Eli Lilly: When Will The Correction Finally Start?

Summary:

- Eli Lilly’s net income was $952.5 million in Q2 2022, down 31.5% year-over-year.

- Eli Lilly’s revenue was $6,488 million in Q2 2022, down 3.7% year-on-year.

- In my assessment, the likelihood of FDA approval of donanemab and subsequent positive Medicare coverage in the treatment of Alzheimer’s is low.

- Mounjaro is the most promising drug in the treatment of type 2 diabetes, but it will take time to capture market share.

- The company has an extremely low dividend yield.

jetcityimage

Eli Lilly and Company (NYSE:LLY) is one of the leaders in the treatment of diabetes and obesity and is committed to expanding its presence in the treatment of cancer and autoimmune diseases. Although the company recently received approval for Mounjaro in the treatment of type 2 diabetes, whose effectiveness exceeds that of other competitors in weight loss and HbA1c, given the high competition in this area, Eli Lilly will have to do a laborious job in persuading doctors to prescribe this particular drug. In parallel, the company shows a decrease in revenue, and net profit, not only on a quarterly basis but also on an annualized basis. Inflated financial indicators that are more than 80% above the health sector average, low dividend yield, and overly high expectations for an Alzheimer’s drug candidate are some of the reasons for a correction in the company’s stock.

Company’s Financial Position

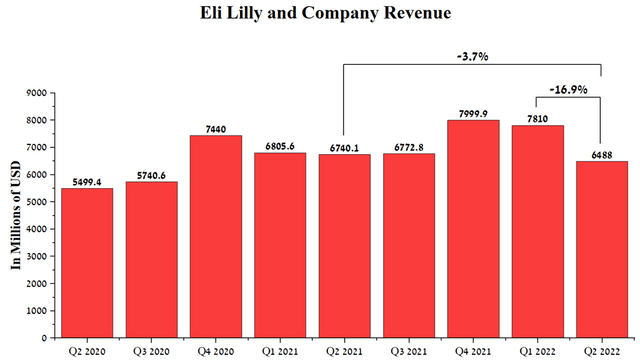

Eli Lilly and Company, for the first time in the past two years, saw a decrease in revenue not only year-on-year but also quarterly, which casts doubt on the company’s management’s ability to improve sales of key medicines as COVID-19 transitions from pandemic to the endemic stage. The company earned $6,488 million in Q2 2022, down 16.9% from the previous quarter.

Author’s elaboration, based on Seeking Alpha

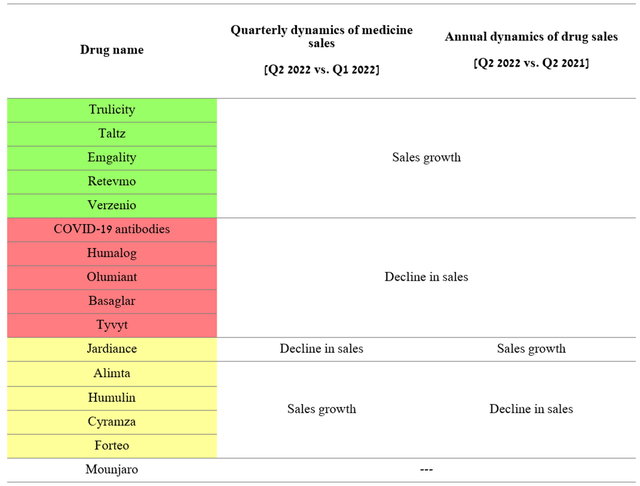

10 out of 16 medicines faced difficulties in demonstrating both quarterly and annual positive sales trends, failing to show their former agility in increasing market share. The reasons for this are pressure from biosimilars, increased competition from more effective drugs, and reduced demand for a monoclonal antibody aimed at combating COVID-19.

