Summary:

- Eli Lilly’s stock is overvalued by around 27% despite its success in developing drugs for diabetes and obesity.

- LLY has strong financial performance with steady revenue growth and profitability expansion.

- The success of its drugs Mounjaro and Zepbound has led to a boost in revenue and positive growth prospects, but competition and market risks remain.

jetcityimage/iStock Editorial via Getty Images

Investment thesis

Eli Lilly’s (NYSE:LLY) stock is on fire after the massive success of its new drugs aimed at treating diabetes and obesity. The company has a stellar track record of success and will likely continue delivering strong results over the long term. However, my valuation analysis suggests that the stock is around 27% overvalued, a premium I am not ready to pay even for a superstar like Eli Lilly. I believe that once the FOMO effect diminishes, buying opportunities closer to the stock’s fair price will likely emerge. Despite recognizing the company’s strength and strategic positioning, I view the current overvaluation as providing favorable selling opportunities. Therefore, I assign LLY a tactical “Sell” rating.

Company information

Eli Lilly is the world’s largest pharmaceutical company, with a market capitalization of close to $700 billion. The company develops and manufactures products to cure diabetes, oncology, immunology, and neurodegenerative diseases. The company’s fiscal year ends on December 31.

Financials

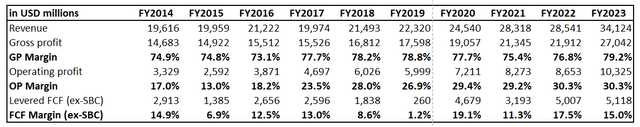

LLY’s financial performance has been stellar over the past decade, with revenue compounding steadily at a 6.3% CAGR and the company delivering stellar profitability expansion.

Continued revenue growth alongside nearly doubling operating margins over the decade signals a strong quality indicator for me. It underscores the management’s strength in driving revenue growth while maintaining strict financial discipline – two critical components in building sustainable shareholder value. Moreover, the company’s consistent payment of dividends, generous buyback programs, and strategic investments in both acquisitions and internal R&D emphasize the sound capital allocation policy implemented by the management. This balance is evident in the company’s robust free cash flow [FCF] margin, excluding stock-based compensation, which has consistently remained in double digits for most of the years.

Seeking Alpha

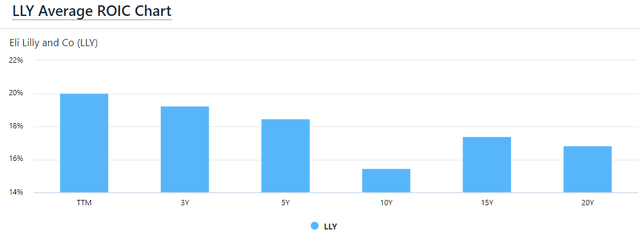

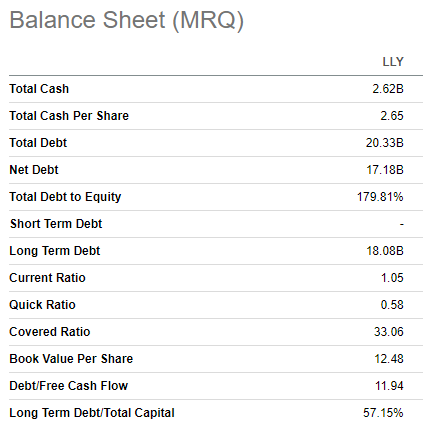

Some readers might say that the balance was achieved at the expense of the company’s balance sheet since the leverage ratio is sky-high. But I have a couple of points to explain why I do not consider a massive $17 billion net debt position a risk. First, all debt is fixed-rate and was mostly raised when interest rates were at the lowest possible levels. Second, out of $20 billion in total debt, $17 billion is payable in 2028 and thereafter. Within the next five years, principal debt repayments will be around $800 million per year, which is insignificant compared to the company’s operating profits in recent years. Last but certainly not least, given LLY’s stellar track record of consistently generating an average return on invested capital [ROIC] of around 17% over the last two decades, I believe that increasing its leverage could potentially enhance the probability of delivering greater value to shareholders.

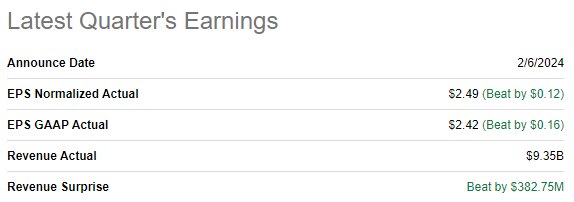

The latest quarterly earnings were released on February 6, when LLY topped consensus estimates by a notable margin. Q4 revenue grew YoY by a staggering 28%, and the full-year revenue increased by 20%. There was a full-year gross margin expansion of more than two percentage points, and the operating margin was flat. There was a dip in the FCF margin, but this was due to changes in net working capital, which I consider to be a temporary rather than secular factor.

