Summary:

- Eli Lilly and Company reported a superb Q2, triggering a sharp price rally and pushing its valuation to a very concerning level in my view.

- There are certainly plenty to be optimistic about, ranging from the volume growth of its current drugs and also the positive results on its pipeline drugs.

- However, I will argue that the valuation risks outweigh the positives under current conditions.

jetcityimage

Thesis

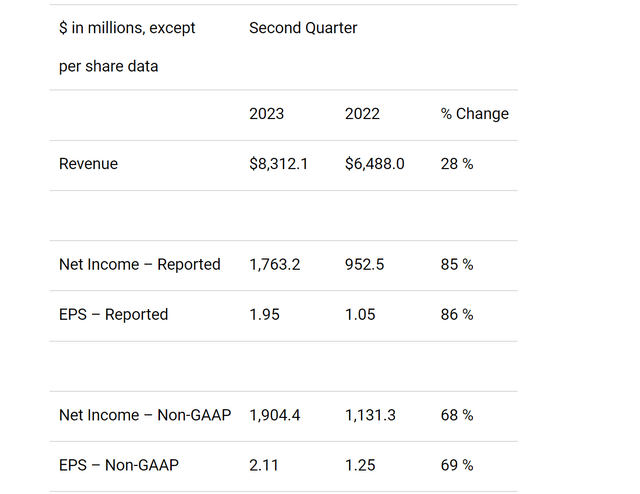

Eli Lilly and Company (NYSE:LLY) just released its 2023 Q2 earnings report (“ER”) last week. The ER was analyzed in detail by a few other SA authors since then. Their articles provided excellent coverage of its Q2 financials and its pipeline drugs, which are both crucial aspects for a pharmaceutical company. Thus, this article won’t repeat these aspects in detail anymore. As a brief recap, the company reported up beating results in both lines and truly impressive YoY growth rates (see the chart below). Its EPS came in at $2.11, representing a 69% growth rate. And revenue dialed in at $8.31B, representing a 28% YoY growth rate. It also reported a robust pipeline with positive results in several key drugs such as TRAILBLAZER-ALZ and also mirikizumab.

For the remainder of this article, I will focus on another important aspect of this mature healthcare heavyweight. I will analyze the stock from the eyes of a dividend investor and explain why I think the company’s valuation is now far ahead of its fundamentals, especially after the strong rallies after the Q2 ER. Therefore, I see current price levels take years of growth to catch up, resulting in limited return potential.

Dividends don’t lie

Before diving in, let me first confess that the title of this article is borrowed from a classic for dividend investing: Geraldine Weiss’ book titled Dividends Don’t Lie. The book was published in 1988, but I feel the relevance is as important now as ever. A key insight here is that dividends provide a simpler and more reliable indicator of a company’s economic earnings. Accounting income could be subject to ambiguity and thus have large uncertainties (again, see the chart above for an example). But dividends are free from such ambiguities.

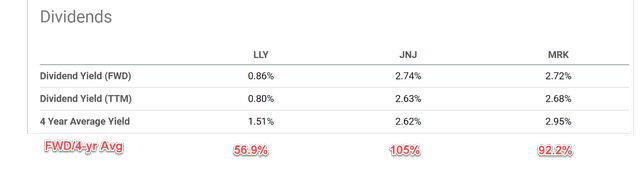

Given LLY’s status as a mature blue-chip stock and its long dividend track record, I feel justified in using its dividends as a good approximation of its economic earnings. And judging by its current dividend yield, I am seeing a considerable degree of overvaluation here, both by horizontal and vertical comparisons. As detailed in the chart below, under its current dividend payouts, its FWD yield is about 0.86%, only about 56.9% of its 4-year average yield of 1.51%. By this metric, the stock is almost overvalued by 100% compared to its historical averages. The comparison to other peers in the sector paints a similar picture. Other peers such as Johnson & Johnson (JNJ) and Merck (MRK) are trading close to their historical valuation multiples.

Next, I will explain why I think the growth seen in the past quarter is not representative of its future growth potential, and thus its current valuation will take years of growth to catch up.

