Eli Lilly: Too Expensive To Buy

Summary:

- Eli Lilly is a quality company with a strong product lineup.

- Its exposure to growth markets will allow LLY to grow its business meaningfully over the next couple of years.

- Shares already account for that today, however. The future upside seems limited.

jetcityimage

Article Thesis

Eli Lilly and Company (NYSE:LLY) is a high-quality pharma company with an attractive product lineup. Its business will likely grow considerably over the coming years. But that is more than priced in today, as Eli Lilly trades at a historically high valuation right now. Multiple contraction will be a major headwind in the future, I believe, which is why I see Eli Lilly’s stock as too expensive at current prices.

A High-Quality Company With Growth Potential

Eli Lilly is a pharma company with a long history. The company was founded close to 150 years ago and has become one of the largest healthcare companies since, at least when it comes to market capitalization, as LLY is valued at $340 billion today.

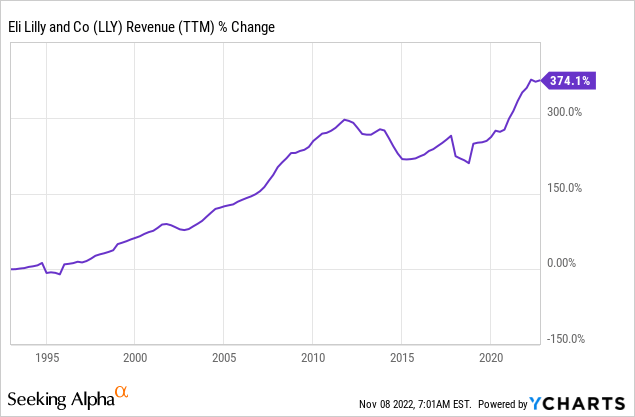

Over the last 30 years, Eli Lilly has generated meaningful business growth as its revenues rose by 370%. This pencils out to an annual revenue growth rate of a little more than 5%. That doesn’t make Eli Lilly an especially fast grower, but when a company can grow its revenue at a mid-single-digit rate for decades, that’s still a pretty solid basis for attractive total returns. After all, earnings per share are generally growing faster than revenues, due to margin expansion thanks to operating leverage, and also due to the impact of share repurchases. Add some dividend payments, and a 5%-6% annual revenue growth rate can result in 8%-10% annual total returns in the long run, at least if valuations do not change materially.

Eli Lilly has delivered much higher returns in the more recent past, which was primarily the result of multiple expansion. Over the last five years, LLY’s share price soared 335%, while revenue grew by 45% over the same time frame. That is unsustainable in the long run — a company’s shares can’t run up faster than its underlying per-share results forever. In fact, I believe that there is a high likelihood that this trend will reverse in the future, and that LLY’s share price will rise less than its earnings per share and cash flow per share over the coming years, but more on that later.

In the past, Eli Lilly has shown solid growth, but not spectacular growth. In the early 2010s, the company’s revenues declined for some time, which is something that many pharma companies experience from time to time, as patent expirations lead to declines in some areas of business. Eli Lilly managed to get back on the growth track a couple of years later, however, thanks to new products in its portfolio.

Overall, the outlook for the pharma industry is pretty solid in the long run. Aging populations will lead to rising healthcare spending, and the pharma company as a whole should be able to take some of that additional healthcare spending. But not all pharma companies will show the same growth rate. Eli Lilly is positioned to grow at an above-average level, as it owns strong assets in two very attractive markets: Diabetes and obesity. These are massive markets that continue to grow at a high pace, due to demographic factors such as aging populations, but also due to the way of life in today’s world, e.g. when it comes to eating out more often, the type of jobs we work (manual labor/no manual labor), and so on.

Eli Lilly was able to grow its revenue by 11% in the US during the most recent quarter, although international revenues declined, with currency rate headwinds — the US Dollar strengthened versus the Euro, Yen, etc. — being a major headwind for the international business. Growth was driven by what Eli Lilly calls its “Key Growth Products”, which saw their sales expand by 18% year over year, while products that were subject to a loss of exclusivity and its other drugs experienced less significant growth. The Key Growth Products group contains a range of products in the aforementioned important growth markets, such as Trulicity (diabetes) and Jardiance (diabetes), but also some cancer drugs such as Tyvyt and Cyramza. With this relatively young group of drugs that do, on average, have long patent protection, Eli Lilly has a pretty positive growth outlook going forward. New approvals will further help Eli Lilly grow its business in the 2020s.

One such candidate that looks very promising is Tirzepatide for the treatment of obesity. Tirzepatide has received an FDA fast track designation for obesity during the third quarter, which indicates that the regulator sees a lot of value in this drug candidate. Eli Lilly expects to enter rolling submission this year, based on two studies. One of these is already completed, the other one will be completed in April 2023. It would thus not be surprising to see Tirzepatide get approved in the US over the next couple of quarters. Tirzepatide is already approved for diabetes under the brand name Mounjaro, but an obesity approval on top of that would increase the drug’s sales potential immensely. Some analysts see Tirzepatide’s peak sales potential at $25 billion, which would make it the biggest drug in the world in terms of revenue generation.