Seeking Alpha

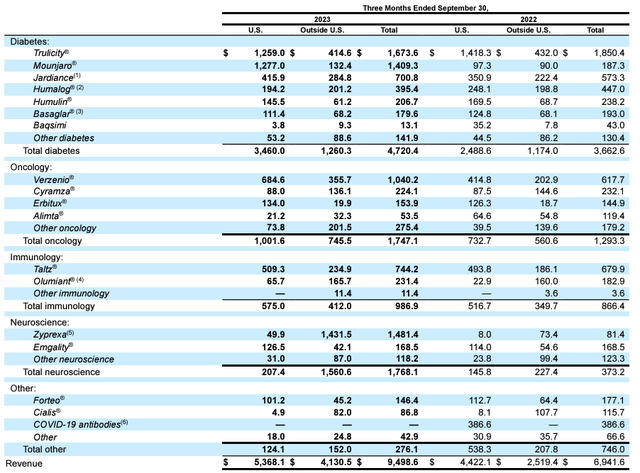

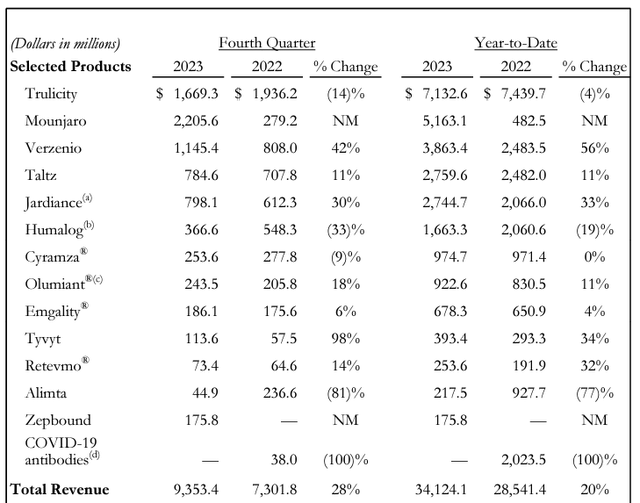

The remarkable success in both Q4 and the entire fiscal year of 2023 can be attributed to the surge in sales of Mounjaro, a medicine designed to treat type 2 diabetes. Revenue from this product skyrocketed by over tenfold for the full year. This exponential growth can be attributed to 2023, marking the first full year of Mounjaro’s availability on the market. Despite receiving its final FDA approval only in May 2022, Mounjaro swiftly emerged as the company’s second-largest revenue contributor.

LLY’s latest earnings press release

I expect the robust demand for Mounjaro to be in place for longer since diabetes is a huge global health problem. According to the World Health Organization [WHO], the number of people with diabetes has about quadrupled within just 34 years between 1980 and 2014. And the trend is not expected to improve over the next couple of decades. Diabetesatlas.org projects that the number of people suffering from diabetes will reach 643 million by 2030 and 783 million by 2045. While this is a big problem for humanity, it creates massive opportunities for the company to own a fresh patent on a medicine that is in high demand.

When I speak about the major positive catalysts for LLY, I also want to emphasize the new drug to treat obesity, Zepbound, which obtained FDA approval only in late November 2023 but still managed to generate $175 million by the end of 2023. The strong start gives high conviction in future success, especially given the fact that obesity also demonstrates warning growth trends for humanity, especially in the wealthiest parts of the world. It is estimated that by 2030 there will be more than a billion people with obesity globally, which means that the potential market for Zepbound will be even larger than for Mounjaro.

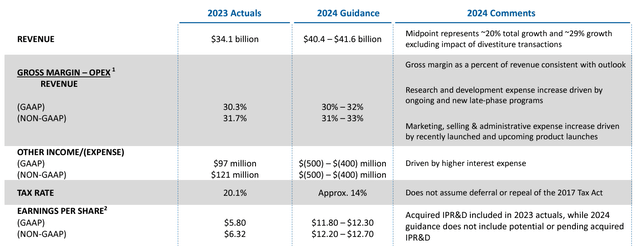

LLY’s latest earnings presentation

Mainly due to the massive success of these two products, there was a substantial 2024 guidance boost, and the company now expects to sustain the above 20% revenue growth recorded in FY2023. Given the strong momentum of Mounjaro and the highly likely accelerating sales of Zepbound in 2024, I am also optimistic about the company’s growth prospects in the next couple of years. It is also important that these two highly appealing products will highly likely help the company sustain stellar profitability.