Author’s elaboration, based on quarterly securities reports

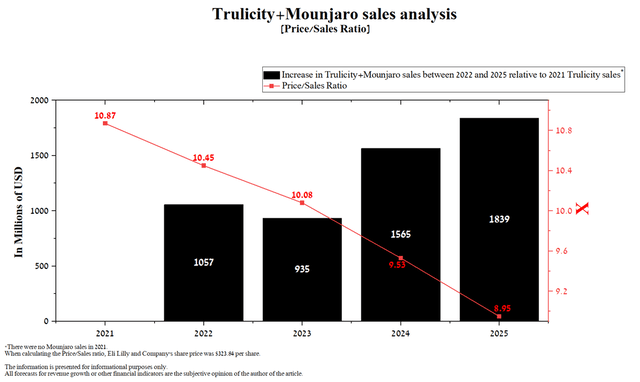

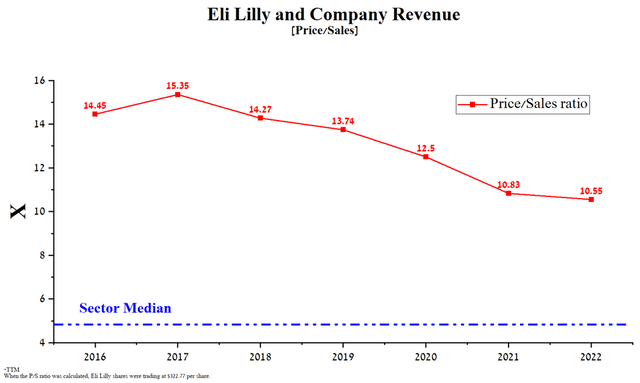

Eli Lilly’s price/sales ratio of 10.55x is substantially higher than the healthcare industry average, indicating that the company is overvalued by Wall Street. Taking into account the slowdown in the growth of other financial indicators, this leads to a weakening of the arguments in favor of the validity of Eli Lilly’s 305 billion dollar capitalization, which exceeds the capitalization of such industry mastodons as Pfizer (PFE), Merck (MRK), and AstraZeneca (AZN).

Author’s elaboration, based on Seeking Alpha

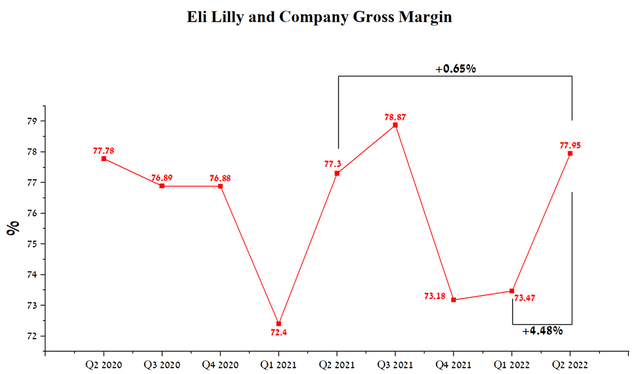

The company has a high gross margin of 77.95% in the 2nd quarter of 2022, up 4.48% QoQ mainly due to sales growth of Trulicity, Taltz, and Verzenio.

Author’s elaboration, based on Seeking Alpha

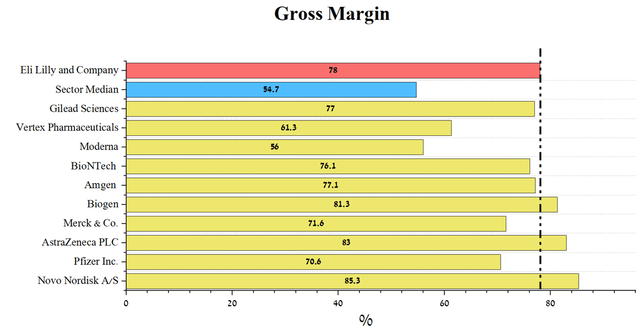

Eli Lilly’s gross margin is above the industry average, yet in line with other global pharmaceutical companies. Moreover, such companies as Biogen (BIIB), AstraZeneca, and Novo Nordisk (NVO) have higher margins, but their capitalization is significantly lower.

