is the reason why we think we may see TSLA deliver underwhelming FQ1’23 revenues of approximately $23.9B. This suggests an increase of 27.4% YoY instead of the impressive growth recorded in FQ4’22 at 37.2% YoY and FQ3’22 at 55.9% YoY.

Despite the assumption of easing supply chain and improved production scale holding the cost of goods sold [COGS] steady, the company’s operating margins may still be impacted, falling to approximately 13.5% by FQ1’23, compared to the FQ4’22 levels of 16% and FQ1’22 levels of 19%.

While our estimated EPS of $0.90 may suggest a somewhat optimistic performance for the next quarter, against the more bearish consensus estimate of $0.85, it also indicates a notable headwind by -24.3% QoQ from $1.19 and -15.8% YoY from $1.07. Therefore, it remains uncertain if TSLA stock will be able to hold on to the recent optimism through April 2023 in our opinion.

So, Is TSLA Stock A Buy, Sell, Or Hold?

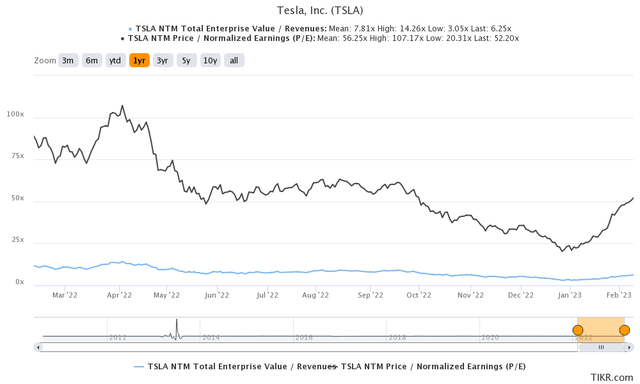

TSLA 1Y EV/Revenue and P/E Valuations

TSLA is currently trading at an EV/NTM Revenue of 6.25x and NTM P/E of 52.20x, higher than its 3Y pre-pandemic mean of 3.16x and 13.54x, respectively. Otherwise, lower than its 1Y mean of 7.81x and 56.25x, respectively.

After accounting for a nominal increase in operating expenses and COGS, we think TSLA may achieve FY2023 EPS of $4.09, if it maintains its current price cuts and sustains a +10% QoQ increase in production output.

Based on this number and the current P/E valuations, we are looking at a moderate price target of $213. While it is somewhat more optimistic than the consensus price target of $197.50, the fact remains that there is minimal upside potential from current levels.

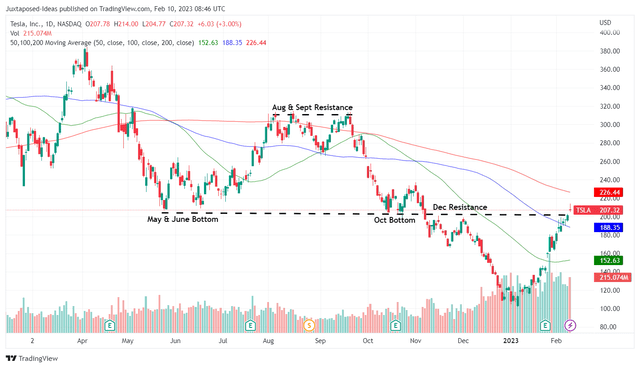

TSLA 1Y Stock Price

This is unsurprising, since the TSLA stock has recorded an impressive 103.6% rally to $207.32 since the January 2023 bottom of $101.81. And it is for this particular reason that we prefer to exercise some caution, since it remains to be seen if the stock may sustain the current optimism and break out from the December 2022 resistance levels.

As discussed above, we may also see some margin compression in its FQ1’23 performance, despite the projected volume growth. As the Fed’s pivot is unlikely to occur before 2024, Mr. Market’s focus will likely be on the health of the company’s financial performance in the short term.

Therefore, we reckon that the TSLA stock may moderately retrace over the next few weeks. Traders may consider taking some gains here and getting in again at the next dip. Otherwise, long-term investors should patiently wait for another attractive entry point to nibble, likely in the $170s for an improved margin of safety.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.