Summary:

- Carnival Corporation is reducing its debt load, but at $30 billion, debt still remains a huge concern.

- 2024 bookings are off to a grand start, but the company has the Red Sea impediment to deal with.

- I am retaining my Hold rating but offering my preferred entry point in this article.

Allen J. Schaben/Los Angeles Times via Getty Images

My most recent coverage of Carnival Corporation & plc’s (NYSE:CCL) was in September 2023 where I rated the stock a “Hold” after evaluating the stock on the five factors listed below.

- Debt

- Earnings Revisions

- Dilution

- Recent Trend

- Technical

How have things changed in the last five months? Let’s find out using the same metrics as above in this review article.

Debt – Going In The Right Direction

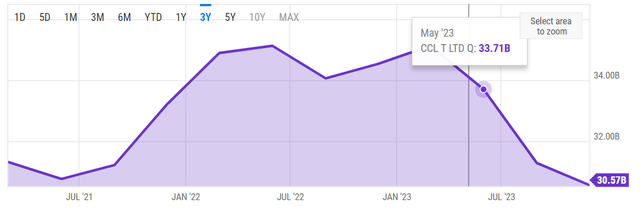

Since June 2023, when I first reviewed Carnival Corporation, its debt has gone from $35.1 billion to $33.1 billion to $30.57 billion at the end of November 2023. That’s a substantial 13% reduction in about two quarters.

CCL Debt (YCharts)

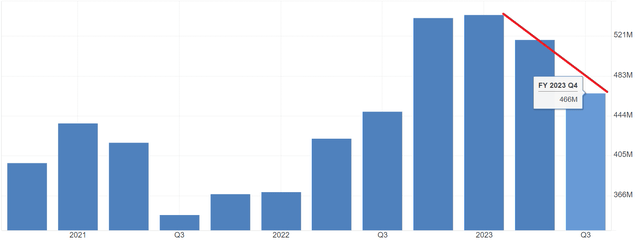

As a direct result of the debt reduction, Carnival’s quarterly interest expense has gone from $542 million to $518 million to $466 million in the last three quarters. While this is going in the direct direction overall, the key takeaway still remains that the debt level is enormous. At $30.57 billion, debt is still almost 60% higher than the company’s market capitalization.

CCL Interest Expense (Trading Economics)

Earnings Revisions

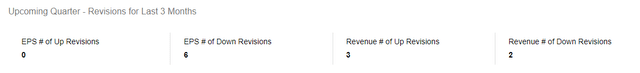

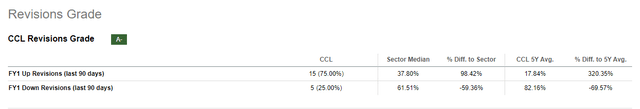

Carnival Corporation is expected to report its Q1 2024 earnings results on or around March 22nd, 2024. 6/6 EPS revisions and 2/5 revenue revisions have been to the downside. The company is expected to lose 19 cents/share on the back of $5.40 billion revenue, which clearly puts the company’s operating expenses and debt-related expenses in focus.

Earnings Revisions (Seeking Alpha)

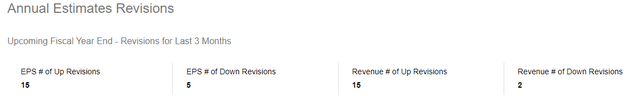

However, things look much better when you look at the annual revisions (for FY 2024), with 15/20 EPS revisions and 15/17 revenue revisions being to the upside. Using 2024’s EPS and revenue estimates, the stock is trading at a forward earnings multiple of 15 and a price-to-sales multiple of < 1, making a reasonable case for undervaluation (but mind the debt explained above, and macro challenges covered below). For the record, I believe the estimates are a little high, especially as the company has already indicated a hit due to the Red Sea crisis.

CCL Annual Revisions (Seeking Alpha)

CCL Revisions Grade (Seeking Alpha)

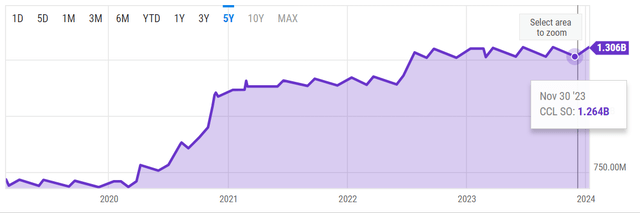

Dilution

After nearly doubling shares count between February 2019 and September 2022, Carnival Corporation has (thankfully) cooled off on diluting shareholders away. Total shares outstanding have remained more or less constant since September 2022. Carnival gets a temporary pass here.