Author’s elaboration, based on Seeking Alpha

Eli Lilly Debt

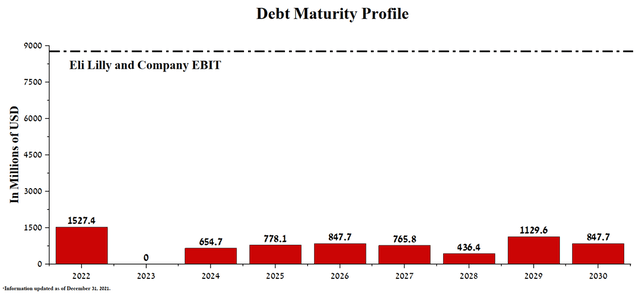

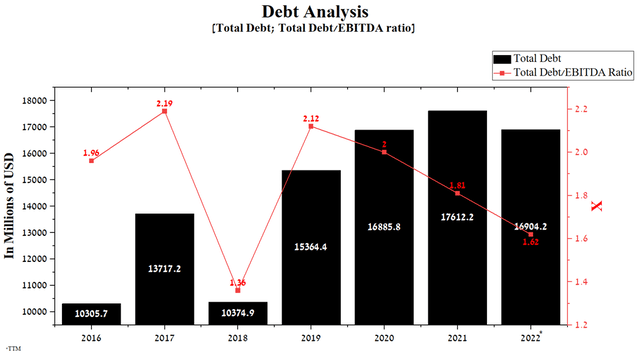

Unlike many large companies in the pharmaceutical industry, Eli Lilly does not have debt service difficulties, which is positively reflected in the flexible financial policy and maintaining the pace of product candidate development. The company’s total debt was $16,904.2 million in Q2 2022, down 4% from the end of 2021. In addition, the Total Debt/EBITDA ratio continues to decline to 1.62x by 2022, indicating that there are no significant risks associated with Eli Lilly’s debt.

Author’s elaboration, based on Seeking Alpha

The senior bond redemptions for the years to 2030 are significantly lower than the company’s EBIT, which was about $8.8 billion over the last 12 months.

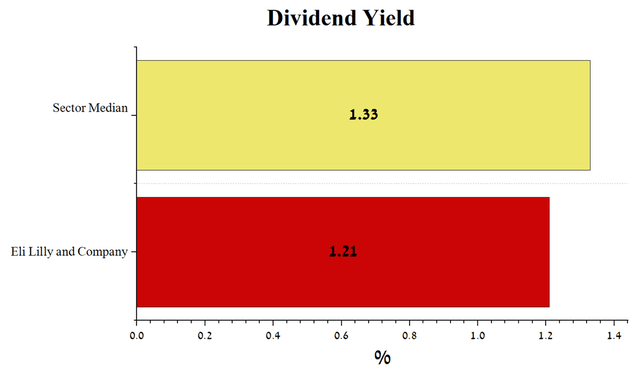

Eli Lilly and Company Dividends

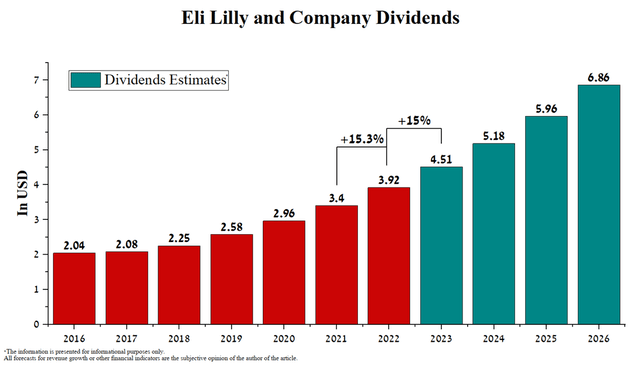

Eli Lilly and Company’s management has a policy of increasing dividend payouts by approximately 15% year on year. As a result, I expect that the company’s investors will receive $6.86 per share by 2026, which is 75% more than the current value.

But on the other hand, the company’s dividend yield is 1.21%, which is below the average for the healthcare sector. This small value could be justified if Eli Lilly showed strong growth in revenue and net income, which would then be reinvested in increased M&A and R&D transactions, which would help maintain the company’s strong business growth, but we do not see this. As noted earlier, the company’s revenue is declining, as is its net income, but Eli Lilly’s management does not want to increase investment interest through a more aggressive dividend policy.

Author’s elaboration, based on Seeking Alpha

In my estimation, only two Eli Lilly medicines are helping to sustain the company’s overcapacity, one of which is Mounjaro’s recently approved treatment for type 2 diabetes and a product candidate for the treatment of Alzheimer’s disease.