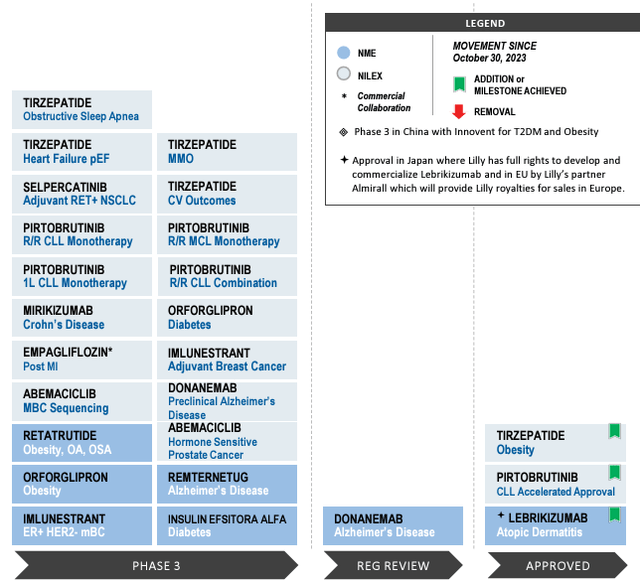

The likelihood of new sensational product releases in the foreseeable future is significantly high, supported by the impressive pipeline of medications currently in late-stage FDA trials, with some awaiting approvals. These potential treatments target a wide array of diseases, suggesting promising prospects for the company. Building on its recent significant successes and historically high ROIC, there’s a strong conviction that these new product releases also have a high likelihood of becoming bestsellers.

LLY’s latest earnings presentation

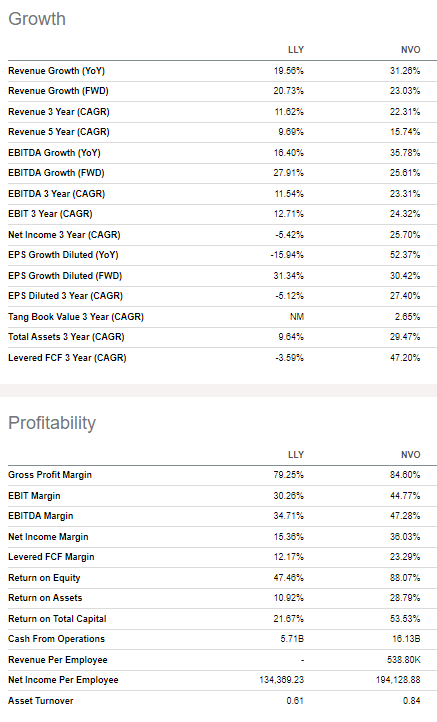

While LLY looks firmly positioned to sustain its success, it is important to understand that the company faces fierce competition. The company’s major competitor in the diabetes and obesity segments is the Danish giant Novo Nordisk (NVO), which is a strong competitor, demonstrating even more impressive revenue growth and substantially higher profitability. That said, when we bring NVO into context, Eli Lilly still has vast room to improve its operations efficiency and portfolio/pipeline strength.

Seeking Alpha

Apart from NVO, there are also other American and European pharmaceutical giants which also invest billions of USD every year in R&D and, despite not overlapping directly with each of them at the moment, also pose substantial competition risks because there is no guarantee that these players will never expand into LLY’s field of interests. The competition includes companies with a market cap of hundreds of USD billions, like Merck (MRK), Pfizer (PFE), Johnson & Johnson (JNJ), Novartis (NVS), and many other notable players. Also, even if all these companies’ segments do not overlap significantly, all these pharmaceutical giants still compete in different areas, like acquiring talent and raising finance.

Valuation

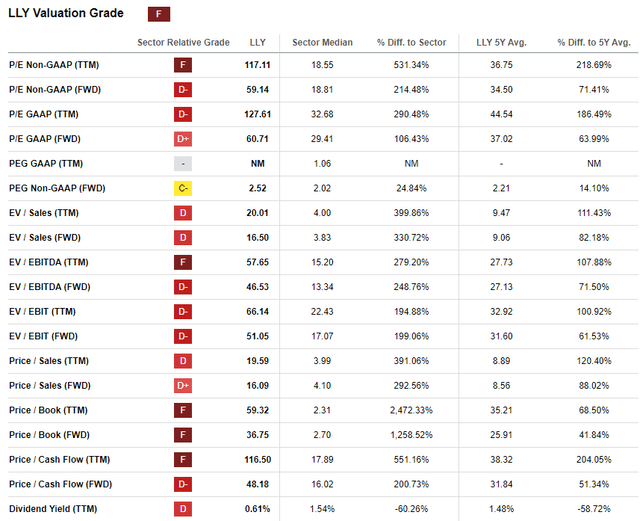

LLY recorded a massive 116% rally over the last 12 months, and the momentum is still strong, with a 27% stock price appreciation since the beginning of 2024. Seeking Alpha Quant assigns LLY the lowest possible “F” valuation grade because its ratios are multiple times higher than the sector median and substantially higher than the company’s historical averages. That said, LLY is overvalued from the perspective of valuation ratios.