CCL Shares (YCharts)

Recent Stock Trend

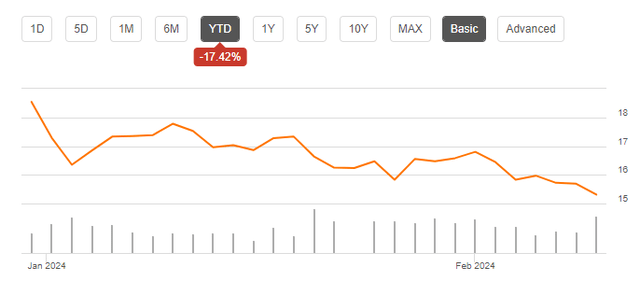

The last two times I reviewed this stock, it was in the midst of a surge. Things have cooled off since, as the stock has lost nearly 20% YTD, despite the general market making new highs constantly. In the last one year though, the stock is up 33%. Personally, I attribute the recent weakness despite strong bookings (covered below) to the market pricing in a quick end to the pent-up demand story.

CCL Chart (Seeking Alpha)

However, investors make money on a cyclical stock on its way up, and it is clear that CCL stock has been on a downtrend over the last 6 months and an uptick cannot be ruled out from here. For what it’s worth, the stock is a good 43% away from its median price target of $22.

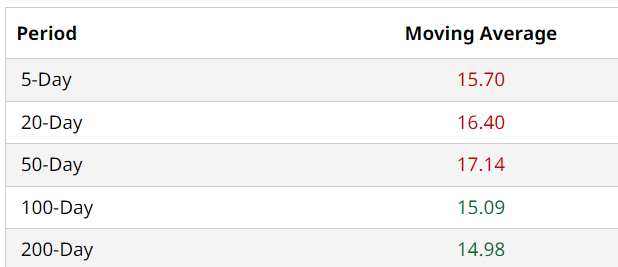

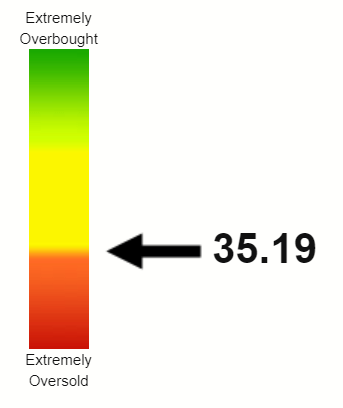

Technicals – Oversold But Close To Support

Carnival’s stock is technically weak, based on a Relative Strength Index [RSI] of 35. However, the 100-Day and 200-Day moving averages have held up so far and are only 1.50% and 2.15% away from the current market price, respectively. In other words, the stock is near long-term support lines and as long as it doesn’t break below these, especially the 200-Day moving average, investors can expect a reasonable margin of safety.

CCL Moving Avgs (Barchart)

CCL RSI (Stock RSI)

Forward-Looking Thoughts And Conclusion

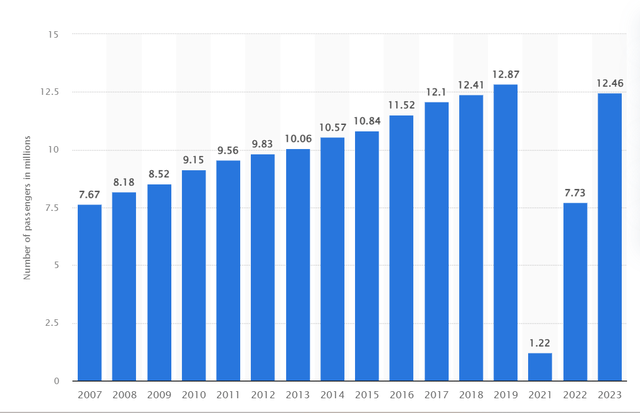

Carnival has already reported that it has two-thirds of its business booked for 2024. More importantly, the company seemed to indicate that it struck a nice balance between higher occupancy rate and higher prices. In addition, the summer season seems to have been booked at higher prices as well. I am also willing to bet that there is still some pent-up demand from the COVID-tailwind, which should help the company push past the 12.87 million high in passengers it recorded in 2019. As a dampener though, Carnival and peers have already warned about the impact from the Red Sea crisis, with Carnival forecasting a 7 to 8 cent impact to its annual EPS.

CCL Passengers (Statista)

However, the resilience of the Cruise industry cannot be understated, as explained here by Seeking Alpha. The industry has been through many turbulent times (pun intended) and has managed to come out alive (although not unscathed) every time. In particular, Carnival Corporation traces its roots backs to 1972 and has been a publicly traded company since 1987.

Overall, I am liking the fact that the company is reducing its debt and that it has not diluted shareholders in the last few quarters. I believe the current FY 2024 EPS estimate of $1 is still too high, especially as the company guided for 93 cents. Factoring in the 7 to 8 cents impact due to the Red Sea disruptions and other unknowns, I am seeing 80 cents as a reasonable estimate for FY 2024. Multiplying that by a generous multiple of 15, we get $12, which is where the stock may get interesting for me, assuming everything else remains constant.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.