Product Candidate for the Treatment of Alzheimer’s Disease

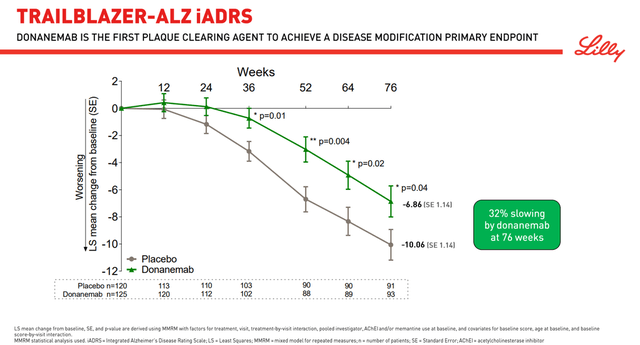

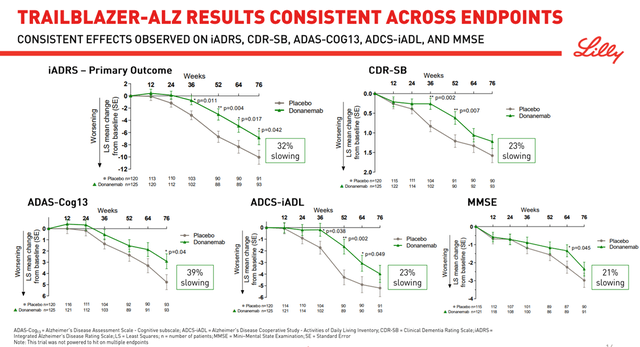

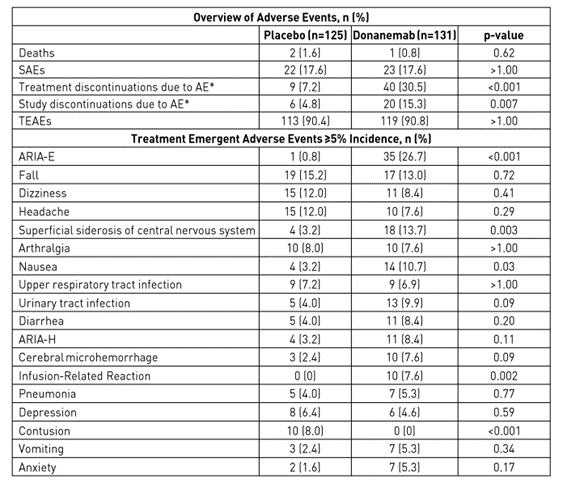

Alzheimer’s is a disease that brings a lot of suffering to patients and their families, and doctors hope that a truly effective drug that can slow down cognitive decline will be approved in the near future. One such product candidate is Eli Lilly’s donanemab, which many investors and analysts are pinning their hopes on. Donanemab is an experimental monoclonal antibody that is being investigated for the treatment of early Alzheimer’s disease and whose mechanism of action is based on the reduction of β-amyloid (Aβ) plaques. On January 11, 2021, the company published the results of the TRAILBLAZER-ALZ clinical trial, which evaluated the efficacy and safety of donanemab. The clinical trial reached its primary endpoint by slowing down the decline in the Integrated Alzheimer’s Disease Rating Scale (iADRS) in the donanemab group by 32 percent compared to placebo. iADRS is a composite tool developed by Eli Lilly scientists combining ADAS-Cog13 and ADCS-iADL.

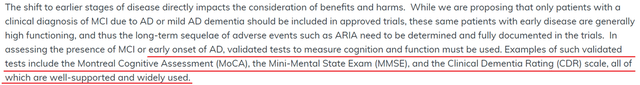

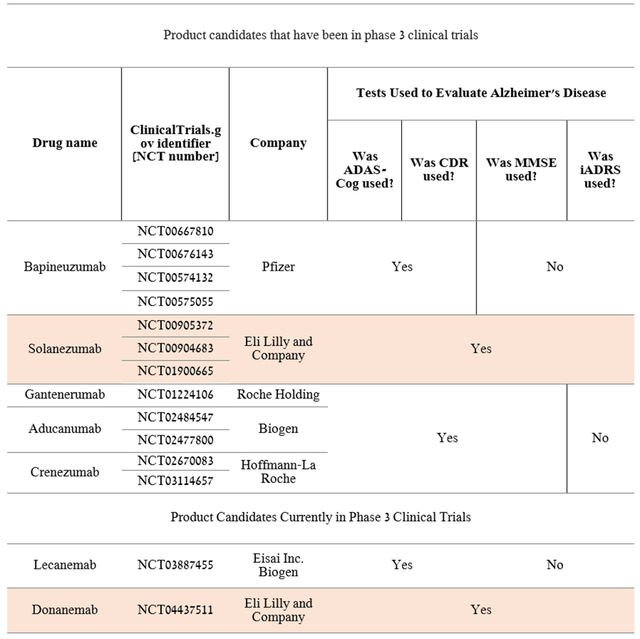

Before discussing the results of the secondary endpoints, it should be noted that the phase 3 clinical trials that evaluated monoclonal antibodies in the treatment of Alzheimer’s disease, with the exception of candidate Eli Lilly, did not use iADRS. What’s more, CMS has issued documents outlining its Medicare drug coverage policy for Alzheimer’s disease. The federal agency has noted the following tests that it believes are objective and validated for assessing patients’ cognitive function.