Growth and projected returns

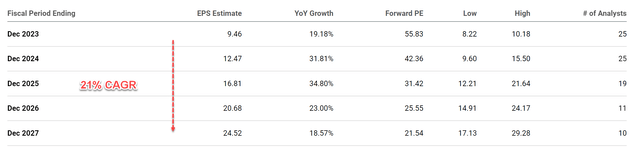

The current valuation implies a continuation of its current growth rates. As shown in the chart below, consensus estimates indeed forecast a 20%+ EPS growth rate in the next few years in terms of CAGR. To wit, consensus projects an EPS growth from $9.46 in 2023 to $24.5 in 2027, translating into a CAGR of about 21%. Here, I will argue that A) such a growth rate is unlikely in the long term (say the next 5 years), and B) even at such a growth rate, the valuation is still elevated and limits the return potential.

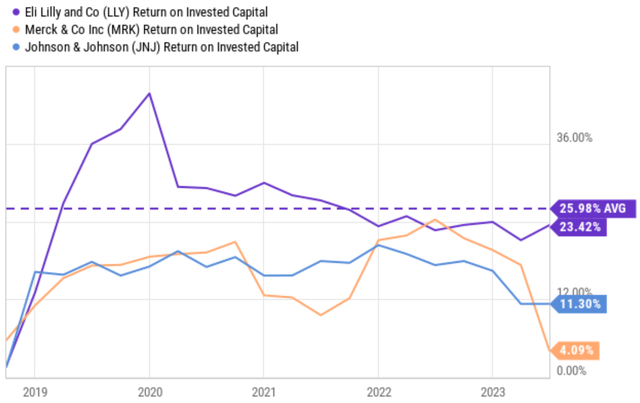

As seen in the next chart, LLY’s return on capital invested (“ROIC”) is on average 26%. It is a very respectable ROIC, as you compare it to its peers. And my estimate of its ROCE (return on capital employed, see details in this blog article) is even higher, around 54%. However, even at such a level of ROCE, maintaining a long-term growth rate of 21%+ would imply maintaining a reinvestment rate of 39%. The company’s current dividend payout ratio is about 54% (which is also about its long-term average. And its debt service requires about 5% of its earnings. These three numbers add up to about 98%. And the math is getting really tight and does leave much margin of safety here.

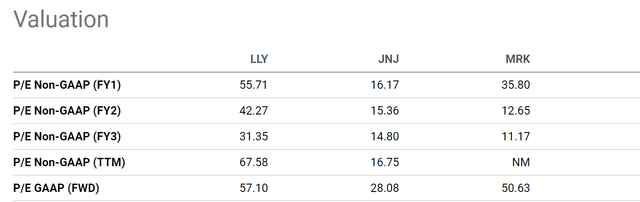

And even if it manages to grow at 21% for the next 5 years, its FWD P/E would still be a lofty 21.5x as seen in the chart above. It is still a level that is above both its own historical average (median is about 19.4x in the past 5 years) and also its peers as seen in the chart below.

Other risks and final words

Besides the risks mentioned above, there are a few other risks that are worth mentioning both in the downside and upside direction. As the cases of COVID kept declining, the demand for its COVID-19 antibodies can continue shrinking. At the same time, its other products face both pricing pressures (such as its diabetes lineup) and also increased generic competition in cancer (such as its cancer drug Alimta). As a global business, it is also exposed to foreign exchange headwinds. On the upside, the company maintains a robust pipeline with encouraging results as aforementioned. In the meantime, many of its current products are enjoying robust volume growth, including Mounjaro, Verzenio, Trulicity, and Jardiance. The early success of diabetes treatment Mounjaro is particularly important in my view. I view it as a key step for LLY to supplement/replace its insulin products, which are facing pricing pressure. Finally, for dividend investors, the company has some of the best financial strength. As aforementioned, its debt service requires only about 5% of its earnings. The dividend yield of ~0.8% is low, but there is no concern for its safety.

All told, my conclusion is that its valuation risks outweigh all the potential positives under the current conditions. Judging by its different yield, it is trading at ~100% overvalued compared to its 4-year historical average. And again, I view dividends as the most reliable indicator of its economic earnings. At ~55x FY P/E, it is also one of the more expensive stocks in the large pharma universe. The current valuation implies a rate that is unlikely to continue in the long term. And the lofty valuation would limit the return potential severely even if it does. With this, I would suggest investors to stay on the sideline for Eli Lilly and Company and wait for a better entry price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.