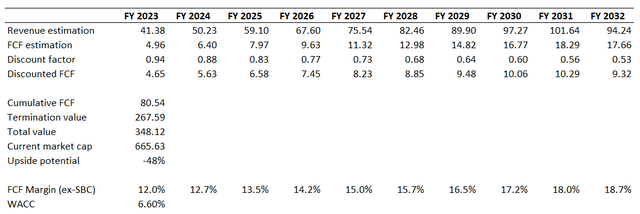

While LLY is a dividend growth superstar, I think that its shallow 0.7% forward yield makes the dividend discount model simulation useless. That said, I will proceed with my valuation analysis with the discounted cash flow [DCF] simulation. I am discounting future cash flows with a 6.6% WACC recommended by Gurufocus. My first scenario will go with consensus revenue estimates, which project a 10% CAGR for the next decade. I use a 12% FCF margin, which is the last decade’s average, and project a 75 basis points yearly expansion.

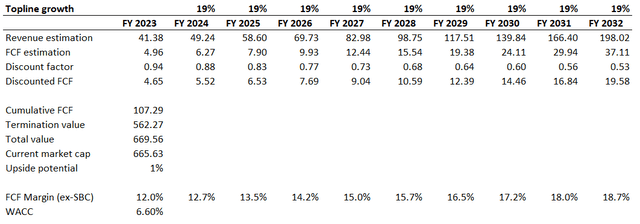

As seen above, the company’s fair market value is around $350 billion, which is almost twice lower than the current market cap. That said, massive long-term revenue forecast upward revision is priced in, and I would like to demonstrate below the level of revenue, CAGR justifies LLY’s current valuation with other assumptions remaining unchanged. According to my calculations, the company’s top line must compound by 19 percent yearly to justify the current generous valuation.

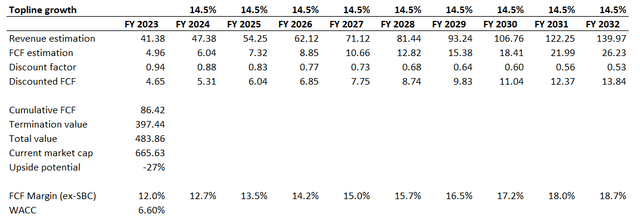

I find it improbable that a long-term revenue CAGR revision from 10% to 19% will occur, considering the significant magnitude of such an upgrade. Conversely, the 10% revenue CAGR might be overly conservative, given LLY’s strategic strength. Therefore, I will simulate a third scenario with a revenue CAGR representing the midpoint between 10% and 19%, i.e., 14.5%. I opt to keep other assumptions unchanged because revenue growth appears to be the most unpredictable factor and has the greatest impact on the outcome.

According to the third simulation, the business’s fair value is around $484 billion, closer to the current market cap than the first scenario. Still, the stock appears to be around 27% overvalued. After implementing a 27% haircut to the current share price, I arrived at a target price of $540.

What can go wrong with my bearish thesis?

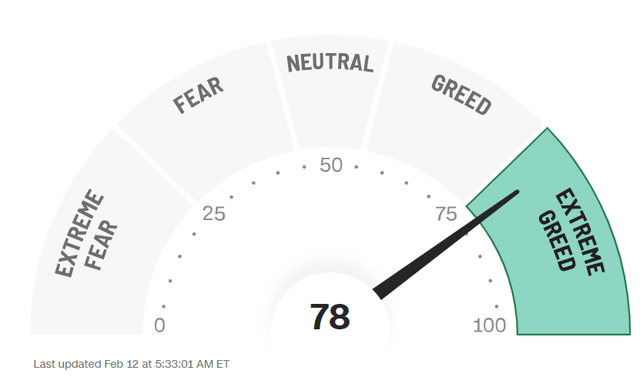

Betting against a company like LLY, its industry behemoth with strong momentum due to fundamental reasons, is inherently risky. The optimism around the stock after the latest earnings call is massive, and this has led to the overvaluation. When the stock records a sharp rally over the short timeframe, I believe that there is a substantial portion of a FOMO factor. The market is currently driven by extreme greed, and this can fuel the stock price for longer.

Another factor that might result in a new wave of optimism around LLY is the better-than-expected new product release. Since the company’s pipeline is extensive, there is a probability of delivering a new sensation to the market. This will lead to a new 2024 guidance upgrade, which will make analysts’ DCF models even more optimistic.

Bottom line

To conclude, LLY is a “Sell” at these stock price levels. The business performance is stellar; however, even under very optimistic revenue growth assumptions, a 27% overvaluation seems excessively high to me, especially considering substantial competition risks. As a result, I’m inclined to add LLY to my wish list and patiently await a stock price pullback.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.