I have studied Phase 3 clinical trials involving Pfizer’s Bapineuzumab, Eli Lilly’s Solanezumab, Roche Holding’s Gantenerumab (OTCQX:RHHBY) (OTCQX:RHHBF), Biogen’s Aducanumab, and Roche Holding’s Crenezumab. All clinical studies used commonly used tests in Alzheimer’s disease, namely MMSE, ADAS-Cog, and CDR.

Thus, the first question that arises from the data obtained and that may arise from regulatory authorities when evaluating the results of the ongoing Phase 3 clinical trial is the objectivity of using iADRS, which has not been used by other pharmaceutical companies. Moreover, in TRAILBLAZER-ALZ, donanemab failed to achieve a statistically significant result in slowing down a cognitive decline at 72 weeks of treatment on the most commonly used tests in the scientific community, namely CDR-SB, MMSE, and ADCS-iADL.

Failure to reach endpoints in such a small study greatly increases the likelihood of failure in a larger study. As a consequence, I believe that donanemab will not show positive results in slowing down cognitive decline in phase 3 clinical trial. In addition, the safety profile of Eli Lilly’s drug was far from ideal due to cerebral edema (ARIA-E) that occurred in 26.7% of patients, nausea, anti-drug antibodies found in 90% of patients, and other events that occurred while taking donanemab.

AD/PD Update

Mainly due to adverse events, only 94 patients remained in the donanemab group at week 76 of the clinical study out of 131 patients who entered the study. On August 4, 2022, at its quarterly report, the company announced that the FDA had accepted the application with a priority review designation, which means the FDA must make a decision on donanemab within six months, i.e. before the end of February 2023. I believe that given the small phase 2, which does not contribute to an objective assessment of the received data on the efficacy and safety of donanemab and also the negative experience with Aduhelm, the FDA will be conservative in its decisions and wait for the results of phase 3 clinical trial, which is expected in mid-2023. Thus, I believe that Mr. Market overestimated the likelihood that donanemab would be approved and, more importantly, that Medicare would make a positive decision to cover this medicine.

Mounjaro is a Potential Leader in the Treatment of Type 2 Diabetes

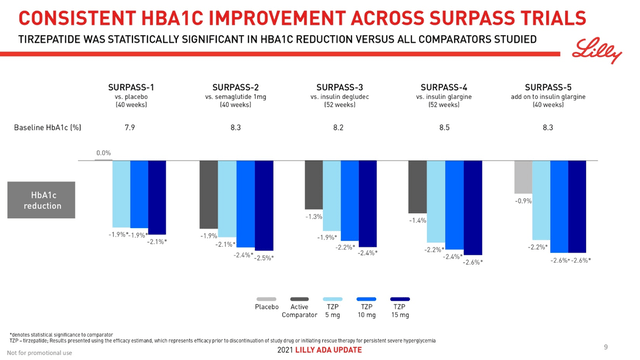

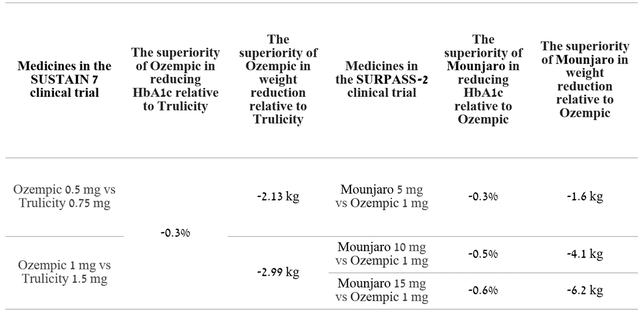

Mounjaro (tirzepatide) is a drug approved for the treatment of adults with type 2 diabetes, and whose mechanism of action is based on the activation of the GLP-1 and GIP receptors. In five clinical studies, all three doses of this medicine have shown stunning efficacy in reducing both body weight and hemoglobin A1c (HbA1c). In the SURPASS-2 clinical trial, Mounjaro was superior to Novo Nordisk’s Ozempic (semaglutide) 1mg in lowering HbA1c from baseline in adults with type 2 diabetes. In this study, a group of patients who took Mounjaro 15 mg as an adjunct to metformin was able to achieve a 2.46% reduction in HbA1C compared to a 1.86% reduction for Ozempic 1 mg.