Of course, approval in obesity is not guaranteed, but due to the fast track designation and the data from the completed study, it seems likely that the drug will receive approval eventually. Tirzepatide showed better weight loss results compared to Novo Nordisk’s (NVO) Wegovy — and Wegovy has been approved for weight loss. With Tirzepatide showing even better results, I believe that the likelihood of approval is high, and once it gets approved, it should take a considerable market share thanks to its best-in-class results. Between this potential mega-blockbuster and some other pipeline candidates in areas such as oncology, the growth outlook for Eli Lilly is pretty positive. Of course, there are some risks that the company will not receive approval for all the drugs it believes it will, and competitors might come out with their own strong and effective drugs. Last but not least, some older drugs in LLY’s portfolio will lose patent protection over time, which will be a sales headwind. Nevertheless, analysts believe that Eli Lilly will generate quite meaningful growth going forward:

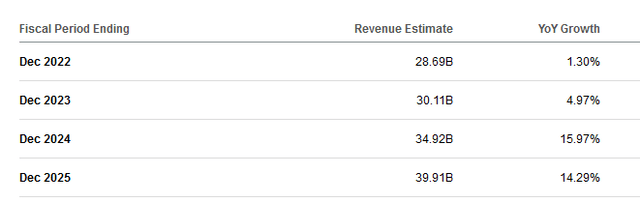

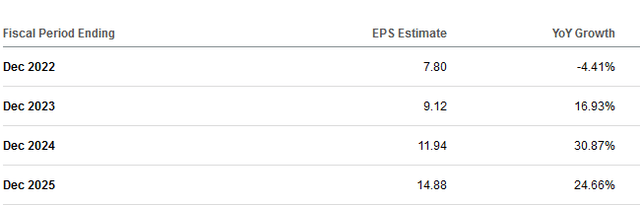

The company is forecasted to grow its revenue by close to 40% between 2022 and 2025, which would be pretty attractive. Of course, earnings per share will grow considerably as well in that scenario:

Analysts believe that the company will generate a little less than $15 per share in 2025, which would be close to twice as much compared to what is forecasted for today. Due to the major expected revenue increase and the impact of operating leverage — fixed costs are distributed over a larger gross profit, thereby expanding margins — the big earnings per share increase seems achievable if everything goes right with drug approvals. The problem, however, is that Eli Lilly is already priced for perfection today.

Eli Lilly: Attractive Growth, But Too Expensive

On average, Eli Lilly has beaten EPS estimates by a couple of cents per quarter over the last three years. So let’s round the 2025 earnings per share estimate up to $15. If the company hits that estimate, its profit growth would be pretty attractive over the next three years. And yet, the company’s share price might flounder or actually decline versus where it is today. That’s due to the fact that Eli Lilly is historically expensive today — the company is trading at a whopping 47x this year’s expected net profit. For a pharma company, that’s very high, and it also compares very unfavorably versus how Eli Lilly has been priced in the recent past, even though the future success of its diabetes and obesity portfolio was already foreseeable a couple of years ago.

Based on the current share price, Eli Lilly is trading at more than 24x 2025’s earnings per share estimate of $15 today. By 2025, the highest-growth years have already passed, according to the analyst consensus — LLY will still generate revenue and EPS growth in 2026 and beyond, but at a lower rate. It thus seems unlikely that shares will trade at a very high valuation at that point. If Eli Lilly were to trade at 20x net profit three years from now, its share price would be $300 at the end of 2025 — below where shares trade today. Even if Eli Lilly were to trade at 25x net profit at that point, which would be a pretty high valuation for a pharma company, its shares would rise to just $375. That would make for an annual share price gain of less than 1% from the current level, which is far from attractive.

LLY has been a great investment over the last couple of years, but right here, it’s historically expensive. Even if the growth story plays out and Eli Lilly trades at a relatively high earnings multiple of 25 in 2025, its share price performance over the next couple of years would be far from great. For investors to see a 10% annual return through the end of 2025, Eli Lilly would have to trade at more than 32x the $15 EPS estimate at that point. In a rising rate environment and with growth likely slowing down beyond 2025, that does not seem very likely to me.

Takeaway

Eli Lilly is a quality company with an attractive product portfolio that should allow for considerable business growth in the coming years. But shares already fully account for that right now, and further upside potential seems rather limited to me. I thus do not think that LLY is an attractive buy at current prices, even though the underlying business growth potential is strong.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

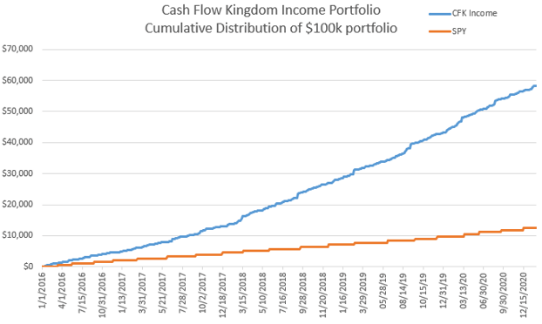

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!