Lilly Diabetes & Obesity ADA Update Presentation

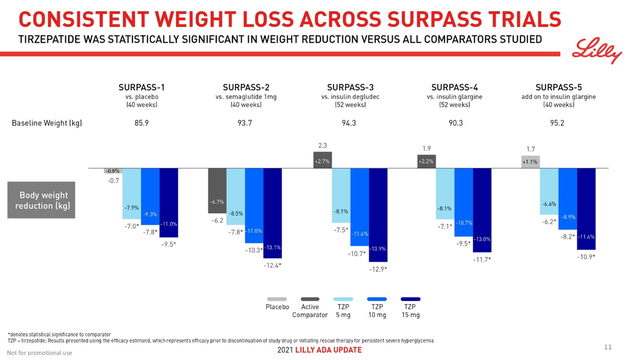

To be commercially successful in the highly competitive type 2 diabetes market, valued at more than $237 billion in the US alone, a new generation drug must not only reduce hemoglobin A1c but also promote significant weight loss. The reason for this requirement is the fact that about 90% of people with type 2 diabetes in the US are overweight. Mounjaro did an excellent job with this task, and patients who received even the minimum dose of this medicine showed a weight loss of 7.8 kg compared to 6.2 kg weight loss in the group of patients taking Ozempic. Moreover, a dose-dependent effect in weight loss was observed and the group of patients receiving the maximum recommended dose of Mounjaro, namely 15 mg, was able to lose 12.4 kg by 40 weeks of treatment.

Lilly Diabetes & Obesity ADA Update Presentation

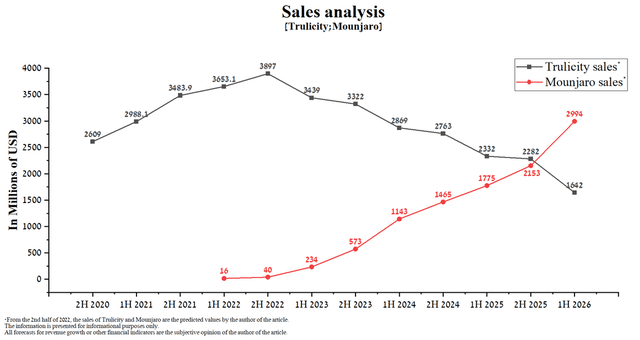

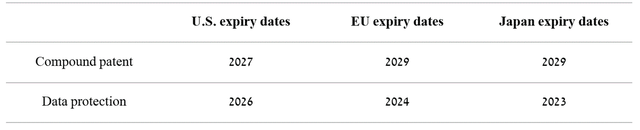

Based on clinical data, Eli Lilly and Company’s drug should dethrone the current leader in the treatment of type 2 diabetes, namely Novo Nordisk’s drug, and take the lead for at least the next five years. Given the current capitalization, Mr. Market expects that Mounjaro will bring additional billions of dollars to Eli Lilly’s current revenue. But I do not agree with this assessment. The first reason is the fact that the company will likely seek to switch patients from the company’s current type 2 diabetes blockbuster, Trulicity to Mounjaro. Trulicity’s patents expire between 2023 and 2029, and as a result, the company needs to mitigate risks in anticipation of a sharp drop in sales of this drug after entering the biosimilar market.

Author’s elaboration, based on Form 10-K

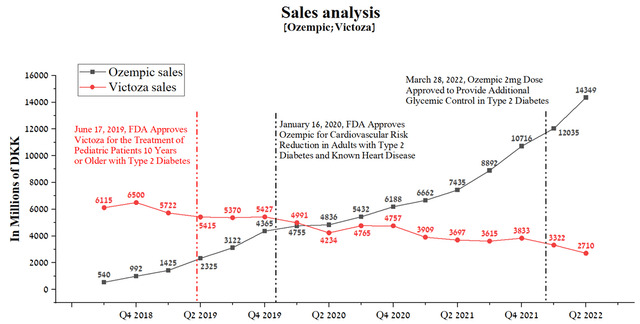

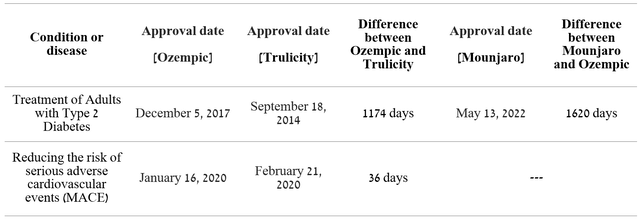

In order to understand the future sales trends of Trulicity and Mounjaro, I analyzed Novo Nordisk’s strategic decision by which the company moved Victoza (liraglutide) patients whose patents ended in a more effective drug, namely Ozempic. The approvals of Ozempic in 2017 and Mounjaro in 2022 brought many innovations and made a big step forward in the treatment of type 2 diabetes compared to the market leaders of the time. That is, Ozempic supplanted Eli Lilly and Company’s most advanced medicine of 2017, namely Trulicity, just as Mounjaro will seek to depose Ozempic.

Author’s elaboration, based on quarterly securities reports

I have analyzed Ozempic’s sales since approval and subsequent declining sales trends for Victoza. Although Novo Nordisk did not disclose sales in the first two-quarters of Ozempic’s approval, starting from Q3 sales a clear upward trend can be seen for the drug’s revenue from DKK 540 million to DKK 14,349 million by Q2 2022, which corresponds to about 2,224.7 million dollars.

Author’s elaboration, based on quarterly securities reports

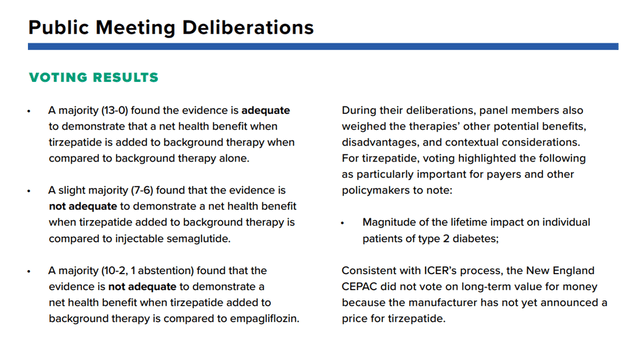

This increase in sales of Ozempic was driven not only by sales for its primary indication, namely improved glycemic control in adults with type 2 diabetes but also by the subsequent expansion of the drug’s use. In my estimation, Mounjaro will show a weaker sales growth rate relative to the rate that Ozempic showed in the first 4.5 years from the date of approval. The reasons for this are the approval of Ozempic with a higher dosage of 2mg, which narrows the gap in human weight loss efficacy relative to Mounjaro, and the approval of Rybelsus, which is the first oral GLP-1 analog for the treatment of adults with type 2 diabetes. Moreover, in February 2022, a report by the Institute of Clinical and Economic Reviews (ICER) questioned the benefits of using Mounjaro over leading competitors, including injectable semaglutide and Jardiance (empagliflozin), Boehringer Ingelheim’s drug.

Institute for Clinical and Economic Review

As a consequence, I expect the next sale of Trulicity and Mounjaro.

And thus, the combined sales of Mounjaro and Trulicity will add to Eli Lilly’s annual revenue, assuming sales of the company’s other medicines remain at 2021 levels as follows.

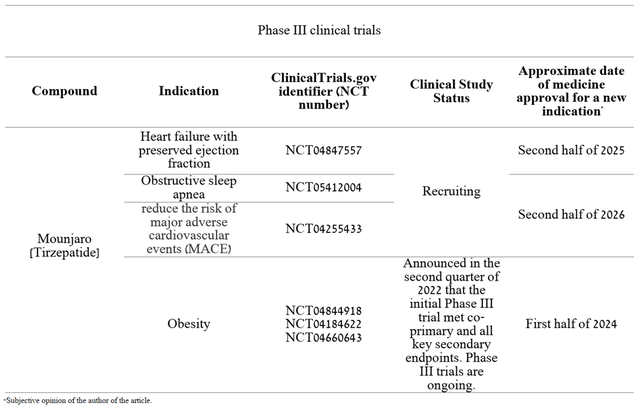

As a result, the reduction in the Price/Sales ratio will be insufficient and will exceed the average value of the healthcare industry by more than 85%. In addition, a significant risk for Mounjaro, which Mr. Market does not lay down, is that the development of clinical trials aimed at expanding the indications for the use of Eli Lilly and Company’s drug is not as fast as desired.

However, if we compare the timing of the change of leaders in the treatment of type 2 diabetes, we can see the backlog of Mounjaro from Ozempic. At first glance, this is not a critical moment, but it is not entirely true. The ability of a pharmaceutical company to develop drugs that outperform competitors in a shorter time frame demonstrates the effectiveness of the business model and also the superiority of scientific approaches, which ultimately attract large institutional investors.

Author’s elaboration, based on quarterly securities reports

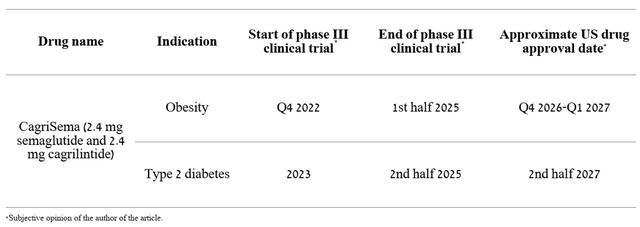

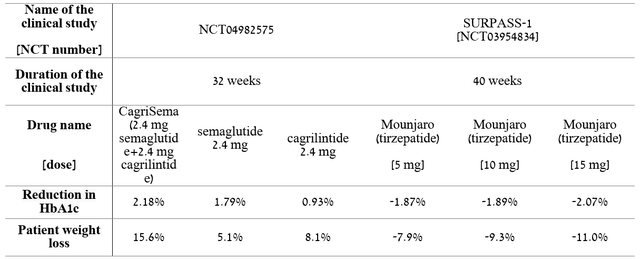

Thus, Eli Lilly and Company, unlike Novo Nordisk, and in general, relative to the top 10 pharmaceutical companies, does not stand out much in terms of the speed of developing product candidates. Moreover, Novo Nordisk does not stop there and continues to actively develop clinical trials investigating the efficacy and safety of cagrilintide in the treatment of type 2 diabetes and the fight against obesity. For example, on August 22, Novo Nordisk announced the results of phase 2 clinical trial comparing the efficacy and safety of CagriSema (2.4 mg semaglutide and 2.4 mg cagrilintide) in the treatment of 92 people with type 2 diabetes and overweight versus cagrilintide and semaglutide 2.4 mg (Wegovy), which has already been approved by the FDA to combat obesity. At week 32 of the clinical study, CagriSema demonstrated a greater reduction in HbA1c of 2.18% compared to a 1.79% reduction in patients treated with semaglutide alone and 0.93% in people treated with cagrilintide alone. Moreover, CagriSema reduced body weight by 15.6%, which is almost 3% more than in patients treated with semaglutide, and by 8.1% in people treated with cagrilintide alone. Comparing preliminary data with Mounjaro, one can see the superiority of Novo Nordisk’s drug, even though the study with CagriSema was eight weeks shorter than the clinical study that took Eli Lilly’s drug.

Author’s elaboration, based on quarterly securities reports

If the efficacy and favorable safety profile of CagriSema are confirmed in phase 3 at the level of the results of phase 1 and 2 clinical trials, then, firstly, this will lead to a slowdown in the growth of sales of Eli Lilly and Company’s drug and will also lead to a decrease in Wall Street’s assessment of its peak sales. I estimate that Novo Nordisk will be able to complete the final phase of the clinical trial and obtain FDA approval for CagriSema in the next period of time.

Technical Analysis of Eli Lilly

On the daily chart, we see that after the end of the corrective wave ④ in mid-February 2022, the final multi-month cycle impulse wave ⑤ was launched, formed by the “Ending Diagonal” pattern. This patent consists of 5 waves labeled (1), (2), (3), (4), and (5), in which waves (1) and (4) intersect and are confirmed by a bearish divergence, which is necessary condition according to the Elliott wave theory. According to my estimate, the company’s shares should come to the upper limit of the Ending Diagonal, namely in the range of $340-343 per share, after which a corrective movement will begin. Given the technical analysis, I expect this corrective movement to continue up to a strong support level located in the region of $260-263 per share.

Conclusion

Eli Lilly and Company is one of the leaders in the treatment of diabetes and obesity and is committed to expanding its presence in the treatment of cancer and immunological diseases. In the past, the company showed significant growth in revenue, EBITDA, and margins, which attracted institutional investors and contributed to the increase in the company’s capitalization. Mr. Market is capitalizing on FDA approval and Medicare’s positive decision on donanemab, which is being investigated in phase 3 clinical trial. However, the controversial efficacy results and the negative safety profile shown in phase 2 call into question the objectivity of assessing the prospects of this medicine. Financial indicators that are significantly higher than the average values of the pharmaceutical industry, declining revenue, a relatively small number of product candidates in Phase 2/3 clinical trials, will be one of the reasons for the start of a corrective movement in the company’s shares. Based on the risks and catalysts described in this article, I set a price target for Eli Lilly and Company at $262 per share through 2023.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.